Home / Aerospace & Defense / Aviation / Aircraft Cabin Interior Market

Aircraft Cabin Interior Market Size, Share & Industry Analysis, By Component (Seats, Cabin Lighting, Windows & Windshield, Galley & Lavatory, In-Flight Entertainment & Connectivity, Stowage Bins, and Interior Panels), By Class (First Class, Business Class, Premium Economy Class, and Economy Class), By Aircraft Type (Narrow Body, Wide Body, Business Jets, and Regional Transport Aircraft), By End-user (OEM and After Market), and Regional Forecast, 2024-2032

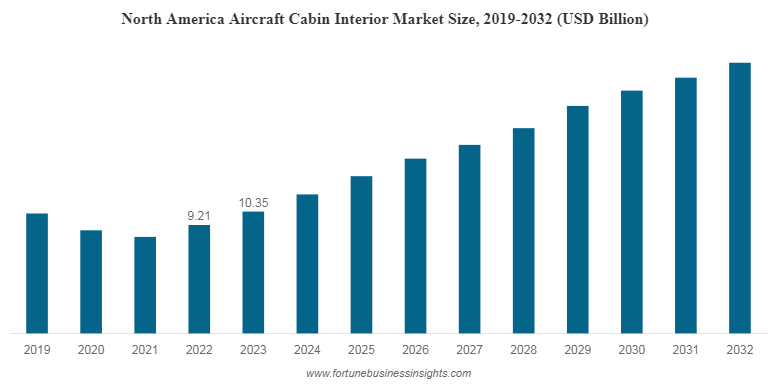

Report Format: PDF | Latest Update: Dec, 2024 | Published Date: Apr, 2024 | Report ID: FBI101814 | Status : PublishedThe global aircraft cabin interior market size was valued at USD 32.07 billion in 2023 and is projected to grow from USD 36.37 billion in 2024 to USD 74.14 billion by 2032, exhibiting a CAGR of 9.31% during the forecast period. North America dominated the aircraft cabin interior market with a market share of 32.27% in 2023.

Aircraft cabin interior is the primary aspect of any aircraft, providing passengers with a comfortable, secure, and aesthetically pleasing environment in the sky. Many passengers sometimes feel uncomfortable due to the high altitude, resulting in a bad travel experience. Hence, airline operators indulge in modernizing the interior products to enhance passengers’ travel comfort and experience. An aircraft cabin interior comprises various components such as cabin seats, a galley, interior aircraft panels, storage bins, in-flight entertainment and connectivity systems, windows, and lavatory.

The rise in demand for advanced aircraft systems and components such as LED cabin lights, wireless in-flight entertainment systems & connectivity, and comfortable, lightweight cushion structures is expected to create ample opportunities for the growth of the market over the forecast period.

Aircraft Cabin Interior Market Trends

Rise in Demand for Aesthetic Interiors and Customization to Act as a Market Trend

OEMs and airlines have started to focus on aesthetically pleasing interiors over the past few years. Earlier interiors in the aircraft donned monotonous tones, basic colors, and lighting schemes, which proved to be of no help in easing the uneasiness for passengers at a high altitude. Additionally, the need to add luxury details in the aircraft for high-end seats and customers has created a scope for OEMs to manufacture and procure aircraft cabin interiors to comfort and secure passengers at a high altitude. For instance,

- In March 2023, Virgin Atlantic Airlines released a redefined aircraft cabin interior and service before the launch of its A330NEO. The airlines aim to redefine the inflight experience with personalized interiors and services.

Furthermore, there has been a rise in demand for the customization of high-end business jets and chartered planes. This has led to a subsequent surge in the demand for luxury, safe, comfortable, and aesthetically pleasing interiors. With growing aircraft deliveries and the rising net worth of individuals, the demand for customization and aesthetically pleasing interiors in the market is expected to grow over the forecast period.

Aircraft Cabin Interior Market Growth Factors

Rising Demand for Long-Haul Flights and Regional Aviation Transport to Support Market Growth

As per the IATA Report on air passenger recovery (released in March 2022), the aviation industry will fully recover from the demand drop due to the pandemic by the end of 2023 and is expected to flourish with growing demand in the next decade. As air passengers return to the pre-pandemic numbers, there will be an upsurge in the demand for long-haul flights. To boost demand and comfort, OEMs will produce and enhance aircraft cabin interiors to suit the taste of passengers. Additionally, a rise in disposable income post-pandemic is expected to enable more people around the globe to air travel, adding to the air passenger numbers. This number is expected to grow substantially during the forecast period.

- For instance, in March 2023, the Indian Minister of Civil Aviation and Steel, Shri Jyotiraditya Scindia, highlighted how growth in the income and spending power of individuals would raise the demand for commercial aviation in the future.

Growing Refurbishment and Renewal of Old Aircraft to Extend Aircraft Life to Drive Market Growth

Recently, there has been a rise in demand for the renewal and refurbishment of old aircraft and business jets. Since several aircraft retire every year, there is a need for old aircraft to be refurbished and renewed as passenger or freighter aircraft carrying passengers and cargo. Numerous airlines and operators have started to refurbish their old aircraft with the latest aircraft cabin interiors as an upgrade.

For instance, in December 2022, Air India, an airline company in India, announced refurbishing their wide-body fleet, 13 Boeing B777 and 27 Boeing B787-8. Similarly, growing MRO and refurbishment activities are anticipated to boost the market during the forecast period.

RESTRAINING FACTORS

Strict Regulations and Delayed Certifications to Limit Market Growth

Safety and weight are critical factors when designing the aircraft interior system and components. The conventional material and components used in the development of the aircraft cabin interior systems can increase the weight burden on the aircraft. Furthermore, stringent aviation regulations regarding weight of the aircraft and safety, among many others increase the production cost of aircraft cabin interior manufacturers. The regulations implemented by various authorities are to ensure safety during flight and expected to be adhered to by OEMs, airlines, and aircraft operators. There are numerous tests that an aircraft component as small as a light bulb has to go through to get flight certification due to the presence of multiple safety rules and procedures.

The increased production and raw material costs are anticipated to hamper the aircraft cabin interior market growth. However, the use of composite materials and additive manufacturing techniques for the development of aircraft interior parts is estimated to reduce the overall cost of production and thereby create new growth opportunities for aircraft cabin interior OEMs.

Aircraft Cabin Interior Market Segmentation Analysis

By Component Analysis

Growing Commercial Aircraft Demand to Propel Seats Segment Share

Based on component, the market is categorized into seats, cabin lighting, windows & windshields, galley & lavatory, in-flight entertainment & connectivity, stowage bins, and interior panels.

The seats segment witnessed high demand during the forecast period owing to the rise in demand for commercial aircraft. As the number of commercial aircraft deliveries grows year on year, the seats segment is also expected to grow and remain dominant. Moreover, the growing demand for 21 G seats and next-generation seats is predicted to bolster the segment’s growth. For instance,

- In February 2024, Air India selected Recaro Aircraft Seating to provide 22,000 seats for its order of 470 aircraft that would be added into the airlines over the next five to six years. The airline chose the CL3710 with a six-way adjustable headrest, the CL3810 seat model, which adds lumbar support, for economy class, and the PL3530 model with 7-inch recline for the premium economy cabins.

The in-flight entertainment & connectivity segment is anticipated to grow at the highest CAGR over the forecast period. This is due to several technological advancements and the availability of a variety of content for in-flight entertainment, which is expected to boost market growth in the forecast period.

By Class Analysis

Growing Demand for Comfortable Seating to Propel the Economy Class Segment Growth

According to class, the market is segmented into first class, business class, premium economy class, and economy class.

In 2023, the economy class segment accounted for the largest segment of the market, owing to a wide number of seats available and most passengers traveling in economy seats. The economy class segment is expected to remain dominant in the forecast period due to the growing demand for comfortable seating and the increasing net worth of individuals associated with an addition to existing air travelers.

However, the premium economy class is expected to grow most during the forecast period. This growth can be attributed to the rising demand for premium economy seats by the passenger, as business class tickets are expensive compared to premium economy class seats.

By Aircraft Type Analysis

Growing Demand for Narrow Body Aircraft to Aid Market Growth

Based on aircraft type, the market is divided into narrow body, wide body, business jets, and regional transport aircraft.

The narrow body segment accounted for the largest market share in 2023. The segment is also expected to dominate during the forecast period due to the availability and demand for narrow-body aircraft.

The wide body segment is anticipated to grow with the highest CAGR from 2023-2030, owing to a rise in demand for long-haul aircraft and pending wide-body aircraft deliveries.

By End-user Analysis

Growing Production of Commercial Aircraft to Aid OEM Segment Growth

Based on end-user, the market is bifurcated into OEM and aftermarket.

The OEM segment emerged as the highest market share in 2023, owing to rise in production post-pandemic. The segment growth is further propelled by the rising demand for new and renewed aircraft due to a growth in the fleet by airline operators as the number of travelers rises.

REGIONAL INSIGHTS

The global market is segmented into five regions, North America, Europe, Asia Pacific, the Middle East, and the rest of the world.

The North America market was valued at USD 10.35 billion in 2023 and is expected to dominate the global aircraft cabin interior market share due to the presence of top aircraft manufacturers, such as Boeing and Bombardier, among many others in this region. Additionally, adopting new-generation manufacturing technologies within the region and increased investments in R&D activities contribute significantly to market growth.

The Asia Pacific region is anticipated to grow at the highest CAGR during the forecast period due to the growing number of OEMs in the region. The region is witnessing large numbers of aircraft cabin interiors exported to manufacturers based in North America and Europe. Additionally, an expansion in the aviation industry in the Asia Pacific is one of the major reasons behind the Asia Pacific market development.

Europe accounted for the second-highest market share in 2023. The region’s large share is due to increased demand for aircraft cabin interiors from developed European countries, such as France, the U.K., Russia, and Germany. Additionally, leading aircraft manufacturers such as Leonardo SPA and Airbus SE and prominent interior OEMs such as Safran support the market growth in Europe.

List of Key Companies in Aircraft Cabin Interior Market

Key Market Players are Focused on Providing a Variety of Services to Survive in the Market

The market is consolidated with several global and a few regional players operating in this industry. It has been observed that international and regional players have a varied product portfolio with a high focus on providing the best possible aircraft cabin interior for superior security and comfort. The top players in the industry are the Boeing Company, Safran, and other listed companies in the ranking analysis. The Boeing Company and Safran are expected to lead the market owing to their global presence.

Other prominent players involved in the market include Collins Aerospace, Honeywell International Inc., Panasonic Corporation, and other players highly involved in new product launches and frequent partnerships and acquisitions to sustain their market position.

List of Key Companies Profiled:

- Astronics Corporation (U.S.)

- Cobham PLC (U.K.)

- Collins Aerospace (United Technologies Corporation) (U.S.)

- Diehl Stiftung & Co. Kg (Germany)

- Haeco Americas (U.S.)

- Honeywell International Inc. (U.S.)

- Jamco Corporation (Japan)

- JCB Aero (France)

- Panasonic Corporation (Japan)

- Safran (France)

- Thales Group (France)

- The Boeing Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2022 – Singapore Airlines unveiled the next-gen cabin interiors for first, business, and economy classes. The airlines have started providing fully flat beds, fine dining, and luxury in-flight shower rooms to ensure maximum comfort. Recently, the airlines have added the widest full flat seat and improved storage, functionality, and features.

- November 2022 – J&C Aero, a Lithuanian aerospace company, entered an agreement with Crow Airlines, a Libya-based airline, for aircraft branding and refurbishment support during the first two aircraft carrier Airbus A320s delivery. The agreement covers galley modification, seat dress covers, seat belts, carpets, curtains, and other cabin interior elements.

- December 2022 – The AeroVisto Group partnered with VARTAN, an aircraft cabin interior company from Switzerland. AERO, a German aircraft cabin interior manufacturer, combines optimized interior refurbishment project processes in private jet aviation. The two conglomerates have jointly decided to provide a one-stop solution for all interior cabin needs for customers in the region.

- October 2022- Bombardier Inc., a Canada-based aviation company, unveiled executive cabins for their Global 7500 and Global 8000 business jets. The new executive cabins feature an open office concept with three workspaces designed for maximum corporate collaboration networking and to boost productivity with fellow passengers.

- June 2022- Safran, a France-based aircraft cabin interior company, unveiled new and updated interiors and aircraft seats at the Aircraft Interiors Expo (AIX) in Hamburg. Interspace, a padded folding wing between seats for better lateral support and privacy, a product of Safran, won a Crystal Cabin Award in 2021.

REPORT COVERAGE

The global market research report provides detailed information on the market competitive landscape and focuses on leading companies, product types, and key product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, it contains several factors that have contributed to the sizing of the global market in recent years.

REPORT SCOPE & SEGMENTATION

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2023 |

Estimated Year |

2024 |

Forecast Period |

2024-2032 |

Historical Period |

2019-2022 |

Growth Rate |

CAGR of 9.31% from 2024 to 2032 |

Unit |

Value (USD Billion) |

Segmentation

|

By Component

|

By Class

|

|

By Aircraft Type

|

|

By End-user

|

|

By Country

|

Frequently Asked Questions

How much is the global aircraft cabin interior market worth?

Fortune Business Insights has stated that the global market value was USD 32.07 billion in 2023 and is projected to reach USD 74.14 billion by 2032.

At what CAGR is the aircraft cabin interior market projected to grow during the forecast period of 2024-2032?

Registering a CAGR of 9.31%, the market will exhibit rapid growth during the forecast period of 2024-2032.

Which is the fastest-growing segment in the market?

The wide body segment will dominate the market during the forecast period.

Who are the major players in the market?

The Boeing Company, Safran, and Panasonic Corporation are the leading players in the global market.

Which region held the highest share in the market?

North America dominated the market in terms of share in 2023.

Which country dominated the market in 2023?

The U.S. dominated the market in 2023.

- Global

- 2023

- 2019-2022

- 180