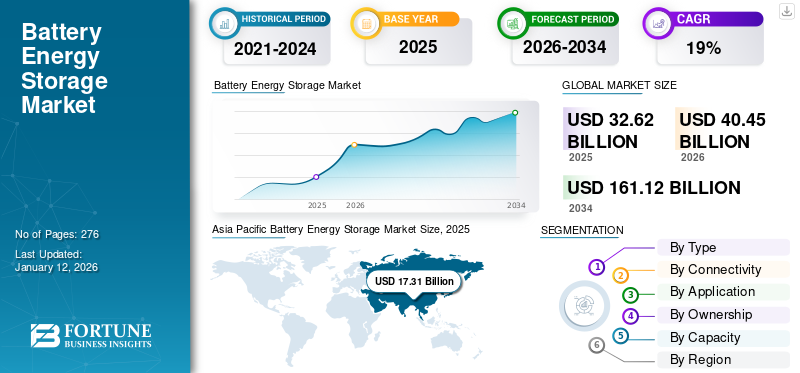

Battery Energy Storage Market Size, Share & Industry Analysis, By Type (Lithium-Ion Battery, Lead Acid Battery, Flow Battery, and Others), By Connectivity (Off-Grid and On-Grid), By Application (Residential, Non-Residential, Utility, and Others), By Ownership (Customer-Owned, Third-Party Owned, and Utility-Owned), By Capacity (Small Scale {Less than 1 MW} and Large Scale {Greater than 1 MW}), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global battery energy storage market size was valued at USD 32.62 billion in 2025 and is projected to be worth USD 40.45 billion in 2026 and is expected to reach USD 161.12 billion by 2034, exhibiting a CAGR of 18.86% during the forecast period. Asia Pacific dominated the battery energy storage market with a share of 34.29% in 2025.

Battery energy storage or BESS is a modern energy storage solution that stores energy using multiple battery technologies including li-ion for later use. Batteries receive energy from solar/wind or other energy sources and consequently stores the same in the form of current to later discharge it when needed. Energy is a fundamental necessity for carrying out day-to-day activities across private, commercial, industrial, and numerous different verticals. Different organizations and countries are constantly striving to secure agreements with stakeholders in the innovation system with the quickly expanding electricity demand in different sectors. Moreover, continually rising emissions of hazardous ozone-depleting Greenhouse Gases (GHG) have forced organizations to adopt low-carbon emission frameworks for energy generation. Subsequently, one such facet is significantly driving innovation is Battery Energy Storage Systems that use different battery chemistries to store energy to meet market demand.

Siemens is one of the major players in the market. The company provides cost-effective energy storage solutions which can be integrated with various renewable technologies for better applicability. Siemens offers BlueVault™ Storage solution for the marine and offshore market and SIESTART for utilities and T&D network operators. For industrial deployment, it offers a customized battery storage solution.

MARKET DYNAMICS

MARKET DRIVERS

Paradigm Shift Toward Low Carbon Energy Generation to Increase BESS Demand

The underlying shift toward lower gas emissions during power generation has fueled the adoption of cleaner alternatives, including renewable energy sources and battery energy storage systems. For instance, in April 2023, RWE Group decommissioned the Emsland nuclear power plant in Germany and invested heavily in battery energy storage projects. The company is working on a large-scale 220 MW BESS project in North Rhine-Westphalia and was expected to be commissioned in 2024.

The battery energy storage systems industry has witnessed a higher inflow of investments in the last few years and is expected to continue the same trend in the coming future. According to the International Energy Agency (IEA), investments in battery energy storage exceeded USD 20 billion in 2022. Moreover, rising investments combined with supportive government initiatives are likely to stimulate the adoption of battery energy storage systems across the globe. Recently, in September 2023, the Government of India approved the scheme of 'Viability Gap Funding' for the battery energy storage systems sector, with a target of raising 4000 MWh worth of BESS projects by 2031.

Rising Adoption of Grid-scale Energy Storage to Stimulate Market Growth

As the world shifts toward green energy production, the need for utility-scale energy storage is growing to balance power demand and power generation. In particular, lithium-ion batteries are very useful during peak loads and can replace gas-fired power plants. Moreover, energy transitions toward cleaner and more sustainable sources, such as solar and wind power, and the intermittency of these sources presents a challenge for maintaining grid stability and reliability. As a result, the amount of electricity they generate varies from zero to full capacity, depending upon conditions. Battery energy storage systems offer a solution by storing excess energy generated during periods of high renewable output and releasing it during times of high demand or low generation.

Moreover, battery energy storage systems allow a high level of integration with renewable energy systems into existing power systems, enabling higher infiltration of renewables and supporting the transition toward green energy infrastructure. As a result, the demand for battery energy storage solutions is expected to continue growing, driven by the need to optimize renewable energy utilization, enhance grid flexibility, and accelerate the transition toward a sustainable energy future. Apart from that, considering current trends and technological advancement, battery technologies are likely to evolve and witness further developments in energy density, cost reduction, and safety configurations. This is likely to promote the battery energy systems in developing economies such as India, Brazil, and Mexico, among others, where the BESS market is at the nascent stage.

Download Free sample to learn more about this report.

MARKET OPPORTUNITIES

Increasing Energy Demand Across Globe to Create Lucrative Opportunities

The exponential demand for energy resources across developing and developed countries, combined with expanding measures to guarantee energy security, is set to push the market growth. Furthermore, advancements in the rising integration of new power generation technologies and revamping existing foundations have increased the requirement for new grid systems with effective backup and peak load characteristics. For example, in June 2020, National Thermal Power Corporation (NTPC) Limited, an India-based free power maker (IPP), announced its arrangements to convey around 1 GWh BESS across the principal matrix scale age offices.

MARKET CHALLENGES

Raw Material Supply Chain Issues Raises a Challenge Across the Market

Supply chain problems related to raw materials pose a significant obstacle for the Battery Energy Storage System (BESS) market, especially for lithium-ion batteries that depend on rare earth elements such as lithium, cobalt, and nickel. The availability of these materials is frequently limited by geopolitical issues, environmental considerations, and mining difficulties. Similarly, the global need for lithium, fueled by electric vehicles and energy storage systems, has created supply shortages, increasing price instability. These supply chain problems can result in increased production expenses for battery producers, subsequently raising the costs of BESS solutions and limiting widespread adoption.

MARKET RESTRAINTS

Excessive Initial Investments May Hinder Market Pace

The higher initial cost is the primary restraining factor for the battery energy storage market growth. These systems are predominantly utilized in large-scale plants to meet energy demands during peak loads. For instance, according to the Energy Sector Management Assistance Program (ESMAP), administered by the World Bank, the total installed cost of various energy storage technologies can fluctuate significantly. This range spans from slightly over USD 2,000 per kW to approximately USD 3,300 per kW, impacting initial capital investments.

However, ongoing research and development efforts aimed at enhancing battery performance characteristics while reducing the capital required for new systems are expected to lower battery costs and offset market growth constraints during the forecast period. According to the International Renewable Energy Agency (IRENA), the total installed cost is likely to decline by 50% and battery cell cost by even more than 60% (as compared to prices recorded in 2016) by 2030. This reduction is attributed to the optimization of manufacturing facilities, combined with better combinations and reduced use of materials.

BATTERY ENERGY STORAGE MARKET TRENDS

Investment in Designing and Manufacturing of BESS Devices to Play a Significant Role in Industry Dynamics

Various industry players are ceaselessly endeavoring to start new natural and inorganic extensions to boost their product acceptability across the globe. Similarly, various players are presenting new and advanced BESS units to keep up with the growth across the business. For example, in March 2021, Tesvolt, a German storage system manufacturer, launched a technologically advanced product line, TS-I HV 80 battery, for the most part, created to shave load peaks and comply with the demand from business and modern clients.

IMPACT OF COVID-19

The global COVID-19 pandemic was unprecedented and staggering, with battery energy storage systems experiencing higher-than-anticipated demand across all regions compared to pre-pandemic levels.

COVID-19 had a negative impact on the battery energy storage market as the pandemic hampered consumption in many end-use industries due to supply chain disruption of services, technology and hindrance in activities due to social distancing norms. The energy demand dropped initially during the pandemic as industrial and commercial activities slowed down. However, with increasing reliance on renewable energy and the push for electrification post-pandemic, energy storage is expected to play a critical role in meeting demand.

The global outbreak of COVID-19 affected different countries across the globe. A worldwide crisis, such as the COVID-19 pandemic, has altogether impacted other businesses and modern tasks globally. However, the national administrations have set significant targets to move the 'green wave' brought about by interferences of industrial processes leaning toward the industry landscape. Moreover, various state governments' supportive economic stimulus packages combined with industry players' persistent endeavors set to boost the interest for BESS units. For example, during the pandemic in August 2020, ABB announced to combine efforts with Zenobē Energy Limited, a BESS producer, to give an advanced traction power solution for the U.K. railroads. The association plans to manufacture a 25 kilovolt (kV) rail traction power system framework to convey yield by converting power from batteries to proceed with a continuous power supply to trains.

SEGMENTATION ANALYSIS

By Type

Increasing Deployment of Lithium-ion Battery is leading to the Dominance of the Segment

Based on type, the market is categorized into lithium-ion battery, lead acid battery, flow battery, and others.

The lithium-ion battery segment is projected to lead the industry and is anticipated to hold a significant share of the global market during the forecast period. Increasing deployment of new large-capacity grid infrastructure, along with continuous advancements in Li-Ion BESS products, will drive the segment’s growth. The segment capture 99.33% of the market share in 2025.

Demand for lead-acid batteries will be fostered by the transportation sector slated to grow exponentially at the end of 2029 due to increasing hybridization of vehicle fleets and their safe and reliable operations in rechargeable systems. The segment is set to grow with a considerable CAGR of 7.72% during the forecast period (2025-2032).

Furthermore, various companies are investing in expanding operational capabilities of different types, such as Vanadium Redox (VRB) flow batteries, to cater to the increasing need across numerous applications.

To know how our report can help streamline your business, Speak to Analyst

By Connectivity

Off-Grid to Lead Owing to Continuous Launch of BESS Expansion Projects

The market is bifurcated into off-grid and on-grid based on connectivity. The off-grid segment dominated the market in 2024 and is expected to continue the same trend during the forecast period. Continuous launch of BESS expansion projects by various large and small scale utility companies is set to favor the off-grid BESS market size. The segment is poised to hold 61.68% of the market share in 2026.

The growing setup of vast electricity networks by public and private utility companies and increasing investments to revolutionize the grid infrastructure are set to favor the on-grid scenario. The on-grid segment is likely to grow with a substantial CAGR of 18.52% during the forecast period (2025-2032).

By Application

Utility Segment is backed by Growing Grid Expansion Plans and Large Power Generation Facilities

By application, the market is segmented into residential, non-residential, utility, and others.

The utility segment is projected to account for the leading share in the industry due to increasing electrification initiatives to power distant and remote locations. The segment captured 46.28% of the market share in 2025.

Clear directives to boost the integration of storage devices across solar power technologies coupled with rapidly expanding residential solar power installation are set to favor the residential segment size.

Furthermore, the non-residential segment is anticipated to grow steadily due to the setup of new advanced commercial & industrial infrastructures coupled with increasing demand for energy security across the verticals.

By Ownership

Rise in Government Investments is driving the Growth of Utility-Owned Segment

The market is trifurcated into customer-owned, third-party owned, and utility-owned based on ownership.

The utility-owned segment held the largest battery energy storage market share in the global market in 2024. The rise in investment from the government & non-government utility companies will propel the demand for utility-owned BESS units in the coming years. The segment is estimated to gain 46.53% of the market share in 2026.

The third-party-owned segment’s growth is backed by continuous partnerships by different players to establish BESS networks, especially across low-income areas.

The presence of different solutions providers & manufacturers of compact & small renewable energy systems in the region is expected to favor the customer-owned segment. This segment is predicted to grow with a substantial CAGR of 21.26% during the forecast period (2025-2032).

By Capacity

Large Scale Segment to Dominate the Market Owing to Higher Adoption of BESS Technology

Based on capacity, the market is predominantly bifurcated into small scale (less than 1 MW) and large scale (greater than 1 MW).

The large scale segment is projected to hold the major share of 69.93% in 2025, owing to the significant usage of advanced technologies to simulate the operational capabilities of the grid networks mandated by regional regulatory policies.

The small scale segment is likely to register a considerable CAGR of 18.60% during the forecast period (2025-2032).

BATTERY ENERGY STORAGE MARKET REGIONAL OUTLOOK

Based on geography, the battery energy storage systems market is segmented into Europe, North America, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Battery Energy Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific’s Market Growth is Supported by Growing Energy Needs

The Asia Pacific was the leading BESS market in the world with a valuation of USD 9.53 billion in 2023 and USD 17.31 billion in 2025 and is likely to continue the same trend during the forecast period. Expanding electrification goals to power remote areas such as villages and small towns, coupled with significant grid enhancement efforts in Japan, Australia, South Korea, and India, is expected to boost the demand for battery energy storage systems dramatically. A sudden rise in overall energy needs to support the fast-changing residential, commercial, and industrial sectors is expected to enhance the adoption of dependable backup and peak power sources, leading to increased demand for BESS installations. South Korea is projected to reach a market value of USD 0.91 billion in 2025, while Japan is poised to be worth USD 0.67 billion in the same year.

China's Dominance over Critical Minerals to Support Market Expansion

The leading country, China, is attributed to the greater adoption of battery energy storage systems. China has been the major source of lithium cells in the world. Hence, Chinese battery manufacturers hold around 80% of the battery cell market, and most of the remaining 20% of the companies rely on the lithium-ion cell components provided by Chinese companies. Moreover, China controls the majority of critical minerals required for battery cell manufacturing. Based on these factors, China dominates the global market by a huge margin and is expected to continue the same trend in the coming years. China is expected to grow with a value of USD 18.94 billion in 2026.

North America

Rising Adoption of BESS to Foster Market Growth

North America is the second leading region estimated to stand at USD 14.23 billion in 2026, exhibiting a CAGR of 16.31% during the forecast period (2025-2032). The North America battery energy storage market is likely to witness significant growth during the forecast period owing to the rising adoption of BESS in the U.S. As China controls the lithium-ion supply chain, the U.S. is engaged in the research and development of alternatives to lithium-based batteries, ultimately supporting the growth of the market. The U.S. market is set to reach a market value of USD 13.76 billion in 2026.

Europe

Supportive Government Policies to Boost Europe’s Market Expansion

Europe is the third largest market set to be valued at USD 4.73 billion in 2026. The Europe market growth benefits from the substantial deployment of various power generation technologies, complemented by supportive governmental and organizational policies that promote the adoption of green energy solutions across various sectors. The U.K. market continues to grow, projected to reach a market value of USD 2.49 billion in 2026. Furthermore, growing investments and initiatives aimed at enhancing and strengthening the grid infrastructure networks to accommodate the rising renewable energy installations are expected to drive the industry's growth further. Germany is anticipated to be worth USD 1.97 billion in 2026, while Italy is estimated to reach USD 0.13 billion in 2025.

U.K

Rising Investment in Battery Energy Storage Systems to Drive Market Growth

The U.K is the front-runner in the Europe market, while Germany is likely to be the fastest-growing market for BESS. It is attributed to the rising investment in battery energy storage systems in these countries. For instance, in July 2023, Eco Stor, a System integrator, announced the plan to build a 300MW/600MWh energy storage system in Germany, one of the largest BESS projects across Europe. Regional market growth is also supported by growing investments in the expansion and modernization of grid infrastructure networks combined with energy security policies, stimulating demand for battery energy storage systems.

Rest of the World

Increasing Demand from Growing Economies to Support Market Growth

The rest of the world is the fourth largest region predicted to grow with a value of USD 0.14 billion in 2025. South Africa, Brazil, Mexico, Saudi Arabia, the United Arab Emirates (UAE), and several other countries have showcased notable prospects for implementing BESS projects of various scales. The rising frequency of power outages caused by grid instability, combined with the swift increase in energy demand, is poised to drive investments in the implementation of advanced and dependable technologies to address the gap, benefiting the global battery energy storage market size.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Advanced Energy Storage Systems to enhance their Position in the Industry

The global battery energy storage market comprises few largest players and a significant number of other players delivering a wide range of products & solutions to bolster their position. Also, the market comprises several small & medium-scale system integrators.

LG Energy, a branch of LG's chemical company, is among the world's leading battery energy storage system providers. Recently, in January 2024, the company unveiled ten grid-scale battery storage projects lined up for 2024.

Additionally, Samsung SDI, Total, Hitachi, and GE are among the leading players delivering numerous types of advanced energy storage battery systems & solutions. These participants also concentrate on R&D activities to extend their product reach across different applications and grasp new contracts with large-capacity projects.

LIST OF KEY BATTERY ENERGY STORAGE COMPANIES PROFILED

- GE (U.S.)

- ABB (Switzerland)

- Samsung SDI (South Korea)

- Hitachi Chemical Co., Ltd. (Japan)

- Siemens Energy (Germany)

- Total (France)

- LG Energy Solution (South Korea)

- Fluence (U.S.)

- Narada (China)

- VRB Energy (Canada)

- Kokam (South Korea)

- EVE Energy Co., Ltd. (China)

- Black & Veatch (U.S.)

- Hitachi Energy (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- February 2024 – LG Energy Solution agreed with WesCEF to expand and strengthen its lithium supply chain for competitive procurement. As per the agreement, WesCEF is poised to supply up to 85,000 tons of lithium concentrate, a crucial raw material for cathodes.

- January 2024 – Spearmint Energy announced the completion of the 300-megawatt Revolution BESS project. The Electric Reliability Council of Texas will be responsible for managing, distributing, and marketing the power.

- August 2023 – ENGIE announced an agreement to acquire Broad Reach Power, the company that specializes in battery storage and operates 350 MW worth of capacity along with 880 MW worth of additional capacity expected to be commissioned by 2024.

- February 2022 – LG Energy Solution announced the completion of its acquisition of NEC Energy Solutions, a U.S.-based grid-battery integrator. This acquisition will help LG Energy Solution to merge energy storage system integration with battery manufacturing vertically.

- December 2021 – TotalEnergies completed the construction of a battery-based energy storage facility in Dunkirk, France. The facility has a capacity of 61 MW and a total storage capacity of 61 megawatt-hours (MWh). The project was chosen as part of the long-term plan rolled out by the French Electricity Transmission Network (RTE) in February 2020. The commissioning of the site is believed to be a breakthrough in the growth of TotalEnergies' battery energy storage capabilities.

REPORT COVERAGE

The research report offers a qualitative and quantitative in-depth analysis of the global industry. It further provides details on the adoption of BESS systems across several regions. The report provides a detailed competitive landscape by presenting information on key players and their strategies in the market. Information on trends, drivers, opportunities, threats, and market restraints can further help stakeholders gain valuable insights into the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.86% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (MW) |

|

Segmentation |

By Type, Connectivity, Application, Ownership, Capacity, and Region |

|

Segmentation |

By Type

|

|

By Connectivity

|

|

|

By Application

|

|

|

By Ownership

|

|

|

By Capacity

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 32.62 billion in 2025 and is projected to reach USD 40.45 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 32.62 billion.

At a CAGR of 18.86%, the market is projected to exhibit staggering growth during the forecast period (2026-2034).

The lithium-ion type segment is anticipated to hold the significant share in this market during the forecast period.

The paradigm shift toward low carbon energy generation and rising peak energy demand coupled with a favorable policy framework are some of the major factors driving the market growth.

Siemens Energy, ABB, Fluence, Total, Samsung SDI, and GE are the key players operating across the industry.

Asia Pacific dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us