In-Flight Entertainment and Connectivity Market Size, Share & Industry Analysis, By Type (IFE Hardware and IFE Connectivity), By IFE Hardware (Portable IFE System and Non-Potable IFE System), By IFE Connectivity (Satellite Connectivity and Air to Ground Connectivity), By Installation (Line Fit and Retro Fit), By Satellite Band (Ka-Band, Ku-Band, and Others), By End User (OEM and Aftermarket), By Platform (Narrow Body, Wide Body, Business Jet, and Regional Jets), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

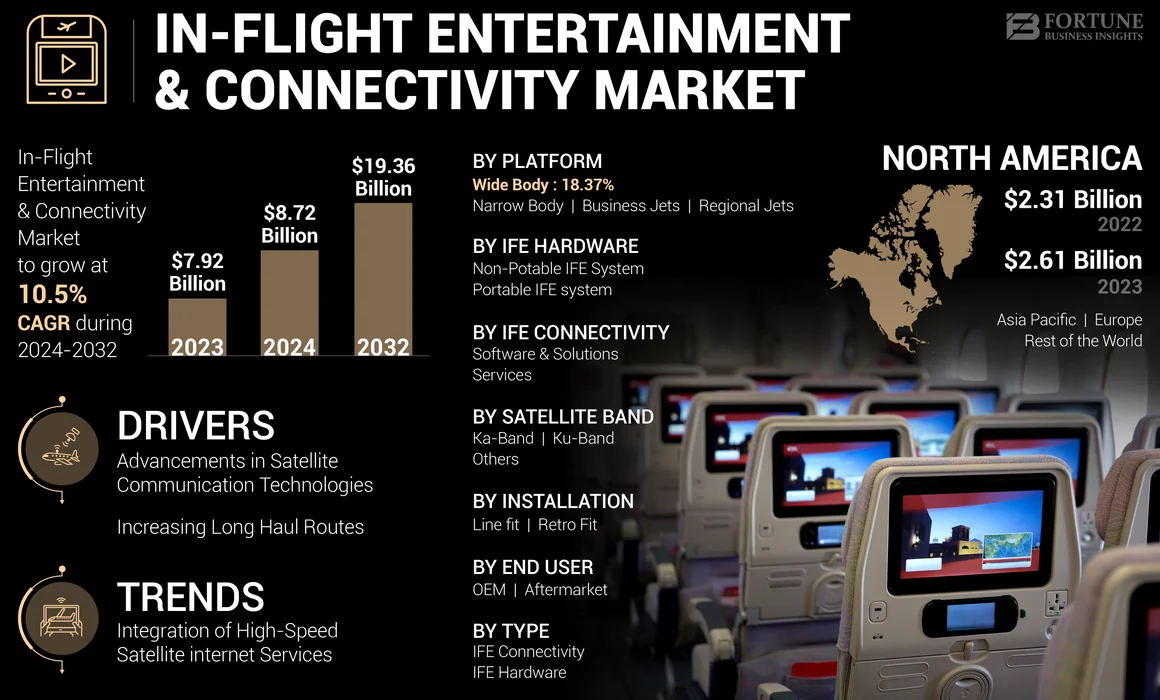

The global in-flight entertainment and connectivity market size was valued at USD 7.92 billion in 2023. It is projected to grow from USD 8.72 billion in 2024 to USD 19.36 billion by 2032, exhibiting a CAGR of 10.5% during the forecast period. North America dominated the in-flight entertainment and connectivity market with a market share of 32.95% in 2023.

In-Flight Entertainment and Connectivity (IFEC) refers to the range of technologies and services provided to passengers during air travel. This includes various entertainment options, such as movies, television shows, music, games, and internet access. The primary goal of in-flight entertainment and connectivity is to enhance the passenger experience by providing engaging content and reliable connectivity throughout the flight.

The backbone of modern in-flight entertainment and connectivity systems is satellite communication technology, which enables high-speed internet access during flights. Technologies, such as Ka-band and Ku-band satellites, provide the bandwidth necessary for streaming services and real-time connectivity. Many airlines are shifting toward wireless IFE systems that allow passengers to stream content directly to their devices (Bring Your Own Device BYOD). This approach reduces the need for heavy seat-back screens and can lower operational costs. In-flight entertainment and connectivity systems are designed to keep passengers entertained during flights, particularly on long-haul journeys where boredom can become an issue. By offering a wide range of entertainment options, airlines can significantly improve passenger satisfaction.

Airlines are partnering with streaming services, such as Netflix and Amazon Prime, to offer familiar content that resonates with passengers during flights. This trend reflects a growing expectation for diverse entertainment options. Moreover, Virtual Reality (VR) and Augmented Reality (AR) technologies are currently being examined as possible upgrades to in-flight entertainment. These immersive experiences have the potential to transform passenger engagement and experience.

GLOBAL IN-FLIGHT ENTERTAINMENT & CONNECTIVITY MARKET OVERVIEW

Market Size & Forecast:

- 2023 Market Size: USD 7.92 billion

- 2024 Market Size: USD 8.72 billion

- 2032 Forecast Market Size: USD 19.36 billion

- CAGR: 10.5% from 2024–2032

Market Share:

- North America dominated the in-flight entertainment and connectivity (IFEC) market with a 32.95% share in 2023, driven by high demand for business and leisure air travel, strong satellite infrastructure, and major airline partnerships with connectivity providers like Viasat and Panasonic Avionics.

- By type, the IFE Connectivity segment held the largest market share in 2023 due to the rising demand for high-speed internet on board. Satellite connectivity, particularly Ka-band systems, is enabling advanced IFEC features such as streaming, gaming, and video conferencing.

Key Country Highlights:

- United States: American Airlines, Hawaiian Airlines, and United Airlines are leading the deployment of Ka-band high-speed connectivity, including partnerships with Starlink, Viasat, and Panasonic to offer immersive passenger experiences.

- India: Air India is investing USD 400 million to retrofit its fleet with Thales’ AVANT Up IFE system, enhancing passenger offerings on Boeing 777 and 787 aircraft.

- China: Sichuan Airlines is leveraging domestic Ka-band satellite systems in partnership with Aerosat to improve regional connectivity.

- Germany: Lufthansa’s partnership with Thales is modernizing its fleet’s digital onboard services, with a focus on lighter, more energy-efficient IFEC systems that align with EU sustainability goals.

- UAE: Emirates is expanding its aircraft renovation program to 191 aircraft with upgraded IFE systems from Honeywell and other providers, reinforcing its premium passenger experience focus.

Market Trends

Integration of High-Speed Satellite Internet Services is a Prominent Trend Shaping the Market

The integration of high-speed satellite internet services is transforming the in-flight entertainment and connectivity market. As airlines strive to meet the growing expectations of passengers for seamless connectivity and engaging entertainment options, technologies, such as SpaceX's Starlink, are playing a pivotal role in shaping this landscape. North America witnessed in-flight entertainment and connectivity market growth from USD 2.31 Billion in 2022 to USD 2.61 Billion in 2022.

High-speed satellite internet services, particularly those provided by Starlink, are revolutionizing in-flight connectivity by offering low-latency, high-bandwidth internet access. Starlink's network of low Earth orbit (LEO) satellites enables airlines to deliver internet speeds ranging from 40 to 220 Mbps, allowing passengers to engage in activities that were previously challenging during flights, such as video calls, streaming services, and online gaming. This capability significantly enhances the overall passenger experience by providing connectivity that mirrors ground-based internet service.

- In September 2024, Hawaiian Airlines has recently revealed that it will be providing complimentary access to Starlink's fast and reliable Wi-Fi service to passengers on all Airbus-operated flights connecting the Hawaiian Islands with the continental US, Asia, and Oceania. The carrier is set to introduce Starlink on its Airbus A321neo aircraft.

- In May 2024, Banyan Avionics announced to be an authorized dealer for Starlink Aviation, which specializes in integrating this technology into business jets, ensuring global in-flight connectivity for clients. As more business travelers seek reliable internet access for work-related tasks during flights, the demand for such integrations will likely continue to grow.

Download Free sample to learn more about this report.

Market Growth Factors

Advancements in Satellite Communication Technologies Boost theIn -Flight Entertainment And Connectivity (IFEC) Market Growth

The market is significantly influenced by advancements in satellite communication technologies, particularly through the use of Ka-band and Ku-band systems. Such technologies enable faster and more reliable internet connections, which are essential for enhancing passenger experiences during flights.

Ka-band and Ku-band systems provide high-capacity data transmission capabilities that are crucial for modern IFE solutions. The Ka-band, operating between 26.5 to 40 GHz, is known for its ability to deliver high data rates, making it ideal for broadband services that can rival terrestrial networks. This capability allows airlines to offer streaming services, real-time updates, and interactive applications that enhance the overall passenger experience. For instance, high-throughput satellites (HTS) utilizing Ka-band technology can achieve data throughput rates that are significantly higher than traditional Ku-band systems, enabling airlines to provide seamless connectivity even on long-haul flights.

The ongoing advancements in satellite communication technologies present numerous opportunities for innovation within the IFE market. As more airlines adopt HTS and explore new frequency bands, such as Q-band and V-band, for future applications, there will be increased competition among service providers to deliver superior connectivity solutions.

Increasing Long Haul Routes Offering to Cater Rise in Global Travel is a Significant Driver of Growth in the Market

The global travel landscape has seen a remarkable transformation, particularly with the expansion of long-haul flights. This trend is significantly influencing the market, which is evolving to meet the expectations of travelers who increasingly demand high-quality entertainment and connectivity options during their flights. For instance, airlines, such as Singapore Airlines, have upgraded their IFE systems to provide personalized content tailored to passenger preferences. The introduction of high-definition screens and extensive content libraries has become essential for differentiating services on long-haul flights, where passenger engagement is crucial for enhancing loyalty.

The rise of low-cost carriers has also contributed to the growth of long-haul routes and subsequently increased demand for IFE systems. LCCs are expanding their offerings by introducing longer routes at competitive prices, which often include basic IFE services to enhance passenger experience without significantly raising operational costs. This trend is evident as airlines, such as Norwegian Air, have successfully implemented IFE systems that provide streaming capabilities directly to passengers' devices.

RESTRAININGFACTORS

High Costs Associated with IFEC Installment to Negatively Impact Market Growth

The initial costs of acquiring and installing IFE systems can be substantial. Airlines must invest in various hardware components, including satellite antennas, onboard servers, Wi-Fi networks, and seatback screens. The high costs associated with implementing and maintaining advanced IFEC systems are significant restraints on market growth. Retrofitting older aircraft with new technologies can be prohibitively expensive, particularly for airlines operating on thin profit margins. The installation of hardware such as satellite antennas, servers, and seatback screens requires substantial capital investment.

Furthermore, ongoing operational costs related to system maintenance, software updates, and content licensing can add financial strain on airlines. These high costs can limit the adoption of advanced IFEC solutions among smaller carriers or those operating in emerging markets where budget constraints are more pronounced.

Moreover, ongoing operational costs related to system maintenance, software updates, and content licensing can add financial strain on airlines. These high costs can limit the adoption of advanced IFEC solutions among smaller carriers or those operating in emerging markets where budget constraints are more pronounced. According to the International Civil Aviation Organization (ICAO), maintenance can represent 15% to 20% of an airline's direct operating costs, depending on fleet age and utilization. Such high costs can hamper the growth of the in-flight entertainment and connectivity market.

SegmentationAnalysis

By Type Analysis

IFE Connectivity Segment Dominates the Market Due to the Increase in Demand for High-Speed Internet

Based on type, the market is categorized into IFE hardware and IFE connectivity.

The IFE connectivity segment accounted for the largest market share in 2023. The growth is primarily driven by the rising demand for high-speed internet access on flights, as passengers increasingly expect seamless connectivity similar to what they experience on the ground. In February 2022, Viasat partnered with Aerosat to install an IFEC system on Sichuan Airlines that connects to China’s Ka-band satellite, showcasing the growing adoption of advanced connectivity solutions in the market.

The IFE hardware segment is projected to grow significantly in the study period. Continuous innovations in hardware technology, such as lightweight displays and energy-efficient systems, are driving the demand for upgraded IFE hardware. These advancements enhance the passenger experience by providing high-quality audio and video content.

By IFE Hardware Analysis

Non-portable IFE Segment To Grow at Highest CAGR Owing to its Widespread Application in Commercial Aviation

By IFE Hardware, the market is classified into portable IFE system and non-portable IFE system.

The non-portable IFE system segment is projected to grow with the highest CAGR during the study period. Non-portable systems often provide more robust features compared to portable options, making them more efficient for commercial airlines. Moreover, the non-portable IFE segment will continue to dominate due to its reliability and extensive content offerings, which are crucial for long-haul flights. In June 2023, United Airlines signed a contract with Panasonic Avionics for the installation of the Astrova IFE system on its new Boeing 787 and Airbus A321XLR aircraft. The Astrova system will enhance passenger engagement with features, such as high-definition seatback screens, Bluetooth connectivity, and improved power outlets for devices.

Portable IFE system is anticipated to show significant growth during the forecast period. The trend toward BYOD allows passengers to use their personal devices for entertainment during flights. Portable IFE systems can support this trend by providing access to content on passengers' devices, enhancing user experience.

By IFE Connectivity Analysis

Satellite Connectivity Segment is Expected to Expand Significantly Due to the Demand for Reliable Internet Access During Flights

Based on the IFE connectivity, the market is divided into satellite connectivity and air to ground connectivity.

The satellite connectivity segment dominated the market share in 2023 and grew at a CAGR higher than other segments. The segment is projected to expand significantly due to the demand for reliable internet access during flights. In October 2024, Qatar Airways announced a partnership with Thales Group to implement advanced non-portable IFE systems across its fleet. This collaboration focuses on enhancing passenger experience through innovative entertainment solutions tailored for long-haul flights.

The air-to-ground connectivity segment is expected to grow as airlines look to enhance their service offerings and meet passenger demands for continuous connectivity during flights. Furthermore, advances in air-to-ground technology allow for faster data transmission rates and improved reliability. This is critical as passengers increasingly expect uninterrupted connectivity for streaming services and real-time communication.

By Installation Analysis

Increase in Maintenance and Retrofit Activities in Commercial Aircraft is Anticipated to Boost Retrofit Segment

Based on the installation, the market is divided into line fit and retrofit.

The retrofit segment is anticipated to dominate the market and grow at the highest CAGR during the forecast period. The retrofit segment is experiencing growth due to the increasing number of older aircraft being upgraded with modern IFE systems. This segment benefits from airlines looking to enhance passenger experiences without investing in new aircraft. In February 2024, Air India selected Thales to retrofit its Boeing 777 and 787 aircraft with the AVANT Up IFE system. This significant contract, valued at USD 400 million, aims to upgrade the IFE systems on 40 aircraft, enhancing passenger experience with features, such as a 4K QLED HDR display and improved connectivity options. The retrofit is expected to be completed by the end of 2025.

The line fit segment will grow significantly owing to the collaborations between airlines and Original Equipment Manufacturers (OEMs) facilitate the integration of advanced IFEC systems into new aircraft models, ensuring that airlines can offer modern entertainment experiences to enhance passenger experience.

By Satellite Band Analysis

Ka Band Segment is Anticipated to Dominate Owing to Ability to Provide High Bandwidth Compared to Traditional Satellite Band

Based on the satellite band, the market is divided into Ka-Band, Ku-Band, and others.

The Ka-band segment is projected to grow at the highest CAGR and dominate the market during the forecast period. Ka-band frequencies, ranging from 26.5 to 40 GHz, provide a much larger bandwidth compared to traditional Ku-band systems. This increased bandwidth allows for higher data transmission rates, enabling the delivery of high-speed internet and data-intensive services such as streaming video and real-time communications. As demand for high-speed connectivity continues to rise, Ka-band technology is well-positioned to meet these needs effectively.

The Ku-band segment is projected to be the second largest segment in satellite band. The expansion of Ku-Band satellite networks enhances coverage and capacity, supporting the increasing demand for in-flight internet services across various regions.

By End User Analysis

Increasing Demand for Upgrades in Commercial Airlines is a Major Factor for Aftermarket Segment Growth

Based on the end user, the market is divided into OEM and aftermarket.

The aftermarket segment is projected to dominate the market during the study period. As airlines strive to improve passenger satisfaction and remain competitive, there is a growing need to upgrade existing IFE systems with the latest technology. This includes enhancements in connectivity options, content offerings, and user interfaces. Airlines are increasingly looking to retrofit older aircraft with advanced IFE systems to meet modern passenger expectations. In May 2024, Emirates announced its plans to overhaul an additional 43 A380s and 28 Boeing 777 wide-body aircraft, further extending its renovation project to a total of 191 aircraft. The initial plan outlined the refurbishment of 120 aircraft, comprising 67 A380s and 53 777s.

The OEM segment is anticipated to show significant growth during the study period. As the global demand for air travel increases, OEMs have significant opportunities to expand their market share by providing innovative solutions that cater to evolving passenger expectations.

By Platform Analysis

Narrow Body Segment Boasts the Highest Market Share Due to the Global Increase in Aircraft Fleet Size

The market by platform is segmented into narrow body, wide body, business jets and regional jets. The wide body segment is expected to hold a 18.37% share in 2023.

The narrow body segment led the market in 2023. It is also forecasted to be the fastest-growing segment throughout the projected period. The expansion of this segment can be attributed to the rise in aircraft fleet size and growing demand for narrow-body aircraft. In July 2023, Ryanair explored new partnerships to enhance its narrow-body aircraft's IFE offerings, aiming to provide a better in-flight experience for passengers by integrating modern entertainment technologies into its existing fleet.

Wide body segment is forecasted to be the second fastest growing during the study period. Airlines operating wide-body fleets are investing in modernizing their IFEC systems to enhance passenger experience. In December 2024, Air India revealed major enhancements to its international route network beginning in 2025. These modifications will allow Air India to utilize its top aircraft at essential gateways in Southeast Asia and Europe, adding to the earlier introduction of its flagship A350 and B777 with improved cabin interiors, IFEC systems on several U.S. and UK routes.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global market regions are segmented as North America, Europe, Asia Pacific, and the Rest of the World.

North America In-Flight Entertainment & Connectivity Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market was valued at USD 2.61 billion in the fiscal year 2023 and is expected to dominate the in-flight entertainment and connectivity market share during the study period. The region has a strong demand for both business and leisure travel, increasing the need for advanced IFE systems that offer high-speed internet and diverse entertainment options. Significant investments in satellite technology and broadband infrastructure facilitate improved connectivity solutions for airlines. In March 2023, American Airlines announced a partnership with Viasat to enhance its in-flight Wi-Fi services using high-speed satellite connectivity. This contract aims to improve passenger experience on long-haul flights by providing reliable internet access.

The Asia Pacific in-flight entertainment and connectivity (IFEC) market share is projected to rise at a significant rate during the forecast period. Governments are investing heavily in aviation infrastructure, which supports the expansion of flight routes and frequencies, creating more opportunities for IFEC providers. The growth of low-cost carriers (LCCs) in this region is driving demand for cost-effective IFE solutions that can enhance passenger experience without significant capital expenditure. In February 2023, Sichuan Airlines announced a contract with Aerosat, which involves installing a new IFEC system connected to China's Ka-band satellite network. This initiative aims to improve connectivity for passengers traveling within China.

Europe accounted for the second-highest market share in the fiscal year 2023. European airlines are increasingly focusing on sustainability, prompting investments in lightweight IFE systems that reduce overall aircraft weight and improve fuel efficiency. In April 2023, Lufthansa announced a multi-year contract with Thales Group to enhance its digital services onboard by upgrading its IFE systems across its fleet. This upgrade includes improved content delivery platforms that deliver passengers with access to a wide range of entertainment options. In August 2023, British Airways announced a new agreement with IFE Services to provide a comprehensive suite of content for its IFE systems on short-haul flights. This contract includes access to a wide range of movies, TV shows, music, and games, enhancing the overall passenger experience on domestic routes.

The Rest of the World is anticipated to show moderate growth during the study period. Regions such as Latin America and Africa are witnessing an increase in air travel demand due to economic development, which drives investment in IFEC technologies. Regions such as Latin America and Africa are witnessing an increase in air travel demand due to economic development, which drives investment in IFEC technologies. In January 2023, Emirates Airlines signed a contract with Honeywell International Inc. to upgrade its IFE systems across its fleet. This upgrade aims to provide enhanced connectivity options and a broader range of entertainment content for passengers.

List of Key Companies in In-Flight Entertainment and Connectivity Market

Key Players in this Sector are Centering on Product Innovation to Meet the Evolving Demands of Passengers

The global in-flight entertainment & connectivity market is fragmented with key players such as Collins Aerospace Panasonic Avionics Corporation, Burrana Pty Ltd, Gogo LLC, Viasat, Inc., and others. The main focus of these key market players is on innovating and developing new IFEC technology. Moreover, the industry is moving toward hybrid IFEC systems that combine traditional embedded solutions with wireless options. This flexibility allows airlines to cater to diverse passenger needs while optimizing costs. Companies are leveraging data analytics to provide tailored content recommendations based on individual passenger preferences. This personalization enhances engagement and satisfaction during flights. In March 2023, American Airlines partnered with Viasat to enhance its in-flight Wi-Fi services using high-speed satellite connectivity, reflecting the airline's commitment to improving passenger experience through technology.

List of Key Companies Profiled:

- Astronics Corporation (U.S.)

- Burrana Pty Ltd (Australia)

- Collins Aerospace (U.S.)

- FDS Avionics Corp. (U.S.)

- Global Eagle Entertainment, Inc. (U.S.)

- Gogo LLC (U.S.)

- Honeywell International Inc (U.S.)

- Lufthansa Systems GmbH & Co. KG (Germany)

- Panasonic Avionics Corporation (U.S.)

- Safran (France)

- Sitaonair (Switzerland)

- SmartSky Networks, LLC (U.S.)

- Thales Group (France)

- Viasat, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

September 2024 – Air Canada announced a new inflight entertainment content agreement with Anuvu, which will significantly increase its content library to include over 1,000 movies and 3,500 TV episodes. This agreement aims to enhance the passenger experience by providing a broader range of entertainment options and more frequent updates to the content offered onboard.

September 2024– Delta Air Lines revealed plans to upgrade its IFE systems across its fleet by integrating high-definition displays and expanding content libraries. This move is part of Delta's strategy to enhance passenger engagement and satisfaction during flights.

July 2024– Panasonic Avionics Corporation, a globally renowned provider of in-flight engagement and connectivity solutions, inaugurated a new software design and development facility in Pune, India. The latest facility in India is exclusively focused on aiding the advancement and provision of IFEC solutions.

April 2024 – JetBlue Airways announced upgrades to its IFE systems, including the introduction of new content partnerships with streaming platforms. The airline aims to provide passengers with a more diverse range of entertainment options during flights

August 2022 – Bluebox Aviation Systems and Jetstar Group agreed to bring Bluebox's digital passenger experience, Blueview, to Jetstar's Airbus fleet. The contract covers the integration of Jetstar Entertainment on all Airbus aircraft belonging to Jetstar Airways and Jetstar Asia, with the option to extend to additional aircraft models within the Jetstar Group.

REPORT COVERAGE

The market report offers in-depth details about the market, highlighting top companies, diverse product types, and key product applications. Moreover, the report provides valuable insights into market trends, market segmentation, technological advancements, and the competitive landscape. It also delves into the demand for in-flight entertainment and connectivity while highlighting key industry developments.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 10.5% during the 2024-2032 |

|

Unit |

Value (USD Billion) |

|

|

By Type, IFE Hardware, IFE Connectivity, Installation, Satellite Band, End User, Platform |

|

Segmentation |

By Type

|

|

By IFE Hardware

|

|

|

By IFE Connectivity

|

|

|

By Installation

|

|

|

By Satellite Band

|

|

|

By End User

|

|

|

By Platform

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was valued at USD 7.92 billion in 2023 and is projected to reach USD 19.36 billion by 2032.

Registering a CAGR of 10.5%, the market will exhibit rapid growth during the forecast period.

Non-portable IFE System type segment will grow at a fastest growth rate during the forecast period.

Astronics Corporation (U.S.), Burrana Pty Ltd (Australia), FDS Avionics Corp. (U.S.), Global Eagle Entertainment, Inc. (U.S.), Collins Aerospace (U.S.), Gogo LLC (U.S.) are the leading IFE industries in the global market.

North America dominated the market in terms of share in 2023.

The U.S. dominated the market in 2023

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us