Agriculture Drone Market Size, Share & Industry Analysis, By Offering (Hardware and Software & Services), By Components (Frames, Control Systems, Propulsion System, Navigation System, Camera Systems, and Others), By Payload Capacity (Lightweight Drones (Upto 10 kg), Medium Weight Drones (Upto 10 - 25 Kg), and Heavy Weight Drones (Above 25 kg)), By Application (Monitoring and Mapping, Precision Farming, Irrigation Management, Crop Health Assessment, Planting and Sowing, and Data Collection and Analysis), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

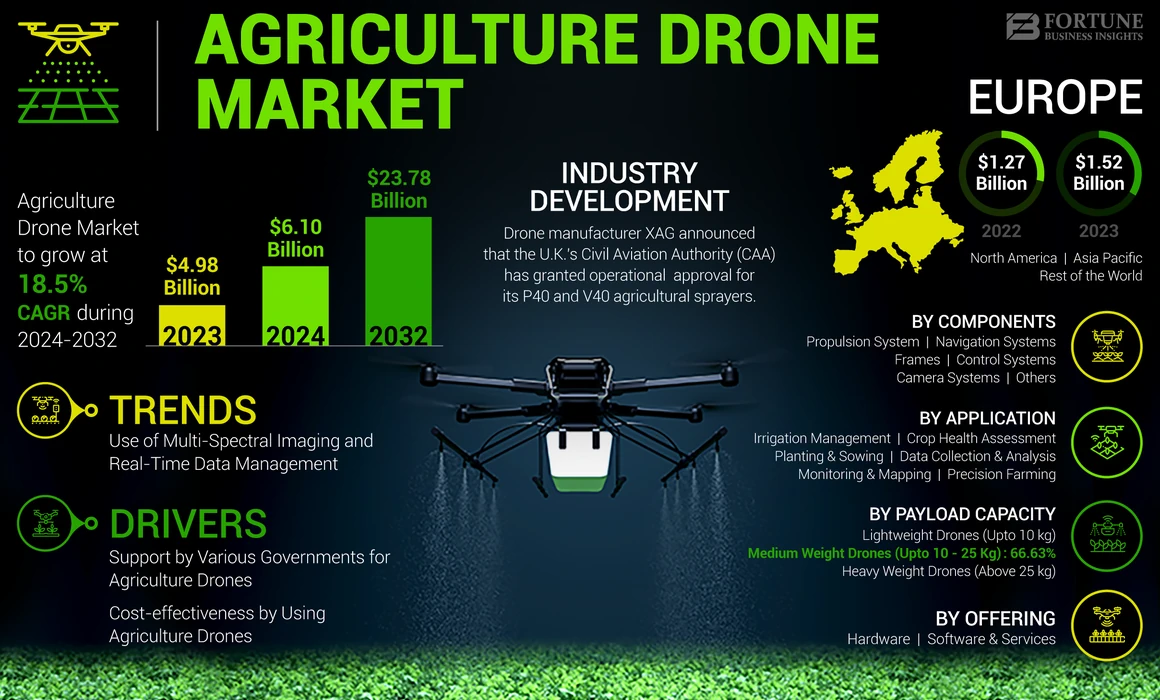

The global agriculture drone market size was valued at USD 4.98 billion in 2023. The market is projected to grow from USD 6.10 billion in 2024 to USD 23.78 billion by 2032, exhibiting a CAGR of 18.5% during the forecast period. Europe dominated the agriculture drone market with a market share of 30.52% in 2023.

Agriculture drones are Unmanned Aerial Vehicles (UAVs) that are designed for the use in farming and agricultural applications. These drones are equipped with a range of sensors and imaging technologies, such as cameras, LiDAR, and multispectral sensors, which allows them to gather data on crops, soil, and other factors that affect agricultural production.

The global market is driven by a range of factors, including the growing demand for precision agriculture, advances in drone technology, cost-effectiveness, government support, and growing awareness and education. Furthermore, the data generated by UAVs can be used for a wide range of purposes, including crop monitoring, mapping, and analysis as well as plant counting, irrigation management, and pest control.

The COVID-19 pandemic had spread at an alarming rate in more than 200 countries around the world. Since the outbreak, coronavirus has infected millions of people and caused thousands of deaths. For several months, labor shortages due to the pandemic prevented the smooth operation of supply chains, leading to reduced revenues and decreased productivity. These factors had increased the need for agricultural robots, machines, drones, and automated equipment.

- In April 2020, Spain became the first European country to deploy agriculture drone amidst COVID-19 pandemic. The Spanish military emergency unit has introduced UAVs to spray disinfectant for large outdoor areas. Owing to such factors, the COVID-19 pandemic had a positive impact on market growth. The growing need for automatic fertilizer sprayers, planters, and small drones for planting is projected to further support the growth of the market.

GLOBAL AGRICULTURE DRONE MARKET OVERVIEW

Market Size & Forecast:

- 2023 Market Size: USD 4.98 billion

- 2024 Market Size: USD 6.10 billion

- 2032 Forecast Market Size: USD 23.78 billion

- CAGR: 18.5% from 2024–2032

Market Share:

- Europe dominated the agriculture drone market with a 30.52% share in 2023, driven by strong R&D capabilities, increased funding, and a surge in agri-tech startups such as Delair and Gamaya.

- By offering, the hardware segment is expected to dominate due to enhanced capability to collect and process large volumes of agricultural data.

- By payload capacity, medium-weight drones (10–25 kg) lead the market owing to their broad application in crop monitoring, spraying, and sowing.

- By application, monitoring & mapping remains the dominant segment, enabling farmers to detect crop stress and field variability using multispectral and real-time imaging data.

Key Country Highlights:

- United States: Growth is supported by grants from the U.S. Department of Agriculture and FAA for drone research and training, along with regulatory relaxations under Part 107 for UAVs.

- China: A major agriculture drone innovator and exporter; companies like DJI are expanding into global markets with advanced models such as Agras T50 and T25.

- France: Home to startups like Parrot and Delair, France is pushing UAV innovation in precision farming through government-backed R&D incentives.

- United Arab Emirates: First in the Middle East to adopt drones for food security and environmental monitoring, establishing tech-driven agricultural transformation.

Agriculture Drone Market Trends

Use of Multi-Spectral Imaging and Real-Time Data Management is a Prominent Market Trend

Multi-spectral imaging technology is being used in drones in farms to capture data across different wavelengths of light. This can help farmers to identify crop health issues that are not visible to the naked eye such as nutrient deficiencies or water health. Owing to various benefits of multi-spectral imaging various key players are focused in development of new products. Europe witnessed agriculture drone market growth from USD 1.27 Billion in 2022 to USD 1.52 Billion in 2023.

- For instance, in November 2022, DJI agriculture launched Mavic 3 Multispectral drones. The aim of the launch is to enhance drone capabilities along with increasing the productivity tool to individuals and organizations in precision agriculture around the world.

Furthermore, drones are being used to provide real-time data on crop health and productivity. This data can be used to make immediate decisions about irrigation, fertilization, and pest control, which can help to optimize crop yields and reduce waste. Additionally, various research organizations and universities around the world are actively focused on improving the capabilities of drones in agriculture. In August 2022, at South Dakota State University, drones were incorporated into a variety of research activities. Maitiniyazi Maimaitijiang, an assistant professor in the Department of Geography and Geospatial Sciences, has been working in conjunction with other faculty members to conduct drone-related research over the last few years, specifically in relation to early diagnosis of crop water stress, nutrient deficiency, crop health and diseases—major threats to food security and crop yield estimations.

Download Free sample to learn more about this report.

Agriculture Drone Market Growth Factors

Rising Support by Various Governments for Agriculture Drones to Propel Market Expansion

Governments around globally are increasingly supporting the adoption of agriculture drones through various policies and initiatives. The support of governments includes R&D grants, tax incentives, subsidies, training and education, regulatory frameworks, and others. In April 2022, the U.S. Department of Agriculture National Institute for Food and Agriculture received a grant for USD 1 million for the development of innovation in digital agriculture. Additionally, in April 2022, the U.S. Department of Transportation’s Federal Aviation Administration (FAA) announced a grant of USD 4.4 million for the purpose of drone research, education, and training to seven universities. The seven universities that have received the grants are University of North Dakota, University of Kansas, Drexel University, the Ohio State University, Embry-Riddle Aeronautical University, Mississippi State University, and Oregon State University.

Overall, government support for drones is helping to drive the adoption and development of this technology. By providing financial and regulatory support, governments are helping to make UAVs on farms more accessible to farmers, while also ensuring that they are used in a safe and responsible way.

Improved Cost-effectiveness by Using Agriculture Drones to Catalyze the Market Growth

Agriculture drones can provide farmers with accurate and timely data on crop health and productivity, which can help to optimize farming operations, reduce waste, and increase yields. This can help to reduce costs associated with over-fertilization, over-watering, and other inputs, while also increasing crop yields. Agriculture drones can help to save labor costs by reducing the need for manual intervention in farming operations. For example, drones can be used for crop monitoring, mapping, and analysis.

Furthermore, these drones can help to save time by providing real-time data on crop health and productivity. This can help farmers to make immediate decisions about irrigation, fertilization, and others. Overall, drones can be a cost-effective solution for farmers looking to optimize their operations and increase crop yields.

RESTRAINING FACTORS

Data Overload and Data Collection Error will Hinder Market Expansion

Data overload is a situation that occurs when an individual or organization has access to more data than they can effectively manage. This happens while using drones in farming, as these drones are capable of collecting large amounts of data on crop health, soil moisture levels, and others. Furthermore, the amount of data collected by drones can become overloaded, and make it difficult for the farmers to make sense of the information or use it effectively to make decisions. This can be challenging especially to small farmers who may not have the resource or expertise to manage and analyze large amounts of data.

Another factor affecting the market growth is the inaccuracies in the data collected by a drone. These errors can occur for a variety of reasons such as hardware or software malfunctions, environmental factors, weather conditions or human error. In particular, environmental factors are a major concern for inaccuracy in data collection. For instance, strong winds or rain can cause the drone to fly off course, resulting in incomplete and inaccurate data. Similarly, changes in lighting conditions can affect the quality of data in the form of images by the drone. Such factors are a major issue in the agriculture drone market growth.

Agriculture Drone Market Segmentation Analysis

By Offering Analysis

Hardware Segment to Dominate Owing to Increase in the Ability to Collect and Process Data on Various Applications

The market, by offering is bifurcated into hardware and software & services.

Hardware segment is anticipated to dominate the market and be the fastest growing segment during the forecast period. The key reason for the growth in the segment is the improved capability of the hardware components to collect, gather, and process the data and enable farmers to make more informed decisions about crop management.

The software & services system plays a significant role in providing accurate and real-time information. The software components collect, process, and analyze the data collected by the drone’s hardware.

By Components Analysis

Frames Segment to Dominate the Market Owing to Increased Need of Robust Frame Structures

The market by components is segmented into frames, control systems, propulsion system, navigation system, camera systems, and others.

The frames segment is anticipated to dominate the market during the forecast period and is also expected to be the fastest growing segment. The significance of the frames lies in its ability to support the drone’s hardware components and provide a stable platform for data collection. Owing to the need for a robust frame, various key players are focused on producing non-breakable frames.

Control systems segment is projected to be the second largest segment during the forecast period. Control system is a critical hardware component responsible for receiving and processing commands from the operators. Owing to the significance of its application, the segment is projected to grow during the study period.

The propulsion system segment is projected to witness significant growth during the study period. The growth in the segment is owing to several key factors such as generating lift and thrust, maneuvering, flight control, and others.

By Payload Capacity Analysis

Medium Weight Drones (Upto 10 - 25 Kg) Segment Dominates the Market Owing to the Wide Application Area in Agricultural Sector

The market by payload capacity is segmented into lightweight drones (Upto 10 kg), medium weight drones (Upto 10 - 25 Kg), and heavy weight drones (Above 25 kg).

Medium-weight drones (10-25 Kg) are positioned to dominate the market as they combine operational efficiency with advanced technological features, making them essential tools for modern farming practices. The medium weight drones (Upto 10 - 25 Kg) segment is expected to hold a 66.63% share in 2023.

The segment of heavy-weight drones (10-25 kg) is set to become one of the fastest-growing segments within the agricultural drone market. This growth is underpinned by technological advancements, government initiatives supporting precision agriculture, and increasing global food demand. As farmers seek more efficient methods to enhance productivity and sustainability, the role of heavy-weight drones will likely expand significantly in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Monitoring & Mapping Segment Dominates Owing to its Wide Usage to Identify Problem Areas in the Farm

Based on the application, the market is segmented into monitoring and mapping, precision farming, irrigation management, crop health assessment, planting and sowing, and data collection and analysis.

The monitoring & mapping segment held the largest share in 2023 and is expected to remain dominant during the forecast period. This is due to improved high-tech camera equipment to monitor crops that can analyze field conditions through software systems that generate large amounts of data.

The agricultural drone market is poised for significant growth, primarily fueled by advancements in precision farming technologies. As farmers increasingly adopt these tools to enhance productivity and sustainability, it is expected to become a critical component of modern agricultural practices. With ongoing technological innovations and supportive regulatory frameworks, the future looks promising for agricultural drones as they play a pivotal role in transforming how farming is conducted globally.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, and the Rest of the World.

Europe Agriculture Drone Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in Europe held the largest market share in the base year. This region's growth is due to a combination of factors such as demand for drones in agriculture, strong research and development capabilities, increase in funding, and others. Additionally, there is an increase in a number of start-ups such as Delair, Gamaya, Accelerated Dynamics, and others in the region who are focused on developing solutions and software promoting the agriculture UAV market in the region.

North America held the second largest market share in 2023. The market in North America was valued at USD 1.46 billion in 2023. The growth in the region is owing to various government initiatives and investments. For instance, the Department of Transportation (DOT) and Federal Aviation Administration (FAA) have introduced favorable regulations to support commercial and small unmanned aerial systems by eliminating the pilot license requirement.

For instance, in September 2023, according to the filings at FCC U.S. (Federal Communications Commission) two new agricultural drones have initiated registry provided by Chinese pioneer company in drone making, DJI Drones. The company has also completed the registration paperwork to bring two new Agras- agriculture drones, T50 and T25, to the U.S. market.

Asia Pacific is the fastest growing region during the forecast period. The Asia Pacific market is expected to show healthy growth owing to high agricultural production and global exports of agricultural products. Large agricultural countries such as China, India, Indonesia, and other Asian countries are expected to boost the demand for UAVs for agriculture. Moreover, market players in the region are investing heavily in product development, which will boost the demand for agricultural UAV services during the forecast period.

The rest of the world is anticipated to witness moderate growth in the market during the forecast period. The growth in the Middle East & Africa is owing to increasing investments in the agricultural drone market.

- In September 2020, with the introduction of drones into agriculture in the United Arab Emirates, the region stood as first in the world to integrate technology into food security and environmental protection, according to Falcon Eye Drones Services, a leading drone service in the Middle East & Africa.

KEY INDUSTRY PLAYERS

Increase in Advancing Capabilities is the Key Focus of Leading Players

The agricultural drone market is fragmented due to the presence of major players in this region. Currently, the market players are Drone Deploy, DJI, GoPro, Precision Hawk, and AeroVironment Inc., which accounted for the dominant share in 2023. Lack of entry barriers is expected to increase the number of domestic players entering the global market. Other major players such as Trimble Navigation Ltd. and 3D Robotics provide end-to-end hardware and software solutions for drones to a global customer base. These companies are also involved in new product development and innovation. The launch of innovative products such as AGRAS MG-1, eBee SQ, and DJI Phantom-4 Pro has increased brand value. New product development, strategic acquisitions, and collaborations with domestic companies are some of the key strategies adopted by key players in this market.

List of Top Agriculture Drone Companies:

- Drone Deploy (U.S.)

- DJI (China)

- Precision Hawk Inc (U.S.)

- AeroVironment Inc. (U.S.)

- Trimble Navigation Ltd. (U.S.)

- 3D Robotics (U.S.)

- Ag Eagle (U.S.)

- Parrot Drone (France)

- Sintera LLC (U.S.)

- Delair Tech SAS (France)

KEY INDUSTRY DEVELOPMENTS

- March 2023 – Avikus and Korea Shipbuilding & Offshore Engineering, a subsidiary of Hyundai, entered into a contract to carry out an experiment on fuel efficiency by implementing self-governing navigation systems. The venture incorporates five firms, POS SM, Pan Ocean, Korea Shipbuilding & Offshore Engineering, Korean Register of Shipping, and Avikus.

- February 2023 – XAG, a smart agricultural technology company, partnered with FarmInno, to bring fully autonomous agricultural drones to Thailand. This cooperation will lead to the launch of fully autonomous agricultural drones with intelligent control systems.

- January 2023 – Drone manufacturer XAG announced that the U.K.'s Civil Aviation Authority (CAA) has granted operational approval for its P40 and V40 agricultural sprayers. This is the first-time drone spreading and spraying has been legalized on the U.K. farms.

- August 2022 – Agrigold initiated the trials of spraying vet fungicides through drones to test multiple nutrients and fungicides at a time on field. These drones will provide a viable option for saturated and small sized frames compared to ground rigs.

- November 2021 – Agricultural robotics and AI pioneer XAG is preparing to launch its V40 and P40 agricultural drones globally, bringing digital agriculture to rural areas with aging populations and weak infrastructure. The XAG V40 and P40 are fully autonomous drones capable of mapping, spraying, and farm broadcasting.

REPORT COVERAGE

The agriculture drone market research report provides a detailed market analysis. It comprises all major aspects, such as R&D capabilities, supply chain management, competitive landscape, and optimization of the manufacturing capabilities and operating services. Moreover, the report offers insights into the market trends analysis, market size, growth of the UAVs, and primarily highlights key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the global market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 18.5% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Offering

|

|

By Components

|

|

|

By Payload Capacity

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global agriculture drone market size was valued at USD 4.98 billion in 2023 and is projected to reach USD 23.78 billion by 2032, growing at a CAGR of 18.5% during the forecast period.

The market is likely to grow at a CAGR of 18.5% over the forecast period.

Agriculture drones are used for monitoring crops, precision farming, irrigation management, spraying fertilizers, and analyzing crop health. They help improve yield by providing real-time data, mapping, and aerial insights for better decision-making.

The agriculture drone market is driven by multi-spectral imaging, real-time data management, and increasing integration of AI and machine learning to analyze crop data. Companies like DJI and XAG are pioneering innovations with drones like Mavic 3 Multispectral.

Europe held the largest share in 2023, accounting for 30.52% of the global market. Factors such as rising R&D investments, increasing agri-tech startups, and strong demand for UAVs in farming support this dominance.

Frames dominate the component segment due to their role in providing structural stability and durability. Additionally, control systems and propulsion units are crucial for maneuverability and flight performance.

Medium-weight drones (10–25 kg) are most in demand due to their ability to balance payload capacity and flight efficiency, making them ideal for spraying and data-gathering in mid-to-large sized farms.

Challenges include data overload, inaccuracies in data collection, high initial costs, and regulatory barriers. Environmental factors like wind and lighting also affect data accuracy.

Government support via subsidies, R&D grants, and training programs plays a major role. For instance, the U.S. Department of Agriculture and FAA have allocated millions in grants to encourage drone adoption in farming.

Major players include DJI, Drone Deploy, AeroVironment, Precision Hawk, Trimble Navigation, and XAG. These companies focus on innovation, software integration, and expanding global reach with autonomous, AI-powered drones.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us