Dental Bone Graft Substitutes Market Size, Share & Industry Analysis, By Product Type (Allograft, Synthetic Bone Substitutes, Demineralized Bone Matrix, and Xenograft), By Form (Granules, Putty, and Others), By End-user (Solo Practices, DSO/ Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

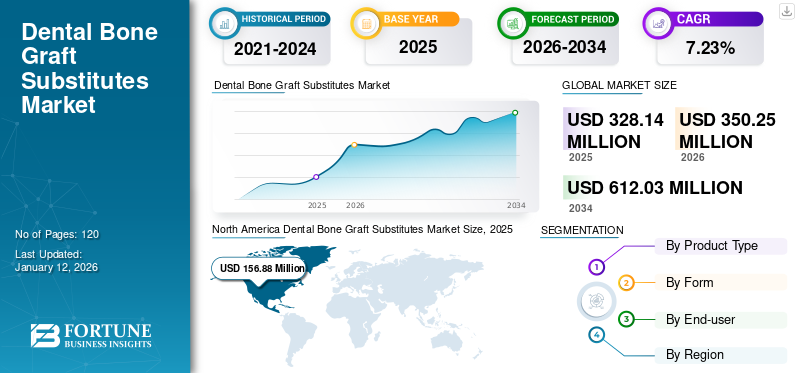

The global dental bone graft substitutes market size was valued at USD 328.14 million in 2025. The market is projected to grow from USD 350.25 million in 2026 to USD 612.03 million by 2034, exhibiting a CAGR of 7.23% during the forecast period. North America dominated the dental bone graft substitutes market with a market share of 47.93% in 2025.

A dental bone graft substitute is a substance, either natural or synthetic, used to replace or repair a damaged or missing bone tissue. These substitutes often consist of a mineralized bone matrix devoid of viable cells. They are designed to mimic the structure and function of a natural bone, allowing for the regeneration and healing of the bone tissue. These products are classified as allograft, synthetic bone substitutes, demineralized bone matrix, and xenograft.

The dental bone graft substitutes market is expected to grow significantly during the forecast period. The rising incidence of periodontal diseases, dental implants, and dental fractures is driving the demand for bone grafting procedures and dental bone graft substitute products. According to the World Health Organization (WHO), 514 million children worldwide suffer from primary tooth decay, while 2 million adults have permanent tooth decay.

Additionally, the introduction of new dental bone graft substitutes and rising awareness about the availability of advanced products are expected to drive the market growth. Furthermore, the growth in R&D investments can increase the launch of innovative products. Moreover, a rising number of collaborations and acquisitions in the market are expected to fuel the market growth.

The market experienced a decline in revenue in 2020 due to the impact of the COVID-19 pandemic as many dental clinics were closed or limited their operations to only the emergency cases. This resulted in a reduced demand for dental products. The implementation of global lockdowns and travel restrictions further compounded the challenges faced by the global market. However, in 2021, the market began to recover as the dental practices reopened, and there was a growth in the utilization of tele-dentistry and digital tools. In the same year, the rising adoption of implant surgeries and bone grafting procedures contributed to a significant market growth, which is expected to continue in the future.

Global Dental Bone Graft Substitutes Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 328.1 million

- 2026 Market Size: USD 350.25 million

- 2034 Forecast Market Size: USD 612.03 million

- CAGR: 7.23% from 2026–2034

Market Share:

- Region: North America dominated the market with a 47.93% share in 2025. This is due to an increasing number of patients suffering from bone injuries, a rising number of dental implant procedures, and a high volume of new product launches in the region.

- By Product Type: The Demineralized Bone Matrix segment held the largest market share in 2025. The segment's growth is driven by the increasing demand for dental implants requiring bone grafts to enhance jawbone stability and counter alveolar bone loss, coupled with the launch of advanced products.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, the market is driven by an increasing geriatric population that requires treatment for dental alveolar bone regeneration and jaw bone thickening.

- United States: Market growth is supported by a strong focus on innovation, including U.S. FDA approvals for advanced products like 3D-printed regenerative bone grafts. The market is also fueled by strategic partnerships to increase access to dental care for veterans.

- China: The market is expanding with increasing investment and funding for new technologies. For example, a significant funding round was secured to bring advanced bioactive bone graft materials used in dental treatments to the Chinese market.

- Europe: The market is advanced by a growing number of strategic acquisitions, such as Geistlich Pharma AG's acquisition of a U.S.-based bone regeneration company, and collaborations to expand product distribution and training for clinicians on oral tissue regeneration.

Dental Bone Graft Substitutes Market Trends

Use of 3D-Printed Synthetic Bone Graft to Emerge as Key Market Trend

3D-printed synthetic bone grafts are becoming increasingly popular in the dental bone graft substitutes market. These innovative grafts are designed to closely mimic the properties of the natural bone, allowing for better integration and long-term success in dental procedures. Technological advances, such as 3D printing enable the creation of highly customized bone grafts that can be tailored to fit the specific needs of each patient. The trend of using these bone grafts is expected to continue to grow as more research and advancements are made in this field. Additionally, the U.S. FDA approvals and an increasing number of procedures using the 3D-printed regenerative bone graft products are expected to positively impact the market. Hence, this is identified as a significant global dental bone graft substitutes market trend.

- For instance, in December 2022, Desktop Metal, Inc. received the U.S. FDA approval for its CMFlex 3D-printed regenerative bone graft product to be used in dental applications.

Download Free sample to learn more about this report.

Dental Bone Graft Substitutes Market Growth Factors

Introduction of Advanced Bone Graft Substitutes to Propel Market Growth

The rising prevalence of dental diseases has created a demand for innovative bone graft substitutes, such as synthetic bone grafts and allografts. Additionally, the increasing number of dental implants that use bone graft substitutes will boost the demand for these products. This has prompted market players to focus on developing advanced bone graft substitutes.

- For instance, in February 2024, Geistlich Pharma AG introduced the vallos granules, a demineralized allograft used for various indications, including dental procedures. Such developments are expected to fuel the demand for dental bone graft substitutes.

Additionally, a rising number of clinical trials and approvals from the regulatory bodies are expected to drive the new product launches and adoption of dental bone graft substitutes in different regions and applications during the forecast period. For instance, in June 2023, RevBio, Inc. received a USD 2 million Phase II Small Business Innovation Research (SBIR) grant from the U.S. National Institutes of Health (NIH) to advance its dental adhesive bone scaffold product into clinical development. These factors are expected to drive the market growth in the future.

Acquisitions and Partnerships by Key Players to Fuel Market Growth

The bone graft substitutes market is witnessing significant growth due to a rising number of acquisitions and partnerships by key market players. These strategic activities enable them to expand their reach and enhance their product offerings. For instance, in June 2023, the U.K-based Biocomposites acquired Artoss, a German firm. Artoss’ portfolio includes bone graft substitutes used in various clinical applications, such as dentistry, orthopedics, spine, foot, and ankle. This acquisition enabled the company to strengthen its position in the dental bone graft substitutes space.

Moreover, growing partnerships between the healthcare systems and manufacturers are expected to fuel the market growth. For instance, in April 2019, Zimmer Biomet & RTI Surgical collaborated with the American Academy of Implant Dentistry Foundation (AAIDF) to donate allograft implants to increase veterans’ access to dental care. These acquisitions and partnerships are expected to increase the product adoption and contribute to the global dental bone graft substitutes market growth.

RESTRAINING FACTORS

Clinical Limitations and Limited Reimbursement Can Hamper Market Growth

The dental bone graft substitutes market is witnessing various developments and product launches across the globe. However, there are certain limitations associated with the clinical evidence of their effectiveness and limited reimbursement for dental procedures. The market may face challenges due to potential side effects of these substitutes, such as adverse tissue reactions, inadequate bone formation, and lack of efficacy. In addition, concerns about disease transmission, immunogenicity, poor resorption rates, weak mechanical strength, and insufficient osteoinductive properties can restrict the growth of the market in the future. Furthermore, difficulties in analyzing the in-vivo and clinical trial results and implementation of stringent regulatory guidelines can limit the market growth.

Moreover, in several countries, dental bone graft substitutes are not covered by insurance or not reimbursed adequately. This may deter patients from undergoing these procedures due to the high out-of-pocket costs, thereby reducing the demand for these products.

Dental Bone Graft Substitutes Market Segmentation Analysis

By Product Type Analysis

Demineralized Bone Matrix Segment Dominated Market Owing to Advanced Product Launches

Based on product type, the market is segmented into allografts, synthetic bone graft substitutes, demineralized bone matrix, and xenograft.

In 2024, the demineralized bone matrix segment accounted for the majority share of the market. This growth can be attributed to the increasing demand for dental implants that require bone grafts to enhance the stability of the jaw bone and counter alveolar bone loss. The increasing prevalence of dental disorders has also contributed to the rise in the utilization of allografts. Furthermore, the launch of advanced products is expected to boost the growth of this segment in the future.

The synthetic bone graft substitutes segment accounted for the majority share of 58.62% in 2026. This growth is primarily driven by the benefits offered by these products, such as high biocompatibility and osteoconductivity, which promote direct bone growth. Synthetic substitutes are also preferred due to their widespread availability and cost-effectiveness, prompting a shift toward these substitutes in dental applications. Moreover, collaborations and acquisitions between the market players, such as the Halma acquisition of NovaBone in January 2020 are expected to drive the adoption of synthetic dental bone graft substitutes and fuel the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Granules Segment Dominated Market Due to its High Usability

By form, the market is divided into granules, putty, and others.

The granules segment held a dominant global dental bone graft substitutes market share of 62.00% in 2026 due to the numerous advantages offered by granule bone graft substitutes in grafting procedures. These granules have a unique surface texture that significantly increases the surface area for osteoblast attachment and stimulates osteogenesis, making them highly preferred by healthcare professionals. Additionally, their easy storage requirements make them a convenient option for dental professionals. Moreover, the increasing product launches and availability of granule-based bone graft substitutes are expected to drive the growth of this segment in the future.

The others segment is expected to witness a higher CAGR in the coming years. This growth can be attributed to the growing focus of key market players on research and development efforts to enhance and introduce bone plugs and block forms of dental orthobiologics.

By End-user Analysis

Solo Practices Segment Dominated Market Due to Strong Patient Preference

Based on end-user, the market is classified into solo practices, DSO/group practices, and others.

The solo practices segment dominated the market in 2026 with a share of 60.18%. The dominance of the segment is attributed to the larger proportion of dental professionals going solo and high patient preference for solo clinics due to their ability to offer personalized experience.

The DSO/group practices segment is expected to record a higher CAGR during the forecast period. The rising number of DSO visits for dental implants is expected to contribute to the demand for bone graft substitutes. Additionally, the transition of dental practitioners toward group practices in developed regions is expected to increase the demand for bone graft substitutes. Moreover, collaborations between DSOs and manufacturers are expected to drive the segment’s growth.

- For instance, in April 2022, The Aspen Group, a DSO that operates in 45 states of the U.S., collaborated with ACE Surgical Supply for supplying bone grafting solutions to its affiliated offices. This collaboration is expected to increase product adoption in group practices.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America Dental Bone Graft Substitutes Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 156.88 million in 2025 and USD 167.86 million in 2026. The increasing number of patients suffering from bone injuries, coupled with the rising number of dental implant procedures in the region, is anticipated to drive the market growth across North America. Moreover, numerous product launches are expected to fuel the market growth in the region. The U.S. market is projected to reach USD 152.04 million by 2026.

Europe held the second-highest market share in 2024. Significant R&D investments and the increasing focus of market players on introducing technologically advanced products in the region are expected to increase the demand for these products during the forecast period. Additionally, a growing number of strategic acquisitions are expected to accelerate the region's market growth. The UK market is expected to reach USD 12.99 million by 2026, while the Germany market is projected to reach USD 22.31 million by 2026.

- For instance, in October 2022, Geistlich Pharma AG acquired Lynch Biologics, LLC. It is a U.S.-based company that operates in bone regeneration, including dental bone graft substitutes.

Asia Pacific is anticipated to record the highest CAGR in the coming years. The regional market’s growth is due to the increasing prevalence of dental disorders and growth in the geriatric population, which requires treatment for dental alveolar bone regeneration and jaw bone thickening. Moreover, surging investments by market players to expand their presence in the region are expected to drive the market growth. The Japan market is anticipated to reach USD 20.11 million by 2026, the China market is forecast to reach USD 18.61 million by 2026, and the India market is projected to reach USD 8.57 million by 2026.

The growth of the market in Latin America and the Middle East & Africa is attributed to the increasing awareness of bone graft substitutes used in dental implant procedures and growing focus on improving the healthcare infrastructure in these regions. Additionally, growing inbound medical tourism is expected to drive the market growth in the regions.

KEY INDUSTRY PLAYERS

ZimVie Inc., Medtronic, and Geistlich Pharma AG Accounted for Substantial Proportion of Global Market

The global dental bone graft substitutes market is partially consolidated. The players, including ZimVie Inc., Medtronic, and Geistlich Pharma AG held substantial revenue shares in the market in 2024.

These companies have a strong portfolio of dental bone graft substitutes. Furthermore, there is a growing focus on strategies, such as acquisitions and mergers with the other players to increase their presence in the market. Moreover, the consistent focus of the key companies on the introduction of new products is expected to strengthen their market share during the forecast period. Additionally, key players in the market are constantly investing in R&D and technological advancements which is expected to drive the growth of these companies.

Envista, BioHorizons, NovaBone, botiss biomaterials GmbH, and other small and medium-sized market players are focusing on geographical expansions and new product launches with advanced features.

- For instance, in August 2021, botiss biomaterials GmbH launched a new generation of bone graft substitutes called the NOVAMag product line. These products have magnesium and are completely bioresorbable. Such futuristic product launches are expected to drive the market position of these companies.

Moreover, the rising number of product approvals is expected to fuel the growth of these companies in the coming years.

List of Top Dental Bone Graft Substitutes Companies:

- ZimVie Inc. (U.S.)

- Institut Straumann AG (Switzerland)

- Envista (U.S.)

- Dentsply Sirona. (U.S.)

- Medtronic (Ireland)

- curasan AG (Germany)

- Henry Schein, Inc. (U.S.)

- BioHorizons (U.S.)

- NovaBone (Halma) (U.K.)

- botiss biomaterials GmbH (Germany)

- Geistlich Pharma AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Geistlich Pharma AG acquired Bionnovation Biomedical in Brazil to expand its bone graft substitutes business in Latin America.

- June 2023: Geistlich Pharma AG launched a non-surgical periodontitis treatment gel. It is a combination of hyaluronic acid, a thermosensitive filler to promote healing.

- January 2023: Envista launched creos syntogain, a biomimetic bone graft substitute in two granule sizes (0.2-1.0 mm and 1.0-2.0 mm).

- July 2022: botiss biomaterials GmbH and the International Team for Implantology (ITI) collaborated to offer training to the clinicians for the treatment concepts in the field of oral tissue regeneration.

- March 2022: CGbio, a company specializing in regenerative medicine, collaborated with Kerunxi Medical to export Bongros Dental, a bone graft material including synthetic bone graft.

- October 2021: CoreBone received USD 3.7 million funding from the Guangzhou Sino-Israel Biotech Investment Fund ("GIBF"), which specializes in bringing Israeli medical technologies to the Chinese Market. CoreBone is a company that offers bioactive bone graft materials used in orthopedic and dental treatments.

- January 2021: Dentsply Sirona acquired Datum Dental, Ltd. with its strong OSSIX biomaterial portfolio. The portfolio includes various regenerative products, including bone graft substitutes.

REPORT COVERAGE

The report provides an in-depth analysis of the market. It focuses on market segmentation, such as by type, product type, design, speed, end-user, and region. Besides, it provides bone graft substitutes market forecast in relation to the current market dynamics, trends analysis, the impact of COVID-19, and the latest market statistics. Additionally, it consists of the market share of various segments and the factors driving the market growth. It provides information about the key players operating in the market, their SWOT analysis, and the competitive landscape of the market at the global level. Moreover, the report offers key insights on technological advancements, prevalence of dental disorders, and key industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.23% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Form

|

|

|

By End-user

|

|

|

By Regin

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 328.14 million in 2025.

The market will exhibit a steady CAGR of 7.23% during the forecast period.

By product type, the demineralized bone matrix segment led the market.

The rising prevalence of dental disorders and growing adoption of synthetic bone substitutes are the key factors anticipated to drive the market.

ZimVie Inc., Medtronic, and Geistlich Pharma AG are some of the key players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us