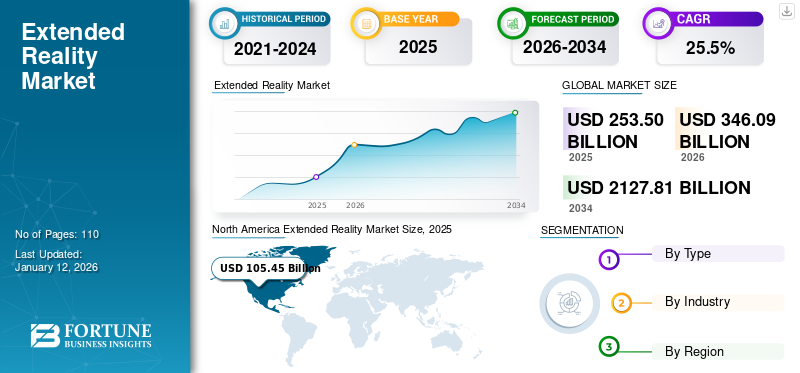

Extended Reality Market Size, Share & Industry Analysis, By Type (Virtual Reality, Augmented Reality, and Mixed Reality), By Industry (Healthcare, Education, Retail & E-commerce, Gaming, Automotive, Media & Entertainment, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global extended reality market was valued at USD 253.5 billion in 2025 and is projected to grow form USD 346.09 billion in 2026 to USD 2127.81 billion by 2034, exhibiting a CAGR of 25.5% during the forecast period. North America dominated the global extended reality market with a market share of 41.6% in 2025.

Extended Reality (XR) is a relatively new idea that blends together cutting-edge technology such as Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR). Due of their easy accessibility through the majority of electronic gadgets, extended reality offers mobility alternatives. XR is a general word for any computer-generated settings that combine the virtual and real worlds to provide consumers all over the world with an immersive experience.

The extended reality market is witnessing rapid technological convergence driven by advancements in 5G connectivity, artificial intelligence (AI), and cloud computing infrastructure. These developments are enabling seamless, real-time XR experiences across industries such as healthcare, retail, education, and entertainment.

Moreover, enterprises are increasingly integrating XR into training, remote assistance, and product visualization workflows to enhance operational efficiency and decision-making accuracy. The adoption of cloud-based XR platforms is further expanding the scalability and accessibility of immersive experiences, reinforcing the market’s long-term growth trajectory. The growing focus on spatial computing and human-machine interaction is anticipated to create substantial opportunities for innovation and investment within the extended reality market.

During the COVID-19 pandemic, companies around the world discovered methods to encourage their internally and geographically dispersed employees to connect, coordinate, and chart the way forward. This need drove the adoption of AR and VR Technologies during the pandemic.

Worldwide spending on XR products and services is estimated to be USD 18.8 billion in 2020. Implementing XR helps businesses with a platform that helps people to work efficiently. Rising usage of XR helps to lower the operational cost and helps to boost the productivity of the business by 10 to 20% by utilizing all the available resources. Increasing adoption of XR technique helps deliver real-world experience to customers worldwide with high engagement and interaction to improve sales and enhance brand awareness.

Latest Trends in Extended Reality Market

Surge in Advancement of 5G Technology Boosts the Product Demand

5G integrated with XR technology provides a wide range of application areas to boost communication capabilities. The penetration of 5G and XR techniques helps deliver remote control access, real-time experience, industrial control, and mobility automation applications. The surge in the advancement of 5G technology boosts its demand and is anticipated to drive the extended reality market growth during the forecast period.

Furthermore, the deployment of 5G infrastructure is revolutionizing the extended reality market by enabling ultra-low latency, high bandwidth, and edge computing capabilities. These advancements are enhancing the scalability and responsiveness of XR applications across sectors such as manufacturing, healthcare, automotive, and entertainment. The combination of 5G and XR technologies is accelerating the adoption of immersive solutions like remote diagnostics, digital twins, and smart factory simulations.

Also, enterprises are increasingly leveraging 5G-enabled XR platforms for workforce training and real-time collaboration, thereby improving productivity and operational efficiency. As network providers and technology firms continue to expand 5G coverage globally, the extended reality market is expected to witness a substantial increase in adoption, supported by enhanced connectivity and the emergence of next-generation industrial use cases.

Download Free sample to learn more about this report.

Extended Reality Market Growth Drivers

Rising Demand for VR Devices for Gaming and Entertainment Applications Drives Market Growth

Virtual reality and alternate reality games represent a futuristic vision in the gaming world. The usage of XR allows users to experience data and analytical representations of current or past games as they prefer. Similarly, the growing usage of VR headsets in the entertainment industry helps to see 3D objects from different angles to deliver an immersive experience. The VR headset is increasingly used to build an emotional connection with the user.

This propels the demand for VR headsets in gaming and entertainment applications, which helps to drive market growth. The extended reality market is experiencing a surge in adoption across the gaming and entertainment sectors due to advancements in display technology, motion tracking, and haptic feedback systems. The integration of XR with cloud gaming platforms and 5G connectivity is enabling real-time multiplayer experiences and high-definition streaming with minimal latency.

Major gaming companies and entertainment studios are investing heavily in XR-based content production to enhance user engagement and storytelling. Additionally, the rising popularity of e-sports, virtual concerts, and cinematic VR experiences is contributing significantly to market expansion. As immersive digital experiences continue to gain mainstream traction, these factors collectively reinforce the long-term growth potential of the extended reality market.

RESTRAINING FACTORS

High Implementation Cost Hinders Market Growth

Extended reality creates virtual replicas of datasets that users can be tested and shared with users. However, this process encounters challenges when capturing the intricate details of real-world images and specialized models. Providing a high-quality XR experience can be expensive, particularly when factoring in the expenses of headsets and tactile sensors. As a result, this factor hampers the overall implementation cost and may hinder the extended reality market growth.

Moreover, the extended reality market faces additional constraints related to hardware limitations, infrastructure requirements, and integration complexities. The need for high-performance computing systems, advanced GPUs, and large storage capabilities significantly increases upfront investment costs for enterprises.

Small and medium-sized organizations often find it difficult to adopt XR due to these capital-intensive demands and the lack of standardized development frameworks. Additionally, ongoing maintenance expenses, software updates, and training requirements add to the total cost of ownership, slowing adoption rates across emerging economies. Despite continuous efforts by technology providers to introduce affordable XR devices and cloud-based delivery models, the high implementation cost remains a major barrier to scaling the extended reality market globally.

Extended Reality Market Segmentation

By Type Analysis

Rising Usage of Virtual Reality for Professional Training Helps to Dominate the Market

Based on type, the market is segmented into virtual reality, augmented reality, and mixed reality. The growing usage of Virtual Reality (VR) applications and headsets aims to immerse users in a computer-simulated reality. These VR headsets generate realistic sounds and images, engaging all five senses to create an interactive virtual world. The dominance of the virtual reality segment in the extended reality market is largely attributed to its expanding role in corporate training, defense simulations, and industrial design. Companies are increasingly adopting VR-based modules to enhance employee performance and safety training efficiency, reducing operational risks and costs. The development of lightweight, high-resolution headsets and cloud-based streaming capabilities is further accelerating enterprise deployment of VR solutions. In 2026, the Virtual Reality segment is projected to lead the market with a 47.86% share.

Moreover, growing investments by tech giants in hardware innovation and software ecosystems are expected to sustain the segment’s leadership position within the extended reality market. The virtual reality segment dominates the market during the forecast period.

Furthermore, augmented reality and mixed reality segments are projected to grow with a prominent share due to increasing implementation of AR and MR among different industry verticals to provide a comprehensive digital experience to users. These technologies are being leveraged in healthcare, automotive, and retail industries for real-time visualization, remote assistance, and interactive product demonstrations. As organizations focus on enhancing digital customer engagement, the AR and MR segments are expected to play a critical role in shaping the future growth trajectory of the global extended reality market.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Gaming Industry Dominate Owing to Penetration of Extended Reality Technique to Deliver Real-World Experience to the User

On the basis of industry, the market is divided into healthcare, education, retail & e-commerce, gaming, automotive, media & entertainment, and others. The gaming industry dominated the market in 2023 as the majority of end users demand immersive experiences provided by the extended reality. Companies that develop games are among the early adopters of XR solutions to create more memorable, immersive, and engaging customer experiences. The Gaming segment is forecast to represent 30.79% of total market share in 2026. The industry has transitioned from the creation of even more engaging and faster game consoles, smart chipsets, and extraordinary graphics.

In addition, the growing availability of cloud-based gaming platforms and the integration of XR technologies with 5G connectivity are significantly enhancing the real-time responsiveness and visual fidelity of gaming experiences. These innovations are driving consumer adoption and expanding the application scope of the extended reality market beyond traditional console gaming to include virtual e-sports, simulation-based training, and metaverse environments. The introduction of affordable standalone VR headsets and high-performance GPUs has also contributed to making immersive gaming accessible to a wider audience, reinforcing the segment’s leadership within the global extended reality market.

Increasing the use of XR technology in hospitals by surgeons helps to learn new skills or improve existing skills in a safe and secure environment. Innovations in the field of XR across the healthcare industry help to reduce the operating costs of clinics and hospitals, to make better diagnostics, and enable patient-to-patient communication. These innovations enhance the penetration of the XR technique in the healthcare industry.

Moreover, the extended reality market is gaining substantial traction in healthcare through the deployment of AR- and VR-assisted surgical simulations, remote diagnostics, and patient rehabilitation programs. Medical institutions are increasingly adopting XR solutions for telemedicine consultations and anatomy visualization, which improve procedural accuracy and patient outcomes. As healthcare organizations prioritize digital transformation, the integration of XR is expected to enhance clinical efficiency and broaden training capabilities across global medical systems, further supporting overall market growth.

REGIONAL INSIGHTS

The global market is classified across five regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Extended Reality Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Extended Reality Market Trends:

North America dominated the market with a valuation of USD 105.45 billion in 2025 and USD 142.68 billion in 2026. North America holds the largest extended reality market share, owing to the presence of multiple market players. The region benefits from opportunities for exposure to high technology and the increasing use of smart devices leading to stronger demand for extended reality experiences. Additionally, the growing investments in infrastructure development facilitate the integration of XR, enabling unprecedented connectivity across the U.S. and Canada. Moreover, technological advancements, such as the emergence of Augmented Reality (AR), Artificial Intelligence (AI), Virtual Reality (VR), and Big Data technologies across several industries, including retail, e-commerce, and entertainment industries, contribute to building fully virtual environments for users. The U.S. market is projected to reach USD 85.01 billion by 2026.

The regional extended reality market is further supported by strong venture capital funding and collaborative innovation ecosystems that foster partnerships between technology developers, universities, and enterprises. Growing adoption of XR in industrial design, telemedicine, and defense simulation also underscores North America’s position as a leading hub for immersive technology deployment, setting global benchmarks for innovation and scalability.

Asia Pacific Extended Reality Market Trends:

Asia Pacific is projected to grow with the highest CAGR during the forecast period. This substantial growth is due to the increasing amount of investments related to technology across the region. In addition, according to a report titled “Accelerating India's Potential to Address the Global XR Opportunity”, industry-related startup firms across India are expected to evolve with the intent of developing global solutions. 76% of these firms were those that serve both domestic and international clients. Thus, these developments indicate strong growth for the market across the region. The Japan market is projected to reach USD 11.15 billion by 2026, the China market is projected to reach USD 23.52 billion by 2026, and the India market is projected to reach USD 26.5 billion by 2026.

Rapid urbanization, expanding 5G infrastructure, and the growing popularity of mobile-based AR and VR applications are significantly driving the extended reality market across Asia Pacific. Major economies such as China, Japan, and South Korea are witnessing large-scale integration of XR technologies in education, manufacturing, and retail sectors, supported by government-led innovation initiatives. These trends are positioning the region as a critical growth engine for the global extended reality market.

Europe Extended Reality Market Trends:

Europe is projected to experience substantial growth with a high CAGR during the forecast period, primarily due to the presence of telecom companies and a surge in investment and innovation in software and other platforms for developing AR applications using 5G technology. This helps propel the market growth in Europe. The UK market is projected to reach USD 15.77 billion by 2026, while the Germany market is projected to reach USD 9.29 billion by 2026.

The European extended reality market benefits from a robust regulatory framework that promotes digital transformation and data security. Increasing demand for enterprise XR solutions across automotive, aerospace, and industrial training applications is further accelerating market expansion. Strategic collaborations between European technology firms and research institutions are also fostering advancements in spatial computing and extended reality hardware design.

Middle East & Africa and South America Extended Reality Market Trends:

The Middle East & Africa and South America are experiencing growth due to the rising penetration of digital technologies across different industrial sectors, including, healthcare, automotive, gaming, and media & entertainment. The increasing usage of smartphones and the rising demand for developments in the gaming and entertainment industry will surge the demand for XR during the forecast period.

The extended reality market in these regions is witnessing growing support from government smart city initiatives and the development of 5G networks. Countries such as the UAE, Saudi Arabia, and Brazil are emerging as early adopters of XR-driven digital transformation, particularly in tourism, education, and enterprise collaboration.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Key Players Focus on Deploying Extended Reality Technology to Strengthen their Position

Companies operating in the market include Qualcomm Technologies Inc., HTC Corporation, Meta, SOFTENGI, AVEVA Group Limited, SoftServe Inc., SphereGen Technologies LLC, Accenture PLC, and others, which serve as XR technology providers/generators. These companies also engage in strategic partnerships, acquisitions, and collaborations to expand their business and distribution network and maintain market growth. For instance, Metaverse is expected to add USD 1 trillion to the APAC economy by 2031 by enhancing the usage of Augmented Reality (AR) and Virtual Reality (VR) across different industries.

List of Top Extended Reality (XR) Companies:

- Qualcomm Technologies Inc. (U.S.)

- HTC Corporation (Taiwan)

- Meta (U.S.)

- SOFTENGI (U.S.)

- AVEVA Group Limited (U.K.)

- SoftServe Inc. (U.S.)

- SphereGen Technologies LLC (India)

- VertexPlus Technologies Limited. (India)

- Accenture PLC (Ireland)

- Theorem Solutions (U.K.)

Extended Reality Industry Developments:

- February 2024 – MediThinQ, a South Korean firm, introduced a pair of XR wearable displays focused on serving surgeons. Along with this, the company also mentions a multimillion-dollar investment that it has received from JLK Technology.

- February 2023 - At the Galaxy Unpacked event in San Francisco, Samsung Electronics Co. announced its strategic partnership with Google and Qualcomm. This partnership is based on the attempt to develop an ecosystem for the market.

- February 2023: OnePlus partnered with Qualcomm to bring Snapdragon Spaces extended reality feature to OnePlus 11 5G and help developers build an easily usable XR ecosystem. This partnership aims to provide users with the digital experience of movies and live concerts and enable them to deliver comprehensive gaming experiences.

- October 2022: Ericsson partnered with the University of Texas (UT) Austin to extend a research partnership to drive 6G-powered XR innovation to deliver users immersive and seamless XR experiences.

- September 2022: Meta formed a partnership with Qualcomm to design customized chips for the next-generation extended reality platforms for the Metaverse.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Moreover, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 25.5% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Industry, and Region |

|

Segmentation |

By Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 2127.81 billion by 2034.

In 2024, the market was valued at USD 1253.5 billion.

The market is projected to grow at a CAGR of 25.5% during the forecast period.

The virtual reality segment is expected to lead the market.

Rising demand for VR devices for gaming and entertainment applications drives market growth.

Qualcomm Technologies Inc., HTC Corporation, Meta, SOFTENGI, AVEVA Group Limited, SoftServe Inc., SphereGen Technologies LLC, and Accenture PLC are the top players.

North America held the highest market share in 2026.

The gaming industry is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us