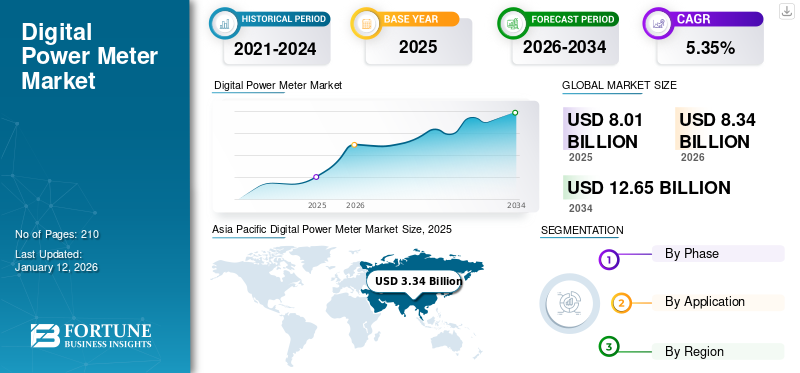

Digital Power Meter Market Size, Share & Industry Analysis, By Phase (Single Phase Power Meter and Three Phase Power Meter), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Digital Power Meter Market Size

The global digital power meter market size was valued at USD 8.01 billion in 2025. The market is projected to be worth USD 8.34 billion in 2026 and reach USD 12.65 billion by 2034, exhibiting a CAGR of 5.35% during the forecast period. Asia Pacific dominated the digital power meter industry with a market share of 41.76% 2025. The Digital power meter market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.31 billion by 2032.

A digital power meter is a semiconductor device that refers to an electricity meter installed to monitor and evaluate the amount of voltage, current, and power of commercial places, residential areas, and electricity-based appliances. The primary function of this product is to measure power quality parameters such as current or voltage fluctuations and electrical energy. These meters are also used to investigate energy leakage or waste, equipment failures, and other power quality issues such as energy management and energy consumption analysis. As it is used for accurate monitoring and reporting of power quality, industrial and commercial operations depend on digital power measurement solutions. This enables reliable and efficient energy use in its operations. Many factors, such as advanced communication, flexible installations, and recording capabilities, make the product an essential device in network automation, commercial facilities such as data centers, and others.

The global impact of the COVID-19 pandemic on the digital power market is moderate, as it impeded consumption in many end-use industries due to supply chain disruption of services and technology and hindrance in activities due to social distancing norms. Furthermore, the shutdown affected the demand and supply of electricity and had long-term consequences for the power sector. As the shutdown significantly reduced industrial and commercial activities in various regions, electricity demand in these segments decreased considerably, and domestic demand increased as people stayed indoors. In the power industry, the direct impact of the pandemic caused a reduction in field services in general, specifically maintenance services. In several cases, services were delayed or extended until their completion. A study in the U.S. found a strong correlation between reduced electricity consumption and the spread of COVID-19 virus, commercial activity, and the severity of lockdown measures. The analysis revealed that as the number of virus cases increased, commercial activity decreased, and lockdown measures became more stringent, causing a significant decrease in electricity usage.

Digital Power Meter Market Trends

Rapid Technological Advancements in Power Monitoring and Expansion of Data Center Infrastructure Emphasizing the Use of the Product

In today's rapidly evolving digital environment, the Middle East & Africa region is at the front position defined by transformative technological development. As businesses and industries increasingly embrace the power of digitization, data has become vital for innovation, efficiency, and competitiveness. Various organizations across different end-use sectors are harnessing the potential of data centers to improve operations, enhance customer experiences, and unlock unprecedented advancements. The hierarchy of power also has several levels, such as real-time monitoring, long-term monitoring, and remote monitoring systems this functions working with all the details in real-time, problem identification and assessment, and faster response are the major functions all without having to be checked in personal.

Digital power meters are advanced electronic meters that provide accurate and user-friendly solutions. They help monitor and control electrical parameters in various settings. These meters are designed for accurate and comprehensive measurement of electrical parameters, including voltage, current, power factor, frequency, and energy consumption. In addition, they often include digital displays and user-friendly software for data visualization and management. They are known for their accuracy, which enables precise monitoring of energy consumption. This revised version of power monitoring introduces the market for digital power meters, which are robust and accurate electronic meters that can considerably expand the efficiency and accuracy of power management.

Download Free sample to learn more about this report.

Digital Power Meter Market Growth Factors

Improved Accuracy for Monitoring Real-Time Data for Commercial and Residential Applications to Drive Market Growth

Digital power meters provide accurate and real-time data on power consumption. Unlike traditional mechanical analog meters, which require manual reading to capture usage, smart meters transmit automatic and precise consumption data to service providers. This enables more efficient and accurate billing and metering. According to 2022 data, the average U.S. residential electric utility customer consumed around 10,791 kilowatt-hours (kWh) annually, or approximately 899 kWh per month. Louisiana had the highest average annual electricity consumption at 14,774 kWh, while Hawaii had the lowest at 6,178 kWh. A digital power meter for home is a device that measures household electricity usage, serving as the basis for metering and billing. It helps reduce the likelihood of issues during peak usage periods when actual usage cannot be quickly verified.

Increasing Smart Grid Efficiency and Outage Response to Propel Market Growth

In addition to its primary function, the product plays a crucial role in optimizing the energy grid's efficiency and stability. By collecting accurate consumption data, customers can take control of their energy usage, integrate renewable energy sources, and respond quickly to power outages. This enables grid optimization, ensuring a stable energy supply and supporting the transition to cleaner and sustainable energy systems. For instance, the European Commission has outlined a plan to digitalize the energy system, expecting to invest approximately USD 633 billion in the European electricity grid by 2030, with a significant portion dedicated to digitalization efforts such as smart meters, automated grid management, and digital metering technologies.

The digital power meter offers a comprehensive package of benefits that addresses both consumer experience and sustainability. The ongoing innovations in product manufacturing are also driving the development of more energy-efficient homes and businesses, bringing the world closer to a green, sustainable future.

RESTRAINING FACTORS

Increasing Concerns about Cybersecurity and Data Privacy May Restrict Market Growth

Cybercriminals are increasingly relying on the general public's lack of cybersecurity awareness to carry out their attacks. When they enter a company's network, they often need only a single point of entry, which can be provided by a team member who encounters a phishing scam or accidentally downloads malware. In recent years, cybercriminals have learned to exploit these soft targets. These data breaches are primarily unintentional and are made possible by a lack of cybersecurity digital literacy. Moreover, poor digital literacy is a leading cause of the ever-increasing number of frauds, extortions, and identity thefts against private citizens. Critical infrastructure providers are increasingly adopting digital technologies to improve real-time operational monitoring, better capacity management, and enhanced decision-making. This drive for efficiency and added functionality opens the door to new cyber-attacks. Connecting industrial control systems (ICS) to the Internet allows operators to better monitor and control their physical infrastructure from anywhere, anytime.

Digital Power Meter Market Segmentation Analysis

By Phase Analysis

Single-phase power meter dominates the Market share as it is Convenient in Various Applications

Based on phase, the global digital power meter market share is classified into single phase power meter and three phase power meter.

Single-phase is the dominating segment as it is the most common phase type used in load distribution contributing 56.75% globally in 2026. Single-phase power, also called 1-phase, requires only two wires to distribute the power. This makes them less powerful compared to three-phase power. Single-phase meters, also called credit meters, kWh meters, or control meters, are electricity meters designed to measure the energy consumption of a single-phase power supply. Digital single-phase power meters have become increasingly popular due to their accuracy and advanced features. These meters use electronic components to measure and record energy consumption and often have additional functions such as remote monitoring and data collection.

The three phase power meter segment is expected to grow during the forecast period as these meters are essential for residential, commercial, and industrial applications. Growing industries and commercial spaces leverage powerful applications, fueling segment growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Holds a Dominant Share Due to Extensive Use in Real-time Data Monitoring.

Based on application, the global market is divided into residential, commercial, and industrial.

Residential application is dominating as digital power meter is mainly heavily used in this areas because the number of construction sites is increasing with a share of 55.85% in 2026, which ultimately affects the growth of the number of apartments in different areas. This requires an efficient energy management system to record electricity consumption and monitor and report data. The product enables real-time data and home consumption evaluation while reducing electricity bills.

Industrial and commercial customers rely on digital power meter solutions for highly accurate power quality monitoring and reporting. This enables reliable and efficient energy use in operations. Advanced communication and logging features and flexible installation options provide application flexibility for both green and brownfield digital metering installations.

REGIONAL INSIGHTS

The market has been studied geographically across five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Digital Power Meter Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Based on the regional analysis, the Asia Pacific region is expected to hold the majority of the market share 41.76% during the study period due to the rapid expansion of advanced technologies and digitalization. Asia Pacific is a large, diverse, and dynamic region, home to 4.7 billion people and comprises countries ranging from the world's largest energy consumers to small island economies most vulnerable to the effects of climate change. A growing energy consumer needs power metering technology to control the energy consumption of multiple applications to control data for home, commercial, factory, and industrial applications eventually, for monitoring the real-time data accuracy this factors in used will lead the demand of digital power meters.The Japan market is projected to reach USD 0.41 billion by 2026, the China market is projected to reach USD 1.8 billion by 2026, and the India market is projected to reach USD 0.63 billion by 2026.

North America is expected to be the fastest growing market, with the residential sector consuming over 1,500 terawatt hours of electricity in the U.S. in 2022, making it the largest consuming sector in the country. Digital power meters are devices that measure the amount of electricity consumed by a company, apartment, or electrical appliance. Energy distribution companies usually use these devices to measure the power consumed by customers and bill them accordingly.The United States market is projected to reach USD 1.64 billion by 2026.

Europe is expected to surge the market growth during the forecast period, as among the European countries, Germany had the highest primary energy consumption in 2022 at 12.3 exa joules, followed by France and Great Britain. The product uses electronic technology to reduce energy consumption and its environmental impact effectively. It is used to analyze the energy used by an electrical load. Energy is the total power consumed and used by the load during a certain period. They are often used to measure power consumption in domestic and industrial AC circuits. With the increase in smart power transmission and distribution in the power sector with constant investment economy of the region in Europe is expected to grow.The United Kingdom market is projected to reach USD 0.29 billion by 2026, while the Germany market is projected to reach USD 0.45 billion by 2026.

Latin America and the Middle East & Africa are expected to grow during the forecast period as the role of digital power meters is indispensable. From measuring electricity consumption to monitoring it and enabling fair billing, these meters have multiple functions.

KEY INDUSTRY PLAYERS

Companies Operate Across Various Nations to Cater to Rising Customer Demand

The global digital power meter market growth is highly fragmented, with large and some medium-scale regional players delivering a wide range of products at local and country levels across the value chain. Numerous companies are actively operating across different countries to cater to the increasing demand from customers, especially for energy-efficient solutions.

Schneider, Delta Electronics, and Chroma ATE are expected to account for a significant market share owing to their extensive product portfolio, substantial brand value, and continuous technology development. Furthermore, the companies are also focusing on enhancing their power metering technologies, data monitoring, and digital visualization through partnerships with different local associates to fortify their product reach across the globe.

List of Top Digital Power Meter Companies:

- Schneider Electric SE (France)

- Delta Electronics (Taiwan)

- Techno Meters (India)

- Hoyt Electrical Instrument Works, Inc. (U.S.)

- Chroma ATE Inc. (Taiwan)

- Weschler Instruments (U.S.)

- Sfere Electric (China)

- Namdhari Eco Energies Private Limited (India)

- CSQ Electric (China)

- Eastron Electronic Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- March 2024- Adani Energy Solutions announced that it is borrowing as much as $600 million for smart meter projects for electricity supply. The company has formed a combined venture with a company backed by Abu Dhabi's International Holding Company to develop its smart meter business in India and around the world.

- February 2024- Itron Inc. and Schneider Electric unveiled that they are partnering to revolutionize energy management and automation. This will enable utilities to optimize energy and grid management as more homeowners and businesses integrate distributed energy resources such as rooftop solar, battery energy storage, electric vehicles, and microgrids at the grid edge.

- December 2023- Adani Energy and Tata Power announced to accelerate the deployment of smart meters to bring superior operational effectiveness by aligning power purchases with real-time demand.

- December 2023- CWD Limited proclaimed its deliberate entrance into the smart meter segment by introducing inventive smart meter communication solutions for the Indian market. The smart meter manufactured by the company has a communication module and is intended to operate at a frequency of 2.4 GHz.

- December 2021- Schneider Electric announced that it will focus on growing the share of local components in electricity meters sold in India. The Schneider electric meters have substantial local value addition, and the company’s manufacturing facility at Mysuru in Karnataka can produce 17 million meters annually.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as key companies by phase and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATTION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.35% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Phase, Application, and Region |

|

Segmentation |

By Phase

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.01 billion in 2025.

The market is likely to grow at a CAGR of 5.35% over the forecast period.

The residential segment is expected to lead due to the significant usage of safety switches for transmission and distribution.

The market size of Asia Pacific stood at USD 3.34 billion in 2025.

The increasing smart grid efficiency and outage response are set to flourish market growth.

Some of the top players in the market are Delta Electronics, Schneider Electric SE, and Techno Meters.

The global market size is expected to reach USD 12.65 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us