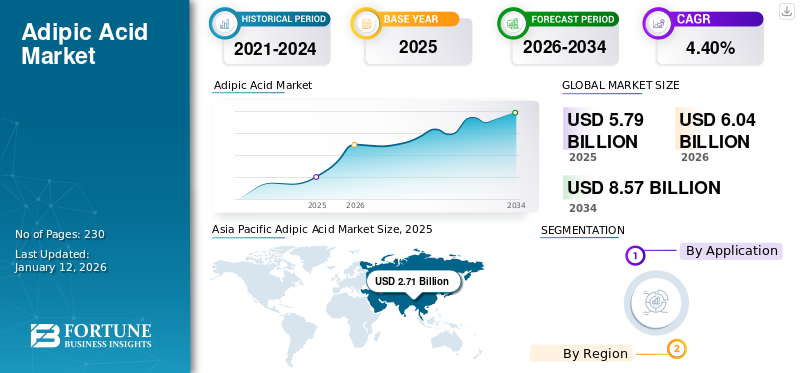

Adipic Acid Market Size, Share & Industry Analysis, By Application (Nylon 6,6 Fiber, Nylon 6,6 Resin, Polyurethane, Adipate Ester, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global adipic acid market size was valued at USD 5.79 billion in 2025. The market is projected to grow from USD 6.04 billion in 2026 to USD 8.57 billion by 2034, exhibiting a CAGR of 4.40% during the forecast period. Asia Pacific dominated the adipic acid market with a market share of 47% in 2025.

Adipic acid is a white, crystalline dicarboxylic acid with applications in several industries. It is primarily produced through the oxidation of cyclohexane or a mixture of cyclohexanol and cyclohexanone using nitric acid. The other production methods include biosynthesis from glucose using genetically modified yeast or bacteria and butadiene oxidation. A major application of the product is in the production of nylon 6,6, a versatile polymer used in textiles, carpets, and automotive parts. It is also used to produce polyurethane, plasticizers, lubricants, and food additives. Rapid urbanization and improved living standards in developing countries contribute to higher consumption of nylon-based products.

The COVID-19 pandemic significantly impacted the market. Initial lockdowns and supply chain disruptions led to reduced production and demand across end-use sectors, such as nylon, automotive, and textile. As manufacturing activities slowed globally, producers faced decreased demand and temporarily reduced their plant capacity. However, as the global economy started to recover, the market experienced a gradual rebound, with demand increasing in line with the automotive and construction sector revivals.

GLOBAL ADIPIC ACID MARKET LANDSCAPE OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 5.79 billion

- 2026 Market Size: USD 6.04 billion

- 2034 Forecast Market Size: USD 8.57 billion

- CAGR: 4.40% from 2026–2034

Market Share:

- Asia Pacific led the global adipic acid market in 2025 with a share of 47%, supported by rising industrial output and strong demand for nylon and polyurethane products.

- By application, nylon 6,6 fiber dominated the market in 2024 owing to its widespread use in automotive, textile, and industrial applications. The nylon 6,6 resin segment is expected to hold a 31.1% share in 2024.

- Polyurethane is also a key segment due to its growing demand in construction, furniture, and appliance insulation. The use of adipate esters in plasticizers has seen a surge, especially in flexible PVC for cables, flooring, and medical equipment.

Key Country Highlights:

- China: Industrial expansion and robust manufacturing activity continue to drive demand, with the nylon 6,6 resin segment estimated to hold a 31.2% market share in 2024.

- India: Rapid industrialization and growing textile and automotive industries fuel consumption of adipic acid in multiple end-use sectors.

- United States: Strong automotive sector and nylon applications in airbags and engine components support market demand; sustainability efforts are influencing shifts toward bio-based alternatives.

- Germany: Sustainability initiatives and R&D into green adipic acid production are reshaping the market landscape and promoting eco-friendly materials.

- Brazil: Textile and apparel sector growth, along with export competitiveness, is driving nylon-based product demand, boosting adipic acid consumption.

- Saudi Arabia: Investments in downstream petrochemicals and plastics manufacturing under economic diversification efforts are expanding the regional market.

Adipic Acid Market Trends

Rising Usage of Polyurethane in Different Applications to Create Market Growth Opportunities

Adipic acid is a crucial raw material in the synthesis of polyurethane resins, which are versatile polymers with a wide range of applications. Polyurethanes are used to manufacture flexible and rigid foams, coatings, adhesives, sealants, and elastomers. These materials find extensive use in various industries, including construction, automotive, furniture, and electronics. For instance, flexible polyurethane is widely used in mattresses, furniture, and automotive seating, while rigid foams are essential for building and appliance insulation. Polyurethane coatings provide durable and protective finishes for various surfaces, from automotive exteriors to industrial floors. The growing demand for energy-efficient buildings, comfortable automobile interiors, and durable consumer goods will continue to drive the demand for polyurethane, subsequently creating new growth opportunities. Asia Pacific witnessed an adipic acid market growth from USD 2.44 billion in 2023 to USD 2.58 billion in 2024.

Download Free sample to learn more about this report.

Adipic Acid Market Growth Factors

Increasing Adoption of Nylon 6,6 in Various Industries to Drive Market Growth

Nylon production is the primary driver for the market, with nylon 6,6 manufacturing accounting for the majority of adipic acid consumption. Nylon 6,6 is a versatile synthetic polymer known for its strength, durability, and heat resistance, making it ideal for various applications across multiple industries. The automotive industry is a significant consumer, using nylon 6,6 in engine components, fuel systems, and engine parts due to its ability to withstand high temperatures and chemical exposure. In the textile industry, nylon 6,6 is widely used in apparel, sportswear, and high-performance fabrics and valued for its elasticity and quick-drying properties. The carpet industry also relies heavily on this type of nylon for its durability and stain resistance. Additionally, it finds applications in electrical and electronic components, industrial machinery, and consumer goods. As these end-use industries expand, particularly in emerging markets, the demand for nylon 6,6 is expected to rise, simultaneously driving the adipic acid market growth.

RESTRAINING FACTORS

Rising Environmental Concerns Regarding Greenhouse Gas Emissions to Restrict Market Growth

Environmental concerns pose a significant challenge to the product demand due to the production process’ substantial greenhouse gas emissions, particularly nitrous oxide. Nitrous oxide is a potent greenhouse gas with a global warming potential of around 273 times carbon dioxide. Traditional adipic acid manufacturing methods can release large quantities of nitrous oxide as a byproduct, contributing to climate change. This environmental impact has increased scrutiny from regulators, environmental groups, and consumers. As a result, there is growing pressure on manufacturers to adopt cleaner production technologies or seek more sustainable alternatives. These environmental concerns may limit demand for conventionally produced adipic acid, especially in regions with strict environmental regulations or strong sustainability initiatives, hampering market growth.

Adipic Acid Market Segmentation Analysis

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Nylon 6,6 Fiber Leads Owing to its Increased Adoption in Industrial Applications

On the basis of application, the market is segmented into nylon 6,6 fiber, nylon 6,6 resin, polyurethane, adipate ester, and others.

The nylon 6,6 fiber application is poised to account for 55.46% of the market in 2026. The automotive and aerospace industries use nylon 6,6 fibers in airbags, seat belts, and tire cords due to their high strength-to-weight ratio and durability. A rising trend of lightweight, fuel-efficient vehicles is expected to create demand for nylon 6,6 fiber, driving the segment growth. In addition, these fibers are used in industrial applications, such as ropes, nets, and conveyor belts. The increasing industrial and manufacturing activities across the globe will indirectly fuel product demand in the industrial sector. The nylon 6, 6 resin segment is expected to hold a 31.1% share in 2024.

The adipate ester segment accounts for a substantial market share. Adipate esters are primarily used as plasticizers in flexible PVC products, such as cables, hoses, flooring, and medical devices. The growing construction sector, along with the high demand for durable and flexible materials, is driving the consumption of adipate esters significantly.

REGIONAL INSIGHTS

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Adipic Acid Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounted for the largest share of the global market in 2025. The region is a major consumer of adipic acid, primarily due to rapid industrialization in China and India. Industrialization has led to an increase in manufacturing activities across various sectors. The region serves as a global manufacturing hub, benefiting from lower production costs, skilled labor, and supportive government policies that encourage industrial development. This manufacturing capability will fuel the product demand as a key raw material in the production of nylon 6,6 and engineering plastics. In addition, the expanding textile and apparel industries in China, India, Vietnam, and Bangladesh have increased the demand for nylon fibers, further driving product consumption. The Japan market is projected to reach USD 0.35 billion by 2026, the China market is projected to reach USD 1.4 billion by 2026, and the India market is projected to reach USD 0.51 billion by 2026.

- In China, the nylon 6, 6 resin segment is estimated to hold a 31.2% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, the product demand is primarily driven by its extensive use in the automotive sector for manufacturing airbag fabrics and other components. The region’s robust automotive sector and strong presence of industries requiring nylon 6,6 for various applications support the consistent demand for adipic acid. The focus on sustainable materials and stringent environmental regulations further influence market dynamics, encouraging innovation in product manufacturing and applications. The U.S. market is projected to reach USD 1.16 billion by 2026.

Europe

Europe’s market is expected to be driven by its push toward sustainability, with countries implementing stringent regulations and initiatives to reduce the environmental impact of carbon emissions and promote recycling. This has increased research and development in bio-based acid production methods. While traditional petroleum-based products still dominate the market, there is a growing trend of using bio-based alternatives. This shift is reshaping the market in Europe, with manufacturers investing in sustainable production technologies. This, in turn, is benefiting the market’s outlook. The UK market is projected to reach USD 0.25 billion by 2026, while the Germany market is projected to reach USD 0.31 billion by 2026.

The market in Latin America is driven by the rising product demand from textile and apparel industries, particularly in countries, such as Brazil and Mexico. The region has been witnessing growth in its fashion industry, with both domestic consumption and exports on the rise. This type of acid is a key component in the production of nylon fibers used in clothing and other textile products. As the region’s countries position themselves as competitive textile manufacturers at the global level, the demand for their products is expected to rise, driving market growth.

The expanding plastics industry in the Middle Eastern region, particularly in GCC countries, is expected to drive market growth as these countries are seeking to diversify their economies beyond oil and gas. There has been significant investment in downstream petrochemical industries. This acid is used in the production of various plastics and synthetic fibers. The growing manufacturing sector in the region, coupled with increasing local demand for consumer goods, is expected to fuel the product adoption in the plastic industry.

KEY INDUSTRY PLAYERS

Market Players to Develop Eco-Friendly Production Methods to Gain Competitive Edge

The market is consolidated and dominated by well-established players, such as BASF SE, Ascend Performance Materials, INVISTA, LANXESS, and Solvay. These major players are competing on factors including product quality, pricing, technological innovation, vertical integration, and improving geographical presence. Their key strategies are focusing on optimizing production efficiency, developing eco-friendly methods, and maintaining strong positions in the value chain.

List of Top Adipic Acid Companies:

- Ascend Performance Materials (U.S.)

- BASF SE (Germany)

- Domo Chemicals (Belgium)

- INVISTA (U.S.)

- LANXESS (Germany)

- Liaoyang Tianhua Chemical Co., Ltd. (China)

- Radici Partecipazioni S.p.A (Italy)

- Solvay (Belgium)

- Tangshan Zhonghao Chemical Co., Ltd. (China)

- Tokyo Chemical Industry Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2024 – Ascend Performance Materials started the operation of a new thermal reduction unit at its Pensacola, Florida site. The company claimed that this move will eliminate around 98% of the greenhouse gas emissions associated with adipic acid production at this facility. The move was part of the company’s 2030 vision initiative that focuses on producing chemicals sustainably.

- March 2024 – The two manufacturing sites of BASF in South Korea received an International Sustainability & Carbon Certification (ISCC)+ certification. This included certification for the entire value chain that creates a low product carbon footprint of adipic acid and polyamide.

- January 2020 – DOMO Chemicals announced that it had completed the acquisition of Solvay’s performance polyamides business in Europe. As a part of the deal, the company would also establish a joint venture with BASF in France to produce adipic acid. The move was part of the company’s strategic plan to strengthen its nylon-based engineering materials business.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on crucial aspects, such as leading companies, applications, and products. It also offers insights into key trends and highlights vital industry developments. In addition, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

CAGR |

CAGR of 4.40% during 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 5.79 billion in 2025 and is projected to reach USD 8.57 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.71 billion.

The market will register a CAGR of 4.40% during the forecast period of 2025-2032.

By application, the nylon 6,6 fiber segment led the market in 2025 .

Rising adoption of nylon 6,6 in different industries will drive the market growth.

Asia Pacific held the largest share of the market in 2025.

BASF SE, Ascend Performance Materials, INVISTA, LANXESS, and Solvay are the leading players in the market.

Rising usage of polyurethane in different applications is driving the product’s adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us