GPU as a Service Market Size, Share & Industry Analysis, By Deployment Model (Private GPU Cloud, Public GPU Cloud, and Hybrid GPU Cloud), By Enterprise Type (Small & Medium-sized Enterprises and Large Enterprises), By Pricing Model (Pay-as-you-go and Subscription-based), By Application (Healthcare, BFSI, Manufacturing, IT & Telecommunication, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

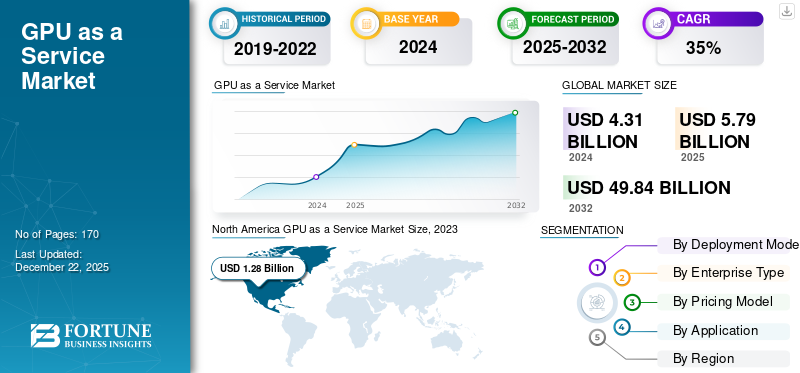

The global GPU as a service market size was valued at USD 5.79 billion in 2025 and is projected to grow from USD 7.80 billion in 2026 to USD 72.49 billion by 2034, exhibiting a CAGR of 32.10% during the forecast period. North America dominated the global market with a share of 38.90% in 2025.

GPU as a service (GPUaaS) is the cloud-based offering of remote GPUs when there is a requirement to process huge volumes of data for financial analysis, 3D modeling & animation, scientific research, and other tasks. A cloud GPU service provider completely maintains the GPUs and enables users to rent remote GPUs via the cloud. GPUaaS eliminates the requirement to purchase and maintain expensive on-premises hardware, helping enterprises minimize the upfront costs of physical GPUs. A server with a single GPU can surpass the performance of dozens of CPU servers. This speeds up the computational process for deep learning models, which are crucial elements of modern artificial intelligence (AI) applications.

The GPU as a service market growth is mainly driven by the rising data center economy, growing cloud computing adoption, and increased adoption of machine learning (ML) and AI-based applications across various sectors such as BFSI, healthcare & life sciences, and automotive. As per the Global AI Adoption Index 2022 by IBM, the adoption rate of AI across the world increased by 35%, a four-point growth from 2021. This, in turn, augmented the demand for inexpensive and scalable computing resources such as cloud GPUs.

To cater to the increasing demand for scalable and cost-effective computing resources, several cloud service providers are offering cloud GPU solutions to individuals and enterprises.

In April 2023, Catalyst Cloud, a New Zealand-based cloud services provider, announced the launch of NVIDIA GPU as a service, offering NVIDIA A100 GPU within the New Zealand market at a competitive price.

The coronavirus pandemic offered lucrative growth opportunities for the market on account of the surge in the adoption of cloud services. Many organizations shifted their operations to the cloud and adopted online productivity and collaboration services. Cloud migration enabled enterprises to spend more on Research and Development (R&D) in the areas of Machine Learning (ML) and Artificial Intelligence (AI). During the outbreak, numerous businesses increased their investment in IoT and the pace of their IoT projects. This, in turn, increased the demand for cloud GPUs for scaling and accelerating the process.

IMPACT OF GENERATIVE AI

Increased Computational Requirements for Training and Deploying Generative AI Models to Augment the Market Growth

Generative Artificial Intelligence (AI) is a revolutionary technology that presents significant computing challenges. Generative AI models are often complex and involve the processing of huge volumes of datasets. For instance, many inference calculations are executed every time a user uses DALL-E, an image generation model. This, in turn, increases the demand for powerful computing resources for efficient processing.

As enterprises and researchers increasingly use generative AI for tasks, such as document search & synthesis, content creation, and image generation, the demand for cost-effective and scalable GPUs becomes essential. Rapid AI adoption during the forecast period is expected to offer lucrative growth opportunities to GPU as a service solution providers.

GPU as a Service Market Trends

Surge in Complex Simulations and Deep Learning Workloads to Impel the Market Expansion

The rapid evolution of large, complex simulations, and deep learning workloads has increased the use of HPC products and services to process large volumes of datasets, run analytics, and other applications in less time, with low latency, and at a lesser cost than conventional computing. Businesses in almost every sector are increasingly employing GPU-assisted HPC infrastructure for data-intensive computing.

Moreover, several companies in the market are increasingly launching GPU as a service solutions to maintain the highest level of performance and speed of HPC. For instance,

In May 2022, atNorth, a Nordic data center services firm, announced the launch of a GPUaaS solution to accelerate HPC workloads. The company aims to integrate its HPC data center capabilities with leading GPU and AI software to offer a 360°solution.

Download Free sample to learn more about this report.

GPU as a Service Market Growth Factors

Increasing Demand for GPU-Intensive Applications and Rapid Technological Advancements to Fuel the Market Growth

The rise of GPU-intensive applications, such as video editing, gaming, computer-aided design (CAD), machine learning, and blockchain, is anticipated to boost the GPU as a service market growth in the upcoming years. GPU as a service solutions help businesses and researchers speed up their machine learning and AI workloads. Cost efficiency, assistance from cloud service providers (CSP), and on-demand scalability are some of the major advantages of GPUaaS. The growing trend of remote work and virtualization is expected to further propel the market growth. By utilizing cloud GPUs, businesses can help employees access GPU-intensive applications and perform data-intensive tasks remotely.

Moreover, the rapid advancements in enhancing the processing capabilities of GPUs further supplement the market growth. The Internet of Things (IoT) applications, such as smart cities, demand high-performance GPUs to deliver real-time metrics and predictive analytics features. This factor is expected to drive the growth of the market in the long term.

RESTRAINING FACTORS

Data Security Concerns Coupled with Less Awareness in Developing Economies May Hamper the Market Growth

Data security is one of the major issues that is anticipated to limit the market growth. Since GPU as a service solution stores and processes data on the cloud, there is a higher risk of data loss, unauthorized access, and cyberattacks. As per Snyk's "The 2022 State of Cloud Security" report, about 80% of businesses experienced at least one cloud security incident in 2022 and 27% of companies observed a public cloud security incident, a 10% increase from previous year. GPU as a service solution providers must ensure that they have placed enough security measures in place to protect users' data. Another factor limiting the market growth is less adoption in emerging economies on account of low awareness of GPU as a service and slow adoption of advanced technologies such as AI and ML.

GPU as a Service Market Segmentation Analysis

By Deployment Model Analysis

Increasing Data Security Threats to Fuel the Private GPU Cloud Demand

Based on deployment model, the market is segmented into private GPU cloud, public GPU cloud, and hybrid GPU cloud.

The private GPU cloud segment is anticipated to hold the maximum market with a share of 53.07% in 2026, owing to the rising security threats such as malware, ransomware, and phishing attacks in cloud computing. As per “The State of Cloud-Native Security 2023” report by Palo Alto Networks, around 39% of respondents noted an increase in the number of security breaches. Owing to this, businesses are increasingly adopting a private GPU cloud deployment model. The private cloud is completely dedicated to a single customer. Hence, the systems and infrastructure can be configured as per the need to offer high levels of security. The private GPU cloud held 53% of the market share in 2024.

On the other hand, the hybrid GPU cloud segment is predicted to record the highest CAGR during the forecast period due to the numerous advantages offered by this model, such as cost-effectiveness and scalability.

By Enterprise Type Analysis

Large Enterprises Adopt Cloud GPU to Overcome Challenges Associated with Infra Maintenance

Based on enterprise type, the market is divided into small & medium-sized enterprises and large enterprises.

The large enterprises segment is expected to hold the largest GPU as a service market share with a 61.30% in 2026. Managing and maintaining hardware such as GPUs is a difficult and resource-intensive job. Cloud GPU helps organizations get relieved from the burden of hardware management, upgrades, and maintenance. Owing to these benefits, large enterprises increasingly adopt GPUaaS solutions to process compute-intensive workloads.

On the contrary, the small & medium-sized enterprises segment is anticipated to register the highest CAGR of 37.20% during the forecast period. SMEs are increasingly adjusting to the digital environment to meet customer requirements and stay ahead of the competitive curve in a highly competitive marketplace.

By Pricing Model Analysis

Pay-as-you-go Segment to Dominate Owing to Cost-efficiency

Based on pricing model, the market is divided into pay-as-you-go and subscription-based.

The pay-as-you-go segment is expected to dominate the market with a share of 72.93% in 2026, and grow with the highest CAGR of 37.3% during the forecast period. This pricing model offers flexible payment options, allowing enterprises to pay only for the resources they utilize. This, in turn, helps organizations minimize overall expenses and eliminate the requirement to manage and maintain costly on-premises GPU infrastructure. The pay-as-you-go pricing model is highly suitable for projects that do not demand constant access to powerful GPUs.

In the subscription-based pricing model, users subscribe and pay upfront for cloud GPUs for a specific period. This model is ideal for users who use significant computing resources however, if only a small amount of computing resources are required, a subscription-based pricing model may not be ideal.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Generation of Huge Volumes of Data to Augment Product Use in IT & Telecommunication Sector

Based on application, the market is segmented into healthcare, BFSI, manufacturing, IT & telecommunication, automotive, and others (aerospace & defense and agriculture).

The IT & telecommunication segment is anticipated to dominate the market with a share of 22.21% in 2026. IT & telecom companies generate massive volumes of data and use it to gain insights and enhance their services. GPUaaS delivers the processing power needed for advanced data analytics and machine learning. In the telecommunications sector, GPUaaS can be used for network optimization tasks.

Contrarily, the manufacturing segment is expected to show the highest CAGR of 38% during the forecast period on account of the increasing adoption of HPC to manage massive volumes of datasets for simulation and modeling. This segment is also likely to acquire 22% of the market share in 2025. GPUs are helpful for parallel processing, making them favorable for running complex simulations and calculations needed for product design, material analysis, and validation. Cloud GPU offers tremendous computational power needed to conduct complex simulations faster, enabling manufacturers to iterate and refine their designs rapidly.

REGIONAL INSIGHTS

Geographically, the market is studied across five major regions, including North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. They are further categorized into countries.

North America

North America GPU as a Service Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to account for the largest market share for GPU as a service during the forecast period due to the presence of well-established computing software and hardware providers, robust cloud computing adoption, rapid adoption of AI applications across various sectors, advancements in computational power, and strong technology investment activity in AI bolstered by government funding & support. North America dominated the global market in 2025, with a market size of USD 2.252 billion. The U.S. has maintained its dominant position in the region due to the continued investment in AI research. As stated in the new report by Stanford University, the U.S. government spending on artificial intelligence (AI) contracts reached USD 3.3 billion in the fiscal year 2022. The U.S. market is valued at USD 1.89 billion by 2026.

All these factors have propelled the growth of the AI market, which, in turn, has augmented the demand for GPUaaS solutions in North America.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Moreover, the Asia Pacific market is anticipated to show the highest growth rate during the forecast period due to rapid cloud adoption and favorable government initiatives. The region is anticipated to be the third-largest market with a value of USD 1.259 billion in 2025. The region is a home to some of the major tech hubs, such as China, India, Australia, Japan, and South Korea, drawing both local as well as global investments. Governments in the region have shown significant interest in AI, with Australia, New Zealand, China, Japan, India, and Singapore announcing ambitious national strategies for the same. The Japan market is valued at USD 0.222 billion by 2026, the China market is valued at USD 0.529 billion by 2026, and the India market is valued at USD 0.428 billion by 2026.

Europe

The market in Europe is majorly driven by surging AI and ML investments, the availability of high-quality digital infrastructure, and the rapid adoption of HPC across various sectors including healthcare and automotive for processing data-intensive workloads. Europe is anticipated to account for the second-highest market size of USD 1.575 billion in 2025, exhibiting the second-fastest growing CAGR of 37% during the forecast period. Several governments in Europe have launched funds to support various AI projects. For instance, The UK market is valued at USD 0.328 billion by 2026, and the Germany market is valued at USD 0.468 billion by 2026.

South America and Middle East & Africa

In South America, the emergence of the startup & innovation ecosystem and the rapid adoption of cloud-based solutions are anticipated to drive the market growth. Brazil is anticipated to maintain its dominant position in the region on account of the presence of a solid ecosystem to conduct the R&D of cutting-edge technologies.

The Middle East & African countries are increasingly adopting digital technologies. The region is expected to be the fourth-largest market with a value of USD 0.40 billion in 2025. In addition, the Gulf Cooperation Council (GCC) countries are increasingly spending on high-tech technology such as AI as part of economic transformation strategies. Moreover, the UAE and Saudi Arabia have already announced national strategies to prepare their economies to incorporate AI. The GCC market is likely to hit USD 0.15 billion in 2025.

List of Key Companies in GPU as a Service Market

Key Players Focus on Strengthening their Market Position with Continuous Product Developments

The global market for GPU as a service is consolidated by the presence of leading players such as Amazon Web Services, Inc., Google, Microsoft, Vultr, and IBM Corporation. These key players are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. For instance, in February 2023, Vultr, a company offering compute, storage, and GPU Solutions, announced the remote accessibility of the NVIDIA A16 GPU, an expansion to the A100 Tensor Core and A40 data center NVIDIA GPUs in the Vultr offerings.

List of Key Companies Profiled:

Alibaba Cloud (China)

Vultr (U.S.)

Linode LLC. (U.S.)

Amazon Web Services, Inc. (U.S.)

Google (U.S.)

IBM Corporation (U.S.)

OVH SAS (France)

Lambda Labs (U.S.)

Hewlett Packard Enterprise Development LP (U.S.)

CoreWeave (U.S.)

KEY INDUSTRY DEVELOPMENTS:

January 2024: WekaIO, Inc., the data platform for cloud & AI, announced a new partnership with NexGen Cloud Ltd., a cloud IaaS firm, to offer on-demand services of Hyperstack, a NexGen Cloud's GPUaaS platform.

December 2023: Yotta Infrastructure, the Indian hyperscale tier IV data center provider, announced a collaboration with NVIDIA Corporation, a pioneer of GPU-accelerated computing. Through this partnership, Yotta Data Services aims to provide GPU computing infrastructure and platforms for its Shakti Cloud platform.

April 2023: CoreWeave, a NYC-based startup, raised USD 221 million in Series B funding led by Magnetar Capital. CoreWeave offers various Nvidia GPUs in the cloud for use cases, such as visual effects & rendering, AI & ML, batch processing, and pixel streaming.

March 2023: Lambda Labs, a cloud company offering GPUs on-demand in a public cloud, raised USD 44 million in a Series B investment round. The company is planning to deploy thousands of Nvidia's latest H100 GPUs with high-speed network interconnects. Lambda Labs has data centers in San Francisco, Texas, California, and Allen.

September 2022: Super Micro Computer, Inc., a storage, networking solutions, and computing company, added an 8U Universal GPU server to its GPU server lineup for large-scale AI training. The 8U server is designed for diverse and computationally-intensive workloads built for maximum performance in data centers.

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro-economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 32.10% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment Model

By Enterprise Type

By Pricing Model

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 72.49 billion by 2034.

In 2025, the market value stood at USD 5.79 billion.

The market is projected to record a CAGR of 32.10% during the forecast period of 2026 – 2034.

By application, the IT & telecommunication segment is poised to dominate during the forecast period.

Increased adoption of cutting-edge technologies, such artificial intelligence (AI), machine Learning (ML), deep learning, and natural language processing, coupled with surge in the digitalization, are poised to aid the market growth.

Some of the top players in the market are Vultr, IBM Corporation, Amazon Web Services, Inc., Alibaba Cloud, CoreWeave, and others.

North America is expected to dominate the market during the forecast period.

By application, the manufacturing segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us