India Faulted Circuit Indicator Market Size, Share & Industry Analysis, By Type (Communicable and Non-Communicable), By Network (Overhead and Underground), By Application (Distribution Lines, Transmission Lines, and Substation), and Country Forecast, 2025-2032

India Faulted Circuit Indicator Market Size

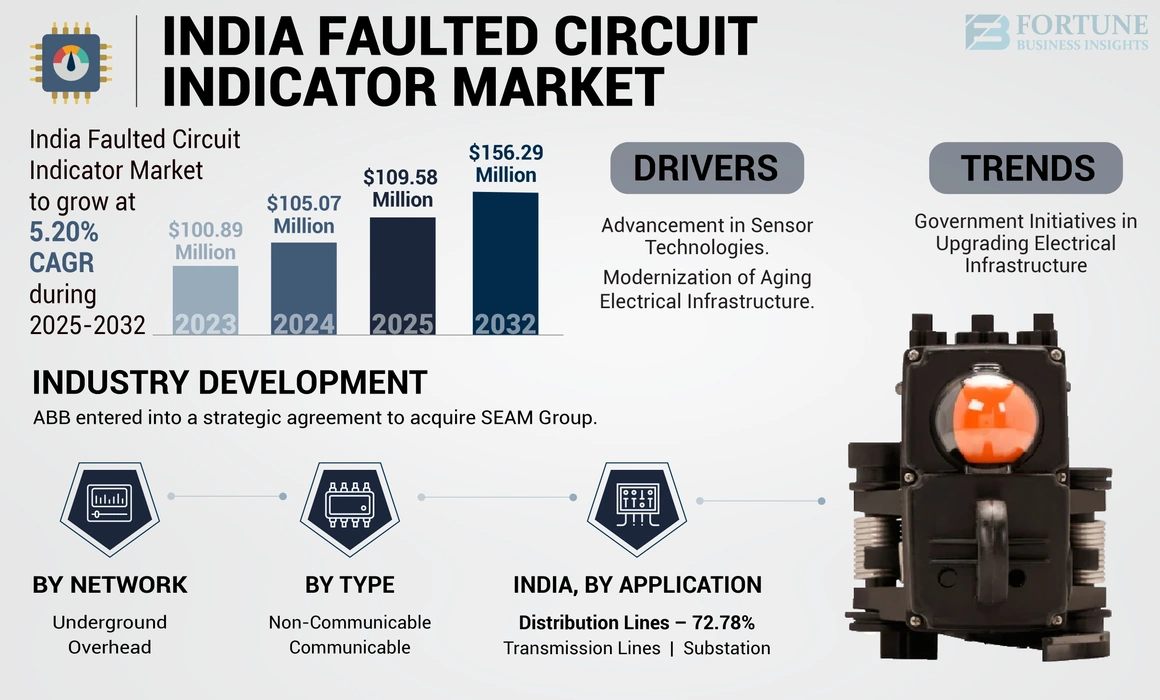

The India faulted circuit indicator market size was valued at USD 105.07 million in 2024. The market is projected to grow from USD 109.58 million in 2025 to USD 156.29 million by 2032, exhibiting a CAGR of 5.20% during the forecast period.

A Faulted Circuit Indicator (FCI), also known as Fault Passage Indicator (FPI), is a device used in electrical power systems to detect and indicate faults or disruptions in the circuit. It provides real-time notification of faults by sensing changes in current or voltage, supporting faster identification and location of electrical faults. Faulted circuits indicators enhance the reliability and efficiency of power distribution networks by facilitating prompt maintenance and reducing downtime. The rising demand for electricity in India, driven by urbanization, industrialization, and increasing population, has put a substantial focus on the power distribution infrastructure. In such a scenario, the need for a solid and resistant electrical grid is dominating. Faulted circuit indicators play a vital role in minimizing downtime and reducing the impact of faults by swiftly identifying the location of disruptions, allowing utilities to respond promptly.

When the pandemic hit, lockdown measures in India significantly reduced electricity demand in the industrial & commercial sectors. The COVID-19 pandemic impacted the industry primarily through a decline in demand, financial stress, and disruption to the energy supply chain. Increased unemployment due to the pandemic left many people unable to pay their utility bills. Delays and late payments by end consumers (private households, commercial and industrial) had a detrimental impact on the energy supply chain. Manufacturing and the supply chain were slowed down drastically, and thus, it had such a critical impact on the power sector that it eventually affected the Indian market.

India Faulted Circuit Indicator Market Trends

Government Initiatives and Investments in Upgrading Electrical Infrastructure are Expected to Create Opportunities for Market Growth

The Indian government unveiled action plans to overhaul its aging electricity infrastructure to meet growing demands for renewable energy. An investment of USD 200 billion has been invested in the power and renewable energy sector since 2014. Over 80 GW of thermal power generation is under construction and will be used by 2030, with over 99 GW of renewable energy generation projects under development. With the new Electricity (Amendment) Rules 2024, over USD 230 billion has been invested in power and renewable energy sectors. The investment includes USD 130 billion in sectors, such as generation, distribution, and transmission and USD 69 billion in renewable energy. This investment is increasing yearly and adding to the total power generation capacity, eventually driving the India faulted circuit indicator market.

Download Free sample to learn more about this report.

India Faulted Circuit Indicator Market Growth Factors

Advancement in Sensor Technologies to Drive Market Growth

Modern sensor technology is progressing now more than ever. There have been swift advancements in the type of sensor resources and their properties, such as the fabrication of Micro-Electro-Mechanical Systems (MEMS) sensors, piezoelectric materials, optical sensors made up of semiconductors, spectroscopy, and advanced nanotechnology. Novel algorithms & approaches have been combined to distinguish the sensor data & deduce system parameters using compound concepts of spectroscopy, electromagnetism, and optics, together with genetic algorithms, machine learning, and metaheuristic solutions.

Moreover, there has been development in normalizing power systems using IoT. Intelligent fault monitoring and normalization technologies in distribution systems by leveraging one of the popular cloud service platforms of (IoT) Hub, the Microsoft Azure Internet of Things, along with some associated services. The construction of a hardware prototype began based on part of a real underground distribution system, and the fault monitoring and normalization techniques were integrated into that system. Therefore, this upcoming progress in sensor technologies will drive India faulted circuit indicator market growth.

Modernization of Aging Electrical Infrastructure Pushes the Demand for Faulted Circuit Indicators

The electrical grid is an engineering marvel and the largest, most complex machine ever built, but aging systems designed to meet the needs of the 20th century must meet the needs of the 21st century. The shift toward renewable energy and the accelerated electrification of transport and economic activity require modernization of the grid and the systems that protect and control it.

By modernizing power grid protection and control systems, utilities can increase operational flexibility, improve reliability, and optimize their assets' lifespan and power quality. With modernized smart grid systems, utilities can reduce fault-related outages by inevitably isolating a faulted line segment & modifying the grid to reinstate service, integrate renewable energy sources, such as wind & solar, while upholding grid reliability, ensuring grid stability through wide-area transmission monitoring & control and defending and protecting against cyber-attacks, and improving protection of people, equipment, and the environment.

As power delivery systems evolve, so must the devices, methods, and schemes that protect those systems. Fundamental characteristics that have defined the power grid and associated protection schemes for the past century no longer hold in many cases, and operational expectations are increasing. DER, such as solar photovoltaics and wind generation, are being introduced to the system at an increasing rate. At the same time, technological advances, such as the incorporation of modern communication architecture, the development of advanced sensors, and the trend toward system-wide interoperability, provide many opportunities to modernize protection schemes to handle today’s added complexity.

RESTRAINING FACTORS

Lack of Awareness Regarding the Safety of Electrical Circuits is Hampering the Market

Faulted circuit indicators have an essential purpose, which should be brought to every individual’s attention as electrical incidents can be upsetting, and every associated injury causes suffering, some with life-changing effects. There is a lack of awareness regarding these indicators, which results in serious errors or accidents. Risk awareness is vital in preventing incidents. Workers can be asked to go beyond their limitations of competence if those involved do not understand the risk. It is essential to spread the awareness that fault indicators improve distribution circuit reliability, enhance the safety of line crews and the public, and reduce costs associated with power system downtime, equipment, and regulation.

Electrical distribution needs are evolving continuously in all sectors. With this increasing demand, the probability of electrical fires existing and damaging a significant amount of property has also increased. It has also become imperative to consider that the electrical installation in every building needs to be protected against fires caused by electricity. Electrical fire can be a silent killer in home areas hidden from view and early detection. Moreover, due to a lack of awareness, investments in safe and robust electric circuit protection devices often take a backseat in the residential and commercial sectors. Locating the exact location of the faulted circuit in a distribution system, which would ultimately send a signal to the relay to operate, is one of the critical features of the FCIs that most sectors are unaware of. Therefore, the absence of knowledge about the characteristics and features of faulted circuit indicators is hampering the Indian market growth.

India Faulted Circuit Indicator Market Segmentation Analysis

By Type Analysis

Rapid Adoption of Innovative Grid Technologies Boosts Communicable Segment Growth

By type, this market is segmented into communicable and non-communicable.

The communicable faulted circuit indicator type faulted circuit indicator is dominating the market. Communicable-type faulted circuit indicators are highly installed and equipped with communication capabilities, enabling real-time monitoring and remote access to fault information. These devices often form an integral part of innovative grid initiatives, allowing utilities to enhance grid management, optimize response times, and improve overall system reliability. The dominance of communicable type FCI is in line with India's increasing adoption of innovative grid technologies.

Non-communicable faulted circuit indicators are often active in traditional power distribution systems, where real-time communication and data analytics are not primary considerations. These systems may still benefit from fault detection capabilities but may lack the advanced features of smart grid integration.

By Network Analysis

Overhead Segment Leads the Market Owing to Its Cost-effectiveness

By network, the India faulted circuit indicator market is segmented into overhead and underground.

The overhead segment is dominant as India's power distribution infrastructure relies heavily on overhead networks consisting of power lines mounted on poles. This infrastructure is predominant in urban and rural areas, and the cost-effectiveness of overhead lines has contributed to their widespread deployment. The overhead segment has driven technological development in faulted indicators designed to address the specific challenges associated with overhead lines. This includes features, such as weather-resistant designs and advanced algorithms for fault identification in exposed environments.

The underground segment is second to dominate the market due to its installation in urban areas, where appealing concerns, space limitations, and reliability considerations drive the preference for underground cables.

By Application Analysis

Surging Need for Distribution Lines in Power Distribution Infrastructure Fuels Segment Growth

By application, this market is segmented into distribution lines, transmission lines, and substation.

The distribution lines segment is dominating the market. The distribution line application segment primarily includes the network that delivers electricity directly to end-users, such as residential, commercial, and industrial consumers. This extensive segment supplies the last-mile connectivity, representing a critical component of the power distribution infrastructure.

Transmission line applications in FCI are second in dominating the Indian market. India's transmission system has been continuously strengthened with the addition of transmission lines and an inter-regional capacity of 16,531 MVA with a 14,625 ckm transmission line installed in FY 2022-23, as transmission lines often traverse strategic corridors, connecting primary power generation sources to critical substations. Targeted investments may influence the secondary dominance of the transmission line segment in strengthening these corridors to ensure the efficient flow of electricity.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Key Market Players are Focusing on Product Development to Heighten Their Market Share

This market is highly fragmented, with many players delivering a wide range of products and services across the value chain. Numerous companies are actively operating in the country to meet the specific demands of the power industry for transmission and distribution. Companies are also focusing on product development technology, and collaborating with industry players, including network providers, system integrators, and end-users, allows companies to access new markets and enhance their India faulted circuit indicator market share.

List of Top India Faulted Circuit Indicator Companies:

- Schneider Electric (France)

- Siemens (Germany)

- ABB (Switzerland)

- Eaton (Ireland)

- C&S Electric Limited (India)

- Stelmec (India)

- Narayan Powertech Pvt. Ltd. (India)

- Elektrolites (India)

- Shyam Energy Solutions (India)

- Ravin Group (India)

- Surya Instruments & Control Engineers (India)

KEY INDUSTRY DEVELOPMENTS:

- February 2024- ABB announced that it has entered into a strategic agreement to acquire SEAM Group. The company is a key provider of energized asset management & advisory services to its clients across industrial & commercial building markets. The acquisition will boost ABB’s Electrification Service offering and bring additional expertise to customers in preventive, predictive, and corrective maintenance, renewables, electrical safety, and asset management advisory services.

- August 2023- Elektro-Mechanik EM GmbH launched an external blinking lamp-Type BL7, which provides directional fault indication. The direction indication is featured with two bright red & two bright green LEDs. It is well equipped with against environmental influences.

- June 2023- C&S Electric Ltd announced at the inaugural ceremony of the C&S Electric Sponsored Electronics, Electric, and Digital Skill Development Lab at ITI Sector 31, Noida. The lab marks a substantial stride toward technological brilliance, offering enormous opportunities for students interested in power systems, electronics, and digital technology. It is also equipped with state-of-the-art tools and resources.

- April 2023- Elektro-Mechanik EM GmbH (EMG) introduced a flexible directional fault indicator, Type SGI. This indicator is highly configurable & offers powerful algorithms to detect the fault in solidly earthed, resistance-earthed, isolated, and compensated networks. Four freely configurable relays installed in the indicators and the serial RS485 interface with Modbus protocol offer integration into SCADA systems.

- March 2023- ABB introduced a new product combo that extends fault protection with a digital solution. The company combines its proven Ultra-Fast Earthing Switch and Relion 615, 620 relay series, and digital REX 640 control relay. It is a low investment & also a simple upgrade for businesses for arc fault detection and for higher level of arc flash protection for equipment and pressure-sensitive buildings.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as major key players, product/service types, and leading applications of the product. Besides, the report offers insights into the competition landscape market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.20% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type, By Network, and By Application |

|

Segmentation |

By Type

|

|

By Network

|

|

|

By Application

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 105.07 million in 2024.

The market is likely to grow at a CAGR of 5.20% over the forecast period (2025-2032).

The distribution lines application segment leads the market.

Advancement in sensor technologies and modernization of aging electrical infrastructure are the key factors driving market growth.

Some of the top players in the market are Schneider Electric, Siemens, ABB, and Eaton.

Indias market size is expected to reach USD 156.29 million by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us