Dental Practice Management Software Market Size, Share & Industry Analysis, By Deployment Mode (Cloud-based and On-premise), By Application (Patient Communication, Invoice/Billing, Payment Processing, Insurance Management, Dental Analytics, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

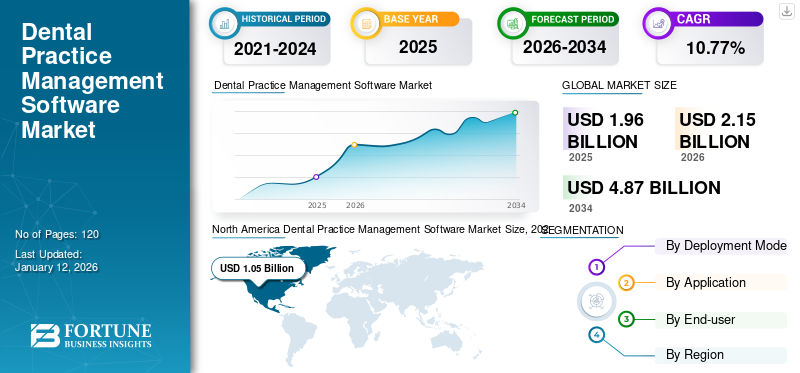

The global dental practice management software market size was valued at USD 1.96 billion in 2025. The market is projected to grow from USD 2.15 billion in 2026 to USD 4.87 billion by 2034, exhibiting a CAGR of 10.77% during the forecast period. North America dominated the dental practice management software market with a market share of 53.57% in 2025.

Dental practice management software is a specialized tool designed to streamline the administrative and clinical operations of dental practices. It helps manage patient records, appointments, billing, insurance claims, and treatment plans all in one platform. By automating routine tasks, this software improves efficiency, reduces errors, and enhances patient care. Many systems offer cloud-based solutions, enabling access from multiple locations. In addition, advanced features such as analytics and reporting provide valuable insights to support practice growth and decision-making, making it essential for modern dental practices.

The global market is expected to grow significantly in the coming years, driven by factors such as the increasing demand for efficient administrative processes and enhanced patient care that fuels its adoption as practices seek to streamline operations and reduce manual errors. The rise of cloud-based solutions offers flexibility and remote access, further accelerating the market growth. Technological advancements, such as integrated analytics and Artificial Intelligence (AI) driven insights, provide valuable data to improve practice management systems and patient outcomes.

The COVID-19 pandemic accelerated the adoption of dental practice management software as practices sought to streamline operations and ensure greater patient safety. The increased need for remote communication, telehealth services, and efficient scheduling led to a surge in the demand for digital solutions. Post-pandemic, from 2021 onwards, there was a marked increase in the use of cloud-based management systems for appointment scheduling, patient data management, and telehealth services. These solutions helped streamline workflows, enhance patient communication, and ensure compliance with health and safety guidelines.

Dental Practice Management Software Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.96 billion

- 2026 Market Size: USD 2.15 billion

- 2034 Forecast Market Size: USD 4.87 billion

- CAGR: 10.77% from 2026–2034

Market Share:

- Regional Leader: North America dominated the market with a 53.57% share in 2025, attributed to the widespread adoption of advanced digital technologies, a high number of practicing dentists, and the presence of major software providers such as Henry Schein and Carestream Dental.

- By Deployment Mode: On-premise segment held the largest share in 2024 due to its enhanced security, data control, and system customization, which appeal to practices with regulatory obligations or specific IT infrastructure.

- By Application: Insurance management led the application segment, driven by the growing volume of dental claims and the need for automated claim processing and real-time insurance verification.

Key Country Highlights:

- Japan: The market is growing steadily, with digitalization in clinics and the country’s emphasis on patient safety and workflow optimization contributing to the adoption of practice management solutions.

- United States: The U.S. dental industry, supported by a large base of over 200,000 active dentists (ADA 2023), is heavily investing in digital infrastructure. Government support for healthcare IT and cloud-based tools is boosting the uptake of dental software for improved care delivery and practice efficiency.

- China: Rapid expansion of dental chains and private clinics, combined with the government's push for health tech adoption, is driving the demand for cloud-based practice management systems.

- Europe: The region ranks second globally in 2024, with high adoption of digital solutions in dental care, favorable healthcare IT policies, and growing demand for integrated analytics and patient engagement tools fueling market expansion.

Dental Practice Management Software Market Trends

Technological Advancements in Dental Practice Management Software

Innovations such as cloud-based platforms, artificial intelligence, and integrated digital tools are reshaping the landscape of dental practice management. Cloud solutions provide flexibility and remote access, while AI enhances diagnostic accuracy and automates routine tasks. Improved integration with digital imaging and electronic health records streamlines workflows and facilitates better data management.

- For instance, in January 2024, Smilefy, Inc. introduced Smilefy 4.0, an AI-powered 3D smile design software. This advanced program enables dental professionals to craft 3D smile designs, produce models ready for 3D printing, and provide patients with a preview of their new smiles before finalizing the treatment.

These advancements increase the efficiency and functionality of management systems and support the growing need for advanced analytics and real-time data access. As technology continues to evolve, it drives the demand for more sophisticated and adaptable software solutions in the dental industry.

Download Free sample to learn more about this report.

Dental Practice Management Software Market Growth Factors

Incorporation of Digitalization in Dental Practices to Enable Market Growth

As dental professionals increasingly incorporate digital tools for diagnostics, treatment planning, and patient records, there is a rising demand for integrated management software. These systems enhance operational efficiency by automating administrative tasks such as scheduling, billing, and patient communication.

Digital technologies also facilitate seamless integration with electronic health records and imaging systems, providing a more comprehensive and streamlined approach to practice management. Furthermore, growing partnerships between market players to create advanced solutions for dental clinics is expected to boost the market growth.

- For instance, in May 2023, Oryx Dental Cloud-based Software partnered with the Kois Center to develop a solution that facilitates standardized data collection and analysis in minutes.

This shift toward digitalization is improving patient care and operational workflows and creating a greater need for sophisticated software solutions that can support and manage these advanced technologies. Hence, this is identified as a key driver for the global dental practice management software market growth.

Increasing Demand for Better Patient Management to Fuel Market Growth

The increasing need for better patient management is a key driver of the dental practice management market. As dental practices strive to enhance patient satisfaction and streamline their operations, there is a growing demand for software that can efficiently handle the various aspects of patient care.

- For instance, in January 2024, Kenworthy Road Dental Clinic was inaugurated by England’s Chief Dental Officer to provide free services in Hackney and nearby areas. Such a growing number of clinics is expected to increase the demand for better patient management.

Modern practice management solutions offer features such as appointment scheduling, patient records management, and communication tools that help improve overall patient experience. These systems enable practices to manage patient information more effectively, track treatment progress, and reduce administrative burdens. By addressing the need for organized and accessible patient data, dental practice management software supports improved care delivery and operational efficiency, driving its adoption in the market.

RESTRAINING FACTORS

High Implementation and Maintenance Costs act as a Barrier to Dental Practice Management Software Adoption

The high implementation and maintenance costs of dental practice management software represent a significant market restraint. Initially, the financial outlay for purchasing and installing these systems can be substantial, which deters many dental practices, particularly the smaller and standalone ones, from adopting the advanced technology. In addition, ongoing maintenance, including software updates, technical support, and hardware requirements, contributes to the total cost of ownership.

For instance, as per the article published by Forgeahead in June 2024, on-premise systems require purchasing additional hardware for scalability, leading to higher initial costs. This can be a significant financial burden for smaller dental practices with limited resources.

These recurring expenses can strain the budgets of the dental practices, impacting their decision-making processes and limiting their ability to invest in other areas of their operations. Consequently, the financial burden associated with these systems can restrict market growth and adoption, particularly among cost-conscious practitioners.

Dental Practice Management Software Market Segmentation Analysis

By Deployment Mode Analysis

On-Premise Segment Dominates Due to its Enhanced Security Options

Based on deployment mode, the market is segmented into cloud-based and on-premise.

The on-premise segment dominated the market with a share of 67.73% in 2026. The growth of the segment can be attributed to its appeal to practices that prefer full control over their data and systems. This segment offers enhanced security and customization options, which are critical for managing sensitive patient information and meeting regulatory requirements. In addition, on-premise solutions provide stability and reliability, making them a preferred choice for practices with established infrastructure and dedicated IT support.

The cloud-based segment is expected to grow at a higher CAGR during the forecast period. The segment’s growth is due to its flexibility, scalability, and ease of access. Cloud solutions enable dental practices to manage operations from any location, streamline updates and maintenance, and reduce the need for extensive on-site hardware. Furthermore, the growing launches of this software are expected to boost the segmental growth in the long run.

- In September 2022, Carestream Dental introduced Sensei Cloud for Oral Surgery, a cloud-based practice management software designed for oral and maxillofacial surgery.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Insurance Management Segment Leads Fueled by High Volume of Dental Procedures

By application, the market is divided into patient communication, invoice/billing, payment processing, insurance management, dental analytics, and others.

The insurance management segment dominated the global dental practice management software market share in 2024. The segmental growth is attributed to its critical role in streamlining the claims processing, verifying patient coverage, and managing reimbursements. This segment’s extensive features, such as automated claim submissions and real-time insurance verification, help dental practices reduce administrative burdens and errors. The increasing volume of dental claims during or after procedures, along with the ongoing enhancement of dental insurance coverage, are the key factors expected to drive segment growth throughout the forecast period. The Patient Communication segment led the market accounting for 34.30% market share in 2026.

- An ADA report from February 2021 indicates that 51.3% of children aged 2 to 18 in the U.S. have private dental insurance, while 38.5% are covered by the Medicaid Children's Health Insurance Program.

The dental analytics segment is expected to grow at the highest CAGR during the assessment period. The growth is due to its ability to provide actionable insights and data-driven decision-making. Advanced analytics tools enable practices to track performance metrics, patient trends, and operational efficiencies, which enhances strategic planning and overall practice management. By offering detailed reports and visualizations, this segment helps dental practices optimize their operations, improve patient outcomes, and drive growth, making it a crucial component of modern dental software solutions.

The others segment includes appointment scheduling, treatment planning, patient record management, etc. The segment’s growth is credited to the growing patient visits to dental clinics for the treatment of various dental disorders which increased the demand for proper management software.

By End-user Analysis

Solo Practices Hold Leading Position in the Market Owing to Large Patient Pool

Based on end-user, the market is classified into solo practices, DSO/group practices, and others.

The solo practices segment dominates due to the specific needs of individual practitioners who seek streamlined, cost-effective solutions. These practices benefit from software that simplifies day-to-day operations, such as scheduling, billing, and patient management, without the complexity of larger systems. The focus on user-friendly, scalable features that cater to the unique requirements of solo practitioners contributes to this segment's significant market share of 59.29% in 2026.

On the other hand, the DSO/group practices segment is expected to grow at the highest CAGR during the study period, fueled by the need for comprehensive, scalable solutions that manage multiple locations and large patient volumes. These practices require integrated systems for centralized scheduling, billing, and reporting, enabling efficient management across various sites. The ability to provide cohesive data and streamline operations for multiple practitioners is expected to increase its segmental share.

- For instance, in 2019, an ADA Health Policy Institute survey found that 7.4% of dentists were affiliated with a Dental Service Organization (DSO) in the U.S.

The others segment comprises hospitals and research institutes, which are expected to witness considerable growth. The rising number of various services, such as oral surgeries in these settings, is expected to drive product adoption.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Practice Management Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

In 2025, North America held the largest share, with a revenue of USD 1.05 billion. The high adoption of advanced technologies, widespread use of digital solutions in healthcare, and a strong presence of key market players are some of the contributing factors leading to the region’s dominance. In addition, a growing emphasis on streamlining dental workflows and increasing demand for dental care in the region is driving the region’s growth prospects. As reported by the American Dental Association (ADA), there were approximately 202,304 professionally active dentists in the U.S. as recorded in 2023. The rising number of dentists in the country is anticipated to boost the demand for dental practice management software. The U.S. market is projected to reach USD 1.08 billion by 2026.

Europe

Europe was the second-largest regional market in 2024. The region’s growth is due to its advanced healthcare infrastructure, high digitalization rates in dental practices, and strong government support for healthcare IT adoption. In addition, growing awareness of oral health, increasing demand for efficient dental care solutions, and the presence of key industry players contribute to the market's growth in the region. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period due to rising healthcare digitalization, increasing awareness of oral health, and growing demand for advanced dental care solutions. In addition, the region's large population, improving healthcare infrastructure, and government initiatives supporting technological adoption in healthcare contribute to the market's rapid growth. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.11 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- For instance, Clove Dental introduced its 12 new dental clinics in a single day and expanded its network to over 500 clinics. The new clinics are expected to increase the demand for these practice management software.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are projected to experience significant growth during the study period. Their expanding healthcare infrastructure and rising awareness of advanced dental technologies drive demand for efficient practice management solutions. In addition, supportive government initiatives and an increasing number of dental clinics contribute to these regions’ significant market presence.

KEY INDUSTRY PLAYERS

Carestream Dental LLC and Other Companies Held Substantial Shares Owing to Efficient Patient Management

The global dental practice management software market demonstrates a partially consolidated competitive structure due to the large shares accounted for by the key players. Henry Schein, Inc., Carestream Dental LLC, and DentiMax held substantial shares of the market in 2023. Carestream Dental LLC’s product offerings provide efficient patient management, billing, and scheduling solutions while also providing seamless integration with digital imaging systems. These advantages make it a popular choice among dental professionals seeking streamlined operations and improved patient care.

Other companies such as ACE Dental Software, Good Methods Global Inc., CD Newco, LLC, and other small and medium-sized market players are constantly focusing on geographical expansions and new product launches with advanced features. Moreover, the rising number of product approvals by these companies is expected to fuel market growth in the coming years.

List of Top Dental Practice Management Software Companies:

- NXGN Management, LLC (U.S.)

- Planet DDS (U.S.)

- ACE Dental Software (U.S.)

- Datacon Dental Systems (U.S.)

- Good Methods Global Inc. (U.S.)

- CD Newco, LLC (U.S.)

- Henry Schein, Inc (U.S.)

- Carestream Dental LLC (U.S.)

- DentiMax (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: CD Newco, LLC, a cloud-based practice management software provider, partnered with Patient Prism, an AI technology company, to introduce a cutting-edge integration designed to boost dental practice growth across the U.S.

- November 2023: Thoma Bravo completed the acquisition of NextGen Healthcare, a cloud-based healthcare technology provider, for USD 1.8 billion. This acquisition is anticipated to further solidify Thoma Bravo's standing in the software investment sector.

- May 2023: P1 Dental Partners chose Henry Schein, Inc.'s Dentrix Ascend, a cloud-based dental practice management software, along with Jarvis Analytics, a dental analytics tool, to streamline practice management across more than 40 practices. This integration aims to enhance patient care and promote practice success for partner dentists.

- April 2023: Henry Schein, Inc. acquired a majority ownership stake in Biotech Dental S.A.S. By combining their existing software offerings, Henry Schein and Biotech Dental plan to develop a digital workflow that enhances customer experience, boosts case acceptance, and improves clinical outcomes for dental practitioners.

- September 2022: Carestream Dental LLC announced the launch of its new cloud-based practice management software solution for oral and maxillofacial surgery. This solution, called Sensei Cloud for Oral Surgery, is designed for accessible, intuitive management solutions for Oral and Maxillofacial Surgery (OMS) specialists.

REPORT COVERAGE

The report offers a comprehensive analysis, focusing on market segmentation by deployment mode, application, end-user, and region. It includes a global market forecast based on the dynamics of the market, the impact of COVID-19 pandemic, and the latest statistics. The report covers market share by segment, key growth drivers, and the competitive landscape. In addition, it provides insights into major industry players, their SWOT analysis, and key technological advancements.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.77% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Mode

|

|

By Application

|

|

|

By End-user

|

|

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 2.15 billion in 2026 and is projected to reach USD 4.87 billion by 2034.

The market is slated to exhibit a steady CAGR of 10.77% during the forecast period of 2026-2034

Currently, the on-premise segment is leading the market by deployment mode.

The rise of telehealth services and the adoption of cloud-based solutions are the key factors driving the market growth.

Henry Schein, Inc. and Carestream Dental LLC are some of the key players in the market.

North America dominated the dental practice management software market with a market share of 53.57% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us