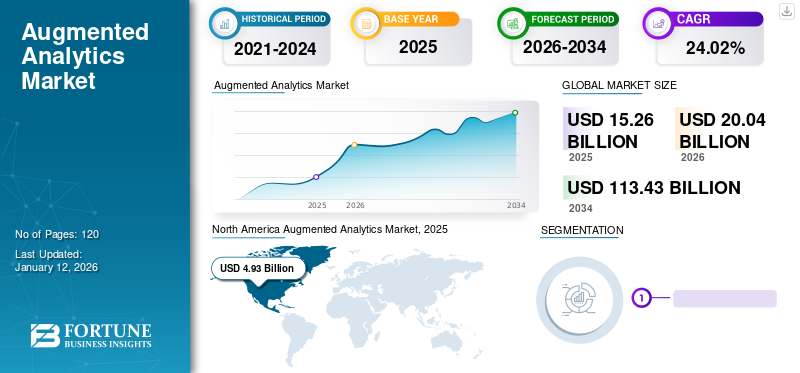

Augmented Analytics Market Size, Share & Industry Analysis, By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By End-user (BFSI, IT & Telecom, Government, Retail, Healthcare, Manufacturing, Transport & Logistics, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global augmented analytics market was valued at USD 15.26 billion in 2025. The market is projected to be worth USD 20.04 billion in 2026 and reach USD 113.43 billion by 2034, exhibiting a CAGR of 24.20% during the forecast period. North America dominated the global market with a share of 32.30% in 2025.

Augmented analytics makes use of advanced technologies such as artificial intelligence, machine learning, and natural language processes to assist in analyzing data. The technology helps enterprises in making quick and smarter decisions that support business growth. The significant rise in data during the pandemic propelled the demand for analytical solutions and artificial intelligence adoption across industries.

Global Augmented Analytics Market Overview

Market Size:

- 2025 Value: USD 15.26 billion

- 2026 Value: USD 20.04 billion

- 2034 Forecast Value: USD 113.43 billion

- CAGR (2026–2034): 24.20%

Market Share:

- Regional Leader: North America held the largest market share in 2024.

- Fastest-Growing Region: Asia Pacific is projected to grow at the highest rate during the forecast period.

Industry Trends:

- BFSI is the leading end-user vertical adopting augmented analytics solutions.

- Large enterprises dominate the market currently, while SMEs are expected to grow at the fastest pace.

Driving Factors:

- Rapid digital transformation and rising demand for AI-powered insights and predictive analytics.

- Increasing adoption of self-service BI, natural language processing interfaces, and low-code/no-code analytics platforms enabling broader data accessibility.

This wave of digitalization across industries accelerated the market growth. Furthermore, rapidly increasing digital data fuels the demand for advanced and efficient tools for data analysis. Considering the growing competition, companies are collaborating with each other to enhance the tool’s efficiency and capabilities for industry-specific needs. To add to this, market players are raising funds to make advancements in the augmented analytics sector. For instance,

- In May 2022, An augmented analytics company, Synergies Intelligent Systems, raised over USD 12 million in a series A funding round with the aim of making advancements in the augmented analytics market. NGP Capital led this funding round with a contribution from New Future Capital (NFC).

Augmented Analytics Market Trends

No-code and Low-code Automation to Boost Market Growth

The low code or the no code solutions are of type that helps businesses and developers with the ease of drag and drop application. The business can directly gain from the technology and not required to train employees with technicalities. The no-code technology empowers the business with quick and expandable capabilities.

For instance,

- In March 2023, Israel-based Pyramid Analytics introduced artificial intelligence-driven augmented efficiency by collaborating with the OpenAI platform. Its no-code and AI-assisted capabilities pushed the widespread adoption of the technology

Thus, easy to use no code or low code solutions are expected to boost the market growth.

Download Free sample to learn more about this report.

Augmented Analytics Market Growth Factors

Digital Transformation across Industries to Drive Market Growth

Digital transformation is reshaping the business operation globally. As per the report published by an industry specialist, 67% of various industries implemented digital products in 2021. The growing competition to propel the adoption of advanced digital solutions. Moreover, analytics are reshaping the way companies approach data analysis. It has become important for organizations to use valuable insights, make informed decisions, and gain a competitive edge within their respective industries. With the help of advanced analytics tools, these companies are accelerating the augmented analytics market growth.

This is expected to boost the digital data, and demand for advanced analytical tools is growing. Augmented analytics help enterprise owners with forecasting and predictive algorithms, sophisticated analytics, and other techniques. Similarly technologies, such as machine learning, natural language processing, and artificial intelligence expand the capabilities and offer smarter decisions. Thus, a rise in digitalization is expected to drive the market growth.

RESTRAINING FACTORS

Security Threats to Hamper Market Growth

Technologies dealing with data have been significantly impacted by the threats data security. In the recent period, many businesses across the countries have witnessed data theft owing to digital solution adoption. Technology offers an analysis of vast data sets, so it is essential to implement a solution to safeguard crucial insights. Thus, growing challenges of data security hampers market growth.

Augmented Analytics Market Segmentation Analysis

By Enterprise Type Analysis

Rapid Digital Transformation to Fuel Technology Demand across Large Enterprises

In terms of enterprise type, the market is classified into small and medium enterprises and large enterprises.

Large enterprises are expected to account for the maximum share over the forecast timeframe owing to growing investments in digital solutions. With vast data sets, large enterprises are keen on implementing advanced analytics to reduce the manual load and to fasten the decision-making process. The technology helps with actionable insights and enhances customer experience. The large enterprises segment is projected to dominate the market with a share of 63.16% in 2026.

Small and medium enterprises are projected to grow rapidly during the forecast period. With the growing competition, enterprises need to enhance the customer experience. The analytics tools help in gaining crucial customer insights that help businesses grow.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Competition to Drive Solution Demand in BFSI

On the basis of the industry, the market is divided into BFSI, IT & telecom, government, retail, healthcare, manufacturing, transport & logistics, and others.

BFSI industry segment led the market in 2024. The banking and financial institutions are significantly investing in advanced solutions to enhance business decision-making. The technology offers efficient data management capabilities to the BFSI system that helps in automating business operations.

Retail to gain the highest CAGR over the projected period. An increase in online shopping and a rise in the e-commerce supply chain is expected to drive the technology demand. The analytics tools helps enhance patient care, and reduce operational complexities. The retail segment is projected to dominate the market with a share of 18.83% in 2026.

Similarly, the increase in connected machines and digital tools to propel solution demand in manufacturing plants.

REGIONAL INSIGHTS

North America

North America Augmented Analytics Market, 2025

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market share in 2024. The rise in digital adoption and growing competition in the region fuels the market growth. Moreover, the region’s capability to adopt new technologies at the earliest, the rise in the amount of digital data, and the increasing number of market players are marking North America’s position higher in the overall market. The U.S. is to gain maximum segment share owing to the dominant presence of top market participants driving revenue growth. The U.S. market is expected to reach USD 4.28 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific to gain a rapid growth rate over the projected period. The rapid adoption of digital technologies across the countries such as China, India, South Korea, and Japan to propel market growth. The presence of highly populated countries with different demography is driving the need for customer insights using advanced tools. This is expected to boost the Asia Pacific augmented analytics market share. The Japan market is forecast to reach USD 0.94 billion by 2026, the China market is set to reach USD 1.14 billion by 2026, and the India market is poised to reach USD 0.99 billion by 2026.

Europe

Europe to gain a significant share over the forecast period. The growing investments in technologies, such as machine learning and artificial intelligence to drive market growth in the region. Small and medium enterprises are on the rise in the region. Thus, to offer efficient customer service these organizations are steadily implementing analytical tools. The UK market is anticipated to reach USD 0.81 billion by 2026, while the Germany market is estimated to reach USD 0.77 billion by 2026.

Rest of The World

Similarly, the Middle East & Africa to gain a prominent growth rate owing to the rise in investments in advanced digital technologies. South America to showcase steady growth owing to the increase in demand for customer insights for drawing future business strategies.

List of Key Companies in Augmented Analytics Market

Collaborations and Partnerships to Fuel Key Players’ Market Share

Key players are collaborating with various industry enterprises to expand their presence across sectors. Also, this strategic partnership is helping market players in expanding their loyal customer base and boost sales. Growing investments in research and development are driving various applications and uses of the technology. Similarly, market players are providing new platforms and devices to support the varying needs of industries. In addition, market players are raising funds with the intent of using the funds to expand their employee size and product expertise.

- August 2022: Seerist, Inc. launched augmented analytics capabilities dedicated to security and threat intelligence professionals. The company integrated a recently merged CORE online platform with machine learning proficiencies.

List of Key Companies Profiled:

- QlikTech International AB (U.S.)

- Salesforce Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- TIBCO Software Inc. (U.S.)

- SAP SE (Germany)

- SAS Institute Inc. (U.S.)

- MicroStrategy Inc. (U.S.)

- Tableau Software, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: California-based cloud analytics company, GoodData, announced the partnership with artificial intelligence provider, Arria, to augment its customer analytics tools. It offers self-service natural language-based insights and lowers manual work.

- May 2023: TrinityLife Sciences announced the collaboration with an artificial intelligence-powered analytics provider, WhizAI, to quickly integrate AI-offered insights. Through the partnership, these companies aim to offer domain knowledge and data services.

- March 2023: AnswerRocket, an advanced analytics provider, launched Max, an AI-assisted data analytics tool to help enterprises analyze uncovered information. Max integrates its augmented analytics platform with GPT-4 large language model of OpenAI to enhance the tool’s capabilities.

- February 2023: An augmented analytical tool company, Seerist Inc., added a new feature to its solution: county-level AI risk assessments. This new addition helps its end users monitor stability and helps them notify about the potential disruptions in countries across the U.S.

- April 2021: London-based Subex launched augmented analytics platform HyperSense to support enterprises with AI in making faster decision making. HyperSense offers five studios, namely, data management, modeling, business intelligence, process automation, and artificial intelligence.

REPORT COVERAGE

An Infographic Representation of Augmented Analytics Market

To get information on various segments, share your queries with us

The report offers its readers a detailed analysis of the market. It highlights the major factors, including market players, solution/service types, and leading applications of the solutions. In addition, the report provides insights to businesses to make informed decisions and thus enhance customer experience. Along with these factors, the report also covers all recent developments and several factors that contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 113.43 billion by 2034.

In 2025, the market was valued at USD 15.26 billion.

The market is projected to grow at a CAGR of 24.20% during the forecast period.

The BFSI industry segment is expected to lead the market.

Digital transformation across industries to drive market growth.

QlikTech International AB, Salesforce Inc., IBM Corporation, Microsoft Corporation, Oracle Corporation, TIBCO Software Inc., and SAP SE are the top players in the market.

North America held the highest market with a share of 32.3% in 2025.

By enterprise type, small and medium enterprises are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic