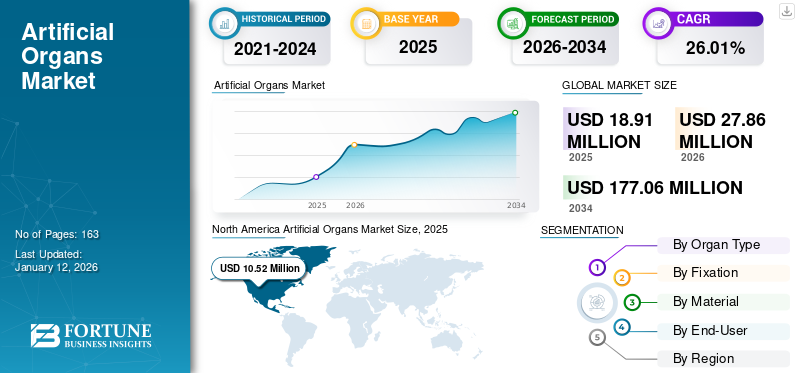

Artificial Organs Market Size, Share & Industry Analysis, By Organ Type (Artificial Kidney, Artificial Lung, Artificial Heart, and Others), By Fixation (Implantable and Wearable), By Material (Silicon, Polyurethane, and Others), By End-User (Hospitals, Academic and Research Institutes, and Specialty Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global artificial organs market size was valued at USD 18.91 million in 2025. The market is projected to grow from USD 27.86 million in 2026 to USD 177.06 million by 2034, exhibiting a CAGR of 26.01% during the forecast period. North america dominated the artificial organs market with a market share of 55.61% in 2025.

Artificial organs are engineered devices that can be integrated or implanted into a human body, interfacing with living tissue to replace a natural organ. In recent times, the market has observed significant progress in developing organ manufacturing technologies.

Growing aging population, coupled with the increasing prevalence of chronic diseases such as diabetes, chronic kidney diseases, and cardiovascular diseases, is leading to increasing cases of organ failure. The increasing cases of organ failures will result in high demand for organ transplants, consequently driving the adoption of these organs as they can act as bridge-to-transplant. Thus, these factors are contributing to the market growth.

- According to the data published by the American Kidney Fund in December 2021, approximately 37.0 million people in the U.S. have kidney disease; approximately 556,000 are on dialysis, and more than 250,000 people are living with a kidney transplant. The same data states that approximately 135,000 people in the U.S. were newly diagnosed with kidney failure in 2021.

Furthermore, an increasing number of pipeline products by market players alongside anticipated product approvals to meet the growing patient needs of organ transplants will further contribute to market growth.

- According to the data published by the Health Resources and Services Administration (HRSA) in 2024, as of September 2023, 107,999 were on the organ transplant waiting list. Thus, with an increasing number of patients on the organ transplant waiting list, the demand for artificial organs will also increase in the coming years.

The COVID-19 pandemic negatively impacted the market owing to the disruptions in manufacturing operations, supply chain management, and healthcare services globally, leading to a slowdown in the production and distribution of artificial organs. Moreover, companies witnessed a drop in their sales due to supply chain restrictions. For instance, CARMAT’s sales were negatively affected in the first half of 2021, as travel restrictions measures delayed certain implants. The company experienced supply chain issues, which slowed the rate of inventory build-up and prosthesis production. This has resulted in a temporary decline in the demand for these organs.

Artificial Organs Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 18.91 million

- 2026 Market Size: USD 27.86 million

- 2034 Forecast Market Size: USD 177.06 million

- CAGR 2026~2034: 26.01%

Market Share:

- North America dominated the artificial organs market with a 55.61% share in 2025, driven by the presence of leading companies such as SynCardia Systems and strong government initiatives like the Advancing American Kidney Health program. Robust R&D investments and the availability of FDA-approved artificial organ devices also contribute to regional leadership.

- By Organ Type, artificial heart held the largest market share in 2024 due to the presence of only two approved total artificial heart products and the rising prevalence of cardiovascular diseases. The artificial kidney segment is expected to grow significantly through 2032 due to technological innovation and clinical trial progress.

Key Country Highlights:

- Japan: The country is seeing steady growth in artificial organ adoption driven by its aging population, increasing chronic disease burden, and strong investment in medical R&D. Government-supported initiatives to advance organ replacement technologies further support the market.

- United States: The U.S. dominates due to high kidney failure rates (37 million with kidney disease), supportive government policies, and a large patient pool on transplant waiting lists. SynCardia’s FDA-approved devices and federal funding for wearable kidney technology further fuel market expansion.

- China: With a large aging population and a growing burden of chronic diseases such as diabetes and heart conditions, China is accelerating R&D in artificial organs. Government initiatives and increasing collaborations with international biotech firms support growth.

- Europe: Europe is the second-leading region, benefiting from a well-regulated market and key players like CARMAT with CE-marked artificial hearts. Active clinical trials, research collaborations, and public-private funding are strengthening the region's artificial organ ecosystem.

Artificial Organs Market Trends

Rising Research and Development Activities Among Research Institutes and Market Players

Research and development activities in the healthcare sector have witnessed significant growth over the past few years. Increasing emphasis on research funding with increasing project initiatives by government organizations and market players have accelerated the R&D activities in the artificial organs market.

- According to the 2023 annual report of CARMAT, the company received a total of USD 9.4 million in 2023 from the European Innovation Council (EIC).

There is a significant gap between the number of patients suffering from end-stage chronic diseases and available treatment options. Therefore, to address the growing need of patients undergoing organ transplants, academic and research institutes have accelerated R&D activities and clinical trials in the artificial organs field. In addition, constant innovations by market players to develop artificial organ devices, along with a strong product pipeline and potential product approvals, will transform the industry and benefit several people suffering from organ failure.

Download Free sample to learn more about this report.

Artificial Organs Market Growth Factors

Increasing Incidences of Organ Failure to Drive Market Growth

Organ failure has become a global health crisis, with a significant gap between the patients requiring organ transplants and the available donors.

- According to the data published by the Centers for Disease Control and Prevention in October 2022, the most commonly transplanted organs in the U.S. were the liver, heart, kidney, pancreas, intestines, and lungs. There were approximately 100,000 people on the waiting list in 2021 for organ transplantation, and only about 14,000 organs were received from deceased donors.

In addition, kidney disease is the fastest-growing non-communicable disease in the U.S., and it is growing at an alarming rate, affecting more than 1 in 7 or 15% of American adults.

- According to the data published by the American Kidney Fund in 2021, approximately 37.0 million people are living with kidney disease, out of which 808,000 people in the U.S. are living with kidney failure and 556,000 people are on dialysis.

Therefore, the growing cases of kidney failure will drive the demand for artificial kidneys as the number of patients requiring kidney transplants will also increase. Thus, these factors are projected to drive market growth during the forecast period.

RESTRAINING FACTORS

Higher Costs of Surgical Procedures May Hamper Device Adoption

The higher costs linked with artificial organ procedures pose a significant economic barrier for the healthcare system and patients. Treatments for these procedures have become increasingly restricted owing to an increase in procedural costs. The financial strain may limit the adoption of artificial organs globally, mainly for individuals from lower socioeconomic status.

Furthermore, the availability of heart donors is lower, boosting the penetration of artificial organ devices. However, the high costs linked with implanting these devices have limited their adoption. An estimated cost for an artificial heart, including surgical procedures, devices, and continuing medical surveillance, ranges from USD 100,000 per patient to USD 300,000 per patient in the initial year.

- In January 2021, the European Commission approved the sale of a total new artificial heart manufactured and developed by CARMAT, which cost around USD 180,000. Thus, the high cost of these devices may restrict their adoption among individuals.

Moreover, the average total artificial heart costs range from USD 150,000 to USD 200,000 when compared to a heart transplant, and using a total artificial heart (TAH) as a bridge to a transplant doubles the cost of care. Thus, these factors may restrict artificial organs market growth.

Artificial Organs Market Segmentation Analysis

By Organ Type Analysis

Presence of Only Approved Products in the Artificial Organ Contributed to the Artificial Heart Dominance

Based on organ type, the market is segmented into artificial kidney, artificial lung, artificial heart, and others.

The artificial heart segment dominated the market share of 91.60% in 2026, as there are only two FDA and CE approved total artificial organ devices available in the market. Moreover, the increasing cases of cardiovascular diseases coupled with the growing aging population will lead to an increasing need for innovative solutions to address the growing demand for artificial organs.

- According to the data published by PCR online in September 2023, approximately 620.0 million people are living with heart and circulatory diseases across the world. Moreover, every year, approximately 60.0 million people across the world develop circulatory or heart disease.

The artificial kidney segment is projected to witness significant growth in the coming years owing to growing product pipelines and growing clinical trials by the market players coupled with potential product approvals in the coming years. Moreover, the constant innovations in this segment, such as wearable kidney devices, are projected to contribute to the segment’s growth during the forecast period.

The artificial lungs, pancreas, and others segments are projected to witness comparatively slower growth in the coming years. According to data published by the ASAIO Journal in August 2020, a suitable long-term artificial lung system is still in the early stages of development. Although, currently, a short-term use of extracorporeal lung support is feasible, it does not allow the long-term use of lung replacement systems in terms of an implantable artificial lung.

To know how our report can help streamline your business, Speak to Analyst

By Fixation Analysis

Increasing Preference Toward Implantable Device Led to their Dominance

The market is segmented into implantable and wearable in terms of fixation.

The implantable segment will dominate the global artificial organ market share of 90.14% in 2026, as it will offer long-term solutions to patients. These devices are designed to be durable and offer long-term support, reducing the need for replacement and repeated surgeries compared to temporary devices. Moreover, the growing technological advancements in the medical technology field and the presence of several major market players will contribute to the segmental growth.

- For instance, Real Heart AB and Sahlgrenska University Hospital are working toward developing an implantable total artificial heart. The device is still in the clinical trial phase.

The wearable segment is projected to witness comparatively slower growth during the forecast period. These devices can easily be carried by the patients throughout their daily activities, enabling continuous monitoring without visiting a hospital. However, these devices are still in their initial phase of development and have yet to receive market authorization.

By Material Analysis

Growing Preference Toward Polyurethane Material Owing to its Enhanced Durability Led to its Dominance

The market is segmented into silicon, polyurethane, and others based on material.

The polyurethane segment dominated the market share of 91.99% in 2026, as these materials have been widely adopted in clinical practice. Moreover, several benefits, such as durability, enhanced biocompatibility, and flexibility, makes it a versatile material to be used for medical applications. These factors contribute to segmental growth.

On the other hand, the silicon segment is projected to witness comparatively slower growth during the forecast period. Silicon-based devices offer several advantages in terms of performance, biocompatibility, and cost-effectiveness. However, they may have limitations in terms of mechanical strength, durability, and compatibility with certain manufacturing processes compared to other materials.

By End-User Analysis

Academic and Research Institutes Led the Market Owing to Increased Funding by Government Organizations

The market is segmented into hospitals, academic and research institutes, and specialty clinics based on end-user.

Academic and research institutes dominated the market share of 13.69% in 2026, owing to the increasing funding of various government organizations, which led to growing innovations and developments for these devices. Moreover, several research institutes are conducting constant research and development activities to develop new materials and technologies, as well as design novel approaches for organ replacement and regeneration, which is also contributing to segmental growth.

- In March 2023, surgeons from Columbia University performed a total artificial heart surgery on a pediatric patient. The surgery aims to remove the failed heart and replace it with an artificial heart.

The hospital segment witnessed comparatively slower growth in 2024. The growth of the segment can be attributed to the growing collaboration among several companies and accelerating the ongoing research activities and clinical trials in the artificial organ field. Moreover, these collaborations are transforming research findings into clinical practice and assisting hospitals to offer the latest innovations and treatment options to patients.

REGIONAL INSIGHTS

Based on geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Artificial Organs Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 10.52 million in 2025 and USD 16.55 million in 2026. The market is anticipated to depict the highest CAGR over the assessment period compared to other regions owing to the presence of one of the leading players in the market offering the sole FDA-approved total artificial organ. Moreover, significant research and development expenditures by pharmaceutical and biotech companies, coupled with an increasing number of clinical trials, are increasing the demand for artificial organ research. The U.S. market is projected to reach USD 16.26 million by 2026.

- In December 2019, the pipeline for a wearable kidney has grown significantly. The U.S. government is emphasizing more on developing an artificial kidney under Advancing American Kidney Health.

Europe

Europe is the second dominant market owing to the presence of a well-established regulatory framework and the presence of market players such as CARMAT offering artificial hearts. Moreover, the company is constantly working toward innovations and research by collaborating with several research institutes, contributing to regional growth. The UK market is projected to reach USD 0.48 million by 2026, and the Germany market is projected to reach USD 1.35 million by 2026.

Asia Pacific

Asia Pacific is projected to register comparatively steady growth owing to constant research and development activities and a strong government support. Moreover, the region has higher cases of chronic diseases unified with a growing number of the aging population. This may lead to growing cases of organ failures, boosting the adoption of artificial organs to meet the growing demand of organ transplants. The Japan market is projected to reach USD 0.1 million by 2026, the China market is projected to reach USD 0.18 million by 2026, and the India market is projected to reach USD 0.06 million by 2026.

Latin America

The market in Latin America is estimated to register a comparatively slower CAGR over the forecast period due to the increasing development of healthcare infrastructure and increasing cases of chronic diseases.

Middle East & Africa

The Middle East & Africa is projected to capture a smaller market share and register a lower CAGR since the market is still nascent. However, the increasing adoption of advanced technologies backed by rising patient awareness and developing economic parameters will contribute to regional growth in the coming years.

Key Industry Players

Presence of Few Established Players in the Market to Help Companies Maintain Market Dominance

In terms of the competitive landscape, the global market is a highly consolidated, currently comprising only few players that offer very few products in the market. Furthermore, SynCardia Systems, LLC., and CARMAT are the only two companies that are offering products in the artificial organs market. These companies are focusing on regulatory approval and raising funds to strengthen their market position.

- In February 2023, SynCardia Systems, LLC received FDA authorization for its portable driver software upgrades for its existing artificial heart. The freedom driver is intended to be used with the company’s total artificial heart in clinically stable patients.

- In December 2022, CARMAT raised funding of USD 33.6 million by the issuance of its shares. The company aims to use the funds that were raised through this global offering to support research and development activities, ramp up production, and resume the company’s product sales.

Furthermore, emerging companies such as BiVACOR Inc., AWAK Technologies, and Wearable Artificial Organs, Inc., among others, with a robust pipeline product portfolio and their approvals and launches will contribute to the growing market shares of these emerging players during the forecast period.

LIST OF TOP ARTIFICIAL ORGANS COMPANIES:

- CARMAT (France)

- SynCardia Systems, LLC (U.S.)

- BiVACOR Inc. (Australia)

- AWAK Technologies (Singapore)

- Wearable Artificial Organs, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 - SynCardia Systems, LLC, announced that the U.S. Patent and Trademark Office (USPTO) had allowed claims of the patent application “Next Generation Total Artificial Heart,” which covers next-generation total artificial heart designs.

- February 2024 - BiVACOR Inc. received USD 13.0 million in funding for total artificial implants. The funding aims to support clinical trials, which will commence in the first quarter of 2024.

- February 2024 - BiVACOR Inc. collaborated with several researchers from New South Wales, Griffith University, and the University of Queensland to develop an 'Artificial Heart' for cardiac patients.

- September 2023 - AWAK Technologies received USD 20.0 million in funding for the US-based pivotal trial of its wearable dialysis device.

- February 2023 - SynCardia Systems, LLC, received FDA authorization for its portable driver software upgrades. The freedom driver is intended to be used with the company’s total artificial heart in clinically stable patients.

REPORT COVERAGE

The global market research report provides a detailed market analysis. It focuses on key aspects, such as market size and market forecast, cost of the procedure (key countries), and procedures conducted per year (key countries). It also gives an overview of significant companies' technological developments.

Besides, the report offers insights into the latest market trends, market statistics, and key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 26.01% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Organ Type

|

|

By Fixation

|

|

|

By Material

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 27.86 million in 2026 to USD 177.06 million by 2034.

In 2025, the North America market value stood at USD 18.91 million.

The market will exhibit a CAGR of 26.01% CAGR during the forecast period.

The artificial heart segment dominated the organ type segment in this market in 2026.

The key driving factors of the market include the rising prevalence of chronic diseases, increasing demand for advanced technologies, and growing product pipelines.

CARMAT and SynCardia Systems, LLC are the leading players in the global market.

North america dominated the artificial organs market with a market share of 55.61% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us