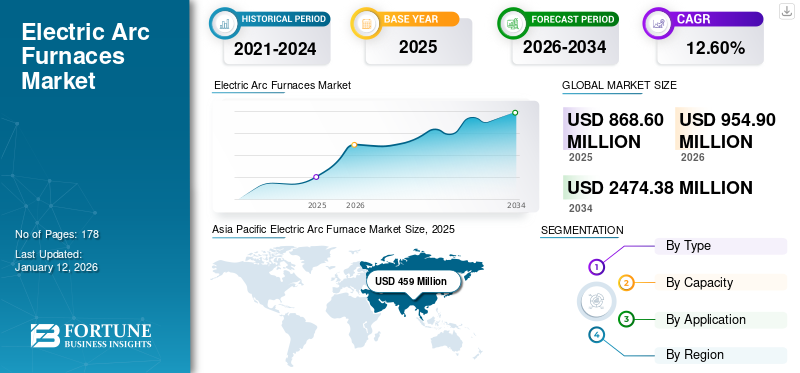

Electric Arc Furnace Market Size, Share & Industry Analysis, By Type (DC Arc Furnace and AC Arc Furnace), By Capacity (Up to 100 Tons, 100-300 Tons, and Above 300 Tons), By Application (Ferrous Metals and Non-Ferrous Metals), and Regional Forecast, 2026-2034

Electric Arc Furnace Market Size

The global electric arc furnace market size was valued at USD 868.6 million in 2025 and is projected to grow from USD 954.9 million in 2026 to USD 2,474.38 million by 2034, exhibiting a CAGR of 12.60% during the forecast period. Asia Pacific dominated the global market with a share of 52.80% in 2025.

Electric arc furnaces are industrial furnaces that use high voltage electric arcs to melt scrap steel and other materials for recycling and refining purposes. They play a crucial role global steel industry, particularly in regions with abundant scrap steel resources. The global electric arc furnace (EAF) market has been witnessing significant growth in recent years due to several key factors. One of the major reasons is the growing demand for steel and its alloys across various industries such as automotive, infrastructure, and construction. EAFs provide a cost-effective and efficient method for steel production, making them increasingly popular among manufacturers.

Additionally, the drive toward sustainable and environmentally friendly practices has contributed to the growth of the EAF market. Compared to traditional blast furnaces, EAF consumes less energy and produces lower greenhouse gas emissions, aligning with the global attempt to lower carbon footprints.

The COVID-19 pandemic unfavorably affected the EAF market, particularly in the second quarter of 2020. Disrupted supply chains and shutdowns hit the end users of the steel industry hard. The demand for electric arc across several growing economies was declining significantly.

Electric Arc Furnace Market Trends

Companies' Inclination Toward Sustainability Goals in Steel Production

Major stakeholders in the market and mining sector are actively addressing Scope 1 and Scope 2 emissions, stemming from direct and indirect sources, respectively. However, there's mounting pressure to address downstream Scope 3 emissions, which account for the majority of the mining industry's emissions.

Consequently, steel producing and mining companies are recognizing the necessity to transition to sustainable technologies that mitigate carbon emissions. This shift is leading to a trend of replacing traditional blast furnaces, known for their Scope 1 and Scope 2 greenhouse gas emissions, with electric arc furnaces (EAFs) as part of their emission control strategies.

Download Free sample to learn more about this report.

Electric Arc Furnace Market Growth Factors

Increasing Usage of DRI in Steelmaking to Aid Market Growth

The growing adoption of Direct Reduced Iron (DRI) technology within the steelmaking sector is expected to drive significant growth in the EAF market. DRI technology offers substantial advantages over traditional blast furnace methods, making it a preferred choice for steel production. Its ability to address emission restrictions, such as CD2, has contributed to its widespread use in steelmaking. Moreover, DRI's flexibility allows for immediate and efficient start-and-go operations, aligning with evolving production dynamics.

Over the years, DRI manufacturing and products have evolved to meet the expanding demands of the steel industry. This evolution provides EAF steelmakers with the flexibility to tailor furnace charges to market conditions and produce higher-quality steel with adjustable carbon levels, high metallic iron content, and consistent physical and chemical properties.

Additionally, DRI offers benefits such as low tramp material content, reduced capital and operating costs, predictable chemistry, and continuous iron making processes. Anticipated growth in steel consumption across various end-use industries is expected to further bolster the market for DRI and EAF technologies.

RESTRAINING FACTORS

Initial Capital Investment to Set Up the Capacity to Restrain Market Growth

EAFs are complex systems that need specialized equipment such as the furnace itself, electrodes, transformers, off-gas treatment facilities, and charging systems. The cost of procuring and installing these components can be substantial. Building and setting up the physical infrastructure for the EAFs operation, including the furnace building, foundation cooling system, and power distribution networks, add to the initial investment. This financial barrier can impact a company’s decision to enter the market, expand operations, or upgrade existing facilities.

Electric Arc Furnace Market Segmentation Analysis

By Type Analysis

DC Arc Furnaces to Dominate the Market Due to Their Higher Energy Efficiency

Based on type, the market is segmented into DC arc furnaces and AC arc furnaces.

DC arc furnaces currently dominate the market with share of 68.80% in 2026 and are expected to maintain their lead in the forecast period. Being more energy efficient compared to AC arc furnaces, DC arc furnaces offer precise control over electrical energy input, resulting in higher efficiency and reduced energy consumption. Consequently, they command a significant share of the global EAF market and are projected to remain dominant in the foreseeable future.

While AC arc furnaces also hold a notable market share, their appeal lies in their lower initial investment costs, making them more accessible to smaller operations or businesses with budget limitations. Additionally, AC arc furnaces are well suited for melting specific types of alloys and materials.

By Application Analysis

Ferrous Metal Segment Captures the Largest Share owing to High Adoption of EAF in Steelmaking

Based on application, the market is categorized into ferrous metals and non-ferrous metals.

Within the global EAF market, the ferrous metal segment holds the largest market share of 80.26% in 2026, primarily focusing on iron and steel production. EAFs have become increasingly prominent in this sector due to their economic advantages, offering a cost-effective and environmentally conscious alternative to traditional blast furnaces. Their efficient recycling of scrap steel and ability to accommodate various steel grades provide manufacturers the flexibility to respond quickly to market demands. Moreover, their reduced carbon emissions support sustainability objectives and align with the global trend toward greener industrial practices.

The non-ferrous metals segment of the global market encompasses materials such as copper, aluminum, and other non-iron-based metals. While EAFs are primarily associated with ferrous metals, they also hold a significant market share in this segment. Through processes such as copper recycling and secondary aluminum production, EAFs contribute to the non-ferrous metals segment as well.

By Capacity Analysis

To know how our report can help streamline your business, Speak to Analyst

Up to 100 Tons Segment to Hold the Largest Market Share Due to Higher Flexibility

Based on capacity, the market is segmented into up to 100 tons, 100-300 tons, and above 300 tons.

The up to 100 tons segment is likely to hold the highest electric arc furnace market share of 65.94% in 2026 and CAGR over the forecast period. This is due to its ability to strike a balance between production capacity and operational flexibility, making them well suited for a diverse range of applications ranging from foundry to integrated steel plants.

100-300 tons EAFs also hold significant market share due to their capacity to handle larger production volumes compared to smaller EAFs, while still offering operational efficiency and cost-effectiveness.

The above 300 tons segment holds the least market share as they require substantial investment in terms of infrastructure, energy consumption, and maintenance, which hinder the segment’s growth.

REGIONAL INSIGHTS

The scope of the study is further segmented across five major regions, namely North America, Europe, Asia Pacific, Middle East and Africa, and South America. They are further categorized into countries.

Asia Pacific

Asia Pacific Electric Arc Furnace Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the global EAF market in 2025 with valuation of USD 459 million and is expected to hold the highest market share throughout the forecast period due to the large-scale production of steel in the region. Rapid urbanization and industrialization in countries such as China, India, and Japan have significantly driven the demand for steel and other metals produced using EAF. The Japan market is projected to reach USD 50.9 million by 2026, the China market is projected to reach USD 249 million by 2026, and the India market is projected to reach USD 124.1 million by 2026.

China is the world’s largest producer of steel, producing more steel than the rest of the countries combined. This has been a significant driver in the growth of the EAF market in the country. In addition, the strong manufacturing base of the country and government support are contributing to the electric arc furnace market growth. As China continues to advance its steel production methods, the increasing adoption of these products is expected to further drive market growth.

To know how our report can help streamline your business, Speak to Analyst

Europe

In Europe, the EAF market has evolved with a focus on sustainability, technological innovation, and stringent environmental regulation. The region holds the second-highest market share after Asia Pacific in 2022. With a strong emphasis on reducing carbon emissions, many European countries have adopted EAFs as green alternatives to blast furnaces. Russia, Italy, and Germany are the major contributors to the market. The UK market is projected to reach USD 9.7 million by 2026, while the Germany market is projected to reach USD 33.7 million by 2026.

North American

The North American market is characterized by its integration of EAF technology with minimill operations and scarp recycling. The U.S. is the major contributing nation in North America. The steel produced in the country by EAF steelmakers exhibits carbon intensity approximately 75% lower than traditional blast furnace steelmakers. The increasing trend toward electrified vehicles in the North American region is influencing the demand for steel and consequently electric arc furnace market. The U.S. market is projected to reach USD 117.8 million by 2026.

Middle East & Africa

In the Middle East & Africa region, the market is growing steadily due to rising demand for steel for construction activities. Turkey is the largest contributing country in the region.

South America

South America has a comparatively smaller market share due to relatively higher reliance on blast furnaces. However, countries like Brazil and Argentina are beginning to embrace EAFs to meet their sustainable goals.

Key Industry Players

Major Manufacturers in the World Are Committed to Sustainability to Reduce Carbon Emissions

The key players in the industry showcase a dynamic landscape characterized by sustainability efforts (such as reducing carbon emissions, maximizing scrap steel recycling, conserving water, and integrating renewable energy resources), technological innovation, diversification, and operational efficiency. With a global reach, the major EAF manufacturers play a pivotal role in shaping the modern steelmaking landscape.

List of Top Electric Arc Furnace Companies:

- Nippon Steel Corporation (Japan)

- Danieli & C. Officine Meccaniche SpA (Italy)

- ArcelorMittal (Luxembourg)

- Tenova S.p.A. (Italy)

- SMS Group GmbH (Germany)

- Electrotherm (India)

- Paul Wurth IHI Co., Ltd. (Japan)

- Primetals Technologies (U.K.)

- Wuxi Dongxong Heavy Arc Furnace Co., Ltd. (China)

- JP Steel Plantech Co. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Tenova supplied its electric arc furnace to ORI Martin, a European steel group that specializes in manufacturing steel for the automotive, fastener, mechanical, and building sectors. Tenova replaced the existing EAF at the mill in Brescia, Italy.

- June 2023: ArcelorMittal planned to invest in a new electric arc furnace production capacity at Belval, Luxembourg. The company planned to invest approximately USD 16.4 Million.

- January 2023: Shinkansai Steel Co. Ltd., a Japanese flat-steel manufacturer, came into contract with Danieli to inbuild its Q-One digital power electronics technology to operate electric arc furnaces and maintain the power factor close to unity.

- August 2022: Primetals Technologies and Salzgitter Flachstahl GmbH undergone a contract for the engineering, supply, and installation of an electric arc furnace where the company has made a capital investment of about USD 724 Million for a low carbon dioxide (CO2) steelmaking facility.

- May 2022: Tenova received contract to supply new electric arc furnace for Tosyali Bethioua plant in Algeria as part of Tosyali’s expansion project.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses numerous factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.60% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Capacity

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 2,474.38 million by 2034.

In 2025, the market was valued at USD 868.6 million.

The market is projected to grow at a CAGR of 12.60% during the forecast period.

The DC arc furnace segment is expected to lead the market.

Increasing usage of DRI in steelmaking is a key factor driving market growth.

Danieli & C. Officine Meccaniche SpA, Nippon Steel Corporation, ArcelorMittal, SMS Group GmbH, Tenova S.p.A., Electrotherm, Primetals Technologies, Paul Wurth IHI Co., Ltd., JP Steel Plantech Co. and Wuxi Dongxong Heavy Arc Furnace Co., Ltd are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, the ferrous metals segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us