Dental Sutures and Collagen Market Size, Share & Industry Analysis, By Type (Sutures and Collagen {Membrane, Cones, and Others), By Product (Absorbable and Non-Absorbable), By Form (Natural and Synthetic), By Application (Implantology, Oral & Maxillofacial Surgery, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

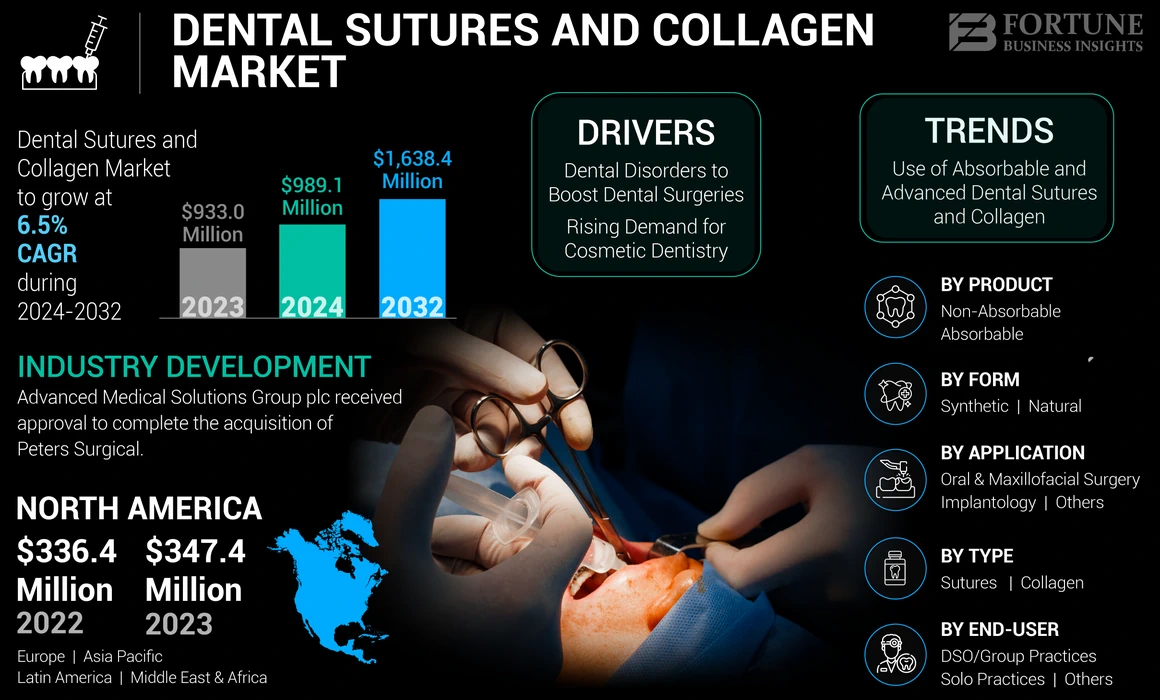

The global dental sutures and collagen market size was valued at USD 933.0 million in 2023. The market is projected to grow from USD 989.1 million in 2024 to USD 1,638.4 million by 2032, exhibiting a CAGR of 6.5% during the forecast period. North America dominated the dental sutures and collagen market with a market share of 37.23% in 2023.

Dental sutures are crucial for closing incisions and ensuring proper healing following various dental procedures. Dental collagen products are used as barrier membranes, hemostats, scaffolds, or matrices in the form of membranes, cones, and others. Collagen products create an optimal environment for cellular activities, promoting essential processes such as cell migration, proliferation, and angiogenesis, all of which are vital for effective healing after various dental procedures.

The global market is anticipated to grow significantly in the coming years due to the increasing prevalence of dental disorders coupled with a rising number of dental procedures that require dental sutures and collagen for effective healing. Additionally, technological advancements, including the development of resorbable and biocompatible ptoducts, are expected to boost the market growth. Furthermore, regulatory approvals and new product launches are expected to fuel the market growth further during the forecast period.

Global Dental Sutures and Collagen Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 933.0 million

- 2024 Market Size: USD 989.1 million

- 2032 Market Size: USD 1,638.4 million

- CAGR: 6.5% from 2024–2032

Market Share:

- Region: North America dominated the market with a 37.23% share in 2023. This leadership is driven by a growing number of dentists in the U.S., an increasing patient population undergoing implant procedures, and the high adoption rate of advanced technological products.

- By Type: The Collagen segment held the largest market share. The segment's dominance is attributed to the increasing demand for dental implants and cosmetic dental procedures, where collagen membranes are essential for promoting healing and providing a stable foundation.

Key Country Highlights:

- Japan: The market is driven by the rising prevalence of dental disorders and an increasing number of dental procedures that require effective healing solutions, supporting the growth of the Asia Pacific market.

- United States: Market growth is supported by a high prevalence of dental disorders, with edentulism having a global prevalence of around 23%. The market is also fueled by a high volume of dental implant procedures, where the average cost for a single tooth implant can range from USD 3,100 to USD 5,800.

- China: As part of the fastest-growing Asia Pacific region, China's market is expanding due to a rising number of dental surgeries, increasing demand for cosmetic dentistry, and growing investments in dental infrastructure.

- Europe: The market is advanced by a significant focus on research and development and strategic acquisitions. For instance, Geistlich Pharma AG's acquisition of a bone regeneration company and its MDR certification for a unique collagen membrane in the European market are key growth drivers.

IMPACT OF COVID-19 ON THE MARKET

In 2020, the COVID-19 pandemic led to a steady decline in the demand for dental sutures and collagen, which negatively impacted the market. During COVID-19 pandemic, lockdowns and social distancing rules enforced to control the spread of the coronavirus which led to a significant reduction in the number of patient visits to dental clinics and declined the demand for dental products, including dental sutures and collagen.

In 2021, the lockdowns were relaxed and number of patient visits and dental treatments increased significantly, propelling the demand for these products. In 2022, the market reached the pre-pandemic level, and it is expected to grow due to the growing prevalence of dental disorders and the rising number of dental procedures.

LATEST TRENDS

Increased Use of Absorbable and Advanced Dental Sutures and Collagen

The dental suture market is experiencing a significant shift towards the increased utilization of absorbable dental sutures and advanced collagen products, driven by their advantages in various dental procedures. Absorbable sutures, crafted from materials such as polyglycolic acid and polyglactin 910, are particularly popular due to their self-dissolving characteristics, which eliminate the need for additional removal appointments. These innovative sutures provide the dual benefits of promoting faster healing and reducing the necessity for suture removal, thereby witnessing growth in the market.

Additionally, the incorporation of advanced collagen is on the rise across the globe due to its biocompatibility and effectiveness in tissue regeneration, which enhances the efficacy of dental surgeries, including periodontal treatments, implant placements, and oral surgical interventions.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Dental Disorders to Boost Dental Surgeries

The global prevalence of dental disorders is on the rise, driven by several key factors, such as sedentary lifestyles, inadequate oral hygiene, and tobacco use. These issues significantly contribute to the increasing incidence of various dental conditions, including periodontal diseases, dental caries, jawbone atrophy, edentulism, and oral cancers. This growing prevalence is a major factor propelling the demand for dental surgeries that require dental sutures and collagen products.

- According to the World Health Organization (WHO) oral health report in March 2023, oral diseases affect nearly 3.5 billion people across the globe, with edentulism having a higher global prevalence of around 23%. Additionally, the data showed severe periodontal diseases impact approximately 19% of adults globally, totaling over 1 million cases globally.

Such prevalence is expected to increase the number of oral surgeries and dental implant procedures, which are expected to drive market growth.

Rising Demand for Cosmetic Dentistry

Globally, the demand for cosmetic dental procedures is growing significantly, driven by advancements in dental technology, societal emphasis on aesthetics, and increased awareness of oral health. These dental sutures and collagen are particularly preferred in cosmetic surgeries due to their biocompatibility and ability to promote faster and better healing. Additionally, dental tourism, government initiatives to promote oral health, and improvement of dental infrastructure in developing countries such as China and India are expected to boost dental procedures, which could increase the demand for dental sutures and collagen-related products.

Market Restraints

High Cost of Advanced Dental Procedures to Hamper the Market Growth

The high cost of dental services and inadequate reimbursement options are significant barriers to the growth of the dental suture and collagen market. Dental treatments can be prohibitively expensive due to various factors, including the high costs associated with dental education, advanced technology, and the overhead expenses of running a dental practice, which can deter patients from seeking necessary care. This, in turn, can limit dental products demand including dental sutures and collagen.

- According to Arlington Dental Excellence, a single tooth implant can cost between USD 3,100 and USD 5,800, a multi-tooth implant can cost between USD 6,000 and USD 10,000, and full mouth implants can cost around USD 60,000 to USD 90,000.

Potential Complications Related to Certain Suture Materials

The growing awareness of oral health and the increasing prevalence of dental disorders are driving up the number of dental procedures, which in turn boosts the dental sutures and collagen market. However, the potential side effects of some sutures and collagen can limit the market growth. Surgical site infection, improper absorption rate, dehiscence due to excessive suture tension, and other inflammation are some of the complications associated with surgical sutures.

For instance, a study published in the journal Antibiotics in January 2022 stated that surgical sutures are the most vulnerable surgical devices for biofilm bacterial contamination, which leads to surgical site infections. These factors can limit the adoption of certain sutures and hamper the market growth.

Market Opportunities

Technological Advancements to Boost the Market Growth

Advancements in dental technologies and materials are enhancing the effectiveness of dental collagen and suture products, which is expected to boost the market growth. Additionally, new product launches and regulatory approval are contributing to the growth of the market.

- For instance, in July 2024, Geistlich Pharma AG received MDR (Medical Device Regulation) certification for the European market for its unique collagen membrane, Chondro-Gide. This enhanced its collagen-based product portfolio for dental applications.

Furthermore, the aging population and increasing awareness about oral health are contributing to a higher incidence of dental surgeries, coupled with technological advancements that are expected to fuel the market growth.

Growing Awareness About Oral Health in Emerging Economies

The prevalence of dental ailments is rising significantly across the globe. However, the lack of access to dental services and the high costs associated with treatment have created a substantial gap, especially in emerging economies, leading to a large unmet patient population. Focusing on this, numerous organizations are launching awareness campaigns about the adverse effects of dental diseases and available treatment options in developing economies.

- For instance, in March 2024, Institut Straumann AG launched the Bridge Program in Gauteng, South Africa. The main aim behind launching this program was to guide new dentists.

These factors are expected to increase awareness among dentists and patients, which offers long-term growth opportunities for the market.

Market Challenges

Dental device approval involves various steps to ensure the safety and efficacy of the product marketed. The stringent regulatory requirements for testing and validating new dental devices, including dental sutures and collagen, can delay the introduction of advanced products, making it challenging for the market.

Additionally, the availability of alternative wound-closing products such as polylactic acid (PLA), chitosan, hyaluronic acid, and poly(lactic-co-glycolic acid) (PLGA) present viable alternatives to collagen. These substitutes often offer similar or superior properties for tissue regeneration and wound healing.

- For instance, a study published in March 2023 in BMC Journal of Biological Engineering showed that PLA combined with hyaluronic acid (HA) can serve as a scaffold for regenerating dental pulp tissue. This can limit the adoption of dental collagen.

The rising popularity of these can be attributed to their biocompatibility, reduced risk of adverse reactions, and the ability to customize them for specific applications. These factors can create a challenge to the market.

TRENDS AND INNOVATION

Adoption of Synthetic, Absorbable, and Knotless Sutures to Reduce Adverse Reaction

The dental sutures and collagen market is witnessing various innovations, such as absorbable sutures, made from materials such as polyglycolic acid and polyglactin 910, which are particularly favored due to their self-dissolving properties, which eliminate the need for additional removal visits and enhance patient comfort. These innovative sutures offer the dual benefits of promoting quicker healing and reducing the need for suture removal, which enhances patient experience and compliance.

- For instance, in April 2021, Dolphin Sutures launched new non-absorbable Polytetrafluoroethylene sutures to expand its portfolio of dental products. The synthetic TEFLENE product line includes dense PTFE (Polytetrafluoroethylene). Such product launches are driving the trend in the market.

Development of Collagen-Based Products for Enhanced Wound Healing

The development of collagen-based dental products is rapidly advancing as a key for wound healing in various dental procedures. Collagen is increasingly utilized in applications such as bone grafts, membranes, and scaffolds due to its biocompatibility and ability to promote tissue regeneration.

Additionally, innovations such as crosslinked collagen membranes that enhance mechanical stability and promote better tissue integration are trending in the market.

- For instance, in September 2024, Regenity Biosciences Receives Regulatory Approval for Collagen Dental Membrane in China. The implantable collagen dental membrane is intended for use in oral surgical procedures.

SEGMENTATION ANALYSIS

By Type

Rising Demand for Dental Implants Boosted the Collagen Adoption

Based on type, the market is classified into sutures and collagen.

The collagen segment accounted for the largest share of the market. The segment is further classified into membranes, cones, and others. The increasing demand for dental implants and cosmetic dental procedures primarily drives the segment domination. The collagen membranes are essential for promoting healing and providing a stable foundation for implants. Additionally, advanced product development is expected to boost the market growth during the forecast period.

The growth of the sutures segment is linked to the rising prevalence of dental diseases that necessitate surgical interventions. Moreover, increasing demand for cosmetic dentistry plays a crucial role as more patients seek aesthetic procedures that often involve suturing to achieve optimal results.

- For instance, According to the Maintaining and Improving the Oral Health of Young Children report published by the American Academy of Pediatrics in January 2023, the prevalence of dental caries remains high, with the condition being present in more than 40% of children in the age group of 2 to 19 years. This high prevalence increases the chances of root canals or other procedures that require dental sutures.

To know how our report can help streamline your business, Speak to Analyst

By Product

Higher Preference of Absorbables Amongst Dental Professional Led to Segment Domination

Based on the product, the market is segmented into absorbable and non-absorbable.

The absorbable segment dominated the market in 2023. The segment growth is mainly attributed to the preference of dental professionals due to the advances in dental procedures. Additionally, market players' strategic initiatives to expand the collagen dental business by acquisition are expected to drive the segment growth over the projected years.

- For instance, in October 2022, Geistlich Pharma AG, a Switzerland-based company, acquired Lynch Biologics, LLC. Lynch Biologics, LLC., operates in bone regeneration, including collagen dental membrane.

This is expected to increase the number of advanced new product launches, combining growth factors in the collagen product, and the segment is expected to grow during the forecast period.

The non-absorbable segment is also expected to grow significantly due to the increasing number of periodontics procedures, which often require non-absorbable surgical products, including surgical sutures and collagen products.

By Form

Increasing Adoption of Dental Barrier Membrane to Augment the Natural Segment Growth

In terms of form, the market is classified into natural and synthetic.

The natural segment accounted for the largest share in the market and expected to grow at a higher CAGR during the forecast period. The growth of the collagen segment in the dental market is largely driven by the increasing adoption of collagen dental barrier membranes and collagen cones as hemostatic agents during procedures such as tooth extractions and implants. Additionally, technological advancements and the introduction of compatible products are expected to boost further the adoption of these collagen-based solutions in the market.

The synthetic segment is expected to grow significantly in the near future. The growth of this segment is attributed to the comparatively lower chances of getting hypersensitivity reactions using synthetic sutures during dental wound closure.

- For instance, according to a report by the BMC Journal in 2020, the chances of hypersensitivity reaction were less in surgical procedures when synthetic absorbable sutures, such as nylon, polyglactin 910, and polyamide 6/6, were used. This increases the chances of synthetic suture adoption.

By Application

Advancements in the Dental Implants is Driving the Segment Growth of Implantology

Based on application, the market is divided into implantology, oral & maxillofacial surgery, and others.

The implantology segment dominated the market in 2023. The segment growth is attributed to the increasing prevalence of dental conditions and edentulism across the globe, along with the growing awareness and acceptance of dental implants as a viable treatment option.

The oral and maxillofacial segment is expected to grow in the near future due to the advancements in surgical techniques and a rising awareness of oral health that increases the number of surgeries requiring dental sutures and collagen products.

The others segment, including endodontics and periodontics, is expected to grow in the near future due to the increasing cases of dental caries and number of root canal procedures. Additionally, key players' collaborative initiatives are expected to drive the segment growth in the coming years.

- In July 2023, Neoss signed a distribution agreement with Apex to expand its presence in Portugal. This partnership enabled the distribution of Neoss products and solutions, including dental collagen membranes, throughout the Portuguese market.

By End-user

Solo Practices Segment Dominated Due to the Larger Patient Proportion in the Facilities

Based on end-user, the market is divided into solo practices, DSO/group practices, and others.

In 2023, the solo practices segment dominated the market and is expected to witness significant growth in the forecast period. This is primarily due to the high patient preference. This segment's growth is further supported by the substantial number of dental clinics operated by solo practitioners and an increasing patient base seeking dental procedures such as bone grafting and implants, which require collagen and sutures.

Conversely, the DSO/group practices segment is projected to experience a highest CAGR during the forecast period. A trend toward DSO affiliations in developed countries drives the growth. Additionally, strategic acquisitions by DSO companies are expected to enhance segment growth and increase the volume of procedures performed.

- For instance, in December 2020, Smile Brands Inc. acquired Midwest Dental, which is expected to develop the procedure volume in the DSOs and boost market growth in the near future.

The others segment, which includes hospitals and research institutes, is anticipated to experience significant growth during the study period. The increasing number of oral surgeries conducted in these environments is expected to drive the adoption of dental products.

DENTAL SUTURES AND COLLAGEN MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Dental Sutures and Collagen Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America was the leading region in the global dental sutures and collagen market and was valued at USD 347.4 million in 2023. This dominance can be attributed to several factors, including a growing number of dentists in the U.S. and an increasing patient population undergoing implant procedures, as well as oral and maxillofacial surgeries. The region is also benefiting from the availability of advanced technological products, a high adoption rate of collagen-based solutions, and numerous new product launches.

Europe

Europe held the second-largest share of the market in 2023, driven by the presence of key players such as Institut Straumann AG and Geistlich Pharma AG. The growth in this region is further supported by an increasing number of dental clinics, strategic mergers and acquisitions, and higher research and development initiatives aimed at advancing product offerings.

- For instance, in April 2024, Geistlich Pharma AG acquired Bionnovation Biomedical to expand its regenerative product portfolio in dentistry. Such initiatives are expected to increase the region's advanced product penetration during the forecast period.

Asia Pacific

The Asia Pacific region is expected to witness a highest CAGR during the forecast period. This growth is fueled by a rising prevalence of dental bone disorders, increased public awareness regarding oral health, and higher spending on dental procedures. Japan and South Korea are particularly noted for their growing penetration of advanced dental products.

Latin America and the Middle East & Africa

In Latin America and the Middle East & Africa, significant growth is anticipated due to a high prevalence of dental diseases, greater awareness among dental professionals, and rising healthcare investments. These factors collectively contribute to the dental sutures and collagen market growth across these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

The global dental sutures and collagen market is a highly fragmented market. Johnson & Johnson Services, Inc., Dentsply Sirona, and Integra LifeSciences are some of the key market players operating in the market. In 2023, Johnson & Johnson Services, Inc. dominated the global market. The dominance is attributed to an advanced sutures portfolio in the dental sutures segment. Additionally, a strong geographical presence across the globe is expected to be a major factor in the dominance of the market.

Tier Analysis

Tier 1 companies: Johnson & Johnson Services, Inc., Dentsply Sirona, and Integra LifeSciences are in Tier 1 due to their strong geographical presence across the globe and wide product portfolio.

Tier 2 companies: Neoss, HYGITECH, and Advanced Medical Solutions Group plc are in the tier 2 list of companies. These companies have a strong regional presence with specific geographical distribution.

Competitive Strategies

Companies such as Integra LifeSciences, Advanced Medical Solutions Group plc, Institut Straumann AG, and Geistlich Pharma AG are focused on growth strategies such as acquisitions, collaborations, and partnerships.

- For instance, in October 2024, RTI Surgical announced the acquisition of Collagen Solutions, expanding its capabilities in regenerative medicine and soft tissue biomaterials. This move aims to boost RTI's market presence in high-growth sectors such as sports medicine, cardiac care, and dental applications.

- For instance, in April 2024, Geistlich Pharma AG acquired Bionnovation Biomedical, a Brazilian medical technology company, to expand its regenerative product portfolio in dentistry.

Additionally, R&D initiatives by these companies are expected to drive the dental sutures and collagen market share during the forecast period. Furthermore, the companies are focused on the launch of advanced suture and collagen products.

LIST OF KEY MARKET PLAYERS PROFILED:

- HYGITECH (France)

- Institut Straumann AG (Switzerland)

- Osteogenics Biomedical (U.S.)

- Dentsply Sirona (U.S.)

- Geistlich Pharma AG (Switzerland)

- Neoss (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Advanced Medical Solutions Group plc (U.K.)

- Integra LifeSciences (U.S.)

RESEARCH AND DEVELOPMENT

Ongoing research and development initiatives in the dental sutures and collagen membrane market are focused on enhancing product efficacy, biocompatibility, improving material quality, and patient outcomes.

The integration of active ingredients into dental collagen products is creating substantial opportunities for market growth by significantly enhancing their therapeutic efficacy and functionality.

- For instance, a study published in MDPI in September 2023 stated that collagen-derived bioactive peptides have been shown to enhance fibroblast function and inhibit matrix degradation, contributing to better healing outcomes. Such ongoing research into new active ingredients and formulations is expected to offer an opportunity for the market.

Additionally, the partnerships between dental product companies and research institutions and government grants for oral health research are expected to boost the advanced product launched during the projected period. Furthermore, the addition of growth factors and bioactive peptides can further promote tissue healing and regeneration, thereby improving the overall effectiveness of dental procedures.

TRADE AND REGULATORY LANDSCAPE

The market for dental sutures and collagen is highly regulated. Marketing of these products requires regional regulatory bodies' approval. In the U.S., it is classified as a Class 2 medical device by the FDA. This classification indicates that they are considered to have a moderate risk associated with their use, necessitating more regulatory oversight than Class I devices. Class II devices typically require premarket notification (510(k)). In Europe, dental sutures must obtain CE marking, which involves compliance with the Medical Device Regulation (MDR) and demonstrates conformity with safety and performance requirements. Similar regulatory frameworks exist in other regions, ensuring that dental sutures meet necessary quality standards before they can be marketed.

The impact of trade policies, including import restrictions and tariffs, can affect the pricing and availability of dental sutures and collagen products. Such barriers can lead to increased costs for manufacturers, which may ultimately be passed on to healthcare providers and patients. Conversely, global health initiatives by WHO aim to promote oral health, potentially driving demand for these essential products in various markets.

FUTURE OUTLOOK

The market for dental sutures and collagen is projected to grow at a compound annual growth rate (CAGR) of 6.5% between 2024 and 2032, driven by several emerging trends and innovations that are likely to shape the future of dental wound care. Key advancements include the development of synthetic, absorbable, and knotless sutures that minimize adverse reactions and improve healing outcomes. Additionally, ongoing R&D initiatives such as 3D printed collagen membranes, antimicrobial sutures, and volume-stable collagen matrices are anticipated to shift the trend in the market.

Moreover, there is significant potential for growth in developing regions where improving access to dental healthcare can drive demand for advanced dental solutions. These markets present opportunities for introducing innovative dental materials and techniques that align with global trends toward minimally invasive procedures. The combination of technological advancements and expanding access to care will likely create a robust environment for the growth of dental sutures and collagen products over the next decade.

KEY INDUSTRY DEVELOPMENTS

- June 2024: Advanced Medical Solutions Group plc received regulatory approval to complete the acquisition of Peters Surgical, strengthening its position as a specialist in tissue repair and wound closure applications.

- April 2024: Geistlich Pharma AG acquired Bionnovation Biomedical to expand its regenerative product portfolio in dentistry, helping the company provide patients in Latin America and other emerging markets

- March 2024: Advanced Medical Solutions Group plc entered into an agreement to acquire Peters Surgical, a provider of specialty surgical sutures, mechanical hemostasis, and internal cyanoacrylate devices.

- August 2023: Neoss partnered with MEDent Europe Kft, marking a significant step in its European expansion strategy. This partnership enabled the distribution of Neoss products and solutions, including dental collagen membranes, throughout the Hungarian market.

- January 2021: Dentsply Sirona acquired Datum Dental, a company known for its innovative dental regeneration products with the clinically superior proprietary technology GLYMATRIX. Through this acquisition, the OSSIX family was incorporated into the portfolio of Dentsply Sirona, which further led to product diversification.

REPORT COVERAGE

The global dental sutures and collagen market report provides an in-depth analysis of the industry. It focuses on market segments, such as type, product, form, application, and end-user. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market trends. Additionally, the report consists of the dental sutures and collagen market analysis by various segments and the factors driving the market and the growth. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.5% from 2024-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By Form

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 933.0 million in 2023 and is projected to reach USD 1,638.4 million by 2032.

In 2023, the market value stood at USD 347.4 million.

The market will exhibit a steady CAGR of 6.5% during the forecast period.

By product type, the collagen segment led the market in 2023.

The rising prevalence of dental disorders and technological advancements are some of the key drivers of the market.

Johnson & Johnson and Dentsply Sirona are the major players in the market.

North America dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us