Dental Panoramic Radiography Market Size, Share & Industry Analysis, By Type (Analog, and Digital), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

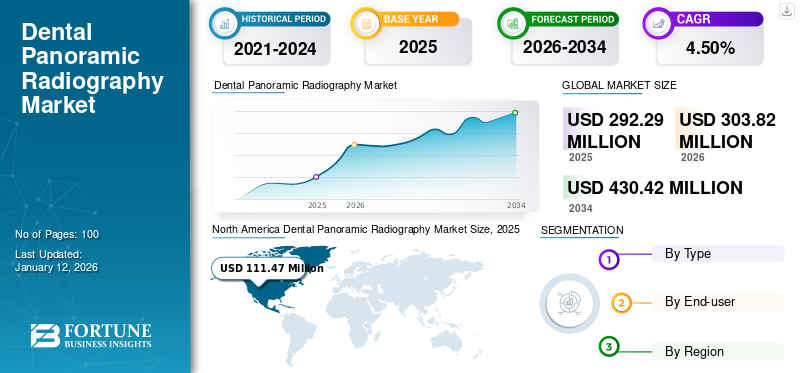

The global dental panoramic radiography market size was valued at USD 292.29 million in 2025. The market is projected to grow from USD 303.82 million in 2026 to USD 430.42 million by 2034, exhibiting a CAGR of 4.50% during the forecast period. North America dominated the dental panoramic radiography market with a market share of 38.14% in 2025.

Dental panoramic radiography, commonly known as a panoramic X-ray or panorex, provides a comprehensive overview of the entire mouth area in a single image. This imaging technique captures a wide-angle view of the teeth, jaws, and surrounding structures, aiding in the diagnosis and treatments of various dental conditions, such as impacted teeth and jaw disorders. Unlike the intraoral X-rays, these dental radiography systems require minimal patient cooperation and reduce their exposure to radiation. It is an invaluable tool for dentists in terms of treatment planning, orthodontic assessment, and identification of abnormalities that are not easily detected through clinical examination alone.

The global dental panoramic radiography market growth is driven by various factors, such as increasing prevalence of dental disorders. Additionally, advancements in imaging technology, such as the development of digital panoramic radiography, will enhance the diagnostic accuracy and workflow efficiencies. Moreover, the growing awareness among patients and healthcare professionals about the importance of early detection of oral disorders and preventive dental care will contribute to the market growth. Furthermore, the rising adoption of panoramic radiography in various dental specialties, including orthodontics, oral surgery, and endodontics, will further propel the market expansion.

The COVID-19 pandemic greatly impacted the sales of dental panoramic radiography systems due to lockdowns and various other restrictions. During this period, many dental practices temporarily closed or reduced their services, leading to a decline in the routine dental appointments and diagnostic procedures. Furthermore, supply chain disruptions and decreased patient visits resulted in a slowdown of equipment purchases and upgrades. However, as the dental services gradually resumed and infection control measures became standardized, the market recovered with a renewed emphasis on digital solutions and patient safety. Additionally, the growing awareness of oral infection control measures further fueled the demand for these products, driving market growth amidst the pandemic. Infection control drove the demand for panoramic dental x-rays by minimizing patient’s contact with the imaging equipment and reducing the need for multiple exposures. This enhanced the overall hygiene and safety in dental settings.

Global Dental Panoramic Radiography Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 292.29 million

- 2026 Market Size: USD 303.82 million

- 2034 Forecast Market Size: USD 430.42 million

- CAGR: 4.50% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 38.14% share in 2025. This is due to a well-established healthcare infrastructure, high adoption rates of advanced dental technologies, favorable reimbursement policies, and a strong presence of key market players.

- By Type: The digital segment held the dominant market share. Its leadership is attributed to numerous advantages over traditional film systems, including instant image viewing, enhanced diagnostic efficiency, advanced image manipulation tools, and lower radiation doses for patients.

Key Country Highlights:

- Japan: Demand is driven by a high level of public awareness and participation in preventive dental care, with a significant percentage of the population seeking regular oral checkups, which often include diagnostic imaging.

- United States: As part of the dominant North American market, growth is fueled by high adoption of advanced dental technologies, a strong emphasis on preventive care, and the presence of leading manufacturers driving innovation.

- China: The market is expanding due to rapidly growing healthcare expenditure and significant improvements in medical infrastructure, which supports the adoption of advanced diagnostic equipment in dental practices.

- Europe: The market is propelled by an advanced healthcare infrastructure, high adoption of technological advancements in dentistry, increasing awareness about oral health, and a growing geriatric population requiring comprehensive dental diagnostics.

Dental Panoramic Radiography Market Trends

Shift Toward Digital Dental Panoramic Radiography for Improved Diagnostic Workflow Efficiency

In recent years, the market has seen a shift toward digital panoramic radiography, driven by the pursuit of improving diagnostic workflow efficiencies in the dental practices. Digital panoramic radiography offers several advantages over the traditional film-based systems, making it increasingly appealing to dental practitioners. These digital products can offer various benefits, such as the ability to produce high-quality images that can be instantly viewed and manipulated on the computer screens. This facilitates rapid image acquisition & interpretation, streamlining of the diagnostic process, and reduction in patient wait times. Additionally, the digital images can be easily stored, archived, and shared electronically, eliminating the need for physical film storage and retrieval systems.

Furthermore, digital dental panoramic radiography often incorporates advanced features, such as image enhancement tools, measurement capabilities, and computer-aided diagnostics. These functionalities enable dentists to perform more detailed analyses and make more accurate diagnoses, leading to improved patient care outcomes.

For instance, the Planmeca ProMax 2D from PLANMECA OY is highly regarded for its sharp image quality and user-friendly interface. It provides reliable diagnostic imaging with advanced modes and adjustable settings, making it a preferred choice among dental professionals for panoramic x-rays. Moreover, digital panoramic radiography systems typically require lower radiation doses compared to film-based systems, thereby enhancing patient safety without compromising on image quality. This aligns with the growing emphasis on minimizing radiation exposure in medical imaging practices. Hence, this transition toward the digital systems is identified as a key global dental panoramic radiography market trend.

Download Free sample to learn more about this report.

Dental Panoramic Radiography Market Growth Factors

Growing Awareness of Early Detection and Preventive Dental Care to Propel Market Growth

The increasing awareness about the early detection of various oral diseases and preventive dental care are significant drivers of the market growth. In recent times, individuals have become more informed about the importance of maintaining oral health and seeking regular dental checkups. There is an increased emphasis on the early detection of dental issues to prevent their worsening.

- For instance, according to the Canadian Community Health Survey 2022 published by the Government of Canada, nearly two-third (65%) of Canadians were reported to have visited a dental professional in the last year.

Dental panoramic radiography plays a crucial role in this context by offering a comprehensive overview of the entire oral cavity, enabling the dentists to identify potential problems at an early stage. The use of these devices to detect issues, such as cavities, periodontal diseases, and oral lesions is increasing to prevent them from becoming symptomatic or reaching an advanced stage. This form of radiography enables timely intervention and treatment, thereby preventing complications and preserving oral health effectively.

Moreover, the growing emphasis on preventive dental care has encouraged individuals to undergo routine dental screenings, including panoramic radiography, as part of their preventive healthcare regime. This increased demand for diagnostic procedures will contributes to the expansion of the market.

Furthermore, various technological advancements in panoramic radiography technologies, such as digital imaging and computer-aided diagnostics, enhances the accuracy and efficiency of these dental examinations, further driving the market growth.

Growing Cases of Dental Disorders to Surge Demand for Panoramic Radiography Equipment

The increasing prevalence of dental disorders, such as dental caries, periodontal diseases, and dental trauma have continued to the increased demand for effective diagnostic tools to aid in their early detection and treatment planning. Dental panoramic radiography, with its ability to provide a comprehensive view of the entire oral cavity in a single image, plays a crucial role in the diagnosis of these dental issues.

- For instance, according to the data published by the World Health Organization (WHO), globally, 1 billion individuals were affected by a severe periodontal disease, and around 2.5 billion people were left untreated from dental caries. Such a large population suffering from severe oral diseases is expected to increase the demand for panoramic X-ray machines.

The aging population and changing lifestyles are also leading to a higher incidence of dental problems. There is also a corresponding increase in the need for regular dental checkups and subsequent diagnostic procedures. Panoramic radiography offers a non-invasive and efficient means of assessing a patient’s dental health, enabling dentists to identify issues, such as impacted teeth, bone abnormalities, and oral pathologies with greater accuracy.

Moreover, advancements in panoramic radiography technologies, including digital imaging and software enhancements, will further enhance its diagnostic capabilities and workflow efficiencies. This makes panoramic radiography an indispensable tool in modern dental practices, driving its adoption across various dental settings. Overall, the growing prevalence of dental disorders, along with growing importance of panoramic radiography in the improvement of patient care and outcomes, is fueling the use of dental panoramic radiography systems.

RESTRAINING FACTORS

Competition from Alternative X-ray Instruments May Limit Market Growth

The availability of Cone Beam Computed Tomography (CBCT), intraoral x-ray systems, and intra-oral scanners for the diagnosis of oral diseases in dental clinics and hospitals is one of the key restraints of the market. CBCT systems offer three-dimensional imaging capabilities, providing detailed anatomical information that is useful in complex dental procedures, such as implant placements and orthognathic surgeries. Similarly, intraoral X-ray units allow for the high-resolution imaging of specific teeth or oral areas, offering detailed views which are crucial for diagnostics and treatment planning in restorative dentistry.

These alternative X-ray instruments are competing with dental panoramic radiography by providing more specialized imaging solutions tailored to specific dental applications. Moreover, advancements in CBCT technology have led to improved image quality and reduced radiation doses, further enhancing its appeal among dental practitioners. As a result, the dental panoramic radiography market faces challenges in its growth.

Dental Panoramic Radiography Market Segmentation Analysis

By Type Analysis

Digital Segment Held Dominant Market Share Due to its High Performance and Reliability

Based on type, the market is segmented into analog and digital.

The digital segment dominated the dental panoramic radiography market share of 95.68% in 2026 and is expected to record a significant CAGR during the forecast period. The segment’s growth is due to the numerous advantages of this type of radiography device over the traditional film-based systems. The images from these devices can be instantly viewed, manipulated, and shared electronically, enhancing the diagnostic efficiencies and workflows. Additionally, the digital systems can often incorporate advanced features, such as image enhancement tools and computer-aided diagnostics, enabling more accurate analyses. Moreover, the digital panoramic radiography systems typically require lower radiation doses, further contributing to their widespread adoption and dominance in the market.

The analog segment holds a considerable share of the global market. The segment’s growth is due to cost-effectiveness of these systems and familiarity amongst dental practitioners, especially in developing countries. Additionally, in regions with limited access to digital infrastructure or where digital systems are expensive, analog systems remain a viable option. Moreover, some dental practices may continue to use analog systems for specific applications or as backup solutions, ensuring the continued relevance of this segment.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices to Continue Dominance Due to Increasing Dental Examination Services in These Institutions

Based on end-user, the global market is segmented into solo practices, DSO/group practices, and others.

In 2024, the solo practices segment held the highest share of 52.83% in 2026. The segment is growing as many independent dental practitioners prefer panoramic radiography due to its versatility and ability to provide comprehensive diagnostic information in a single image. Additionally, solo practices often prioritize their cost-effectiveness and simplicity, which expected to increase the demand for these x-ray systems. Moreover, the growing number of dental practices, along with the rising number of visits to these clinics for oral checkups, is expected to increase the segment’s growth during the forecast period.

- For instance, according to a study published by the International Dental Journal in December 2023, 18.6% of the Japanese population went for preventive dental care visits

The DSO/group practices segment is expected to record the highest CAGR during the forecast period. Dental Service Organizations (DSOs) and group practices often have multiple locations and a higher patient volume, leading to a greater demand for diagnostic imaging equipment, such as panoramic x-ray machines. Additionally, DSOs and group practices tend to prioritize efficiency and standardization across their facilities, making digital panoramic radiography systems an attractive choice due to their streamlined workflow and ease of integration with Electronic Health Records (EHR) systems.

The other segments include hospitals, military hospitals, long-term care facilities, and academic research institutes.

REGIONAL INSIGHTS

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Panoramic Radiography Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a revenue of USD 111.47 million in 2025 and is expected to continue its dominance during the forecast period. The region benefits from a well-established healthcare infrastructure, high adoption rates of advanced dental technologies, and a strong presence of key market players. Moreover, the increasing awareness about oral health, rising prevalence of dental disorders, and favorable reimbursement policies will contribute to the market growth. The U.S. market is projected to reach USD 106.86 billion by 2026.

- For instance, according to data published by the Government of Canada, in 2023, the Canadian Dental Care Plan is expected to become available to uninsured Canadians under 18 years of age and persons with disabilities. Additionally, by 2025, the Canadian Dental Care Plan will be fully implemented to cover all uninsured Canadians with an annual family income under USD 90,000.

Europe

Europe held the second-highest market share in 2024 and is anticipated to expand at a moderate growth rate during the forecast timeframe. The segment’s growth is due to the presence of an advanced healthcare infrastructure and a high adoption rate of technological advancements. Additionally, increasing awareness about oral health and growing geriatric population will contribute to the market's expansion. The UK market is projected to reach USD 13.62 billion by 2026, while the Germany market is projected to reach USD 25.94 billion by 2026.

Asia Pacific

Asia Pacific is expected to expand at the highest CAGR during the forecast period. The regional market growth is attributed to the growing healthcare expenditure and improving medical infrastructure in countries, such as China and India. Furthermore, increasing awareness about oral health and a surge in dental tourism are factors contributing to the market’s growth. The Japan market is projected to reach USD 16.11 billion by 2026, the China market is projected to reach USD 18.78 billion by 2026, and the India market is projected to reach USD 8.47 billion by 2026.

Latin America and the Middle East & Africa

The markets in Latin America and the Middle East & Africa are expected to expand at a comparatively lower CAGR during the forecast timeframe. The growth is attributed to the improving healthcare infrastructure, rising disposable incomes, and increasing awareness about oral health.

KEY INDUSTRY PLAYERS

VATECH and Dentsply Sirona to Launch Advanced Machines to Maintain Market Position

The market is consolidated due to the presence of prominent players, such as VATECH and Dentsply Sirona, which hold significant market shares. These companies provide a comprehensive range of extraoral X-rays for the dental industry that have vast applications. Furthermore, they are continuously focusing on growing their geographical presence with strong distribution channels, contributing to their dominance in the market. VATECH is one of the leading players in the market due to its advanced imaging technology, which offers high-resolution, detailed images for precise diagnostics and treatment planning. Their systems are renowned for combining innovation with user-friendly interfaces, effectively catering to the needs of modern dental practices seeking reliable and efficient imaging solutions.

Other companies, such as Acteon, Trident, Dental Imaging Technologies Corporation, and others held substantial market shares due to the high demand for their products in their domestic countries. Furthermore, the focus of these companies on increasing their presence in developed countries with cost-effective products is expected to increase their share in the market.

LIST OF TOP DENTAL PANORAMIC RADIOGRAPHY COMPANIES:

- Acteon (U.K.)

- VATECH (South Korea)

- Trident (Italy)

- PLANMECA OY (Finland)

- Dentsply Sirona (U.S.)

- Dental Imaging Technologies Corporation (Australia)

- DÜRR DENTAL SE (Germany)

- Owandy Radiology (France)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 - Denti.AI received the FDA 510(k) clearance for Denti.AI Detect, a revolutionary AI-powered imaging solution that amplifies the disease detection capabilities of panoramic X-ray along with other x-rays.

- September 2021 – PLANMECA OY announced the acquisition of the KaVo Treatment Unit & Instrument business from Envista Holdings Corporation.

- May 2021 - KaVo Dental announced a collaboration with A-dec, Inc. to deliver premier products and services to dental professionals worldwide.

REPORT COVERAGE

The analysis provides a detailed overview of the market and focuses on the market dynamics. The various key insights provided in the report are product launches and key industry developments, such as partnerships, mergers, and acquisitions. Furthermore, it also includes the number of dental practitioners in key countries along with the prevalence of key oral diseases in these countries. Additionally, it includes a detailed product profiling of key devices by companies operating in the market. In addition to the aforementioned factors, the report encompasses the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 4.50% from 2026-2034 |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 303.82 million in 2026 and is projected to reach USD 430.42 million by 2034.

In 2025, the North America market value stood at USD 111.47 million.

The market is expected to exhibit a CAGR of 4.50% during the forecast period.

By type, the digital segment leads the market.

North America dominated the dental panoramic radiography market with a market share of 38.14% in 2025.

Key factors, such as the rising prevalence of oral disorders, growing popularity of digital dentistry among dentists, and increasing dental expenditures are expected to drive the market growth.

VATECH and Dentsply Sirona are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us