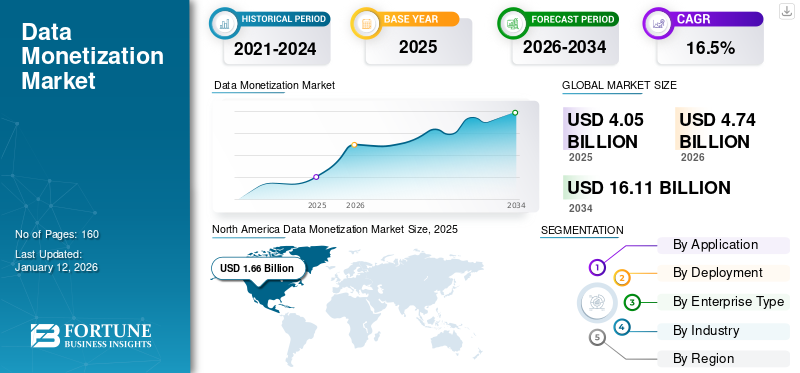

Data Monetization Market Size, Share & Industry Analysis, By Application (Customer Service, Sales & Marketing, Finance, and Others (Human Resources)), By Deployment (On-premises and Cloud), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By Industry (BFSI, Healthcare, Consumer Goods & Retail, Manufacturing, IT & Telecommunication, and Others (Travel & Hospitality, Government)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global data monetization market size was valued at USD 4.05 billion in 2025 and it is projected to be worth USD 4.74 billion in 2026 and reach USD 16.11 billion by 2034, exhibiting a CAGR of 16.5% during the forecast period. North America dominated the global market with a share of 41% in 2025. Additionally, the U.S. data monetization market is predicted to grow significantly, reaching an estimated value of USD 3,446.6 million by 2032.

Data monetization involves financing data sheets and information collected within the provider's company and reselling it for further industrial use. This can be categorized into internal monetization process and external monetization process. Internal monetization is implemented to use data to improve a company's operations, products, productivity, and services. External monetization, on the other hand, increases the revenue earned by selling data to customers and partners.

Many companies are leaning toward data monetization to optimize data usage, reduce operating costs, increase profitability and customer retention, increase compliance, strengthen partnerships, and improve customer experience and understanding. Moreover, the increasing number of data centers and cloud services to reduce data complexity is also driving the adoption of the product. It also increases the value of products and services, streamlines planning and decision-making activities, enhances collaboration and data sharing between external and internal stakeholders and enables targeted products and services, which enhances marketing & service delivery.

The COVID-19 pandemic impacted industries by imposing restrictions on travel and logistics. This slightly hampered the data monetization market growth by reducing the flow of data being gathered and implemented for further utilization. However, as remote working and virtual reality gained traction, it provided a boost to the market by enabling SMEs to retail private data and business insights to generate income and revenue.

Data Monetization Market Trends

Increasing Demand for Private Data and Analytics by Emerging Industries to Fuel Market Growth

Data monetization has driven trends such as Big Data, Artificial Intelligence (AI) tools and platforms, IoT, and sensor networks embedded in physical objects, surging the demand for edge computing software architecture. Chief officials globally are recognizing the immense value of data and are implementing sensors for real-time analytics, boosting the market for private data. Another aspect of monetization involves categorizing data insights and models for specific markets.

According to Baker McKenzie, enterprises improve monetization by identifying appropriate data, valuing its utilization and costs, and developing strategies for data valuation.

Successful monetization of data involves integrating analytics with existing products or sharing data as standalone products. According to IDC, 95% of organizations are predicted to engross some sort of private data KPIs by 2023 digitally. CITO Research states that partnering with third-party analytics platform allows companies to enhance their offerings with integrated collateral, content, media, and raw data.

Download Free sample to learn more about this report.

Data Monetization Market Growth Factors

Diversification of Data Usage and Technological Advancements to Drive Market Growth

According to Internet Live Stats and IDC, 1.134 trillion megabytes of data were generated every day in 2021. The figures reached 149 zeta bytes of acquired data by the end of 2023.

Enterprises collect diverse types of data, which are further analyzed to generate business insights. Some companies offer analyzed data as data as a service. Competitors and partners are primarily provided with the data to strategically develop and strengthen the partnerships to enhance production and revenue generation.

However, without analytical tools and systematic utilization, the acquired data becomes futile. Maintaining secure data governance programs and capabilities to nurture a data-driven culture aids in handling and utilizing data for utilization at a more significant potential.

For instance, Instacart generates revenue by delivering grocery items from stores such as Whole Foods and Costco. The company further monetizes its data, which provides valuable insights into consumer behavior, demand graphs of certain products, customer mapping routes, and weather impacts, driving industry growth.

RESTRAINING FACTORS

Security Concerns and Fraudulent Practices on Data Platforms to Hinder Market Growth

The security concerns and fraudulent practices on data platforms pose significant challenges to the expansion of the data monetization market share. Due to the significant value and sensitivity of data assets, they are exposed to several potential risks, including cyber-attacks, data breaches, data theft, data loss, and abuse. Ensuring robust data security and privacy is crucial for successful data monetization. According to IBM's cost of data breach report, the global average cost of data breaches is expected to increase by 15% to USD 4.45 million in 2023 compared to the previous three years.

Data Monetization Market Segmentation Analysis

By Application Analysis

Competition for Effective Data Analytics and Surge in Sales & Marketing to Enhance the Practice of Data Monetization

By application, the market is divided into customer service, sales & marketing, finance, and others. Sales & marketing segment dominated the market share of 34.83% in 2026. Multiple capabilities in sales & marketing, including ROI and Pay-Per-Click (PPC) campaigns, contribute to the largest market share in 2024. The utilization of Big Data analytics helps to generate compelling insights and enhance customer experience through personalized marketing. According to Marketingdive report of January 2021, 88% of marketers prioritize data storage and accumulation of first-party data.

The customer service segment is expected to register the highest CAGR during the forecast period. Customer services departments utilize data monetization to improve engagement, retention and call center performance by analyzing consumer behavior and implementing digital marketing tactics. Data is also utilized to track consumer analytics to maintain user response time, abandonment rates, and average queue times.

Big Data gathered from internal and external monetization techniques is utilized in finance departments to streamline cash flow, track profit, and loss margins, and improve managerial expenditures. Similarly, human resources leverage data in reducing workforce uncertainty, tracking employee statistics, and retaining talent management. Moreover, the market’s growth is supported by optimizing business models through internal and external data gathering via monetization programs.

By Deployment Analysis

Cloud Segment to Dominate due to its Ability to Offer Flexibility

By deployment, the market is bifurcated into cloud and on-premise. The cloud segment is projected to dominate the market share of 74.04% in 2026 and grow at the highest CAGR during the forecast period.

Monetization platforms, whether hosted on the cloud or on-premise systems, streamline data management by enhancing the analysis of personalizing data information assets, facilitating collaboration, and improving security measures. Boundaryless monetization solutions enable consumption-driven processes and the implementation of information semantics to boost usability across all data types, including machine-generated, transaction, master, connected, and social enterprise data. Numerous vendors utilize data lakes to handle raw, analytics, and enriched data.

The utilization of cloud services boost market share by engaging the workforce from multiple domains to deliver enhanced analytics and insights. For instance, in November 2022, Fosfor, a subsidiary of Larsen & Toubro Infotech, extended its partnership with Snowflake. This accelerated the monetization opportunities for Fosfor consumers by combining AI abilities with Snowflake’s Data Cloud.

Data monetization options are implemented at the client's location using their IT infrastructure through on-premises deployment. This delivery approach involves installing and running software or solutions from the customer's own server and computing infrastructure. On-premises deployment is typically feasible only for large businesses due to its high initial costs and manual management requirements.

By Enterprise Type Analysis

Large Enterprises Segment to Dominate due to its Ability to Generate Larger Data Resources

By enterprise type, the market is bifurcated into large enterprises and Small & Medium Enterprises (SMEs). Large enterprises require data-driven and backed results, which are gathered by discovering and operationalizing data management. The Large enterprises segment is poised to account for 71.32% of the market share in 2026. Implementation of an analytical data governance platform improves data management processes, which are further analyzed for data monetization.

For instance, in January 2022, TickSmith secured series A funding for its B2B data-selling platform, owing to their analytical cloud-based SaaS applications. With a USD 20 million investment, the company strengthened its business and marketing strategies, resulting in an improved data shopping experience, enhanced data monetizing, and optimized data preparing & packaging. Thus, large enterprises are projected to dominate the market with a significant market share and showcase a healthy CAGR during the analysis period.

SMEs accounting for their profit-driven approach are projected to exhibit the highest CAGR during the forecast period. Moreover, Small and Medium-Sized Enterprises (SMEs) are anticipated to encounter a lack of resources, leading to increased complexities in business operations and a greater demand to streamline expenses. During this scenario, the growing prevalence of cloud-based data monetization is projected to be instrumental in lowering operational costs and enhancing effectiveness, ultimately contributing to the growth of this sector.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

BFSI Sector Holds the Largest Market Share due to Abundant Data Streams

Based on industry, the market is classified into BFSI, healthcare, consumer goods & retail, manufacturing, IT & telecommunication, and others (travel & hospitality, government).

The BFSI sector held the largest market share in 2024 due to vast data collected from users regarding financial habits, preferences, and product sales, among others. Employees in the BFSI industry primarily gather data from client project meetings, project handling, and site visits. These factors, including scalable financial data and streamlined expenditure data, drive the increasing practice of monetizing data. For instance, in May 2022, Fidelity Investments started internally monetizing its data to generate income and revenue opportunities.

In healthcare, employees are utilizing available patient data to make appropriate care decisions, leveraging lab results and medication histories for enhanced accuracy. However, healthcare organizations utilize data to support profitability. Recently, New Mexico’s Presbyterian Healthcare Services started using an asynchronous reporting system. For instance, in 2020, medical professionals completed 50,000 low-acuity care requests in an average of two minutes, with patients generally receiving responses to text-based content in under 15 minutes.

The consumer goods and retail segment exhibits adequate potential to leverage data for monetization. There is an increasing demand for monetization applications across multiple industries. According to a survey by New Vantage Partners, more than 91% of executives surveyed observed escalations in related investments. Additionally, data gathered through e-commerce websites and media statistics deliver highly valuable insights into consumer preferences, habits, and information.

Manufacturing organizations adopt analytics and Business Intelligence (BI) strategies to enable flexible and timely visibility across the driving agility, production lifecycle, and speed-to-market. It also enables streamlining data, sales, and operational planning to enhance the analytics and insights generated from accumulated data.

Through data analytics, IT & telecom providers can track consumer activities on their software and generate data for consumer behaviors. Having a source of truth enables IT and telecom businesses to streamline data for enhanced decision-making, gain insights into project status, reduce the market time for products, and ensure usage and adoption, resulting in helpful analytics for product and business enhancements.

REGIONAL INSIGHTS

The market has been studied across five regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

North America

North America Data Monetization Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.66 billion in 2025 and USD 1.93 billion in 2026. North America dominated the global market share in 2024, driven by the increasing deployment of IoT devices and cloud-based applications. The surge in cloud adoption in the North American market is attributed to the higher data generation in the U.S. According to SG Analytics, 2.5 quintillion bytes of data were generated by the U.S. population in 2020. Additionally, growing industries such as airlines, manufacturing, retail, and healthcare are contributing to the rise in data generation and utilization trends. The U.S. market is projected to reach USD 1.37 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America exhibited a surge in investments in retail and oil & gas industries, driving accelerated digitalization and cloud adoption. The region is projected to witness rapid growth in terms of data generation while manifesting a higher CAGR than other regions during the forecast period. For instance, in August 2022, Brazil, under Governor Robert Nato, initiated an agenda for financial and technological evolution, incorporating tokenized currency to boost tokenized deposits and data monetization.

Europe

Europe is projected to play a significant role in the global market, securing the second highest revenue share, owing to stringent data monetization compliances and data trading in the region. For instance, the Union-approved General Data Protection Regulation (GDPR) replaced the prior Directive 95/46/EC. It provided functions to empower and protect the privacy of all European nationals and amend the approaches E.U. organizations deploy to handle user data privacy. The UK market is projected to reach USD 0.2 billion by 2026, while the Germany market is projected to reach USD 0.25 billion by 2026.

The Middle East & Africa is expected to exhibit robust CAGR in the global market owing to surging investments in the telecom industry. For instance, in Sierra Leone, telecom enterprises implemented data trading strategies, which helped in the prediction of frequent outbreaks of the Ebola virus and contain the spread of diseases by taking preventive action.

Asia Pacific

Asia Pacific is estimated to be one of the fastest-growing regions as it offers immense opportunities for market growth. The region is expected to grow at an appreciable CAGR during the forecast period. The growing adoption and deployment of cutting-edge technologies, such as cloud-based service utilization and IoT implementation, is expected to fuel the demand for data monetization solutions and platforms. The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 0.31 billion by 2026, and the India market is projected to reach USD 0.18 billion by 2026.

List of Key Companies in Data Monetization Market

Integration of Exchange Platform and Advanced Data Analytics to Enhance Market Growth

Enterprises across various industry domains are expected to gain financial benefits from various data monetization applications. Majorly, BFSI and consumer goods enterprises frequently lack perceptibility into their product sales and performance details, presenting opportunities to generate additional revenue streams.

To address this gap, some vendors provide data analytics suites to end-user companies. For instance, the wholesaler, Costco, has a reputed Collaborative Retail Exchange (CRX) platform for implementing the latest technologies. The company provided its vendors with segment and category data, enabling them to gain valuable insights into market growth.

LIST OF KEY COMPANIES PROFILED:

- Revelate (Canada)

- Trūata Limited (Ireland)

- Dawex Systems (France)

- Datarade GmbH (Germany)

- Sisense Ltd. (U.S.)

- Data Vault Holding, Inc. (U.S.)

- CARTO (U.S.)

- Infosys Technologies Pvt. Ltd. (India)

- Optasia (Dubai)

- ThinkData Works Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – Revelate's data exchange platform is now available on the Amazon Web Services marketplace. This strategic integration enables organizations to leverage their data assets easily, enabling smooth data discovery, monetization, and sharing.

- October 2023 – Narrative I/O collaborated with Snowflake to display data within the Trade Desk through the Snowflake Marketplace. It helps create effective, data-driven digital media campaigns. This initiative by Narrative and Snowflake would provide joint customers with a cost-effective solution for activating and distributing audiences from the Snowflake Marketplace.

- March 2023 – Revelate partnered with Matillion, a player in data productivity, to offer a solution for the commercialization of their data. Leveraging Matillion’s Data Integration Platform and Revelate Data Marketplace, companies can swiftly generate revenue from previously untapped datasets.

- August 2022 – Trūata and IBM announced a partnership to aid businesses in assessing privacy risks in data with an enhanced fingerprint mechanism. This solution aimed to streamline data privacy risk management for enterprises, facilitating efficient analysis of critical data and operationalizing privacy-secured data flows. The partner solution is an additional program that can be bought in addition to Cloud Pak for Data, which uses Trūata’s enhanced fingerprint mechanism to find and surface hidden identifiers.

- May 2022 – Data Vault Holdings, Inc. completed its strategic partnership with Stemit, a music company specializing in developing and managing music streams, to launch an NFT marketplace and exchange. This marketplace offers artists across genres digital solutions to itemize their music into individual assets of value, revolutionizing monetization opportunities for independent labels and artists.

REPORT COVERAGE

An Infographic Representation of Data Monetization Market

To get information on various segments, share your queries with us

The market research report provides business insights to improve business decisions, focusing on regional dynamics. Furthermore, it provides key insights into the recent developments and a review of emerging technologies, which are being adopted worldwide. It also emphasizes the major growth-stimulating factors and elements, which allows the reader to obtain an in-depth understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.5% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market value is projected to reach USD 16.11 billion by 2034.

In 2025, the market value stood at USD 4.05 billion.

The market is projected to register a CAGR of 16.5% during the forecast period of 2026-2034.

By application, the customer service segment is likely to lead the market.

The increasing practice of data generation and data collection within businesses is expected to drive the market growth.

Adastra Corporation, Sisense Inc., DOMO Inc., Infosys Technologies Pvt. Ltd., Talend, and Tibco Software Inc., among others are the top players in the market.

In 2026, North America led the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic