Data Center Chip Market Size, Share & Industry Analysis, By Chip Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Application-Specific Integrated Circuit (ASIC), Field-Programmable Gate Array (FPGA), and Others), By End-user (BFSI, Healthcare, Retail, Telecommunications, Media and Entertainment, Energy and Utilities, and Others), By Data Center Type (Small and Medium Data Centers and Large Data Centers), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

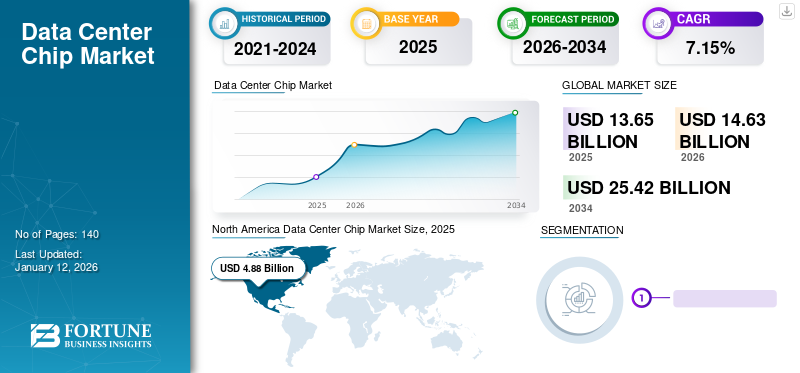

The global data center chip market size was valued at USD 13.65 billion in 2025 and is projected to grow from USD 14.63 billion in 2026 to USD 25.42 billion by 2034, exhibiting a CAGR of 7.15% during the forecast period. North America dominated the data center chip market with a share of 35.73% in 2025.

A data center chip is a specialized chip designed to handle the computational and data processing demands of data center servers. These chips include central processing units (CPUs), graphics processing units (GPUs), application-specific integrated circuits (ASICs), and field-programmable gate arrays (FPGAs), each serving different purposes, such as general processing, graphics rendering, application-specific tasks, and reconfigurable logic functions. These chips are critical for supporting large-scale applications, cloud services, AI workloads, and big data analytics, offering high performance, energy efficiency, and scalability. The market is driven by technological advancements, increasing data traffic, and the need for efficient, scalable, and cost-effective data center infrastructure.

Impact of Generative AI

Increasing Demand for AI-driven Applications to Boost the Market Acceleration

Generative AI significantly impacts the market by driving the demand for advanced, high-performance data center chips. AI models, including large language models (LLMs) such as GPT-4, require immense computational power and memory. For instance, companies such as NVIDIA and AMD are developing specialized GPUs and AI accelerators to meet these needs. The increased demand for AI-driven applications, such as real-time language translation and image generation, pushes data centers to upgrade their infrastructure. This trend leads to the adoption of cutting-edge chips that can handle the intensive workloads of generative AI, ultimately fueling market growth.

Data Center Chip Market Trends

Increasing Artificial Intelligence (AI) and Machine Learning (ML) Workloads to Fuel the Market Growth

AI and ML applications require immense computational power and specialized hardware to process large datasets and complex algorithms efficiently. This demand is propelling the adoption of high-performance chips such as GPUs (Graphics Processing Units), TPUs (Tensor Processing Units), and custom AI accelerators.

- For instance, NVIDIA's A100 Tensor Core GPU is specifically designed to accelerate AI and ML tasks, offering significant improvements in performance and energy efficiency compared to traditional CPUs.

Moreover, the proliferation of AI-driven services such as natural language processing, image recognition, and autonomous systems is further boosting the need for advanced data center chips.

- Companies such as Microsoft and Amazon are investing heavily in AI infrastructure, integrating custom chips such as Amazon's Graviton processors to enhance AI processing capabilities.

This surge in AI and ML applications underscores the critical role of advanced chips in meeting the computational demands of modern data centers, driving the expansion of the market.

Download Free sample to learn more about this report.

Data Center Chip Market Growth Factors

Growing Emphasis on Energy Efficiency and the Rising Adoption of IoT Devices to Drive Market Expansion

As data centers consume vast amounts of energy, there is an increasing pressure to reduce their carbon footprint. Advanced data center chips, such as Intel's Xeon and AMD's EPYC processors, are being designed for energy efficient data centers, reducing power consumption while maintaining high performance. For instance,

- NVIDIA's latest GPUs are engineered to deliver superior processing power with lower energy usage, supporting more sustainable operations.

Furthermore, IoT devices, from smart home appliances to industrial sensors, produce massive amounts of data that need to be processed, analyzed, and stored, necessitating powerful and efficient chips. This surge in IoT devices across various sectors increases the demand for high-performance chips to manage the data influx effectively, driving data center chip market growth. For instance,

- Smart cities rely on IoT sensors to monitor traffic, air quality, and energy usage. The data from these sensors is sent to data centers where powerful processors, such as Intel Xeon or AMD EPYC chips, perform complex computations to provide actionable insights.

RESTRAINING FACTORS

Complexity of Advanced Chip Manufacturing Processes May Impede Market Growth

The market expansion may be impeded by the high cost of research and development (R&D) and the complexity of chip design and manufacturing. Developing advanced chips necessitates substantial investments in advanced technologies and processes, which can be excessively costly for many companies. The intricate nature of chip design and manufacturing further adds to these operational costs, requiring specialized expertise and extensive resources. This complexity can lead to longer development cycles and increased production expenses. As a result, only well-funded companies can afford to innovate and compete effectively, potentially slowing down global market growth and limiting the entry of smaller firms or startups into the market.

Data Center Chip Market Segmentation Analysis

By Chip Type Analysis

Need for Managing and Performing Wide-ranging Computing Tasks to Boost the CPU Segment Growth

The Central Processing Unit (CPU) segment is projected to dominate the market with a share of 35.23% in 2026. Based on chip type, the market for data center chips is divided into central processing unit (CPU), graphics processing unit (GPU), application-specific integrated circuit (ASIC), field-programmable gate array (FPGA), and others.

The central processing units (CPUs) segment holds the highest share in the market due to their versatility and essential role in managing and executing a wide range of computing tasks. They are crucial for processing general-purpose workloads, running operating systems, and handling various applications, making them vital for data center operations.

The graphics processing units (GPUs) segment is expected to grow at the highest CAGR over the forecast period due to their superior parallel processing capabilities, which are crucial for artificial intelligence (AI), machine learning (ML), and deep learning applications. Their ability to handle large-scale data computations efficiently makes them increasingly valuable for data-intensive tasks.

By End-user Analysis

Burgeoning Need for High-performance Data Processing and Storage Solutions to Boost the Telecommunications Segment Growth

By end-user, the market for data center chips is segregated into BFSI, healthcare, retail, telecommunications, media and entertainment, energy and utilities, and others.

The Telecommunications segment is expected to lead the market, contributing 30.51% globally in 2026. The telecommunications segment holds the highest share of the market due to its massive demand for high-performance data processing and storage solutions to support extensive network operations and the rollout of 5G infrastructure. This sector's need for scalable, efficient, and reliable chips to manage large volumes of data and deliver high-speed connectivity fuels the market growth.

The healthcare industry is expected to grow at the highest CAGR over the analysis period due to its increasing reliance on data-intensive applications, including telemedicine, electronic health records, and advanced medical imaging. The expansion of these digital health solutions drives demand for high-performance, scalable chips to process and analyze vast amounts of medical data efficiently.

To know how our report can help streamline your business, Speak to Analyst

By Data Center Type Analysis

Growing Need for Robust and Scalable Chips to Boost Segment Growth

On the basis of data center type, the market is subdivided into small and medium data centers and large data centers.

The Large Data Centers segment will account for 68.04% market share in 2026. The large data centers segment holds the highest share of the market due to their extensive infrastructure and high capacity for processing and storing vast amounts of data. These facilities require robust, scalable chips to handle massive workloads and support a wide range of applications, including cloud services, big data analytics, and AI, which drive their significant market share.

The small and medium data centers segment is expected to grow at the highest CAGR over the forecast period due to the increasing demand for localized and scalable solutions that provide cost-effective and efficient processing and storage for businesses. As organizations seek flexible on-premises solutions for data management and edge computing, the adoption of smaller data centers is accelerating, driving the rapid growth of the market.

REGIONAL INSIGHTS

The global market scope is classified across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Data Center Chip Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 4.88 billion in 2025 and USD 5.16 billion in 2026. North America holds the highest share of the market due to its advanced infrastructure, significant investment in data center chip technology, and high demand for data processing driven by major tech companies and financial institutions. The region's strong technological base and early adoption of innovations contribute to its leading market position. The U.S. market is expected to reach USD 3.01 billion by 2026.

Europe

Europe holds the second-highest share in the market due to its advanced IT infrastructure, strong emphasis on data privacy regulations such as GDPR, and substantial investments and developments in the data center sector by major tech companies, such as Arm Neoverse V2. The region's focus on digital transformation and sustainable data center practices further supports its significant market presence. The U.K. market is projected to reach USD 0.68 billion by 2026, while the Germany market is anticipated to reach USD 0.58 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific market is expected to grow at the highest CAGR over the analysis period. This is due to rapid digitalization, increasing cloud adoption, and significant investments in data center infrastructure by tech giants and governments in countries including China, Japan, and India. Additionally, the region's expanding IT and telecom sectors drive the high demand for data center chips to support emerging technologies and large-scale data operations. The Japan market is expected to reach USD 0.91 billion by 2026, the China market is projected to reach USD 0.73 billion by 2026, and the India market is anticipated to reach USD 1.15 billion by 2026.

The Middle East & Africa market is expected to grow at the second-highest CAGR due to increasing investments in data center infrastructure and digital transformation initiatives. Additionally, the growing demand for cloud services, data storage, and processing in emerging economies, combined with regional government initiatives, is set to boost technology adoption.

South America is expected to grow at an average CAGR over the forecast period due to moderate investments in data center infrastructure and digital services. While there is an increasing demand for cloud computing and data storage, the region's growth is tampered by economic challenges and slower technology adoption compared to other regions.

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positioning

Market players launch new solutions to strengthen their market positions by staying ahead of competitors, addressing diverse consumer needs, and leveraging the latest technological advancements. They prioritize strategic collaborations, portfolio enhancement, and acquisitions to strengthen their product portfolios. Such strategic product launches help industry players increase their data center chip market share.

List of Top Data Center Chip Companies:

- Intel Corporation (U.S.)

- Advanced Micro Devices (AMD) (U.S.)

- NVIDIA Corporation (U.S.)

- Broadcom Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Micron Technology, Inc. (U.S.)

- Samsung (South Korea)

- Marvell Technology Group Ltd. (U.S.)

- Huawei Technologies Co. Ltd. (China)

- Cisco Systems, Inc. (U.S.)

- Arm Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- In June 2024, Intel announced AI chips for data centers, with the aim to compete with NVIDIA and AMD. The new Xeon 6 processor offers improved performance and power efficiency for high-intensity data center workloads.

- In March 2024, NVIDIA declared that TSMC and Synopsys are using its computational lithography platform to advance semiconductor chip manufacturing. TSMC and Synopsys have integrated NVIDIA cuLitho with their systems to accelerate chip fabrication and support future NVIDIA Blackwell architecture GPUs.

- In March 2024, Samsung Electronics established a research lab to create new semiconductors for artificial general intelligence (AGI). The lab would develop chips for large language models, emphasizing efficient inference and aiming to enhance performance and support for larger models while reducing power and cost.

- In November 2023, Broadcom Inc. announced the launch of Trident 5-X12 chip, featuring the NetGNT on-chip inference engine. It augments the standard packet-processing pipeline by using machine learning to detect traffic patterns across the entire chip, enhancing network analysis.

- In November 2023, Qualcomm introduced the Cloud AI 100 Ultra, an AI inference card designed for generative AI and large language models. It offers up to four times the performance of its predecessor, supporting 100 billion parameter models on a single 150-watt card.

- In May 2023, NVIDIA and SoftBank Group Corp. collaborated on an advanced platform for generative AI and the 5G/6G applications, leveraging the NVIDIA GH200 Grace Hopper Superchip. Additionally, SoftBank strategizes to deploy this technology in new, distributed AI data centers across Japan.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.15% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Chip Type

By End-user

By Data Center Type

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 25.42 billion by 2034.

In 2025, the market was valued at USD 13.65 billion.

The market is projected to grow at a CAGR of 7.15% during the forecast period

By type, the Central Processing Unit (CPU) segment is the leading segment in the market.

The growing emphasis on energy efficiency and the rising adoption of IoT devices is a key factor driving the market expansion.

Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation, and Broadcom Inc. are the top players in the market.

North America holds the highest market share.

By data center type, small and medium data centers segment is expected to grow at the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us