C-Reactive Protein Testing Market Size, Share & Industry Analysis, By Product (Reagent & Kits and Instruments), By Assay Type (Chemiluminescence Immunoassay (CLIA), Enzyme-Linked Immunosorbent Assay (ELISA), Immunoturbidimetric Assay, and Others), By Detection Range (Conventional CRP and hs-CRP), By Setting (Laboratory Testing and Point-of-Care (POC) Testing), By End User (Hospitals & Clinics, Diagnostic Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

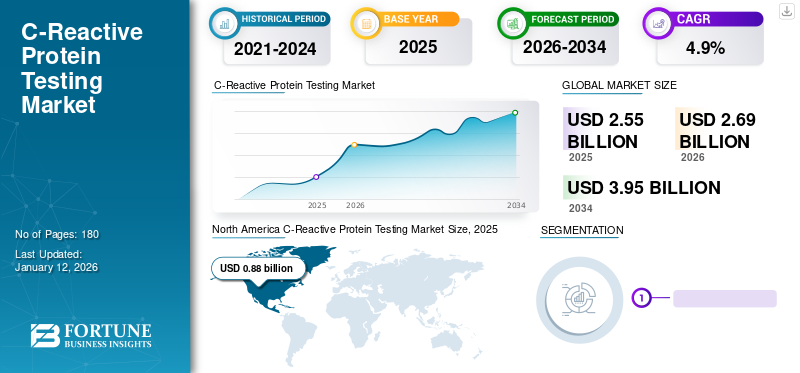

The global C-reactive protein testing market size was valued at USD 2.55 billion in 2025 and is projected to grow from USD 2.69 billion in 2026 to USD 3.95 billion by 2034, exhibiting a CAGR of 4.9% during the forecast period. North america dominated the c-reactive protein testing market with a market share of 34.5% in 2025.

C-reactive protein is considered a non-specific marker of inflammation. It plays an important role in predicting the risk of an individual suffering from a heart attack and stroke. Additionally, the level of C-reactive protein in the blood helps in the diagnosis of various chronic diseases, such as cancer, cardiovascular diseases, rheumatoid arthritis, and others.

The key factors driving the growth of the market include the rising prevalence of chronic diseases and increased usage of these tests during the COVID-19 pandemic. Additionally, increasing importance of C-reactive protein point-of-care tests while using antibiotics in primary care settings is also anticipated to drive the C-reactive protein testing market growth in future.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in October 2022, the number of adults aged 20 years and older suffering from Coronary Artery Disease (CAD) in the U.S. had reached 20.1 million. Furthermore, it was stated that an estimated 805,000 people in the U.S. suffer from a heart attack every year.

Thus, the increasing prevalence of cardiovascular diseases, cancer, autoimmune diseases, and others has raised the adoption and demand for C-reactive protein (CRP) test, in turn, driving the market growth during the forecast period. Furthermore, increasing focus of key players in the research and development of technologically advanced instruments and kits, such as point of care products for C-reactive protein testing is also expected to propel the market growth.

C-Reactive Protein Testing Industry Landscape Overview

Market Size & Forecast

- 2025 Market Size: USD 2.55 billion

- 2026 Market Size: USD 2.69 billion

- 2034 Forecast Market Size: USD 3.95 billion

- CAGR: 4.9% from 2026–2034

Market Share

- By Product: Reagents & Kits accounted for the largest share in 2026, driven by the increasing number of diagnostic tests and strong presence of CRP testing solutions offered by key players like Abbott and LumiraDx.

Key Country Highlights

- United States: Market growth is supported by a high burden of cardiovascular diseases (805,000 heart attacks annually), increasing preference for CRP point-of-care tests, and government initiatives such as CDC guidelines promoting CRP testing for risk prediction.

- Germany & U.K. (Europe): The presence of a supportive regulatory framework, frequent use of CRP testing in autoimmune diseases, and CE-approved product launches drive the market. Use of CRP testing in psoriatic arthritis and cardiovascular risk management is increasing.

- China & India (Asia Pacific): Rapid growth is driven by the high burden of chronic and infectious diseases, increased adoption of CRP tests in community health programs, and initiatives like FIND-SD Biosensor partnerships to expand access to CRP-malaria combo RDTs.

- Brazil & Mexico (Latin America): Market expansion is supported by efforts to improve healthcare infrastructure and growing use of rapid diagnostic tests in public health clinics.

COVID-19 IMPACT

High Usage of these Diagnostics in Determining Severity of Inflammation Propelled Market Development During Pandemic

The impact of COVID-19 pandemic on the C-reactive protein market growth was positive. The market witnessed a strong demand for products and services for CRP testing during the COVID-19 pandemic. In addition, several research studies were conducted to understand the role of C - reactive protein in terms of COVID-19 infection.

- For instance, according to an article published in the International Journal of Epidemiology in March 2021, the levels of CRP can be used by clinicians as an early indicator for treatment decisions, enhanced observation, and advanced care planning.

Furthermore, several regulatory bodies were also in support of the usage of these tests as a marker for COVID-19 infection. For instance, the International Federation of Clinical Chemistry and Laboratory Medicine (IFCC) issued guidelines on COVID-19 Testing in Clinical Laboratories. In these guidelines, it stated C-reactive protein as one of the markers, which can be used to evaluate the severity of the infection and prognostic as well as therapeutic monitoring.

The market witnessed a decline in 2021 and 2022 due to slowdown in the number of these testing procedures; however, the market is anticipated to witness steady growth prospects henceforth.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Adoption of Point-of-Care (POC) CRP Tests to Guide Prescribing of Antibiotics

In recent years, C-reactive protein point-of-care testing has emerged as a promising diagnostic tool in terms of reducing antibiotic prescriptions. These tests are increasingly being promoted to enhance control on antibiotic and reduce diagnostic uncertainty. An increasing number of research studies are being conducted to evaluate the use of CRP POCT in primary care settings.

- For instance, a research article was published in the British Journal of General Practice in February 2022, which demonstrated the implementation of the C-reactive protein POC testing for improved diagnosis of acute respiratory infections.

- Similarly, another article published in BMC Health Services Research in February 2020 demonstrated a clinical study which was being conducted to evaluate whether the use of CRP point-of-care testing for suspected Lower Respiratory Tract Infection (LRTI) was effective in reducing antibiotic prescription in nursing homes.

Furthermore, to support the use of these point-of-care testing tools in primary and community care, in 2022, the Primary Care Respiratory Society published a guide to examine the application and evidence of these testing procedures. Such initiatives are anticipated to supplement the market growth in the coming years.

C-REACTIVE PROTEIN TESTING MARKET GROWTH FACTORS

Rising Prevalence of Chronic Diseases to Surge Demand for C-Reactive Protein Testing

The rising prevalence of chronic diseases is one of the major factors contributing to the increasing usage of these test kits globally. Chronic diseases linked to higher C-reactive protein levels include rheumatoid arthritis, inflammatory bowel disease, cancer, cardiovascular diseases, and others. With the rising prevalence of these diseases, CRP tests are being increasingly used to detect inflammation. Elevated CRP level is an indicator of chronic inflammation in the body.

- For instance, according to the NCBI, in 2022, the number of new cancer cases was predicted to be 1,918,030 in the U.S. It was also predicted that cancer would be the cause of 609,360 deaths across the U.S. in the same year. Increased CRP levels are associated with the progression of ovarian, skin, and lung cancer.

Moreover, during the COVID-19 pandemic, CRP testing was recommended by doctors for patients with critical conditions as well as patients in home isolation. As these tests are not as costly as CT scans, it was recommended that these tests be conducted twice within four to five days to decide the further course of treatment. Thus, the above-mentioned factors are anticipated to drive the C-reactive protein testing market share throughout the forecast period.

Growing Focus of Key Players on New Product Launches to Propel Market Growth

The increasing efforts of market players on the development of new, technologically advanced products are expected to boost the expansion of the market during the forecast period.

These players are taking robust efforts to develop and launch innovative products. Their increasing focus on catering to the unmet demands of the rising patient population is expected to supplement the market growth in the coming years.

Moreover, the development of point-of-care tests by key companies is also expected to boost the market progress in the coming years.

- For instance, in July 2022, Bloom Diagnostics, a Swiss meditech company, launched the Bloom Inflammation Test for the detection and quantitative determination of CRP levels. This test can be used with the Bloom system.

RESTRAINING FACTORS

Availability of Alternative Disease Diagnostics Methods to Limit Product Adoption

C-reactive protein is a non-specific marker of inflammation. Hence, this test is not useful for an accurate diagnosis of any disease. Thus, the fact that it is not a self-sufficient diagnostic test may impede the development of this market.

Furthermore, there is a vast presence of a number of different tests for the accurate diagnosis of a particular disease. For instance, high-accuracy tests, such as coronary CT angiography, electrocardiography (ECG or EKG), exercise cardiac stress test, and others, are available for the screening of cardiovascular diseases. Thus, the availability of such alternative disease diagnostic methods may limit the market’s growth to a certain extent.

SEGMENTATION

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Number of CRP Tests Resulted in Growing Demand for Reagents & Kits throughout the Forecast Period

On the basis of product, the market is segmented into reagents & kits and instruments.

The reagents & kits segment accounted for the largest market share of 73.61% in 2026. This can be attributed to factors such as an increasing patient pool undergoing C-reactive protein testing for various conditions. The increasing number of market players offering various consumables, such as test kits, new product approvals, and introduction of innovative products, have also supported the segment’s growth.

- For instance, in November 2022, LumiraDx launched the hs-CRP point-of-care antigen test in India. This test was aimed at reducing the unnecessary prescribing of antibiotics in the country.

The instruments segment is anticipated to witness significant growth throughout the forecast period. Increasing regulatory approvals for medical instruments is one of the key factors driving the segment’s growth during the forecast period.

- For instance, in November 2022, the U.S. FDA approved the ProciseDx instrument and C reactive protein (CRP) test for the quantitative determination of C-reactive protein levels. This instrument is said to provide results in less than five minutes.

By Assay Type Analysis

Immunoturbidimetric Assays to Dominate Market Owing to Growing Presence of Products Equipped with this Technology

On the basis of assay type, the market is segmented into chemiluminescence immunoassay (CLIA), enzyme-linked immunosorbent assay (ELISA), immunoturbidimetric assay, and others.

The immunoturbidimetric assay segment dominated the C - reactive protein testing market share of 75.09% in 2026 owing to the presence of several products that use this technology. Increasing usage of these test kits among end-users also supports the dominance of th is segment in the market. In addition, active involvement of the research community in the development of innovative assays will further support the segment’s growth.

- For instance, a research study was published in the Journal of Clinical Chemistry and Laboratory Medicine in September 2020. In this study, researchers demonstrated the use of latex-enhanced immunoturbidimetric assay in the detection of CRP in human serum.

The Enzyme Linked Immunosorbent Assay (ELISA) segment captured a considerable share of the market in 2024. Several advantages offered by ELISA assays are supporting the increasing use of these assays in the market. These advantages include high specificity, low-cost, low detection limit, ease of preparation, ease of operation, and others.

In the field of clinical diagnostics, chemiluminescence immunoassay (CLIA)-based testing plays a significant role in the early detection of various chronic diseases. The high prevalence of chronic diseases will drive the demand for effective diagnostic methods such as CLIA. Various research studies are also being conducted to develop innovative CLIA-based testing kits. Other assay types are expected to witness slow growth over the forecast period owing to their slow adoption among the end-users.

By Detection Range Analysis

Rising Incidence of Chronic & Autoimmune Diseases to Support the Dominance of conventional CRP Segment

On the basis of detection range, the market is segmented into conventional CRP and hs-CRP.

The conventional CRP segment dominated the market share of 89.96% in 2026. The rising prevalence of chronic and autoimmune diseases, such as rheumatoid arthritis, inflammatory bowel disease, and cancer among the population is one of the major factors driving the segment’s growth. Along with this, the growing number of initiatives for raising awareness about these diseases is increasing number of these tests being prescribed for the patient population.

The adoption of high-sensitivity CRP (hs-CRP) testing is rising amongst the patient population owing to the high prevalence of cardiovascular diseases across the globe. An hs-CRP test is widely used to predict the risk of heart disease among the population.

- According to the U.S. Centers for Disease Control and Prevention (CDC), about 805,000 people in the U.S. suffer from a heart attack every year. Out of these, about 1 in 5 heart attacks are silent.

By Setting Analysis

High Preference of Laboratory Testing to Support the High Share of the Segment

On the basis of setting, the market is segmented into laboratory testing and Point-of-Care (POC) testing.

The laboratory testing segment dominated the market share of 75.84% in 2026 and is expected to continue its dominance throughout the forecast period. This can be attributed to the detailed analysis provided by laboratory-based tests. It is considered a more precise method for measuring CRP levels. Laboratory testing includes testing in public health labs, commercial/private health laboratories, and hospital-associated laboratories.

The Point-of-Care (POC) testing segment is anticipated to witness high growth in the future. The factors contributing to this segment’s growth include growing adoption of POC testing in resource limited settings, new product launches, and increasing regulatory approvals for POC testing products.

By End User Analysis

Increasing Number of Diagnostic Testing in Laboratories to Support the High Share of Laboratory Testing Segment

On the basis of end user, the market is divided into hospitals & clinics, diagnostic laboratories, and others.

The diagnostic laboratories segment captured the largest share of the market in 2024. This is majorly due to the increasing awareness about chronic diseases, use of CRP in various medical conditions, and increasing number of test orders by healthcare professionals. Furthermore, the COVID-19 pandemic also boosted the segment’s growth due to increased hospitalizations and use of these tests in determining the severity of the SARS-CoV-2 infection.

The hospitals & clinics segment is projected to witness notable growth throughout the forecast period. This can be attributed to the increasing number of hospital visits and hospital stays, especially in developing countries due to high prevalence of chronic conditions.

- For instance, according to the National Center for Health Statistics, updated as of February 2023, 18.6 million individuals in the U.S. were admitted in hospitals through emergency room visits in 2020.

REGIONAL INSIGHTS

North America

North America C-Reactive Protein Testing Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

On the basis of region, North America captured the largest C-reactive protein testing market size and generated a revenue of USD 0.88 billion in 2025. The region is estimated to dominate the market throughout the forecast period. This can be attributed to the high prevalence of chronic diseases in the U.S., availability of innovative products, and high focus on clinical research in the region. The U.S. market is valued at USD 0.85 billion by 2026.

- For instance, according to CDC estimates, six in ten individuals in the U.S. have a chronic disease and four in ten individuals have two or more than two chronic diseases.

Moreover, increasing healthcare expenditure to support chronic disease care in the region and presence of favorable reimbursement policies will further supplement the dominance of the region in the global market.

- According to the American Action Forum, the average direct healthcare cost for an individual suffering from a chronic disease is USD 6,032. This is approximately 5 times higher than that of an individual without chronic disease.

Europe

Europe accounted for the second largest share in the global market. High usage of C-reactive protein testing for a specific disease, supportive regulatory framework, and increasing number of new products receiving CE marking are some of the factors driving the Europe market growth. The UK market is valued at USD 0.12 billion by 2026, while the Germany market is valued at USD 0.18 billion by 2026.

- According to an article published in the National Center for Biotechnology Information (NCBI) in January 2022, in Europe, C-reactive protein testing is conducted more frequently and used to diagnose and monitor psoriatic arthritis (PsA).

Asia Pacific

The market in Asia Pacific is expected to record the highest CAGR during the forecast period owing to the rising prevalence of chronic diseases that require these diagnostic procedures. In addition, increasing strategic initiatives by the market leaders to expand their product portfolios and growing awareness among the population are some other factors that might support the regional market’s growth throughout the forecast period. The Japan market is valued at USD 0.15 billion by 2026, the China market is valued at USD 0.22 billion by 2026, and the India market is valued at USD 0.11 billion by 2026.

- For instance, in March 2017, SD Biosensor Inc. collaborated with FIND to develop a Rapid Diagnostic Test (RDT) that can simultaneously detect C-reactive protein and malaria infection in a patient’s blood. Such products were said to be suitable for managing the disease rate in low and middle-income countries.

Furthermore, the markets in Latin America and Middle East & Africa are expected to witness moderate growth during the forecast period. Factors, such as increasing focus of market players and government authorities on establishing advanced testing facilities and launches of new products, are responsible for the growth of the market in these region.

KEY INDUSTRY PLAYERS

Abbott Inc., to Lead Market Growth with Strong Product Portfolio

This market is highly fragmented and competitive owing to the presence of a large number of leading market players that are offering testing kits and instruments. These companies also witnessed a significant growth in their revenues due to the increased demand for CRP testing during the COVID-19 pandemic.

Abbott is one of the leading players in this market. The company has a broad portfolio, which includes both reagents & kits and instruments for these testing procedures. With the acquisition of Alere Inc. in February 2016, the company expanded its POC testing portfolio including C-reactive protein testing products. The growing investment of other prominent players, such as Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Quest Diagnostics, CTK Biotech Inc., and others, in research and development activities for the development of innovative C-reactive protein testing products is also contributing to the intense competition in the market. These firms are also focusing on expanding their customer base through various initiatives.

- For instance, in March 2021, Boditech Med announced its plans to construct a new R & D center in South Korea.

LIST OF KEY COMPANIES PROFILED IN C-REACTIVE PROTEIN TESTING MARKET:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthcare Private Limited (Germany)

- Quest Diagnostics Incorporated (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Merck KGaA (Germany)

- Getein Biotech, Inc. (China)

- Randox Laboratories Ltd. (U.K.)

- BODITECH MED, INC. (Republic of Korea)

- LumiraDx (U.K.)

KEY INDUSTRY DEVELOPMENTS

- February 2023 - Qlife Holding AB launched Egoo CRP test in Sweden. This test was a soft-launch and will be followed by the submission of application for the CE mark.

- December 2022 - Siemens Healthcare Diagnostics Products GmbH received 510(k) clearance for its CardioPhase hs-CRP prognostic test from the U.S. FDA.

- March 2022 – Novo Integrated Sciences, Inc. and Boditech Med Inc. signed a Memorandum of Understanding (MoU) for the launch and deployment of the latter’s IVD solutions and technologies in North America.

- October 2020 – Nova Biomedical introduced the Allegro CRP Test, which can be used for point-of-care (POC) testing in primary care settings. This product was launched in countries accepting the CE mark.

- September 2017 - VTT Technical Research Centre of Finland developed a portable, home-use device to measure inflammation levels. This device provides CRP levels in numeric forms.

REPORT COVERAGE

The global C-reactive protein testing market research report provides an in-depth analysis of the industry. It focuses on market segments such as product, assay type, detection range, setting, and end-user. Besides this, it offers an analysis related to the market overview, the impact of COVID-19, and latest market trends. Additionally, the report consists of several factors that have contributed to the market growth. The report also provides competitive landscape of the global market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.9% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product, Assay Type, Detection Range, Setting, End User, and Region |

|

By Product |

|

|

By Assay Type |

|

|

By Detection Range |

|

|

By Setting

|

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the global C-reactive protein testing market was valued at USD 2.55 billion in 2025 and is projected to reach USD 3.95 billion by 2034.

In 2025, the market value stood at USD 0.88 billion.

The C-reactive protein testing market is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2026 to 2034, driven by the rising prevalence of chronic diseases and advancements in point-of-care diagnostics.

Currently, the immunoturbidimetric assay segment is leading the market by assay type.

Rising prevalence of chronic diseases, increasing research & development activities by major market players, rising number of approvals, and launch of innovative POC products are the key drivers of the market.

Abbott, F. Hoffmann-La Roche Ltd., Siemens Healthcare Private Limited, Quest Diagnostics Incorporated, and Thermo Fisher Scientific, Inc. are the major players in the market.

North America dominated the market in 2026.

Surge in demand for effective treatment of infectious diseases, increased adoption of technologically advanced diagnostic testing, and a considerable patient population base are some of the factors expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us