Plastics Market Size, Share & Industry Analysis, By Type (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Polyamide, Polycarbonate, Polyurethane, Polystyrene, and Others), By End-use Industry (Packaging, Automotive & Transportation, Infrastructure & Construction, Consumer Goods/Lifestyle, Healthcare & Pharmaceutical, Electrical & Electronics, Textile, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

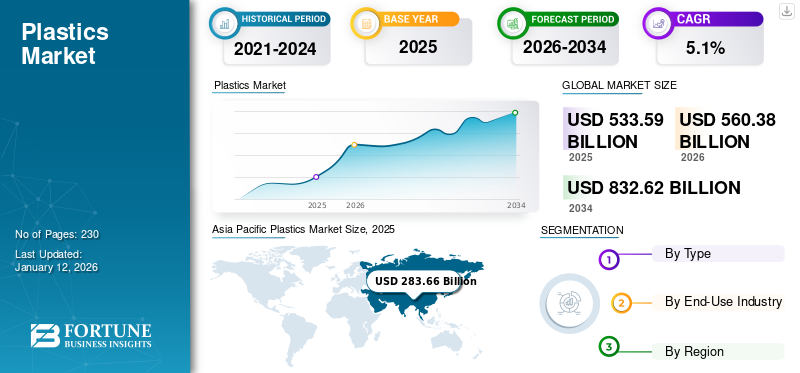

The global plastics market size was valued at USD 533.59 billion in 2025 and is projected to grow from USD 560.38 billion in 2026 to USD 832.62 billion by 2034, exhibiting a CAGR of 5.1% during the forecast period. Asia Pacific dominated the plastics market with a market share of 53% in 2025. Moreover, the U.S. plastics market is projected to reach USD 93.43 billion by 2032, fueled by rising applications in packaging, automotive, and consumer goods.

Plastics are polymers that are used in several industries, such as automotive, packaging, healthcare, construction, and consumer goods, due to their versatility, easy manufacturing, moldability, lightweight, waterproof nature, and low cost. They are traditionally derived from petroleum and natural gas. The depleting sources of polymers have encouraged manufacturers to use renewable sources. The plastics manufactured using renewable biomass sources, such as corn starch, vegetable oil, food waste, and sawdust, are called bioplastics. The rising demand for biodegradable and sustainable polymers on account of rising environmental concerns and consumer preference for eco-friendly products is expected to influence the demand for bioplastics. Many companies are investing in research and development to produce bio-based polymers from renewable sources such as sugarcane and corn starch, aiming to reduce carbon footprints.

Moreover, rising innovations in polymer science for developing high-performance plastics that should be durable and lightweight would expand their applications in the automotive and aerospace industries. The major operating companies in the market include LyondellBasell, ExxonMobil Chemical, INEOS, and SABIC.

Global Plastics Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 533.59 billion

- 2026 Market Size: USD 560.38 billion

- 2034 Forecast Market Size: USD 832.62 billion

- CAGR: 5.1% from 2026–2034

Market Share:

- Asia Pacific dominated the plastics market with a 53% share in 2025, driven by rapid urbanization, industrialization, and growing demand in packaging, construction, and consumer goods across China, India, and Southeast Asia.

- By type, polyethylene is expected to retain the largest market share in 2025, supported by its durability, moisture resistance, and widespread use in packaging applications.

Key Country Highlights:

- United States: Projected to reach USD 93.43 billion by 2032, driven by high demand in packaging, automotive, and healthcare sectors, along with advancements in recycled plastics and sustainability practices.

- China: Remains the leading producer and consumer due to abundant raw materials, low-cost manufacturing, and strong demand across packaging, construction, and consumer goods industries.

- Germany: Growth is supported by automotive sector demand for lightweight components, along with high adoption of engineering plastics in electrical and electronics applications.

- India: Rising middle class, expanding construction sector, and increasing use of plastics in textiles and consumer goods are driving significant market expansion.

MARKET TRENDS

Increasing Demand for Engineering Plastics Due to their Properties to Favor Market Growth

Engineering plastics being more robust and durable than regular ones have increased product demand. They provide better thermal and mechanical properties and are lightweight and cost-effective. The rising need for greater polymer solutions for different end-use industries, such as componentry, machinery, and construction, supports the market expansion. Moreover, the rising demand for metal substitution increasingly leads to broader usage of engineering polymers in various industries. These materials offer more decisive benefits over metal structures in automotive engineering, construction, solar, and water industries. As per DSM, several global OEMs are replacing metal parts with engineered plastic components and materials. For instance, the crankshaft covers for Volkswagen earlier, made from aluminum, are now made from polymers. This resulted in about 40% weight reduction of the part. Asia Pacific witnessed a growth from USD 280.30 billion in 2023 to USD 277.16 billion in 2024.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand from Packaging Industry to Drive Product Consumption

Plastic demand is advancing in widespread industries, such as food & beverage, consumer goods, automotive, and electrical & electronics. The increasing need for packaging from the food & beverage industry drives product consumption globally. Food manufacturers prefer packaging that minimizes food quality degradation and avoids contamination. The ability of plastics to act as a hurdle between food products and the external environment is fueling the demand.

Besides, the ability of polymers to defend against physical stress and offer high durability is increasing their usage in sports goods, fashion wear, toy-making, and polymer clay. Moreover, they are easy to mold and offer flexibility to produce packaging in any size and shape. Their utility is surging in the textile industry due to their high durability, elasticity, and enhanced visual appeal. Moreover, polymers are rigid, making them suitable for packing automotive and electrical spare parts. Thus, the increasing application across food & beverage, electrical & electronics, textile, automobile, and consumer goods industries is augmenting the plastics market growth.

Rise in Demand for Electric Vehicles to Drive Market Growth

The hike in the price of fossil-based fuels such as petroleum and diesel has created a demand for alternative energy sources in the automotive industry. Therefore, automotive manufacturers have developed electric energy-based vehicles that deliver nearly the same output as traditional vehicles. These EVs can provide great efficiency owing to the utilization of advanced plastic materials and high-power electric motors. The product consumption makes the vehicle lighter, faster, and energy efficient. On the other side, the emerging trend of EVs resolves the greenhouse gas and additional toxic gas emissions in nature. Therefore, the governments of different countries are providing subsidiaries for Hybrid Electric Vehicles (HEVs) and EV holders. These factors lead to an escalating product consumption in the automotive industry.

MARKET RESTRAINTS

Stringent Regulation on Single Use Plastic to Restrain Market Growth

Regulations over product usage are likely to affect market growth. Stringent government regulations and other policies have come into the picture due to the growing concerns over the damage caused by polymers to the environment. Many governments are imposing stringent environmental regulations and policies with the aim of reducing plastic waste and adopting single use plastics, thereby compelling several manufacturers to adopt sustainable practices. For example, the UN Environment Program (UNEP) started a Clean Seas campaign in 2017 in more than 50 countries. It appeals to the government to enforce plastic reduction policies and encourage industries to minimize polymer-based packaging and change their products. Many countries, including India, have also committed to removing single-use polymers. Therefore, this shift necessitates significant investments in recycling technologies and the development of eco-friendly materials and acts as a restraining factor for global market growth.

TRADE PROTECTIONISM

Trade protectionism related to the market involves measures such as restricting imports or exports of plastic waste, banning single-use plastics, and using ecolabels to impact plastic trade, aiming to tackle the global plastic pollution crisis. China's Anti-Dumping Duties: In January 2025, China imposed provisional anti-dumping duties ranging from 3.8% to 74.9% on industrial plastics imports from the U.S., European Union, Japan, and Taiwan. This move aims to protect domestic industries from foreign competition. On the other hand, the U.S. has implemented tariffs on various imports, including polymers, as part of broader trade protection measures. These policies affect global trade dynamics and influence the market strategies of multinational corporations.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

In the wake of the COVID-19 pandemic, the product demand from the automotive and building & construction industries declined substantially. This drop was associated with decreased manufacturing activities in these industries and lockdown restrictions imposed globally. Additionally, a significant drop in crude oil prices due to the decline in demand and lower storage capacity for oversupply reduced the market expansion. On the contrary, the demand for the production of Personal Protective Equipment (PPE), such as face masks, goggles, shields, gloves, respirators, gowns, and coveralls, from the medical industry propelled the market. For instance, according to the National Health Service trust in Lincolnshire, England, about 2.3 billion PPE products were distributed to health and social care personnel in England between February and July 2020.

SEGMENTATION ANALYSIS

By Type

Polyethylene Type Led Market Due to its Increasing Adoption in Packaging Products

Based on type, the market is segmented into polyethylene, polyethylene terephthalate, polyvinyl chloride, polypropylene, polyamide, acrylonitrile butadiene styrene, polycarbonate, polyurethane, polystyrene, and others.

Amongst these, polyethylene is the majority type due to its augmented demand from application areas such as packaging and automotive. Several manufacturers use this polymer for packaging their products due to their durability and act as a barrier to protect the product from moisture. The segment dominated the market share by 23.3% in 2024.

Further, the polypropylene (PP) type is anticipated to grow rapidly with a share of 2.32% in 2026 owing to increasing demand from automotive industry. The usage of PP in the automotive industry is increasing as manufacturers are reducing the vehicle's weight to increase efficiency and minimize carbon emissions.

Polyvinyl Chloride (PVC) is mainly used in producing pipes & fittings owing to its numerous advantageous properties such as electric insulation, high elasticity modulus, thermal insulation, and chemical resistance. The construction industry uses PVC products, such as frames, doors, and windows, with their longer life cycle, enhanced looks, and easy availability of material.

Polyethylene Terephthalate (PET) is used on a large scale for applications such as bottling and packaging. It observed high demand for packaging in food & beverage industry as it is lightweight, non-toxic, strong, and easily recycled. Due to its strong and flexible nature, PET material is also used for 3D printing.

Polyamide is majorly used in industries such as textile and others, owing to its solid and flexible properties. It exhibits good elasticity, high tensile strength, and is wrinkle-proof. These benefits make it suitable for clothes, mats, and other products.

Polyurethane, in foam form, is observed in high demand in the furniture and automotive industries.

Polycarbonate is mainly used for electrical & electronics applications due to its high electrical insulation properties.

Acrylonitrile Butadiene Styrene (ABS) is a rigid and sturdy polymer that provides resistance to chemicals. Hence, it is used in camera bodies, housing appliances, packing crates, and luggage.

Polystyrene has exhibited high demand from electronics and packaging industries owing to its insulating and cushioning properties.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Rising demand from Various Industries to Boost Packaging Segment Revenue

In terms of end-use industry, the market is segmented into automotive & transportation, packaging, consumer goods/lifestyle, infrastructure & construction, healthcare & pharmaceutical, electrical & electronics, textile, and others.

The packaging segment will hold the highest plastics market share by 45.51% in 2026 and grow at the highest CAGR during the forecast period. This growth is driven by the rising demand for rigid and flexible packaging solutions in the personal care, food and beverage, and pharmaceutical industries. The growth is attributed to the durability, versatility, and cost-effectiveness of plastics, which make them preferable for various packaging applications.

In the automotive & transportation segment, plastics are extensively utilized to reduce vehicle weight, enhance design flexibility, and improve fuel efficiency. The major applications include interior and exterior components such as bumpers, dashboards, and fuel tanks.

Growing product demand from applications such as household items, toys, and sports equipment, benefiting from their lightweight and versatile properties, would surge the market growth in the consumer goods/lifestyle segment.

In the construction industry, polymer is mainly used in insulation, piping, windows, and flooring. This is due to its corrosion resistance, durability, and ease of installation characteristics. In electrical & electronics, polymer is used in insulators and structural components in various electronic devices and appliances, contributing to safety and performance. In healthcare & pharmaceutical, the product is utilized in the production of disposables, medical devices, and packaging, ensuring sterility and compliance with health standards.

- Infrastructure & construction will likely to grow at a CAGR of 14.2% during the forecast period.

PLASTICS MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Plastics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share, accounting for USD 300.38 billion in 2026. In 2025, the market value led the region by USD 283.66 billion. The growth is attributed to rapid urbanization, industrialization, and a growing middle class in countries such as China and India, thereby driving demand across construction and packaging industries. In this region, China is anticipated to remain the leading country in the region due to the abundant availability of raw materials at low rates. This further minimizes the hurdles involved in plastic production. The growth in Asia Pacific is also attributed to the strong growth in the packaging and construction industries. Additionally, rising demand from the consumer goods industry for manufacturing toys, textiles, and sports goods is expected to drive the market in the region. The market value in China is expected to be USD 141.79 billion in 2026.

On the other hand, India is projecting to hit USD 29.73 billion and Japan is likely to hold USD 32.96 billion in 2026.

North America

North America region is to be anticipated the third-largest market with USD 92.29 billion in 2026. In North America, the U.S. held the largest market share, driven by increased demand from the automotive, packaging, and healthcare industries. Moreover, the increasing focus on sustainable practices and technological advancements by the government has increased the adoption of recycled plastics in the region. The U.S. market size is expected to stand at USD 88.06 billion in 2026.

Europe

Europe is anticipated to account for the second-highest market size of USD 107.05 billion in 2026, exhibiting the second-fastest growing CAGR of 3.7% during the forecast period. Europe is anticipated to have substantial growth in this market, owing to the rising demand from the region's automotive sector. Additionally, properties, including excellent heat resistance, corrosion inhibition, electric insulation, and low density, support the adoption of polymers in Europe. The market value in U.K. is expected to be USD 11.13 billion in 2026.

On the other hand, Germany is projecting to hit USD 38.08 billion in 2026 and France is likely to hold USD 13.58 billion in 2025.

Latin America and the Middle East & Africa

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 27.42 billion in 2026. The key factor influencing the growth in the Middle East & Africa is the growing demand from the textile and packaging industries. The surging demand for lightweight packaging and the use of polymers over metal and glass are set to boost the regional market. Furthermore, Latin America is projected to grow due to rising urbanization and the growing number of companies specializing in industrial packaging solutions. Saudi Arabia is projected to hit USD 6.61 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players to Strengthen Position Offering Innovative Solutions to Packaging Industry

Most of the major companies in the market have a global presence. The major companies include LyondellBasell Industries N.V., BASF SE, and others such as Dow Inc., DuPont de Nemours, Inc., Evonik Industries AG, Sumitomo Chemical Co., Ltd., Arkema, Celanese Corporation, Eastman Chemical Company, and Chevron Phillips Chemical Co., LLC. These companies have a global presence, broad product portfolio, and manufacturing plants, and they offer technological innovation, product quality, and sustainability initiatives. For instance, LyondellBasell is involved in refining activities and produces several chemicals and polymer-based products. The company has established its presence worldwide by using production capacity expansion and acquisition strategies. It is also keeping up with the latest trends in this market to serve its consumer base efficiently. For instance, in May 2021, the company announced that it would produce virgin quality polymers from raw materials derived from plastic trash at its plant in Wesseling, Germany.

LIST OF KEY PLASTICS COMPANIES PROFILED

- LyondellBasell Industries N.V. (Netherlands)

- ExxonMobil Chemical (U.S.)

- China National Petroleum Corporation (China)

- INEOS (U.K.)

- China Petroleum & Chemical Corporation (China)

- SABIC (Saudi Arabia)

- Ducor Petrochemicals (Netherlands)

- Reliance Industries Limited (India)

- Formosa Plastic Group (Taiwan)

- Total S.A. (France)

- Braskem (Brazil)

- BASF SE (Germany)

- Repsol (Spain)

- Borouge (UAE)

- Borealis AG (Austria)

- MOL Group (Hungary)

- Beaulieu International Group (Belgium)

KEY INDUSTRY DEVELOPMENTS

- November 2023 – LyondellBasell announced plans to set up an advanced recycling plant in Germany. The plant is expected to recycle 50,000 tons of plastic per year. The construction will be completed by 2050 and will maximize the company’s revenue in the plastic segment in the upcoming years.

- July 2023- TotalEnergies struck a partnership with a Plastic Energy company for the recycling of plastic. Under the deal, TotalEnergies would offer the TACOIL plastic product made in Plastic Energy’s Spain-based plant. This partnership for the recycling activity is expected to provide more than 15,000 tons of recycled plastic waste per year.

- May 2023: TotalEnergies acquired Iber Resinas to expand its plastic recycling activity in Europe. The company aims to establish the key presence of circular polymers in Europe, increase its recycled product offerings, and extend its access to raw materials through Iber Resinas’s suppliers.

- April 2023: LyondellBasell announced that its renewable CirculenRenew polymer will be utilized in the medical device industry. The offered bio plastic grade is certified by ISCC PLUS and delivers a certificate of mass balance to adopt the bio-based raw materials into final products.

- April 2022: ExxonMobil launched Exceed S, a Performance Polyethylene (PE) resin that provides toughness and stiffness and is easy to process. The new PE will aid the company in offering lucrative opportunities to decrease the complexity of film designs and formulations while improving conversion efficiency, packaging durability, and film performance from its competitors.

- February 2022: Borouge started its fifth polypropylene facility (PP5) in Ruwais, UAE. This expansion will help the company to serve infrastructure, recyclable advanced packaging, and other industrial sectors by increasing polypropylene production.

- February 2021: ExxonMobil completed the initial phase plant trial of a patented advanced recycling process in Texas, U.S. This process will be used for converting plastic waste to raw materials for producing polymers. This development indicates the company’s efforts to reduce plastic waste from the environment and increase resource recovery.

REPORT COVERAGE

The report offers an in-depth industry analysis and highlights key factors such as leading players, types, and end-use industry. Also, it offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, it encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global plastics market size was valued at USD 533.59 billion in 2025 and is projected to grow from USD 560.38 billion in 2026 to USD 832.62 billion by 2034, exhibiting a CAGR of 5.1% during the forecast period.

The plastics market is primarily driven by rising demand from the packaging industry, the growing use of plastics in electric vehicles, and increased applications in construction, healthcare, and consumer goods. Plastics versatility, lightweight nature, and cost-effectiveness make them indispensable across multiple industries.

Registering a CAGR of 5.1%, the market will exhibit rapid growth during the forecast period.

Asia Pacific dominated the global plastics market in 2025, accounting for 53% of the global market share. This is attributed to rapid industrialization, urbanization, and high demand from packaging and construction sectors in countries like China and India.

Key plastic types include Polyethylene, Polypropylene, Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polystyrene, Polycarbonate, Polyamide, Acrylonitrile Butadiene Styrene (ABS), and Polyurethane. Among them, Polyethylene leads due to its extensive use in packaging.

To address sustainability and environmental concerns, the industry is increasingly investing in bioplastics made from renewable sources like corn starch and sugarcane. Companies are also developing advanced recycling technologies and adopting circular economy practices to reduce carbon footprints.

Plastics help make EVs lighter, more energy-efficient, and cost-effective. High-performance plastics are used in vehicle interiors, exteriors, and battery components. With rising EV adoption and government subsidies, plastic demand in the automotive sector is accelerating.

The plastics market faces significant restraints from stringent regulations on single-use plastics, environmental concerns, and trade protectionism policies. Many countries are implementing bans and restrictions that require manufacturers to shift towards eco-friendly alternatives.

Major players include LyondellBasell Industries, ExxonMobil Chemical, SABIC, INEOS, BASF SE, Dow Inc., TotalEnergies, Braskem, Reliance Industries, and China National Petroleum Corporation. These companies focus on innovation, recycling, and capacity expansion to maintain competitiveness.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us