Data Historian Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Application (Production Tracking, Performance Management, Environmental Auditing Asset, GRC Management, Predictive Maintenance, and Others), By Industry (Oil & Gas, Marine, Paper & Pulp, Metals & Mining, Chemical & Petrochemicals, Energy & Utilities, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

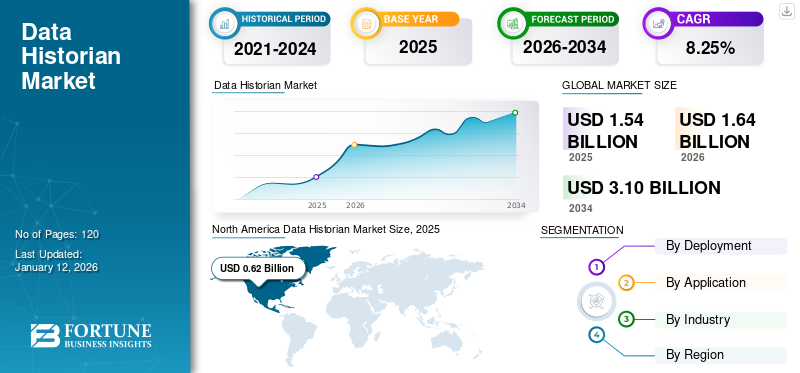

The global data historian market size was valued at USD 1.54 billion in 2025. The market is projected to grow from USD 1.64 billion in 2026 to USD 3.1 billion by 2034, exhibiting a CAGR of 8.25% during the forecast period. North America dominated the global data historian market with a share of 40.47% in 2025.

Data historian is a tool that captures, stores, and analyzes large amounts of data over time, including in process and discrete manufacturing industries. This tool allows tracking key performance metrics, including cycle time or throughputs, for predictive maintenance purposes, optimizing inventory management, identifying bottlenecks, eliminating manual recording, increasing machine uptime, and automating reporting functions. The market is witnessing growth as there is an increasing demand for consolidated data for processing and performance improvements among industries and increasing investments in data centers.

During the COVID-19 pandemic, the demand for data storage and analysis surged due to an increase in data generation among various industries, and only 20% of the data generated by enterprises was in a structured format. 80% of data is unstructured as the implementation of smart factories, industry 4.0 and 5.0 solutions, and IIoT machinery continues to grow. Due to this, more enterprises started implementing data historian tools. The market witnessed a growth during the pandemic.

IMPACT OF AI

Integration of Artificial Intelligence and Machine Learning with Data Historian to Aid Market Growth

A data historian is a central repository for all the industrial data from equipment, sensors, and processes. It is also a series of databases optimized for industrial environments. It is designed for data collection and efficient storage of massive amounts of data. Integration of AI and ML with historian tools enables prediction maintenance. Professionals train machine learning models based on the historian's maintenance and operational history. These ML models can then find patterns that show an upcoming requirement for servicing or machinery failure. Also, developing AI agents can help in optimizing processes and automation as the historian provides this Artificial Intelligence (AI) agent with an environment that is data rich so that the AI agent can smartly control equipment and make split second operational decisions.

Integrating AI with data historian provides a more energy-efficient industrial setup. By evaluating historical data on energy use and production metrics, the historian can forecast energy for different operations and, based on this AI recommended modifications. This can lead to carbon footprint reduction, significant cost savings, and optimal use of resources. With data historians providing regular and complete energy data to an AI engine, it contributes to sustainable working practices.

Data Historian Market Trends

Increasing Popularity of Cloud Data Historian to Drive Market Growth

Cloud-based data historian is a software application that collects, stores, and analyzes data from distributed control system networks in the cloud and can connect distributed control system networks through various communication protocols, including Modbus, OPC, and UA, and transfer the data to the cloud using encryption and compression techniques. The data can be visualized, accessed, and analyzed from any device or location using a mobile app or web browser. The cloud based historian offers several advantages over local on-premise historian, including better performance, reliability, lower capital, and operational cost, and enhanced security and compliance.

Cloud-based historian protects the data from unauthorized access or tampering through authentication, encryption, authorization mechanism, and provides valuable insights and feedback on DCS network so enterprises can optimize it. With data and analysis through cloud-based historian it is easy to identify and troubleshoot problems, enhance key performance indicator and control and monitor security and safety conditions. Therefore, cloud based historian is gaining popularity.

Thus, the increasing popularity of cloud historian is set to drive the data historian market growth.

Download Free sample to learn more about this report.

Data Historian Market Growth Factors

Increasing Adoption of Data Historian in Industry 4.0 is Propelling Market Growth

Data historian adoption is increasing in industry 4.0 as the tool is used to help industries make data-driven decisions for maximizing operational excellence and profit. Reduced cost of sensors on industrial equipment that detect operational conditions, temperature, vibration, pressure and RPM, and advancement in Machine Learning (ML) and AI algorithms that are authorized and offer valuable insights into equipment condition monitoring collectively increase the adoption of historian tool.

Robotics is used on a large scale in modernized plants to gain efficiency and accuracy and to reduce overall operating costs. These systems generate massive amounts of data. The data from such systems is referred to as “time series data”. The parameters, including vibration, temperature, pressure, per second or sub second, RPM, and others, are monitored to check the system's functioning. Then, this data is grouped with the local data historian, who optimizes it for such data. Through equipment condition monitoring, enterprises are moving away from time-based equipment maintenance to condition-based maintenance. This increases overall throughput, uptime, and profitability.

Therefore, the increasing adoption of historian tools in industry 4.0 drives the data historian market share.

RESTRAINING FACTORS

Increasing Adoption of Industrial Internet of Things (IIoT) Solutions to Hinder Market Growth

IIoT consists of connected industrial systems that manage their information analytics to improve overall industrial performance. The key function of IIoT is to provide insights to industries to enhance their operational processes and assist in actionable decision making. IIoT and historian solutions can collect data from sensors and actuators used by industries to gain deep knowledge via analytics and records. However, data historians require more time to extract data than IIoT solutions, which restricts market growth.

Data Historian Market Segmentation Analysis

By Deployment Analysis

Increasing Adoption of Cloud based Solutions to Aid Segment Growth

By deployment, the market is segmented into on-premise and cloud.

The cloud segment is expected to register the highest CAGR during the forecast period as cloud-based historians require minimal upfront investment. Cloud-based solutions scaling is often simple and has built-in tools that make monitoring and managing the data and infrastructure easy.

The on-premise deployment model is projected to dominate the market, accounting for 58.80% of the total market share in 2026, as on-premise solutions require lower total ownership costs than cloud-based solutions. Also, the on-premise solution provides an added layer of security as the data resides behind the organization’s firewall.

By Application Analysis

Demand for GRC Management to Mitigate Risk among Enterprises Drives Segment Growth

By application, the market is divided into production tracking, performance management, environmental auditing asset, GRC management, predictive maintenance, and others.

The GRC management segment is estimated to grow with the highest CAGR during the forecast period. GRC is fundamental for business continuity, protecting the company's reputation, and effective resource management. It helps mitigate risks, reduce operational costs, and improve efficiency.

The predictive maintenance application is expected to hold a significant position, contributing 30.39% of the market share in 2026. Data historians support predictive maintenance by monitoring equipment performance and identifying issues before they lead to costly breakdowns.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Energy & Utilities to Lead with High Adoption of Data Historian for Enhancing Its Processes

By industry, the market is segmented into oil & gas, marine, paper & pulp, metals & mining, chemical & petrochemicals, energy & utilities, and others.

The energy & utilities is expected to showcase the highest CAGR during the forecast period, as it needs constant process optimization. Large amounts of data is generated in this industry daily, which is used to enhance the process and asset performance monitoring. The data historian performs root cause analysis in real time, places the data in historical context, and continuously enhances operations.

The chemical & petrochemicals industry is anticipated to remain a key end-use segment, representing 23.50% of the total market share in 2026. It is necessary to maintain the equipment in the oil & gas industry as it is a multibillion dollar industry, and even small malfunction in the equipment results in significant loss. Due to this, the organizations in the sector are adopting data historian to access the historical data to assess the condition of the equipment.

REGIONAL INSIGHTS

The market is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further classified into leading countries.

North America Data Historian Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America generated the maximum revenue in 2025, owing to increasing investments and spending on research and development for innovation. Due to increased demand for industrial automation data to improve asset performance and analyze the large amount of data generated across process manufacturing industries in the region, the U.S. accounts for 90% of data center space globally, further propelling the growth of data historian tools. The U.S. market is projected to reach USD 0.49 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR during the forecast period owing to increasing need for improved business productivity. As various countries in the region are undergoing digital transformation, data is a major asset for development. Also, the expansion of IoT infrastructure and surge in big data analytics are contributing to market growth in the region. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.10 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

Europe

Europe is witnessing substantial growth due to adoption of cutting edge technologies, including cloud computing. Also, the U.K. is known for its innovation and adoption of technologies. It has over 30 programs that provide investment assistance to new data analytics companies. Therefore, this investment in data analytics is driving growth in the region. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.07 billion by 2026.

South America and the Middle East & Africa are experiencing significant growth as Brazil, Argentina, GCC, and South Africa governments invest in digital strategies. In addition, the countries are implementing smart technologies to establish a solid foundation in their various end-use sectors, including oil & gas, energy & utility.

List of Key Companies in Data Historian Market

Major Players Adopt Advance Technologies to Strengthen Market Positions to Drive Market Growth

Key players, such as Siemens, GE, and Rockwell Automation, among others operating in the market, are upgrading their existing solutions to keep up with the changing user requirements. With the advanced technologies, including AI and ML, companies are upgrading their product portfolio. With this, companies aim to transform their services and better serve their customers. Furthermore, these market players proactively pursue partnerships, collaboration, mergers, and acquisitions to boost their product offerings.

List of Key Companies Profiled:

- Siemens (U.S.)

- GE (U.S.)

- Rockwell Automation (U.S.)

- IBM (U.S.)

- ABB (Switzerland)

- Honeywell (U.S.)

- Emerson (U.S.)

- AVEVA (U.K.)

- Inductive Automation (U.S.)

- Open Automation Software (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: dataPARC launched its next-generation data historian platform for delivering federated plant operations data to technology and operation teams.

- February 2023: Aspen Technology was selected by DuPont for modernizing its industrial data foundation and creating greater access, insights and visibility across its business. DuPont migrated 20 years of historical data to Aspen’s data historian.

- May 2022: GE Digital launched the Proficy data management solution for electric utilities, which is integrated with Advance Distribution Management Solution and Advanced Energy Management System.

- April 2022: GE Digital announced the availability of Proficy Historian for Cloud, a cloud native operational data historian in AWS marketplace. The solution helps companies to leverage existing IT cloud investments and combine OT and enterprise data.

- February 2022: InfluxData announced accelerated momentum in Internet of Things and industrial data driven by product enhancements, new customers and expanded industrial partnership fueled by the growth of time series data.

REPORT COVERAGE

An Infographic Representation of Data Historian Market

To get information on various segments, share your queries with us

The data historian market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.25% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 3.1 billion by 2034.

In 2025, the market was valued at USD 1.54 billion.

The market is projected to grow at a CAGR of 8.25% during the forecast period.

The predictive maintenance segment led the market in 2025.

Increasing adoption of data historian in Industry 4.0 is propelling market growth.

The top players in the market are Siemens, GE, ABB, Rockwell Automation, and Emerson.

North America held the highest market share in 2025.

By industry, the energy & utility is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic