Home / Healthcare / Medical Device / Bio-Sensors Market

Biosensors Market Size, Share & Industry Analysis, By Type (Electrochemical Biosensors, Optical Sensors, Piezoelectric Sensors, and Others), By Application (Clinical Diagnostics [Glucose Monitoring, Infectious Disease Screening, Pregnancy & Fertility Testing, and Others], Health Monitoring [Vital Signs Monitoring, and Activity Tracking], and Others), By End User (Medical Device Companies, Contract Development and Manufacturing Organizations (CDMOs), and Others), and Regional Forecast, 2025-2032

Report Format: PDF | Published Date: Mar, 2025 | Report ID: FBI100146 | Status : PublishedThe global biosensors market size was valued at USD 27.40 billion in 2024 and is projected to grow from USD 29.88 billion in 2025 to USD 55.78 billion by 2032, exhibiting a CAGR of 9.3% during the forecast period. North American dominated the biosensors market with a market share of 44.77% in 2024.

Biosensors are analytical instruments that convert biological reactions from cells, tissues, organisms, and enzymes into electrical signals to detect target chemicals or analytes. A typical biosensor consists of a bioreceptor that recognizes explicitly the analyte and a transducer that converts the bio-recognition event into a measurable signal. These small instruments are used in multidisciplinary applications such as medical applications, agriculture, environmental monitoring, food control, and biomedical research.

The incidence of chronic disorders such as diabetes and cardiovascular diseases is growing across the globe. The surge in prevalence has increased the demand for medical devices in the diagnosis of the underlying disease among the population across hospitals and clinical settings. Additionally, an increase in the presence of diagnostic devices equipped with biosensors aids in rapid, accurate, and pain-free diagnosis of diseases among patients, which boosts the growth of the market. Moreover, the rise in collaborations among semiconductor and medical device companies to develop such devices with sensor platforms to achieve high-precision detection across several applications further propels the growth of the global market.

- For instance, in September 2020, Abbott introduced the Libre Sense glucose sport biosensor for athletes to continuously measure glucose levels, enhancing their understanding of the correlation between glucose levels and athletic performance.

The COVID-19 pandemic spurred market growth in 2020, prompting a shift from laboratory-based diagnostics to point-of-care diagnostics across health settings and home care, accelerating the adoption of these products among industry players. The rise in at-home/self-testing during the post-pandemic time and the high demand for biosensors-enabled products in home settings further augmented the market growth in 2021.

Biosensors Market Trends

Increasing Device Deployment for Diabetes Monitoring

The prevalence of diabetes and associated complications is rising among the population across the globe. Owing to the high prevalence, the demand for early disease diagnosis and monitoring is increasing among the population. Biosensors aid in accurate diabetes diagnosis and monitoring for efficient treatment and management among diabetic patients due to their potential advantages, such as accurate estimation of insulin sensitivity, cost-effectiveness, and user-friendliness.

- According to an article published by MDPI in 2023, the conventional laboratory analytical techniques for insulin detection are time-consuming, expensive, and lack real-time monitoring capability, as compared to offering point-of-care tests and continuous monitoring by these products.

Thus, the rising emphasis on R&D by industry players aiming toward continuous insulin-monitoring biosensors in combination with existing glucose biosensors is expected to propel the adoption of these products in the market. Moreover, the increasing adoption of electrochemical-based continuous glucose monitoring (CGM) devices among patients is further augmenting the growth of the market.

- According to a second-quarter report published by Abbott in July 2021, the FreeStyle Libre, an integrated continuous glucose monitoring (iCGM) system, is used by more than 3.0 million population worldwide.

Biosensors Market Growth Factors

Rising Technological Advancements in Biosensors by Market Players to Propel Market Growth

The demand for innovative analytical devices such as biosensors is increasing across several fields, such as drug discovery, health monitoring, and medical diagnostics, among others. Thus, recent changes in biological techniques and instrumentation involving fluorescence tags and nanomaterials have increased the sensitive limit of these products. For instance, graphene and graphene-based nanomaterials provide tools to develop innovative products over classical techniques such as polymerase chain reaction, DNA microarrays, and ELISA.

- In January 2022, IDENTIFYSENSORS developed a biosensor-based SARS-CoV-2 test that relies on graphene sensors and electric currents that can be economically mass-produced while returning results with approximately 96.0% sensitivity.

Moreover, the rising shift in the use of these products across diverse applications such as drug substance abuse tests, cancer diagnostic tests, and medical research has further augmented technological advancements in existing biosensor components. Additionally, an increase in the number of clinical studies with the use of advanced technologies, such as fiber-optic chemical sensors for drug discovery and biomedicine research, boosts the adoption of these products in advanced devices.

RESTRAINING FACTORS

Limitations Associated with the Use of Biosensors to Hamper the Product Adoption

Biosensors employing emerging techniques offer potential advantages such as ultra-sensitivity, high selectivity toward the detection of multiple analytes, and compact size. However, certain limitations related to the stability of these products limit their adoption across healthcare settings. Similarly, high costs associated with the production of some advanced products have further restrained their commercialization by medical device enterprises.

- For instance, according to an article published by NCBI in June 2020, biorecognition elements in electrochemical products provide reliability and good analytical performance. However, they have certain disadvantages, such as short lifetime and low levels of stability.

Moreover, the limited lifespan of these products due to device degradation, sensor drift, and the requirement for component replacements are expected to hamper their potential adoption across several industries, thus limiting the biosensors market growth during the forecast period.

Biosensors Market Segmentation Analysis

By Type Analysis

Electrochemical Biosensors Segment Dominated owing to High Adoption of Glucose Monitoring Devices Across Healthcare Settings

Based on type, the market is segmented into electrochemical biosensors, optical sensors, piezoelectric sensors, and others.

The electrochemical biosensors segment accounted for the highest share in 2024. The share was attributed to the high adoption of glucose monitoring devices containing electrochemical sensors across hospitals and other health settings. Moreover, the rising introduction and adoption of this technology in point-of-care applications, such as diabetes monitoring across homecare settings, further propels the segment share.

- As per data published by the University of Alabama at Birmingham in March 2023, about 2.4 million people in the diabetic population of the U.S. use a continuous glucose monitor.

- In April 2021, Medtronic announced the U.S. Food and Drug Administration (FDA) approval of its MiniMed 780G system with the Guardian 4 sensor to provide sensor glucose values.

The optical segment is projected to grow at the fastest CAGR over the forecast period. This is due to the increasing focus of industry players on offering advanced ultrasensitive sensors to meet the growing demand for early detection and monitoring of various non-communicable diseases such as cancer. Moreover, the rising adoption of optical sensors across research laboratories for the detection and quantification of pathogens/ biomarkers in biological fluids for diagnostic applications will further propel segment growth.

By Application Analysis

Surge in Clinical Diagnostic Tests Among Global Population Propelled Clinical Diagnostics Segment Growth

Based on application, the market is segmented into clinical diagnostics, health monitoring, and others.

The clinical diagnostics segment accounted for the highest market share in 2024. The highest share was attributable to an increase in the number of point-of-care tests across the globe and the increasing adoption of technology in disposable point-of-care devices or continuous monitoring of implantable devices.

- According to data published by the Association for Diagnostics & Laboratory Medicine in May 2020, there were more than 100 POC tests available in the U.S.

By End User Analysis

Extensive Product Collaborations Among Medical Device Companies Drove Medical Device Companies Segment Growth

On the basis of end user, the market is segmented into medical device companies, contract development and manufacturing organizations (CDMOs), and others.

The medical device companies segment held a dominant share of the market in 2024. This was owing to the rise in initiatives of industry players on the production of advanced biosensor products for several applications such as clinical diagnostics and home healthcare, among others. Moreover, the increase in demand for biosensor devices across healthcare settings further propelled the segment share in the global market.

- In November 2023, DuPont announced that DuPont Liveo Healthcare Solutions entered into collaboration with STMicroelectronics to develop a new smart wearable device concept for remote biosignal monitoring.

The contract development and manufacturing organizations (CDMOs) segment is likely to depict the highest CAGR during 2025-2032. The growth is due to the rise in strategic initiatives among manufacturing organizations and research institutes. This growth is attributed to the R&D of technologically advanced products across developed economies, along with the increased production of medical by CDMOs.

- According to an article published by The White House in January 2022, the U.S. government distributed one million at-home, rapid COVID-19 tests among the population to expand their testing capacity and increase access to home testing.

REGIONAL INSIGHTS

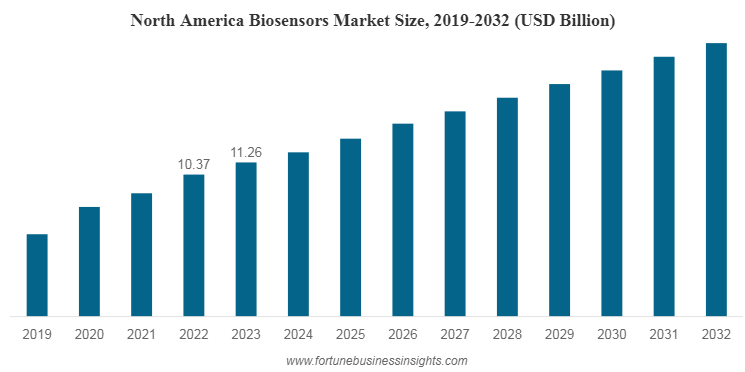

Rising Launch of Biosensor-Embedded Devices to Augment North America Market Growth

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The North America market was valued at USD 12.24 billion in 2024 and is anticipated to dominate the global market during the forecast period. The industry expansion is driven by the rising introduction of new technologies by key players to facilitate patient screening for chronic disorders. Moreover, increasing collaborations among manufacturing players and rising approvals of new products further boosted the North American market.

- In December 2022, Dexcom, Inc. announced the launch of the Dexcom G7 continuous glucose monitoring system in the U.S.

Europe region accounted for a considerable share of the global market. The Europe market held a significant share due to the rising awareness regarding cancer and prenatal screening among the population. Moreover, several research institutes in the Europe region are collaborating to enhance biosensor R&D, thereby stimulating industry growth over the forecast period.

- According to an article published by the University of Cambridge in May 2023, the Engineering & Physical Sciences Research Council granted USD 10.12 million to the Ubiquitous Optical Healthcare Technologies (UbOHT) project in the U.K. The project would develop 'BioSensors 2.0, ' new sensors that are low-cost and help medical professionals monitor, prevent, and manage diseases better.

The rising prevalence of chronic diseases such as diabetes and cancer among the population drives the market growth in Asia Pacific. The region is anticipated to exhibit the highest CAGR over the forecast timeframe due to the increasing demand for point-of-care diagnostics across health settings. The rise in the number of diagnostic tests is expected to increase the adoption of biosensor-based devices across the globe, further propelling the market from 2024 to 2032.

- According to the International Diabetes Federation (IDF) estimates, in 2021, more than 90.0 million of the Southeast Asia population between the ages of 20 and 79 years suffered from diabetes, and the number is expected to grow to 113.0 million in 2030.

The Latin America market is anticipated to grow at a considerable pace over the forecast period. The growth is due to the rising prevalence of chronic disease amongst the population and the high demand for infectious disease screening across hospitals and pathology laboratories.

The Middle East & Africa is expected to grow at a moderate CAGR owing to the rising awareness of disease diagnosis and monitoring at home settings among the population.

Key Industry Players in Biosensors Market

Key Players are Forging Patnerships to Boost Their Market Share

The industry is majorly dominated by prominent manufacturers such as Abbott, Medtronic, F. Hoffmann-La Roche Ltd, and other prominent players. These market players are focusing on accelerating biosensor-based device production and forging collaborating with emerging players, further augmenting their global biosensors market share.

- In March 2022, Rockley Photonics Holdings Limited, a pioneer in photonics-based health monitoring, entered into a development partnership with Medtronic. The two companies planned to collaborate to bring Rockley’s Bioptx biomarker sensing platform into Medtronic’s solutions for use across various healthcare sectors.

Other major players operating in the market, such as Universal Biosensors, Inc., DuPont, Biosensors International Group, Ltd., and others, are focusing on advanced product launches across several applications, such as healthcare and veterinary diagnostics and environmental sensing, among others. Such initiatives by key players are projected to propel the global market over the forecast period.

- In 2022, Universal Biosensors, Inc., launched Xprecia Prime, the next-generation blood coagulation analyzer in the European Union and the U.K.

Such continuous engagement in the launch of diagnostic tests by several market players and a rising focus on collaborations with other manufacturers to establish their footprints in biosensor-enabled devices will further propel the market expansion.

LIST OF TOP BIOSENSORS COMPANIES:

- Abbott (U.S.)

- Medtronic (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Universal Biosensors (Australia)

- DuPont (U.S.)

- Biosensors International Group, Ltd. (Singapore)

- Bio-Rad Laboratories Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- LifeScan IP Holdings, LLC (U.S.)

- Molecular Devices, LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: University of Missouri researchers developed an innovative method using nanopores to help scientists advance their discoveries in neuroscience, other medical applications using medical biosensors.

- February 2023: Northwestern University developed an accurate, low-cost, and easy-to-use test for detecting toxic levels of fluoride in water. The test is a biosensor that employs RNA, DNA, and protein transcription to produce a signal when a target contaminant is detected.

- February 2023: Miltenyi Biotec acquired Lino Biotech AG. Lino Biotech is a pioneer in developing new biosensors to facilitate quality control in bioprocessing, measuring viral load in cell & gene therapy manufacturing, and testing for off-target responses in living cells to support drug discovery.

- January 2023: Intricon Corporation, a developer and manufacturer of medical devices powered by smart miniaturized electronics, launched a new Biosensors Center of Excellence (CoE). Thi center is focused exclusively on bringing biosensor devices into the medical market.

- December 2022: - Nix Sensor Ltd. launched the Nix Hydration Biosensor. It is the first-ever consumer biosensor to analyze sweat and provide athletes with personalized hydration data, scientifically validated and delivered in real-time.

REPORT COVERAGE

The global report provides a detailed market analysis and focuses on crucial aspects such as leading players, product types, and major indications of the product. Additionally, it offers insights into market trends, key industry developments such as mergers, partnerships, acquisitions, and the impact of COVID-19 on the market. In addition to the factors mentioned above, the report includes the factors that have contributed to the market growth in recent years with a regional analysis of different segments.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2024 |

Estimated Year |

2025 |

Forecast Period |

2025-2032 |

Historical Period |

2019-2023 |

Unit |

Value (USD Billion) |

Growth Rate |

CAGR of 9.3% from 2025-2032 |

Segmentation |

By Type

|

By Application

|

|

By End User

|

|

By Region

|

Frequently Asked Questions

How much will be the global biosensors market worth during the forecast period?

Fortune Business Insights says that the global market is projected to grow from USD 29.88 billion in 2025 to USD 55.78 billion by 2032.

At what CAGR is the biosensors market projected to grow during the forecast period (2025-2032)?

Registering a CAGR of 9.3%, the market will exhibit steady growth over the forecast period.

Which was the leading segment by type in the market in 2024?

By type, the electrochemical segment led the market in 2024.

What are the key factors driving the market?

The rising prevalence of chronic diseases and the increasing R&D for technologically advanced products across the globe are the key factors driving the market growth.

Who are the top players in this market?

Medtronic, F. Hoffmann-La Roche Ltd., and Abbott are major players in the global market.

- Global

- 2024

- 2019-2023

- 162