Air Filters Market Size, Share & Industry Analysis, By Type (Cartridge Filters, Dust Collectors, HEPA Filters, Baghouse Filters, and Others), By End-User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Air Filters Market Size

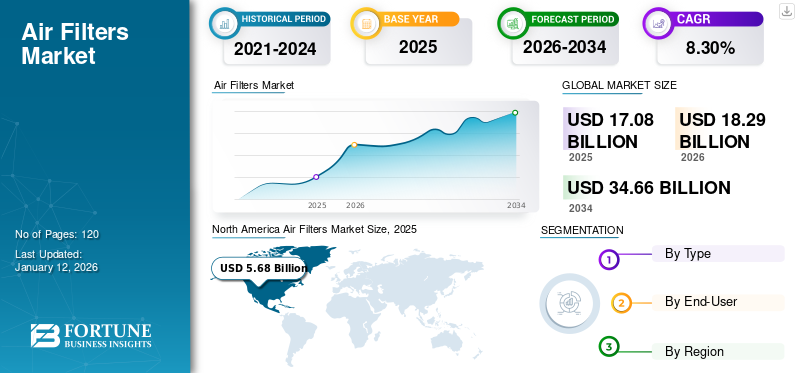

The global air filters market size was valued at USD 17.08 billion in 2025 and is projected to grow from USD 18.29 billion in 2026 to USD 34.66 billion by 2034, exhibiting a CAGR of 8.30% during the forecast period. North America dominated the global market with a share of 33.20% in 2025. The air filters market in the U.S. is projected to grow significantly, reaching an estimated value of USD 7.31 billion by 2032, driven by the rising need for air purification in commercial and industrial structures.

The air filters are an important part of the heating, ventilation, and air conditioning (HVAC) system, which removes small particles from internal combustion engines. These systems are used across the residential, commercial, and industrial sectors. They are crucial in industrial and residential settings to ensure cleaner and healthier air. The aim is to capture particles such as dust, pollen, pet dander, mold spores, bacteria, and other airborne particles. They also significantly remove pollutants and particulate matter from indoor air, contributing to better indoor air quality.

Market Size & Growth:

- 2025 Market Value: USD 17.08 billion

- 2026 Estimated Value: USD 18.29 billion

- 2034 Forecast Value: USD 34.66 billion

- CAGR (2025–2032): 8.30%

- Top Region: North America – 33.20% share in 2025

- Top Country: U.S. – Projected to reach USD 7.31 billion by 2032

- Leading Type: Dust Collectors – 99.9% particle removal efficiency

- Top End-User: Industrial – Driven by healthcare, automotive, and semiconductor sectors

Key Trends and Drivers:

- Urbanization-Driven Demand: Growing urban populations are accelerating the need for cleaner indoor air across all building types

- Reusable & Washable Filters: Adoption of sustainable, cost-effective filter options is gaining traction in green building design

- Health Awareness Post-COVID: Increased focus on respiratory health is boosting demand for HEPA and high-efficiency filtration systems

- Green Building Standards: Rising adoption of LEED and other environmental certifications is driving advanced filtration deployment

- R&D Investments: Companies like Daikin are investing in Southeast Asia to expand air filter manufacturing capacity

Market Challenges:

- High Upfront Costs: Installation and maintenance of high-efficiency filters remain a barrier for cost-sensitive buyers

- Frequent Replacements: Filters often need to be changed every 4–6 months, adding to operational costs

- Low-Cost Alternatives: End-users in some regions opt for cheaper filters with lower filtration efficiency, impacting market penetration

Market Opportunities:

- Automotive Sector Demand: Increasing installation in vehicles to reduce emissions and improve cabin air quality

- Industrial Expansion in Asia: Rapid industrialization in India, China, and Southeast Asia is creating new demand nodes

- Green Infrastructure Growth: The shift toward green buildings, especially in Europe and North America, promotes high-efficiency air filter usage

- Healthcare & Cleanroom Adoption: Rising deployment in hospitals and biotech manufacturing creates long-term demand for HEPA and cartridge filters

Rapid urbanization and industrialization across the globe, which, in turn, raise the demand for such products for improving clean air quality across residential and commercial sectors, subsequently fueling market growth. For instance, according to a statement by The World Bank Group, in 2020, around 55% of the global population lived in urban areas, and such a ratio is projected to grow to 68% by 2050. Such tremendous population growth creates the demand for air filters, driving the market growth.

The rising construction of green buildings and re-utilization of such filters are the key trends available in the market. The growing awareness of the health risks associated with air pollution has prompted individuals and businesses to invest in air purifiers and filters to improve indoor air quality. Moreover, major players planned to invest in research and development technologies in global filter systems to expand production capacity. For instance, in November 2022, Daikin Industries Ltd planned to invest around USD 711.0 million to expand production capacity from India and Southeast Asian countries and drive market growth.

The COVID-19 pandemic had a mixed impact as it was negatively affected several industries, owing to disruption in supply chain, and halted manufacturing activities across the globe. However, due to the increasing importance of fresh air, the air filter market resulted to be least affected in the pandemic era. It is owing to growing awareness about indoor air quality among premises. According to the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE), standard 52.2 low-efficiency filters have a minimum efficiency ratio value (MERV) of less than eight and are unlikely to clean the air. The reason is its incorrect installation. ASHRAE recommended a two-step approach to air filtration to prevent the spread of COVID-19.

Increased support from government agencies, including ASHRAE and others, will complement the increased demand for HEPA filters, dust collectors, and other air quality systems in such pandemic situations. The modern HEPA filter is used in industrial applications, such as automotive, manufacturing, and others, and commercial applications, as it can capture approximately 99.95% of airborne bacterial particles. HEPA filters used in home applications prevent the spread of bacterial viruses that cause respiratory problems. The demand for installing air purifiers will grow rapidly in the coming years. This is due to the increasing demand for fresh indoor air quality (IAQ) worldwide.

Air Filters Market Trends

Growing Demand for Reusable Air Filters Drives Market Growth

Manufacturers compete based on dust-holding capacity, consistent airflow and filtration efficiency. The end user is moving toward sustainable options, including reusable and washable products. These products can control harmful emissions and ensure high indoor air quality by preventing the growth of microbes. The payback for reusable filters is relatively short as these systems require costs less than buying a new filter every 4-6 months. In addition, government agencies and various environmental organizations are developing green building standards to ensure fresh indoor and outdoor air quality in all end-use areas.

According to the World Green Building Council, Australia has a green building focus of almost 46% and Ireland almost 40%. The development economy is primarily focused on the supply of energy-efficient air purifiers. Therefore, the growing demand for green buildings with increased installation of reusable filters supports the air filters market growth.

Download Free sample to learn more about this report.

Air Filters Market Growth Factors

Rising Demand from Automotive Industry to Trigger Market Growth

Rising growth in the automotive and related sectors subsequently surged the demand for the installation of filters in all vehicles, including heavy machinery and small vehicles. The demand for such products across the automotive sector is growing drastically. It filters out the sensitive dust particles, minimizing the risks of molecular and microbiological contamination. In addition, rising demand from the automobile sector drives market growth. The Organization for Economic Co-operation and Development (OECD) states that excessive pressure across contaminated air filters causes a 1% – 15% increase in fuel consumption. The accelerated demand for luxury car components, such as industry-leading filters for improved vehicle efficiency, is projected to drive the demand for such products across the automotive sector.

RESTRAINING FACTORS

High Initial Installation and Maintenance Cost is Causing Hindrance to Market

High installation and replacement costs are major factors limiting the market expansion. The high cost of filter replacement is around USD 35 to USD 60 as the filter requires regular changes in four to six months. Additionally, several end-users procure cheap filtration equipment to replace the working environment in commercial, residential and industrial applications in terms of reduced pressure drop. All the aforementioned factors are restraining the air filters market share.

Air Filters Market Segmentation Analysis

By Type Analysis

Dust Collectors Maintain Market Dominance, Fueled by Rising Demand Across Multiple Sectors

Based on type, the market is classified into HEPA filters, cartridge filters, dust collectors, baghouse filters, and others.

In 2026, the dust collectors dominated the market in terms of revenue market with a share of 27.06% and is projected to maintain its dominance throughout the forecast period from 2025 to 2032. The growth is attributed to the rising commercial, industrial, and residential demand. This filter has features such as an innovative diffusion technique and is highly efficient at removing dust particles by 99.9%, gaining traction from healthcare, commercial, residential, automotive, and related sectors.

The cartridge filters, baghouse filters, and HEPA filters segments are projected to grow with moderate growth during the forecast period as several manufacturers have already initiated offerings with green technology, compatibility with smart devices and higher energy efficiency. The rising demand from earth-moving equipment across the mining, construction, and agriculture sectors drives the segments’ growth.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Industrial Segment Dominate the Market Owing to Rising Adoption from Various Manufacturing Facility

Based on the end-user, the market can be divided into commercial, industrial, and residential.

As per our estimates, in 2026, the industrial segment dominated the market in terms of market revenue with a share of 48.55% and is expected to grow at a substantial growth rate during the forecast period. There was a rising demand for installing air filtration systems across medical, healthcare, automotive, and semiconductor sectors where the environment shifted from hot to cold and vice versa. In addition, increasing industrialization and growing investment in the industrial sector is expected to increase the segment’s growth.

The commercial and residential segments are projected to grow moderately owing to growing urbanization and growth in the construction industry. There is an increasing demand for HVAC filtration systems in the residential, commercial, and industrial sectors. The construction of new buildings and the renovation of existing ones also contribute to the growth of the air filter market globally.

REGIONAL INSIGHTS

By geography, the market for air filters is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Air Filters Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

As per our analysis, North America dominated the market with a valuation of USD 5.68 billion in 2025 and USD 6.05 billion in 2026. The dominance is attributed to the growth in the automotive and healthcare sectors across the U.S., Canada, and Mexico. Furthermore, rising awareness about adopting such products across residential and commercial spaces to improve indoor air quality and several government initiatives to promote the usage of such products from several industrial plants fuel market growth. The U.S. market is valued at USD 4.77 billion by 2026.

U.S. to Witness Highest Growth Rate Owing to Rising Spending on Adoption of Such Products

Rising urbanization, industrialization, and green building concepts are implemented across the U.S. market. Rising awareness among the U.S. population regarding the health risks associated with poor air quality has led to an increased interest in air purifiers and filters. In addition, key players, such as Cummins Inc, Parker Hannifin Corp, and Donaldson Company Inc, among others, are heavily concentrating on improving the product portfolio of these products from the U.S., owing to indoor air quality being one of the biggest concerns that the country is facing.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is projected to be the fastest growing region in the global market, owing to growing urbanization and industrialization across India, China, and other nations. The rising disposable income of the population in Thailand, China, India, and Malaysia, among others, fuels the market growth by raising spending on adopting such products from residential spaces. For instance, according to Trading Economics, the disposable income of the Indian population is projected to grow by 6.4% in 2024 compared to 2023. The Japan market is valued at USD 0.9 billion by 2026, the China market is valued at USD 1.89 billion by 2026, and the India market is valued at USD 1.24 billion by 2026.

Europe is projected to grow at moderate growth during the forecast period. The increasing demand for these systems from Italy, Germany, and Spain drives market growth in Europe. Along with this, growth in the automotive sector across Germany, Spain, and France, which subsequently creates the demand for filter products for maintaining indoor air quality, fuels the market's growth. The UK market is valued at USD 0.95 billion by 2026, while the Germany market is valued at USD 1.33 billion by 2026.

The Middle East & Africa and South America are projected to grow steadily during the forecast period. The rising initiatives of manufacturing and installing dust collectors, baghouses, and other systems across the medical, gas turbine, chemical and aerospace industries in Israel, UAE, Saudi Arabia, South Africa, and other countries further fuel market expansion.

KEY INDUSTRY PLAYERS

Key Players Adopt Acquisition and Product Launch Strategies to Strengthen Market Position

Major players, such as MANN+HUMMEL, Daikin Industries Ltd, and Camfil, among others, are adopting acquisition as a key developmental strategy to enhance the product portfolio of such products through diversified geographies. For instance, in January 2022, MANN+HUMMEL acquired Pamlico Air to expand its North American Presence in the indoor air filtration market. The subsidiaries Tri-Dim Hardy, Tri-Dim, and Pamlico Air join forces to form the MANN+HUMMEL’s Air Filtration Americas group.

List of Top Air Filters Companies:

- Daikin Industries, Ltd. (Japan)

- Camfil (Sweden)

- MANN+HUMMEL (Germany)

- Parker Hannifin Corp (U.S.)

- Cummins, Inc. (U.S.)

- Donaldson Company, Inc. (U.S.)

- Freudenberg Filtration Technologies SE & Co. KG. (Germany)

- Absolent Group AB (publ) (Sweden)

- Lydall Gutsche GmbH & Co. Kg (Germany)

- Purafil, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2022: AAF International acquired the National Air Filter Service of New Jersey, an air filtration management company. The acquisition aims to deliver customers more value by expanding the filtration portfolio.

- August 2022: Donaldson Company Inc. opened a new manufacturing facility of 50,000 square feet in Pune, India. This expansion aims to improve the production capacity of air filters and related products.

- July 2022: Camfil opened a new manufacturing facility in Arkansas, the U.S., to expand its filtration operations in the state. The new facility includes a filter production plant, weld, warehouse, fabrication, and dust lab.

- March 2022: Daikin Industries Ltd launched a new Streamer air purifier, which can remove 99.9% of dust, bacteria, allergens, and viruses. It uses a HEPA filter, which is highly efficient compared to other products. This product has a lifecycle of around a decade.

- December 2021: Camfil USA, Inc. plans to build a new state-of-the-art air filtration product manufacturing facility in Texas, U.S. The company plans to capitalize more than USD 50.0 million in the facility. This new facility is anticipated to support the company in increasing its sales and improving services in the Southwest region.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional insights, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The report is quantitatively analyzed to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 8.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, End-User, and Region |

|

Segmentation |

By Type

By End-User

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 17.08 billion in 2025.

Fortune Business Insights says that the market will reach USD 34.66 billion in 2034.

Growing at a CAGR of 8.30%, the market will exhibit strong growth during the forecast period 2026-2034.

Rising demand for filters across the automotive and healthcare sectors drives market growth.

Daikin Industries Ltd, Camfil, Parker Hannifin Corporation, Cummins Inc, Donaldson Company Inc, and Mann+Hummel are top companies in the market.

Asia Pacific is the fastest-growing region in this market.

The HEPA filters segment is expected to hold the highest CAGR in the market.

The industrial segment is expected to hold the highest CAGR in the market.

Accelerated construction of green buildings, coupled with reusable filter demand, is a growing market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us