Home / Aerospace & Defense / Aviation / Aerospace 3D Printing Market

Aerospace 3D Printing Market Size, Share, Growth & Industry Analysis, By Vertical (Printers, Materials), By Industry (UAVs, Aircraft, and Spacecraft), By Application (Engine Components, Space Components, and Structural Components), By Printer Technology (Direct Metal Laser Sintering (DMLS), Fused Deposition Modeling (FDM), Continuous Liquid Interface Production (CLIP), Stereolithography (SLA), Selective Laser Sintering (SLS), and Others), and Regional Forecast, 2024-2032

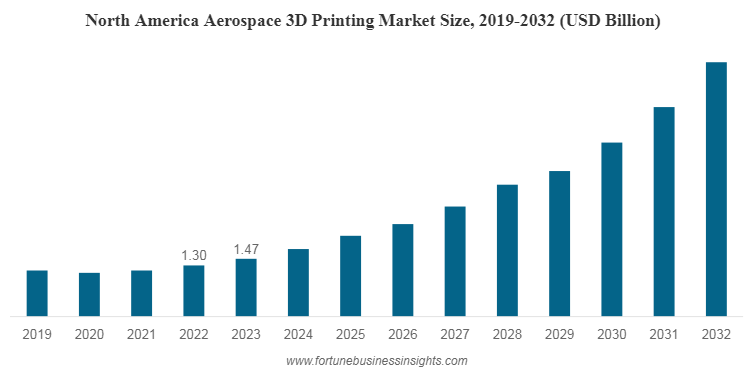

Report Format: PDF | Latest Update: Feb, 2025 | Published Date: Jun, 2024 | Report ID: FBI101613 | Status : PublishedThe global aerospace 3D printing market size was valued at USD 3.33 billion in 2023 and is projected to grow from USD 3.89 billion in 2024 to USD 14.55 billion by 2032, exhibiting a CAGR of 17.95% during the forecast period. North America dominated the aerospace 3d printing market with a market share of 38.14% in 2023.

The global impact of COVID-19 has been unprecedented and staggering, with aerospace 3D printing experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our analysis, the global exhibited a decline of 6.29% in 2020 as compared to 2019.

3D printing or additive manufacturing is a process of making three-dimensional solid objects from a digital file. The creation of a 3D-printed object is achieved using additive processes. In an additive process, an object is created by laying down successive layers of material until the object is created. Each of these layers can be seen as a thinly sliced cross-section of the object. 3D printing enables the production of complex shapes using less material than conventional manufacturing methods.

Due to advancements in 3D printing technology, the current trend is to find solutions through 3D printing for real-world applications in aerospace and space manufacturing. The airline and aerospace industries have been among the first to embrace additive manufacturing (AM) for research and development in production; however, the space sector is speeding up 3D printing adoption. Moreover, technological advancement has helped create complex, customized, and one-of-a-kind parts, or even entire rocket engines; the space sector is paving the way for the future of 3D type of printing beyond Earth.

To combat the COVID-19 impact, a number of industry participants, notably Stratasys, from the additive manufacturing sector offered to create medical equipment for hospitals. The majority of Stratasys' clients are in the industrial sector. Businesses in industries including aircraft and automotive had difficulty operating because of the COVID-19 epidemic. The client base struggled and was unable to ratchet up the financial commitment even as businesses discovered creative uses for 3D printing.

Aerospace 3D Printing Market Trends

Increase in Demand for Lightweight Components Triggers Innovations

Weight is a crucial factor in reducing the environmental impact of flying. By reducing the weight of an aircraft, 3D printed parts help reduce its air drag, which then reduces fuel consumption. At a given speed, aircraft weight will increase drag because the wing must then generate sufficient lift. However, the most significant impact weight has is at cruising altitude. The heavier the aircraft’s weight is, the lower its cruising altitude will be because of the air density required for lift. The greater the air density, the more impact draft will have. This then results in more fuel consumption. Carbon fiber materials and shape memory alloys can reduce the weight of aircraft while enabling greater efficiency in construction.

Material made from 3D printing technology has the ability to operate within extreme temperature. As a result, airlines have chosen to expedite the retirement of older aircraft to save money and are currently aiming to replace them with newer generation aircraft that are lighter and more fuel efficient. Several aerospace manufacturers are funding large-scale research programs to improve the utilization of 3D-printed parts and components in future aircraft. Furthermore, satellites with lower physical weight are given higher priority in space missions since their weight has a direct impact on component production costs. Many key players such as NASA and other government organizations are focused on investing in 3D technology for space exploration programs.

For instance, in January 2022, Fleet Space Technologies, an Australia-based nanosatellite communications technologies and ultra-efficient satellite networks provider, unveiled the development of a completely 3D printed satellite. The Alpha satellite group is expected to set in the Centauri constellation.

Aerospace 3D Printing Market Growth Factors

Increase in Use for Composite Materials Results in Increasing Demand for 3D Printing

Composites are versatile, used for structural applications and components, in all aircraft and spacecraft, from hot air balloon gondolas and gliders to passenger airliners, fighter planes and the Space Shuttle. Applications range from complete airplanes such as the Beech Starship to wing assemblies, helicopter rotor blades, propellers, seats and instrument enclosures, ensuring a significant reduction in overall weight and improved performance. Hence, the use of composite materials has also been a factor in the rise in demand for 3D printed parts.

Growing Demand for 3D Printed Components in Space Is a Major Factor Promoting Use of 3D Printers

3D printing could revolutionize space exploration by helping astronauts create objects in space and on-demand replacement parts for repairs, custom equipment for scientific experiments, and even things such as food or buildings. While space is an extreme environment with very few exploitable raw materials, there is plenty of dust floating around. 3D printing technology can build solid structures from aggregated dust and microscopic particles. The European Space Agency (ESA) is considering 3D printing their base on the moon, creating greater opportunities for the growth of 3D type of printing.

RESTRAINING FACTORS

Excessive Cost of Parts and Limited Materials Available for Use in 3D Printing Limited Growth

3D Printing has its different advantages in manufacturing, but the available raw materials for 3D printing are limited. This is due to the fact that not all metals or plastics can be temperature-controlled enough to allow 3D printing. In addition, many of these printable materials cannot be recycled and very few are safe.

Post Processing of 3D Printed Parts Is a Time Consuming Process, Which Could Hamper Market Growth

Although large parts require post-processing, most 3D printed parts need some form of cleaning up to remove support material from the build and to smooth the surface to achieve the required finish. Post-processing methods used include water jetting, sanding, a chemical soak and rinse, air or heat drying, assembly and others. While 3D printing allows for the fast production of parts, the speed of manufacture can be slowed by post-processing. Reduced manufacturing speed can have a negative effect on the supply chain, thus delaying product deliveries.

Aerospace 3D Printing Market Segmentation Analysis

By Vertical Analysis

Increase in Investment in Technology Seen to be a Major Factor to Drive the Market

Based on vertical type, the global market classified into printers and materials.

Among the Verticals, the printers dominated the global aerospace 3D printer market in 2023. The printer segment accounted for the highest market share in 2023.

The material segment accounted for the highest CAGR due to the growing demand for high strength-to-weight ratio materials. The growth is due to the increase in the number of advanced materials in the aviation industry. This has propelled the growth of the material segment during the forecast period.

Furthermore, the material segment is anticipated to grow due to the increase in demand for materials possessing a high strength-to-weight ratio for this type of printing technology.

By Industry Analysis

Development in Aerospace 3D Printing to Aid the Space Segment During 2024-2032

By industry, the segment is divided into UAVs, spacecraft and aircraft segment.

Among the Industry, the aircraft segment dominated the global aerospace 3D printer market in 2023. The segment is anticipated to grow at a higher CAGR during the forecast period. The increase in aircraft deliveries and requirement for 3D printed parts are expected to boost the growth of the aircraft segment during 2024-2032.

The spacecraft segment is expected to exhibit the fastest CAGR during the forecast period, due to the rise in the demand for 3D printed components in space application.

The UAVs segment is anticipated to grow significantly during the forecast period. The increase in the growth of the segment is due to rise in investments by key players and space industry in Asia Pacific.

By Application Analysis

Heightened Demand for 3D Printing in Engine Components to Propel the Segment Growth

By application, the market is divided into engine components, space components and structural components.

Among the application segment, the space components segment dominated the global market in 2023. The segment accounted for the highest market share in 2023. The growth is owing to the increasing number of aerospace 3D printer deliveries for space components across the globe and the rise in small-scale companies.

The engine components segment is also anticipated to witness significant growth. The lightweight equipment for engine components is supporting the growth of the engine segment during the forecast period.

In case of the structural components, the growth in the segment is due to the increase in demand for 3D printing in the design and development of complex aerospace parts and replacement parts at a low cost in the commercial, aerospace and military aviation sector is anticipated to account for the larger market share by 2023.

New 3D printers and new 3D printing materials are appearing on the market, allowing to manufacture impressive projects. Metal 3D printing is becoming accurate, which has proven to be a real game-changer for many industries. Instead of components, it is possible to print larger parts efficiently.

3D printing materials are developed each year, making the future of 3D printing promising. 3D printed spare parts have been used to solve maintenance issues. Recently, NASA has 3D printed engine combustor. Printer manufacturers are also developing large-scale 3D printers.

By Printer Technology Analysis

The Increasing Demand for use of FDM and SLS Technology to Propel the Segment Growth in the Base Year

Based on printer technology, market is segmented into Direct Metal Laser Sintering (DMLS), Fused Deposition Modeling (FDM), Continuous Liquid Interface Production (CLIP), Stereolithography (SLA), Selective Laser Sintering (SLS), and Others.

Among the printer technology, the fused deposition modeling (FDM) segment dominated the global aerospace 3D printer market in 2023. The segment accounted for a significant market share in 2023. The FDM is increasingly adopted in the aerospace sector to build concept models created in the early stages of product development. FDM models save money and time during development. Moreover, FDM provides end-use parts robust enough for integration into the final product without the cost or lead-time of traditional tooling or machining.

The direct metal laser sintering (DMLS) segment is anticipated to grow with the highest CAGR. The increase in demand for DMLS to make complex geometry structures and the properties such as light-weighted, corrosion-resistant the segment is expected to grow during the forecast period.

Stereolithography (SLA) accounted for a significant market share in 2023. The segment is attributed to grow at a significant growth rate during the forecast period. SLA is an essential additive manufacturing process in which an object is created by selectively curing a polymer resin material using an ultraviolet (UV) laser beam.

REGIONAL INSIGHTS

Global aerospace 3D printer market is divided into regions: North America, Europe, Asia Pacific and the Rest of the World.

North America accounted for the highest market share in 2023. At present, the adoption of Aerospace 3D Printer in North America is preliminarily driven by the growing demand for aircraft and space exploration programs. Rising Demand for light weight components for Modern Aircraft to Boost Segmental Growth in North America. North America is expected to maintain the largest share of the market in 3D printing in aerospace. The market's forecasted growth can be attributed to increasing investment in 3D printing technology in the region, a larger manufacturing base for aerospace components and presence of key industrial players are expected to drive the growth in this region.

Asia Pacific is anticipated to grow with the highest CAGR during the forecast period. Adoption of aerospace 3D Printer in China, India, and Japan, is likely to drive the Asia Pacific. This is due to the increasing use of 3D printers for small component manufacturing of space and aircraft systems.

Europe accounted for a significant market share in 2023. The launch of new technologies and the rise in investment by European government in the development of aircraft programs are expected to drive the market in the region.

KEY INDUSTRY PLAYERS

Key Players Focus on Innovation and Advancements to Reinforce Market Position

The market is dominated by some key manufacturers such as 3D Systems, Stratasys, Materialise NV, Relativity Space, Ultimaker BV, among others. The wide range of product portfolios, good relations with aircraft manufacturers and airline operators, and significant investment in R&D for aerospace 3D printing advancements activities are strategies increasingly adopted by major companies to expand their aerospace 3D printing market share.

List of Top Aerospace 3D Printing Companies:

- 3D Systems (U.S.)

- Stratasys (Israel)

- Materialise (Belgium)

- EOS GmbH (Germany)

- General Electric Company (U.S.)

- CleanGreen3D (Mcor Technologies Limited) (U.S.)

- Ultimaker BV (Netherlands)

- Proto Labs, Inc. (U.S.)

- Relativity Space (U.S.)

- The ExOne Company (U.S.)

- Voxeljet AG (Germany)

- Velo 3D (U.S.)

- SLM Solutions Group AG (Germany)

- EnvisionTEC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2022- Materialise, a global leader in 3D printing solutions introduced CO-AM, an open software platform to manage the additive manufacturing (AM) production process more efficiently. CO-AM will give manufacturers cloud-based access to a full range of software tools that allow them to plan, manage and optimize every stage of their AM operations. With CO‑AM, with this, Materialise has addressed the untapped potential to use AM for serial manufacturing and mass personalization.

- May 2022- Sratasys subsidiary MakerBot and 3D printer manufacturer Ultimaker announced a merger that will see the creation of a new desktop 3D printing company. The merged company will look to provide a comprehensive ‘ecosystem’ of hardware, software and materials for the desktop 3D printing market to an expanded global customer base.

- May 2022- 3D Systems announced that aerospace manufacturer Airbus has contracted it to produce “critical components” of the satellite OneSat by Airbus. 3D Systems will now deploy its DMP Factory 500 platform to serially produce parts of its antenna arrays for the satellite.

- March 2022- Stratasys Ltd. (NASDAQ: SSYS), a leader in polymer 3D printing solutions, today announced that it is providing the public with baseline material qualification data for Antero 840CN03 filament material in collaboration with Lockheed Martin (NYSE: LMT) and Metropolitan State University of Denver. The release of this qualification data allows those in the industry to use the material for additively manufactured aerospace parts, such as those on the Orion spacecraft, using Stratasys production-grade 3D printers.

- September 2021- 3D Systems has signed an agreement to acquire software startup Oqton, a global SaaS company founded by manufacturing and artificial intelligence experts in 2017 that offers an agnostic, intelligent, cloud-based Manufacturing Operating System (MOS) platform that automates the end-to-end workflow. By acquiring Oqton and its unique AI-enabled MOS solution, 3D Systems hopes to speed AM adoption in production environments, as the system can help automate digital manufacturing for reduced costs and more efficiency on the factory floor.

REPORT COVERAGE

The global aerospace 3D printing market report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2023 |

Estimated Year |

2024 |

Forecast Period |

2024-2032 |

Historical Period |

2019-2022 |

Growth Rate |

CAGR of 17.95% from 2024 to 2032 |

Unit |

Value (USD Billion) |

Segmentation

|

By Vertical

|

By Industry

|

|

By Application

|

|

By Printer Technology

|

|

By Geography

|

Frequently Asked Questions

How much is the aerospace 3D printing market worth?

Fortune Business Insights says that the global market size was USD 3.33 billion in 2023 and is projected to reach USD 14.55 billion by 2032.

At what CAGR is the aerospace 3D printing market projected to grow over the forecast period (2024-2032)?

The market is projected to exhibit a CAGR of 17.95% during the forecast period.

Which is the leading segment in the market?

Space segment is the leading segment in the market.

Who are the leading players in the market?

3D Systems, Stratasys, Materialise NV, Relativity Space, Ultimaker BV and others.

Which region held the highest share in the market?

North America dominated the market in terms of share in 2023.

- Global

- 2023

- 2019-2022

- 200