Deep Packet Inspection Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Large Enterprises and Small and Medium Enterprises), By Application (Network Security, Network Management, Network & Subscriber Analysis, Content Regulation, and Others), By End-user (BFSI, Government, Healthcare, IT and Telecom, Retail, Manufacturing, and Others), and Regional Forecast, 2026 – 2034

Deep Packet Inspection Market Size

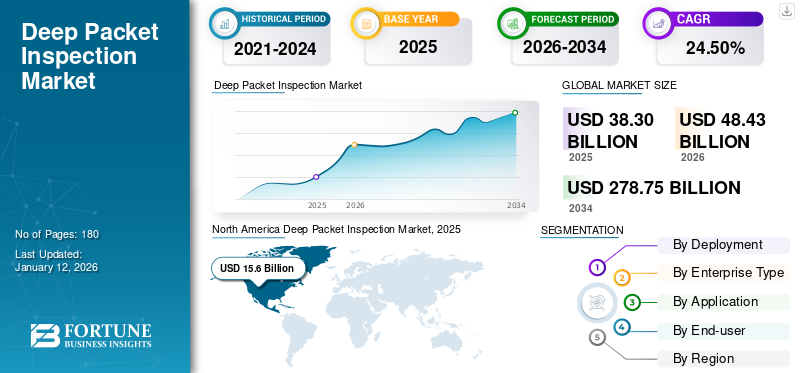

The global deep packet inspection market size was valued at USD 38.30 billion in 2025 and is projected to grow from USD 48.43 billion in 2026 to USD 278.75 billion by 2034, exhibiting a CAGR of 24.50% during the forecast period. North America dominated the global market with a share of 40.70% in 2025.

Deep Packet Inspection (DPI) involves the inspection of data packets in a network to gather information about the content, source, destination, and other attributes. This technology enables detailed analysis and monitoring of network traffic, aiding in security, Quality of Service (QoS), and traffic management.

Global Deep Packet Inspection Market Overview

Market Size:

- 2025 Value: USD 38.30 billion

- 2026 Value: USD 48.43 billion

- 2034 Forecast Value: USD 278.75 billion

- CAGR (2025–2032): 24.50%

Market Share:

- Regional Leader: North America held the largest market share in 2025.

- Fastest-Growing Region: Asia Pacific is projected to record the highest growth rate through 2032.

Industry Trends:

- The BFSI sector is the leading adopter of DPI solutions.

- Network & Subscriber Analysis applications are expected to grow at the fastest CAGR during the forecast period.

Driving Factors:

- Rising need to manage increasing network traffic volumes while ensuring advanced security.

- Growing regulatory compliance requirements and demand for optimized network performance.

DPI is applied in various sectors, including telecommunications, cybersecurity, and network optimization. Key elements of the market include advanced hardware and software solutions designed to perform real-time analysis of network packets, helping organizations enhance network visibility, security, and performance. The market is influenced by the increasing demand for robust cybersecurity solutions, the rise in network traffic, and the growing need for efficient bandwidth management. Furthermore, as the digital transformation progresses, deep packet inspection plays a crucial role in enabling organizations to maintain a secure and optimized network environment.

The COVID-19 pandemic significantly transformed the market, primarily driven by the widespread adoption of high-speed broadband and remote work. As organizations transitioned to remote operations, there was a notable surge in internet traffic and data consumption, leading to heightened concerns about cybersecurity. In response, the demand for deep packet inspection solutions surged as businesses sought advanced technologies for their networks and sensitive data security. Additionally, the pandemic presented challenges related to network management, promoting the need for DPI to monitor and optimize traffic, allocate bandwidth efficiently, and ensure quality of service.

IMPACT OF GENERATIVE AI

Introduction of Advanced Algorithms for Traffic Classification to Aid Market Growth

Generative AI is revolutionizing the DPI market by introducing advanced algorithms, such as anomaly detection and traffic analysis. Advanced generative models, such as Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs), enhance DPI systems’ ability to identify subtle deviations in network traffic, strengthening the resilience against cyber threats. For instance, these algorithms can identify anomalous patterns indicative of network intrusions, enabling proactive threat detection and mitigation. Additionally, these technologies improve the accuracy of traffic classification, employing sophisticated neural networks to distinguish between applications, protocols, and services. This heightened accuracy empowers DPI to optimize quality of service policies, ensuring efficient bandwidth management.

Deep Packet Inspection Market Trends

Incorporation of Artificial Intelligence (AI) and Machine Learning (ML) with Deep Packet Inspection Solutions to Surge Market Growth

Integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies to enhance network security and efficiency is expected to surge the deep packet inspection market growth during the forecast period. Deep packet inspection solutions are increasingly leveraging AI and ML algorithms to intelligently analyze network traffic patterns, detect anomalies, and identify potential security threats in real time. This trend enables DPI systems to adapt to evolving cyber threats and provide more accurate and proactive threat detection. For instance, AI-powered DPI can quickly identify and mitigate cyber-attacks by learning from historical data and recognizing patterns indicative of malicious activity. Additionally, these advanced technologies enable DPI solutions to optimize network performance by predicting and addressing potential bottlenecks or congestion. As the cyber threat landscape evolves, the integration of AI and ML in DPI solutions becomes instrumental in ensuring robust network security and efficient traffic management.

Download Free sample to learn more about this report.

Deep Packet Inspection Market Growth Factors

Rising Demand for Advanced Solutions in Managing Network Traffic to Fuel Market Growth

Continuous expansion of network traffic coupled with the increasing complexity of cyber threats is driving the deep packet inspection market share. The escalating volume of data transmission across networks, driven by the proliferation of digital services, cloud applications, and Internet of Things (IoT) devices, necessitates robust mechanisms for traffic management and security. DPI serves as a key enabler in this context, allowing organizations to analyze and understand the content, source, and intent of data packets traversing their networks. This enables the identification and prevention of potential security threats, ranging from malware and phishing attacks to unauthorized access attempts. For instance, in the context of telecommunications, DPI is crucial in optimizing bandwidth usage and ensuring Quality of Service (QoS) for diverse applications. As the digital landscape continues to evolve, the demand for DPI solutions is propelled by the higher need to maintain network integrity and security in the era of escalating data complexity and cyber risks.

RESTRAINING FACTORS

Growing Privacy and Regulatory Concerns to Impede Market Growth

The extensive examination of data packets raises ethical issues regarding user privacy, especially as DPI involves inspecting the content and details of network traffic. Additionally, the potential for misuse of DPI technology has led to increased analysis and regulatory challenges. As a result, organizations need to navigate these privacy concerns and ensure that DPI implementation aligns with ethical standards and regulatory requirements. Furthermore, the complexity of managing encrypted traffic poses another restraining factor, as traditional DPI methods may encounter limitations in analyzing such data, affecting the technology’s effectiveness.

Deep Packet Inspection Market Segmentation Analysis

By Deployment Analysis

Surge in Demand for Cost-effective Solutions Fuels Cloud Segment Growth

As per our study, the deployment is bifurcated into cloud and on-premise.

Among them, the cloud segment holds the maximum share of 67.11% in 2026, due to its scalability, resource optimization, and real-time threat response capabilities. The technical advantages of cloud-based deep inspection, including elastic computing, distributed architecture, and seamless updates. These features align with the dynamic nature of cybersecurity requirements, making it the preferred choice for organizations seeking agile and efficient threat detection and mitigation.

On-premise solutions exhibit a low CAGR in the market compared to cloud deployments due to the constraints of fixed infrastructure, slower scalability, and higher maintenance overhead. The technical limitations of on-premise models, involving hardware dependencies and manual updates, contrast with the agility and resource efficiency offered by cloud-based deep inspection solutions. This contributes to the lower growth rate of on-premise deployments in the evolving cybersecurity landscape.

By Enterprise Type Analysis

Surging Need for Managing Complex Network Architectures in Large Enterprises Boosts Segment Growth

According to our research, the enterprise type is divided into large enterprises and small and medium enterprises.

The large enterprises segment dominates the market share of 60.71% in 2026, due to their complex network architectures and heightened cybersecurity requirements. Large enterprises’ extensive infrastructure demands advanced deep packet inspection and processing capabilities for threat detection. The technical complexity of scrutinizing packet payloads, coupled with the need for high-performance and scalable solutions, aligns with the requirements of large enterprises, positioning them as key contributors to the market's majority share.

By Application Analysis

Rising Demand for Robust Inspection of Network Data among Businesses Drives Network Security Segment Growth

As per our research, the application is classified into network security, network management, network & subscriber analysis, content regulation, and others.

The network security segment holds the maximum share of 34.90% in 2026, as it necessitates a robust inspection of packet-level data for intrusion prevention, malware detection, and anomaly identification. Deep inspection technologies play a pivotal role in fortifying network perimeters, utilizing advanced packet analysis, signature-based detection, and behavioral analytics. The technical complexities of scrutinizing packet payloads align with the comprehensive security requirements of network infrastructure, positioning network security as a primary application for the market.

The network & subscriber analysis segment exhibits the highest CAGR owing to the increasing demand for granular visibility into network traffic patterns, user behaviors, and application usage. The technical intricacy of deep inspection in this context involves advanced protocol analysis, flow monitoring, and machine learning algorithms for anomaly detection. This addresses the evolving needs of telecommunications and service providers in optimizing network performance, ensuring Quality of Service (QoS), and enhancing overall cybersecurity posture.

By End-user Analysis

Necessity for Protecting Sensitive Information from Cyber Security Threats Boosts BFSI Segment Growth

As per our research, the end-user we have studied are BFSI, government, healthcare, IT and telecom, retail, manufacturing, and others.

The BFSI segment holds the maximum share of 25.19% in 2026, due to its stringent regulatory requirements and the critical landscape of financial data. Deep inspection technologies, with advanced packet analysis, intrusion detection, and threat intelligence integration, are crucial for ensuring compliance, protecting sensitive information, and mitigating sophisticated cyber threats targeting the financial industry. The technical complexities of examining packet payloads align with the heightened security demands and risk mitigation strategies essential for the banking, financial services and insurance sector.

The healthcare sector is expected to witness the highest CAGR during the forecasted period due to the escalating demand for robust cybersecurity solutions to safeguard sensitive patient data and comply with stringent privacy regulations. The technical intricacies of deep inspection align with the sector's increasing reliance on digital systems, telemedicine platforms, and interconnected medical devices, driving the rapid adoption and growth in the healthcare segment.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Our report includes market research across five regions, including North America, South America, Europe, Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Deep Packet Inspection Market, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 15.6 billion in 2025 and USD 19.62 billion in 2026. The U.S. deep packet inspection market is predicted to grow significantly, reaching an estimated value of USD 47,961.1 million by 2032. North America holds the highest market share as its technical landscape encompasses sophisticated DPI applications for intrusion detection and prevention, application-layer filtering, and compliance with stringent data protection regulations. Furthermore, key players in the region provide advanced solutions tailored for diverse sectors, leveraging DPI for network visibility, real-time traffic analysis, and proactive threat mitigation. The U.S. continued focus on cybersecurity and the proliferation of high-speed networks contribute to sustained dominance. The U.S. market is projected to reach USD 13.03 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific deep packet inspection market is expected to grow at the highest CAGR over the forecast period owing to the presence of major technological hubs in the region, such as China, Japan, and South Korea. Additionally, the region has experienced a surge in internet penetration and digitalization, enabling DPI solutions to enhance cybersecurity across telecommunications, healthcare, and government sectors. This factor underscores its strategic importance in the global landscape, reflecting the region's commitment to technological advancements and cybersecurity measures in the escalating complex digital landscape. The Japan market is projected to reach USD 2.21 billion by 2026, the China market is projected to reach USD 2.66 billion by 2026, and the India market is projected to reach USD 2.04 billion by 2026.

Europe

Europe holds the second largest share in the market as major European countries, including Germany, the U.K., and France, are at the forefront of DPI deployment. The market's technical landscape encompasses the implementation of sophisticated DPI solutions for intrusion detection and prevention, application-layer filtering, and adherence to stringent data protection regulations, such as the General Data Protection Regulation (GDPR). The UK market is projected to reach USD 2.26 billion by 2026, and the Germany market is projected to reach USD 2.71 billion by 2026.

South America and Middle East & Africa

South America and Middle East & Africa are expected to grow at an average rate over the forecast period. DPI technologies are gaining traction as telecommunication operators in countries, including Brazil, Argentina, and GCC incorporate advanced DPI solutions for traffic analysis and security enhancement. Moreover, the growth of e-commerce and digital services in the region contributes to the demand for DPI applications to ensure efficient network operations and protect against cyber threats.

Key Industry Players

Key Players Launch New Products to Strengthen their Market Positioning

Top deep packet inspection solution providers are actively creating advanced solutions to cater to customer demands. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively pursue collaborations, acquisitions, and partnerships to bolster their product offerings.

List of Top Deep Packet Inspection Companies

- NETSCOUT (U.S.)

- ipoque GmbH (Germany)

- Enea (Sweden)

- Nexnet Solutions (UAE)

- Palo Alto Networks (U.S.)

- Zoho Corporation Pvt. Ltd. (U.S.)

- Nokia (Finland)

- Sandvine (Canada)

- VIAVI Solutions Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In September 2023, Enea launched the Qosmos Threat Detection SDK, a revolutionary system that can potentially double the performance of network-based cybersecurity solutions. This SDK integrates Enea's Qosmos ixEngine with core IDS capabilities from Suricata, significantly boosting performance and scalability for extensive cloud-based platforms. It offers an efficient solution for large-scale, multifunctional cybersecurity applications.

- In September 2023, Viavi Solutions Inc. launched NITRO AIOps on Google Cloud, a collaborative solution combining VIAVI's advanced network analytics with Google Cloud's native services. This innovative offering is designed to tackle key challenges encountered by Communication Service Providers (CSPs) and unlock opportunities for enhanced network intelligence and optimization.

- In July 2023, Netscout Systems unveiled Omnis Cyber Intelligence (OCI), an enhanced Network Detection and Response solution. OCI utilizes scalable deep packet inspection and diverse threat detection methods at the packet source for real-time threat identification. It enables both real-time detection and historical investigation through high-fidelity network metadata and packets.

- In June 2023, Netscout introduced the Visibility Without Borders (VWB) platform, unifying performance, security, and availability for essential organizations. This platform proactively identifies and addresses complexity, fragility, and risk, delivering unparalleled insights to enhance visibility, agility, and the security of data and applications.

- In May 2023, Cubro introduced the EXA32400, a revolutionary 400G enhanced Network Packet Broker with a P4 programmable chipset. This innovative NPB caters to high-speed network needs with 32 x 400G Ports, offering breakout mode to 4 x 100G and up to 128 x 100G coverage in a particular unit height cabinet. All ports can simultaneously operate at full potential without restrictions.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment, Enterprise Type, Application, End-user, and Region |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 278.75 billion by 2034.

In 2025, the market was valued at USD USD 38.3 billion.

The market is projected to grow at a CAGR of 24.50% during the forecast period.

The BFSI industry leads the market.

Rising demand for advanced solutions in managing network traffic to fuel market growth.

NETSCOUT, ipoque GmbH, Enea, and Palo Alto Networks are the top players in the market.

North America dominated the global market with a share of 40.70% in 2025.

By application, the network & subscriber analysis segment is expected to grow with a highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us