Automotive Suspension System Market Size, Share & Industry Analysis, By System (Passive System, Active System, and Semi-active System), By Component (Shock Dampener, Struts, Control Arm, Ball Joint, Air Compressors, and Others), By Suspension Type (Hydraulic Suspension, Air Suspension, and Leaf Spring), By Vehicle Type (Passenger Cars and Others), and Regional Forecasts, 2026–2035

KEY MARKET INSIGHTS

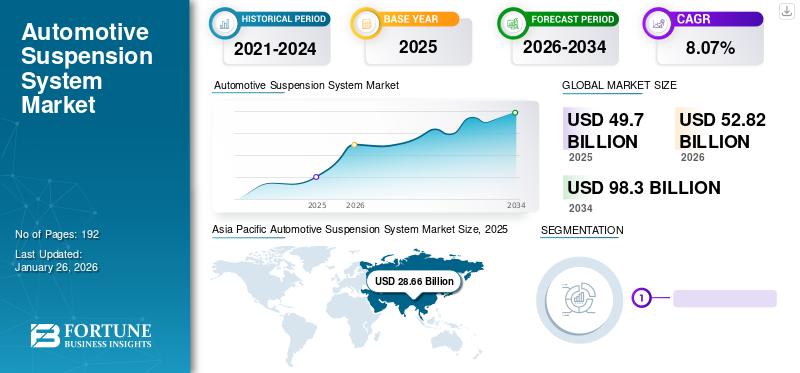

The global automotive suspension system market size was valued at USD 49.70 billion in 2025 and is projected to grow from USD 52.82 billion in 2026 to USD 107.12 billion by 2035, exhibiting a CAGR of 8.07% during the forecast period. Asia Pacific dominated the global market with a share of 57.66% in 2025.

An automotive suspension system comprises a mechanical system of springs or shock absorbers connecting the wheels and axles to the chassis of a wheeled vehicle. This system further allows the relative motion between the wheels and axles, thus absorbing the impact from varying road surfaces.

The surging demand for enhanced comfort and safer ride quality in vehicles is fueling the global market. Additionally, technological advancements in suspension systems concerning future mobility, electrification, and autonomous driving technology are expected to drive market growth. However, the high capital investment and suspension component costs and shortage of raw materials hamper market growth.

The COVID-19 pandemic affected the market, causing disruption in supply chains and leading to shortages of raw materials and components. Manufacturers witnessed increased production costs, due to increased cost of materials and operating while following the safety protocols issued for the prevention of outbreak of coronavirus. Major players shifted to growing e-commerce platform to generate sales and focused on developing suspension systems for electric & hybrid vehicles.

Automotive Suspension System Market Trends

Use of Advanced Lightweight Material to Further Support the Adoption and Trend of Electrification of Vehicles

One of the market trends in automotive suspension system is the increased use of advanced materials, such as carbon fiber and aluminum, to reduce the weight of the suspension and increase its efficiency. For instance, in February 2023, Elka Suspension tested a composite spring prototype for off-road vehicles at King of the Hammers 2023, which is an off-road racing event held in Johnson Valley, California, February 5-11, 2023. This technology was tested on Can-Am Maverick X3. Composite springs are up to 30% lighter than metal springs. For UTV, the composite springs could reduce the weight of the vehicle by 14 pounds. The composite ability to store energy per unit mass is also higher than steel.

The increasing adoption of air and active suspension systems has aided market growth during the forecast period. Dynamic suspension systems play a vital role in an electric vehicle, providing comfort and safety to the driver. Advanced sensors and control systems are used to improve system’s performance. Thus, the development of new suspension systems that are more energy-efficient, intelligent, and lightweight drives the market during the forecast period. For instance, an Electronically Controlled Active Suspension System (ECASS) has fewer moving parts and operates without fluid in the dampers. The system also generates power using linear electric motors and dampers, which benefits electric vehicles.

Download Free sample to learn more about this report.

Automotive Suspension System Market Growth Factors

Surge in Demand for Electric & Autonomous Vehicles to Propel Market Growth

Electric vehicles typically have a lower center of gravity than vehicles with internal combustion engines. This leads to improved handling and stability, which results in increased demand for advanced suspension systems that can further enhance the handling and performance of EVs. Additionally, using electric motors and battery packs in electric vehicles provides extra space under the hood, allowing for more innovative suspension designs.

Recently, a growing populace has been shifting toward adopting electric vehicles for efficient, clean, and sustainable environmental factors. This has created lucrative growth for the electric vehicle market, which drives the automotive suspension system market growth. Moreover, autonomous and connected cars require advanced systems to ensure smooth operation and improved safety. Autonomous cars need advanced sensors and cameras to navigate and communicate with other vehicles, which require stable and smooth systems to ensure accurate data collection. Connected cars, on the other hand, require a stable and smooth ride for passenger comfort and safety, as well to properly function in-car technologies such as infotainment systems. This propels the market during the forecast period.

In July 2023, ClearMotion signed a partnership with the BWI Group. The BWI Group specializes in automotive braking system and suspension system technology. Together, the companies developed ClearMotion1 (CM1) high-bandwidth active suspension system, which includes the damping technology of BWI and the intellectual property portfolio and the know-how of vehicle and hydraulic motor/pump control of ClearMotion.

Increasing Demand for SUVs to Drive the Market Growth

SUVs typically have higher ground clearance than sedans or hatchback vehicles. This means that SUVs require more robust suspension systems to handle off-road conditions and rugged terrain. This led manufacturers to invest in new suspension technologies and components to cater to the growing SUV market.

The growing preference of consumers toward luxury SUVs equipped with advanced features and ride comfort is fueling the demand for these systems. These vehicles also incorporate advanced suspension technologies such as air suspension and adaptive damping systems, increasing the market for these high-end suspension systems and fueling market growth. For instance, in September 2022, XPENG Inc. launched its 4th production of the model G9 flagship SUV in China. The G9 lineup comprises three series, each with a diverse driving range, and six configurations in total. These are the RWD 570G, RWD 570E, and RWD 702E; the 4WD Performance 650E and 650X; and the Launch Edition 650X.

RESTRAINING FACTORS

High Capital and Suspension Costs along with Shortage of Raw Materials Hamper Market Growth

The high capital investments in research and development make it difficult for companies to invest in technologies and innovate new products in the market. Additionally, the high cost of manufacturing and assembling advanced suspension systems limits the demand from consumers creating the issue of affordability. The high cost of these systems provides a barrier to the growth of this market. The high cost of suspensions increases the price of the vehicles. Moreover, the shortage of raw materials also leads to increased system costs and delayed production and supply chain disruptions, further hampering the market growth.

Automotive Suspension System Market Segmentation Analysis

By System Analysis

Passive System Segment to Hold Larger Share Backed by its Higher Adoption Rate in Numerous Vehicles

Based on system, the market is segmented into passive system, active system, and semi-active system. The passive system segment is expected to hold a major market share in 2023. The passive system segment dominates the market with a share of 86.10% in 2026, due to its higher integration rate in various automotive vehicles, such as passenger cars, commercial vehicles, and off-roading vehicles.

The active system segment is attributed to grow at the fastest CAGR during the forecast period. The continuous development of active suspension systems surpasses the popularity of passive suspension systems. Companies are enhancing the capabilities of active systems which fuels the development of the segmental market. Moreover, the demand for active suspension systems witnessed an increase in application in electric vehicles. Thus, as the demand for EVs grows, the demand for the segmental market also elevates. For instance, in December 2023, ClearMotion signed a contract with NIO. The contract includes the supply of active suspension technology for the ET9, a luxury sedan EV model of NIO. The contract covers the supply of suspension systems for around 750,000 cars.

By Component Analysis

Others Segment Holds Maximum Market Share and Drives the Market for Suspension System

Based on component, the market is categorized into shock dampener, struts, control arm, ball joint, air compressors, and others. In 2024, the others segment held a sizable market with a share of 31.93% in 2026. The others segment includes essential suspension system elements, including leaf springs, rubber bushings, and sway bars. The others segment also consists of struts, control arms, air compressors, and ball joints.

with a share of 31.93% in 2026

The struts segment is expected to grow significantly at the highest CAGR of 9.3% over the forecast period.

The shock dampener segment accounted for a market share of 21.7% in 2024. The growth is directly integrated with rising automotive sales worldwide, leading to a high demand for shock dampers from automotive OEMs and in the aftermarket.

To know how our report can help streamline your business, Speak to Analyst

By Suspension Type Analysis

Hydraulic Suspension Segment’s Growth Driven by High Demand from the Automotive Industry

Based on suspension type, the market is categorized into hydraulic suspension, air suspension, and leaf spring. In 2026, the hydraulic suspension segment commanded majority of the market with a share of 60.44% in 2026. The major players in the automotive industry are focused on introducing enhanced hydraulic suspensions for improved vehicle handling and smoother riding experience. Hydraulic suspension is most widely used in various vehicles, thus fueling the market growth.

Air suspension and leaf spring also had significant market shares in 2024. Leaf spring segment accounted for a high integration rate in commercial and off-roading vehicles, thus exhibiting their respective market shares. However, the growing demand for advanced suspension types in various upcoming electric and fossil-fueled vehicles drastically drives the air suspension segment during the forecast period.

By Vehicle Type Analysis

Growing Production Rate and Sale of Passenger Vehicles are Fueling Market Growth

Based on vehicle type, the market is categorized into passenger cars and others. Passenger cars segment holds the largest market with a share of 68.99% in 2026, and is the most dominant over the other segments. Passenger cars are the most widely produced and sold vehicle type. Thus, it accounts for majority of global automotive production and vehicle sales. According to OICA, in 2022, passenger cars production volume rose by 7.9% compared to the previous year 2021. The increase in production and sales of passenger cars leads to a rise in the market demand.

The others segment also accounted for a sensible market share in 2024. The others segment includes commercial vehicles, electric vehicles, and two-wheelers. The others segment is expected to grow significantly over the forecast period, with rising vehicle production.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Automotive Suspension System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest automotive suspension system market share in 2025. Asia Pacific dominated the global market in 2025, with a market size of USD 28.66 billion. The regional growth is attributed to the increased production rate of vehicles that occurred as part of the recovery from the pandemic in this region. Major key players in regions are focusing on developing innovative technologies further to strengthen the trend of electrification in the automotive industry. The growing demand for high-performance suspension kits in major countries, such as China, India, and Japan, further drives the market growth in Asia Pacific. The Japan market is projected to reach USD 4.87 billion by 2026, the China market is projected to reach USD 20.72 billion by 2026, and the India market is projected to reach USD 1.57 billion by 2026.

Europe

The Europe market accounted for a significant market share in 2025 and is expected to be the most demanding region for advanced suspension systems during the forecast period. Many countries are integrating stringent emission regulations to reduce carbon consumption and are switching toward sustainable mobility solutions. Moreover, the growing demand for electric vehicles and connected cars is driving the need for advanced suspension systems, thus propelling the automotive suspension system market in this region. The UK market is projected to reach USD 0.77 billion by 2026, and the Germany market is projected to reach USD 3.22 billion by 2026.

North America

North America also accounted for a substantial market share in 2025 and is the second most dominant region, followed by Asia Pacific. The growth is attributed to increasing demand for new advanced vehicles, particularly SUVs and trucks, which tend to have larger, more advanced suspension systems. This propels the market growth in the North America region. The U.S. market is projected to reach USD 8.02 billion by 2026.

The rest of the world

The rest of the world accounted for a decent market share in 2025 and is expected to grow level-headedly over the forecast period. The growth is attributed to the high demand for luxury vehicles in countries such as the UAE and Saudi Arabia. These luxury vehicles are equipped with high-performance, advanced suspension systems. Furthermore, increased tourism in these locations leads to increased demand for rental cars, which leads to increased demand for these systems and fuels market growth.

List of Key Companies in Automotive Suspension System Market

Companies are Focusing on Mergers & Acquisitions, and Partnerships to Gain Competitive Edge

Various regional and international automotive suspension system players consistently develop advanced strategies to take a leading step in the competitive landscape. Many companies are forming mergers & acquisitions and partnership and collaboration strategies to enable market growth. For instance, in February 2024, SAF-HOLLAND SE, a leading supplier of trailer and truck components, acquired Tecma Srl, which manufactures special axle systems and suspensions. Tecma Srl specializes in developing axle systems and suspensions for special vehicles and heavy-duty applications according to customer requirements.

List of Key Companies Profiled:

- KYB Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- ThyssenKrupp AG (Germany)

- Tenneco Inc. (U.S.)

- Continental AG (Germany)

- NHK Springs Co., Ltd. (Japan)

- Benteler International AG (Germany)

- HL Mando Corp. (South Korea)

- Sogefi Group (Italy)

- Marelli Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- In December 2022, Sono Motors unveiled Solar Powered Electric Vehicle, which is equipped by the MacPherson suspension type.

- In December 2022, Magnaflow Group acquired Camburg Engineering, a leading off-road and aftermarket suspension company. Camburg designed and distributed race-tested parts.

- In December 2022, Fleetpride acquired Keystone Spring Service. Keystone Spring Service offered specialized parts and services in suspension, wheel end, driveline, hydraulics, and truck parts based in Pittsburgh and Portersville.

- In August 2022, BMW, in collaboration with ZF, developed a carbon fiber suspension for the K 1600 GT Duolever. The lightweight material would help reduce weight and enable BMW to study the characteristics of its superbike, the M 1000 RR.

- August 2022 – Vibracoustic developed a cost-effective ride height and suspension leveling system. The system can allow car manufacturers to experience the height leveling benefits of an air suspension with less complexity and expense. Air suspensions are beneficial to electric vehicles, and developing a new system can help reduce the cost of electric vehicles. The system also helps increase the efficiency of electric vehicles allowing them to use a smaller battery pack and maintain the same range.

- July 2022 – Rheinmetall developed unique glass fiber suspensions spring. The new glass fiber-reinforced plastic springs provide a weight advantage in the unsprung mass of up to 75% compared to conventional steel coil springs, which is particularly suitable for range-optimized electric vehicles. Additional to the lower weight, the spring also provides maximum pitch and roll stability and high inherent damping of the material, assuring optimum noise, vibration and harshness characteristics. Another type of suspension spring is resistant to corrosion.

- In May 2022, Dexter Axle Company, Inc. acquired The Expediter, a premium supplier of wholesale trailer parts, braking systems, towing solutions, suspensions, and trailer electrical parts.

- In January 2022, Wheel Pros acquired Teraflex, which designs, manufactures, and distributes aftermarket suspensions, shocks, and other components for automotive and off-roading segment.

- April 2021 – KYB Corporation announced its expansion in the KADS application, an electronically controlled suspension system for snowmobiles. The electronic suspension system integrates core control and hydraulic technologies. The expanded system also includes attitude control technology that enhances the vehicle handling of snowmobiles.

REPORT COVERAGE

The research report provides a global market analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2035 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2035 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.07% from 2026 to 2035 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By System

|

|

By Component

|

|

|

By Suspension Type

|

|

|

By Vehicle Type

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights study, the market size stood at USD 49.70 billion in 2025.

The market is likely to grow at a CAGR of 8.07% over the forecast period (2026-2035).

The others segment is expected to lead the market due to the development of high-performance suspension systems.

Some of the top players in the market are KYB, ZF Friedrichshafen AG, and Tenneco Inc.

Asia Pacific dominated the market in terms of market size in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us