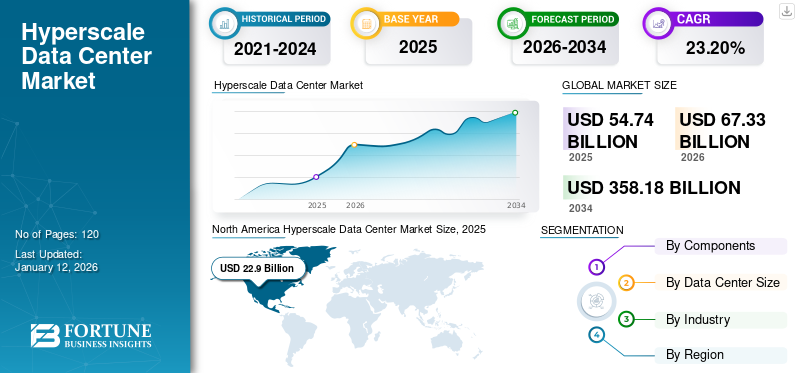

Hyperscale Data Center Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Data Center Size (Small and Medium-Sized Data Centers and Large Data Centers), By Industry (IT & Telecom, Retail & E-commerce, BFSI, Government, Energy & Utilities, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global hyperscale data center market size was valued at USD 54.74 billion in 2025 and is projected to grow from USD 67.33 billion in 2026 to USD 358.18 billion by 2034, exhibiting a CAGR of 23.20% during the forecast period. North America dominated the hyperscale data center market with a market share of 41.80% in 2025.

Hyperscale data center is a large-scale data center that offers extreme scalability and is designed to support large workloads with a high-performance network infrastructure, efficient network connectivity, and low latency. The hyperscale data center needs a physical site, large enough to host all the associated equipment, including a minimum of 5000 servers and potentially thousands of miles of connection infrastructure. This data center is also known as cloud data center, which is a large, centralized, and highly-efficient, custom-built computing facility that is managed by a single entity. The growing adoption of cloud technologies, IoT, and big data by various industry verticals boosts the demand for hyperscale.

The COVID-19 pandemic had a mixed impact on the market. Increased demand for digital services and the adoption of work-from-home culture by different enterprises created a positive outlook for the market. Similarly, the rising usage of online shopping applications, video conference tools, streaming services, and other online activities enhanced the need for data processing and data storage solutions and services. These factors boosted the demand for building high-scale data centers in different countries. The market also experienced a slowdown in expansion with disruptions in global supply chains and limited worker mobility.

IMPACT of GENERATIVE AI

Implementation of Gen AI Across Hyperscale Data Center Automate Repetitive Tasks to Improve Operational Efficiency

Integrating generative AI with hyperscale data centers help to handle the growing complexity of data and workload of Gen AI applications. The rising need to manage a large number of AI-specialized servers, high electricity expenses, and robust operational efficiency is expected to increase the demand for high-scale AI-operated data centers during the forecast period. Gen AI helps automate repetitive tasks, streamline workflows, improve operational efficiency, as well as reduce operational and maintenance costs of data centers. According to a survey, half of all cloud data centers present across the globe will use Artificial Intelligence (AI) by 2025 to improve the performance and efficiency of the data center.

The AI-based servers are equipped with high computing power to handle complex algorithms and intensive workloads. It helps to enhance the productivity of data centers by using large amounts of computing electricity and massive resources along with increased server density. The integrated AI also brings innovations in liquid cooling, which is 3,000 times more effective than air cooling. This factor also helps to enhance the performance of data centers more effectively by cooling the servers.

Increasing the implementation of gen-AI with high-scale data centers enables the improvement of different operations, such as resource optimization and predictive maintenance, along with data analysis capabilities. It also helps in managing data security by continuously monitoring the performance of the systems. Hence, the integration of generative AI across hyperscale data centers helps to manage the complexity of data to improve the operational efficiency of businesses.

Hyperscale Data Center Market Trends

Growing Need for Data Storage and Processing Capabilities to Drive Market Growth

The large scale data centers provide the computing power and storage capacity required to process large volumes of data quickly and efficiently. In recent years, there has been an enormous increase in data driven by integrating the rise of Internet of Things (IoT) devices, social media applications, online shopping, and many more. These factors generated a need for new and innovative storage solutions to process and manage the large volume of data.

Hence, the hyperscale data centers are designed to meet the storage and networking needs of the users by providing scalable and flexible infrastructure that can manage large amounts of data in real-time using various advanced technologies such as AI, machine learning, virtual reality, cloud, and many more.

Thus, due to the growing need for high volume data storage, the demand for situating such data centers increases over the forecast period.

Download Free sample to learn more about this report.

Hyperscale Data Center Market Growth Factors

Surge in Demand for Cloud Computing Among Enterprises to Fuel Market Growth

The rising adoption of cloud-computing services by enterprises of different sizes for storage and computing purposes boosts the total IT spending of the companies. The sudden shift toward work-from-home culture and increasing implementation of digital collaboration and communication tools drive the demand for cloud-computing services, mainly project management tools, communications solutions, and virtual desktop infrastructure.

In recent times, businesses have relied on digital technologies such as artificial intelligence, cloud computing, and big data analytics, which mainly require scalable and dependable data center infrastructure. Hence, the growing demand for agile, cost-efficient, and scalable cloud solutions is anticipated to drive the growth of the market during the forecast period. Furthermore, the rising number of internet-connected devices—such as smartphones, IoT devices, and streaming services—is generating a vast amount of data that needs to be processed and stored.

The high-capacity data centers are designed to accommodate the immense computational demands of cloud computing technology. Cloud providers such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure add resources to their data centers in order to improve the organization’s performance. Hence, by considering these factors, the rising demand for cloud computing services by enterprises fuels the growth of the hyperscale data center market share.

RESTRAINING FACTORS

High Energy Cost Hinders Market Growth

Building and operating data center costs can evolve high initial investment along with expensive operating costs, mainly in terms of energy consumption and cooling requirements. Many servers and IT equipment generate a high heat at the individual rack level. Hence, the need for a cooling solution arises. The massive power is critically important for maintaining effective cooling systems that prevent hardware from reaching thermal overload situations.

Increased usage of large amounts of energy by various operating servers and networking equipment to continue their operation enhances the overall spending of data centers on power usage. This results in raising sustainability concerns due to the high energy consumption among this industry and the wider computing industry.

Furthermore, the constant integration of data center operations with advanced AI platforms and high-performance computing technologies can consume large amounts of electric power, significantly increasing maintenance and monitoring expenses. Thus, the high energy cost is the key factor that restricts the growth of the market during the forecast period.

Hyperscale Data Center Market Segmentation Analysis

By Component Analysis

Solutions Segment Leads by Managing the workload to fulfill the High-Performance Computing Requirements of the User

Based on component, the market is segregated into solutions and services. In solutions, we have considered storage, server, networking, and software, whereas in services, installation and maintenance & support services are considered.

The solutions segment held the largest market with a share of 51.85% in 2026 and is estimated to depict the highest growth rate during the forecast period. This is due to the increasing demand for data storage, mining, and networking equipment by various industries to manage workloads across multiple servers and to support the high-performance computing requirements of large-scale data processing. These solutions help to boost operational efficiency and reduce the storage costs of the data centers. The high-scale data center contains 5,000 servers with a minimum of 10,000 square feet of space along with at least 40MW power capacity.

The services segment includes installation and maintenance & support services. Among these, the demand for maintenance and support services is high as compared to installation, due to the growing need for maintaining cloud capabilities among hyperscale data centers in order to accelerate the operational performance of the organization.

By Data Center Size Analysis

Large Sized Data Centers Lead as they Maintain High Volume of Data for Majority of Cloud Providers

On the basis of data center size, the market is divided into small and medium-sized data centers and large data centers.

The large sized data centers segment holds the largest market with a share of 56.42% in 2026 and is anticipated to grow with the highest CAGR during the forecast period. This is due to the majority of cloud providers being the primary buyers and users of data centers for which they require large-sized infrastructure to deliver cloud services to enterprises and individuals.

The small and medium sized data center segment holds a lower share compared to large sized data centers as the data generated by small sized enterprises is smaller in size. Thus, the investment by small sized companies is also low as compared to large size companies. Hence, to store and maintain high-volume data, the demand for situating large sized data centers is comparatively high as compared to small-sized data centers.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

BFSI Segment to Depict Accelerated Growth with High Demand for Maintaining Security and Privacy of Financial Data of the Customers

By industry, the market is divided into IT & Telecom, retail & e-commerce, BFSI, government, energy & utilities, healthcare, and others.

The BFSI sector is expected to grow at the highest CAGR during the forecast period, driven by the increasing use of banking and financial applications that generate large volumes of data, accounting for a 24.82% market share in 2026. This confidential data needs a secure storage solution to maintain the privacy and security of the user’s information. The BFSI sector needs an efficient IT infrastructure to fulfill the demands of the customer. Thus, to optimize the workflow efficiency with low latency and to deliver improved customer experience, the BFSI sector boosts the implementation of high-scale data centers.

IT & telecommunication held the largest market share in 2023. This is due to the increasing investment by companies to develop new digital workplaces to align the business processes for improving overall operational productivity. The use of process management, workflow management, project management and messaging tools by employees helps them to manage their work and collaborate effectively.

REGIONAL INSIGHTS

The market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America and each region is further studied across countries.

North America

North America Hyperscale Data Center Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is estimated to be a prominent contributor to the hyperscale data center market growth and held the maximum market with size of 22.9 in 2025. Growing technological advancements and the presence of a large number of hyperscale data centers in the U.S., and Canada are anticipated to drive the demand for the market during the forecast period. The U.S. market is projected to reach USD 19.04 billion by 2026. According to research, the U.S. has more than 2700 operating data centers for data storage, networking, and data mining solutions for global customers.

Furthermore, the increased number of 5G users in North America with increased network capacity boosts the usage of large amounts of data by smartphones and other smart devices. Thus, to store the large amount of data, a high-scale data center is needed.

Asia Pacific

Asia Pacific is projected to grow with the largest CAGR during the forecast period. This is due to the continuous digital transformations and growing investments in developing advanced technologies such as artificial intelligence, big data, and cloud computing by the governments of India, China, Japan, and other countries. The Japan market is projected to reach USD 3.28 billion by 2026, the China market is projected to reach USD 3.88 billion by 2026, and the India market is projected to reach USD 2.58 billion by 2026.

- For instance, in October 2022, Yotta Infrastructure, a digital transformation service provider, launched North India’s first hyperscale data center, “Yotta D1” in Greater Noida. The development of Yotta D1 helps to bring digital transformation to India’s infrastructure development.

Similarly, the initiatives taken by key developers for developing new cloud computing-based infrastructure by investing in deploying a digital ecosystem accelerates the demand for data centers in the region.

Europe

Europe is projected to showcase moderate growth during the forecast period. This is due to the rising development of data centers and the presence of Cloud Service Providers (CSPs) among the U.K., Germany, Italy, and France, due to increased cloud spending by enterprises. The UK market is projected to reach USD 19.04 billion by 2026, while the Germany market is projected to reach USD 2.82 billion by 2026. Furthermore, the growing penetration of the internet and other smart devices, which generate a high amount of data traffic, requires large-sized data centers. This factor drives the growth of the market in Europe during the forecast period.

South America and Middle East & Africa

South America and the Middle East & Africa are estimated to experience significant market growth during the forecast period. It is due to the rising popularity of social media applications, OTT services and online gaming apps among people that generate huge amounts of data. Thus, the demand for storage solutions and servers will increase rapidly during the forecast period to store and manage large amounts of data. These are the key factors that are expected to enhance the growth of the market during the forecast period.

Competitive Landscape

Technological Developments by Leading Companies to Aid Market Proliferation

Companies operating in the market mainly include Amazon Web Services, Inc., Cisco Systems, Inc., IBM Corporation, Oracle Corporation, and Arista Networks, Inc. These firms are focusing on bringing innovations in developing high-scale data centers. To enhance their operations throughout the world, market players are using various strategic methods, such as partnerships, collaborations, acquisitions, and mergers.

List of Key Companies Profiled:

- Amazon Web Services, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Arista Networks, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Google, Inc. (U.S.)

- Intel Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Ericsson, Inc. (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Evroc aims to raise USD 641.0 million to develop the first hyperscale cloud data center in Stockholm, Europe. The startup’s newly deployed hyperscale data center aims to build a sustainable cloud and Artificial Intelligence (AI) infrastructure for Europe.

- September 2023: Solarvest Holdings Bhd entered into a partnership with Centre for Technology Excellence Sarawak (Centexs), Huawei Technologies Sdn Bhd, and GreenBay CES Sdn Bhd and launched a new hyperscale green data center in Borneo. This newly developed hyperscale green data center aims to reduce its carbon footprint by using Solarvest’s energy-efficient solutions.

- July 2023: Equinix, Inc., a colocation data center provider, launched a new hyperscale data center in Tokyo, Japan, with a maximum of 36MW of capacity across the TY12x and OS2x facilities.

- April 2022: NTT Ltd., an IT infrastructure and services company, developed a new hyperscale data center in Jakarta, Indonesia. This data center aims to fulfill the requirements of hyperscalers and high-end companies in order to support Indonesia's developing digital economy.

- March 2022: Yondr Group, a data center service provider, launched a 200MW hyperscale data center project in Malaysia. This data center aims to scale up cloud computing capabilities in the Malaysian market.

REPORT COVERAGE

The study on the market includes prominent areas globally to gain enhanced knowledge of the industry verticals. Moreover, the research offers insights into the most recent endeavors and industry developments and an analysis of high-tech solutions being adopted promptly worldwide. It also highlights some of the growth-stimulating limitations and elements, allowing the reader to obtain a comprehensive understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Data Center Size

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 358.18 billion by 2034.

In 2025, the market stood at USD 54.74 billion.

The market is projected to grow at a CAGR of 23.20% over the forecast period (2026-2034).

The IT & telecom industry is likely to hold the largest market share.

The surge in demand for cloud computing among enterprises is expected to drive market growth.

Amazon Web Services, Inc., Cisco Systems, Inc., IBM Corporation, Oracle Corporation, Arista Networks, Inc., Microsoft Corporation, and Google, Inc. are the key players in the market.

North America dominated the hyperscale data center market with a market share of 41.80% in 2025.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us