Cardiac Troponin Market Size, Share & Industry Analysis, By Type (Troponin T and Troponin I), By Setting (Laboratory Testing and Point-of-Care (POC) Testing), By Indication (Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, and Others) By End User (Hospitals & Clinics, Diagnostic Laboratories, and Homecare Settings & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

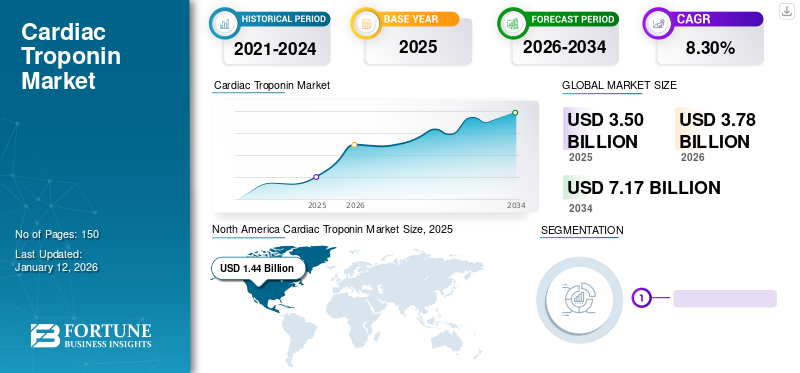

The global cardiac troponin market size was valued at USD 3.50 billion in 2025 and is projected to grow from USD 3.78 billion in 2026 to USD 7.17 billion by 2034, exhibiting a CAGR of 8.30% during the forecast period. North America dominated the global cardiac troponin market with a market share of 41.15% in 2025.

Cardiac Troponin is considered a primary diagnostic biomarker for detecting cardiac muscle injury. The accurate and timely diagnosis from this biomarker plays an important role in preventing the risks of adverse effects of heart attack. In recent years, with the advancements in technology and improved knowledge related to cardiac biomarkers, the market has witnessed a significant demand for these products. The early detection of changes in this protein helps in early diagnosis of myocardial infarction (MI).

Troponin I (cTnl) and troponin T (cTnT) are the cardiac regulatory proteins that are involved in controlling calcium-mediated interaction between myosin and actin. These are the biomarkers of myocardial necrosis, and their high cardiac specificity makes them a preferred biomarker for the diagnosis of myocardial infarction. For this, the rising or falling levels play an important role. The changing levels help in differentiating between chronic heart diseases and acute myocardial infarction. For instance, according to data published by the American Heart Association, Inc., in January 2021, a cohort study was conducted in the U.S. to evaluate the effect of high-sensitivity cardiac troponin T (hs-cTnT) in the U.S. population. The study's results indicated that the patients with Acute Coronary Syndrome (ACS) symptoms are treated by combining hs-cTnT strategies with a heart score and achieve acceptable performance for diagnosing adverse cardiac events.

The growing prevalence of cardiovascular diseases and technological advancements in the products are driving market growth during the forecast period. Additionally, increasing adoption of point-of-care tests in hospital emergency departments is also estimated to drive the cardiac troponin market growth in the future.

- For instance, as per the data published by Centers for Disease Control and Prevention (CDC) in May 2023, in the U.S. every 40 seconds one individual has a heart attack.

Furthermore, the growing geriatric population is anticipated to increase the demand for treatment and management of acute and chronic health conditions, especially hypertension, heart disease, and stroke.

- For instance, according to National Center for Health Statistics, the number of Americans aged 65 years and above, increased by roughly 25% from 2003 to 2013 and is expected to increase by another 50% by 2040. Also, from 2018 to 2038, the number of Americans aged 85 years and above is expected to be more than double from 6 million to 14.6 million

The COVID-19 pandemic positively impacted the market growth. The market observed a robust demand for products and services for this protein testing during the pandemic phase. Several studies have demonstrated the association between COVID-19 infection and cardiovascular complications. This has resulted in increased demand for troponin tests for the management of cardiovascular diseases (CVD) associated with COVID-19 infection. In 2021, the market experienced a decline in its growth owing to the reduction in the number of testing procedures related to COVID-19. From 2022 onwards, the market is expected to witness significant growth throughout the forecast period.

Global Cardiac Troponin Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.50 billion

- 2026 Market Size: USD 3.78 billion

- 2034 Forecast Market Size: USD 7.17 billion

- CAGR: 8.30% from 2026–2034

Market Share:

- North America dominated the cardiac troponin market with a 41.15% share in 2025, driven by the rising prevalence of cardiovascular diseases, increasing product approvals, and robust adoption of advanced diagnostic assays in emergency departments.

- By type, Troponin I is expected to retain its largest market share owing to its high specificity as a diagnostic biomarker for myocardial infarction and the increasing availability of advanced point-of-care testing products.

Key Country Highlights:

- United States: Strong demand for troponin testing is driven by high incidence of heart attacks, increasing adoption of point-of-care diagnostics in emergency care, and favorable reimbursement policies supporting advanced cardiovascular testing.

- Europe: Growth is supported by wide adoption of high-sensitivity assays in healthcare settings, presence of key market players with CE-marked products, and a robust regulatory framework promoting early cardiac diagnostics.

- China: Increasing patient population with cardiovascular diseases and rising awareness about early detection are driving market demand, supported by initiatives to expand advanced diagnostic facilities across hospitals.

- Japan: The market is propelled by a rising geriatric population with a high burden of heart-related conditions and the growing emphasis on introducing cutting-edge cardiac biomarker tests to improve diagnostic accuracy in healthcare institutions.

Cardiac Troponin Market Trends

Increasing Adoption of Point-of-Care (POC) and High Sensitivity Tests Identified as Significant Market Trends

In recent years, cardiac POC testing has appeared as a favorable tool for diagnosis for reducing cardiovascular disease burden. These tests are being heavily used to gain control on the cardiac diseases. With this, the key players have also introduced point-of-care testing products as well as high-sensitivity tests in the recent years.

- For instance, in January 2017, the U.S. FDA approved the Elecsys Troponin T Gen 5 STAT test manufactured by Roche. This was the first high-sensitivity troponin test approved in the U.S.

Download Free sample to learn more about this report.

Cardiac Troponin Market Growth Factors

Growing Prevalence of Cardiovascular Diseases to Drive Demand for Troponin Testing

Rising cases of cardiovascular diseases is one of the main factors for the market growth. The higher levels of this protein are linked to the high risk of heart attack or any cardiac-related indication. With constantly increasing patient population of these diseases, such tests are progressively used to detect myocardial injury.

- For instance, as per the study published by the American College of Cardiology in August 2022, by 2060, the risk factors associated with cardiovascular diseases will increase exponentially, resulting in a steep rise in the patient population for these diseases.

- Similarly, according to the data published by the National Center for Biotechnology Information (NCBI) in December 2021, the prevalence of AMI approaches 3 million people globally, with more than one million deaths in the U.S. annually. An increase in the prevalence of MI is driving the market's growth.

During the pandemic, doctors recommended this testing to patients with critical conditions and also to patients under home isolation. Several studies have found that acute myocardial injury is most commonly described in COVID-19 patients.

New Product Launches by Primary Key Market Players to Drive Market Growth

With the increasing usage of troponin testing by end users, the operating players are focusing on the development of new and technologically advanced products to capture the untapped avenues of the market. These developments are expected to boost the market growth in the coming years. The focus of the key players has been increasing to meet the unmet demand of the patient population which is set to drive the market growth during the forecast period.

- For instance, in November 2022, the Biotechnology unit of the Department of Life Technologies of the University of Turku and the Heart Center of Turku University Hospital collaboratively developed a new cardiac troponin test. This product aims to enhance the diagnosis of heart attacks.

- Similarly, in June 2018, Beckman Coulter’s new high-sensitivity troponin (hsTnI) product received 510(k) clearance from the U.S. FDA.

RESTRAINING FACTORS

Lack of Sensitivity of Conventional Assays to Limit Product Adoption

Even though troponin is considered as a superior marker for the prediction of cardiovascular diseases as compared to other cardiac biomarkers, there are certain factors that are impeding the market growth. The lack of sensitivity of conventional assays is one of the factors that is restraining the market growth to a certain extent. In addition, these assays also lack in detecting the presence of small amounts of this protein in circulating blood in the first few hours after acute myocardial infarction.

Cardiac Troponin Market Segmentation Analysis

By Type Analysis

Increasing Number of Troponin I Tests Boosted the Troponin I Segment Growth

By product, the market is categorized into troponin T and troponin I.

The troponin I accounted for the highest global cardiac troponin market share of 73.32% in 2026. This troponin type plays an important role as a specific marker for predicting the risk of cardiovascular disease as well as heart attack. In addition, the development of advanced products, such as point-of-care testing products, has also boosted the segment growth.

On the other hand, the troponin T segment is anticipated to witness significant growth over the projected years. Increasing regulatory approvals for troponin T kits is propelling the growth of the segment in coming years. The growth can also be attributable to the growing implementation of cardiac troponin T tests as a routine screening for early detection and prevention of heart failure (HF). For instance, according to the data published by TCTMD in September 2019, high-sensitivity cardiac troponin T (hs-cTnT) measurements highly predict diastolic dysfunction in people with no preexisting CVD.

To know how our report can help streamline your business, Speak to Analyst

By Setting Analysis

High Number of Tests Performed at Laboratory Settings Supported the Dominance of the Segment

Based on setting, the market is segmented into laboratory testing and point-of-care (POC) testing.

The laboratory testing segment held the dominating market contributing 73.68% globally in 2026 and is expected to continue its dominance over the forecast period. The factors driving the segment growth include the fact that the laboratory-based tests provide the detailed analysis compared to point-of-care tests. These tests are a more precise to measure troponin levels. Laboratory testing includes testing in commercial/private health laboratories, public health labs, and hospital-associated laboratories.

The point-of-care (POC) testing segment is set to record the highest market growth rate in the coming years. The factors such as the increasing adoption of these tests in resource-limited settings, introduction of new products, and increasing regulatory approvals for point-of-care testing products are expected to drive the segment growth.

By Indication Analysis

High Prevalence of Acute Coronary Syndrome Augmented Acute Coronary Syndrome Segment Growth

Based on indication, the market is categorized into myocardial infarction, congestive heart failure, acute coronary syndrome, and others.

The acute coronary syndrome segment captured the highest global market accounting for 55.15% market share in 2026. The rising prevalence of acute coronary syndrome is the major factor that has driven the segment's growth. Cardiac troponin is widely used as a diagnostic biomarker for this disease. The role of this biomarker is well established.

- For instance, according to an article published in January 2022, an estimated 805,000 American individuals experience an ACS event annually. Out of this, 200,000 are recurrent heart attacks, and 605,000 are new heart attacks.

On the other hand, the myocardial infarction segment accounted for the second-largest market share in 2023. The levels of cardiac troponin are elevated due to myocardial injury. The growing need for the management of this disease is expected to fuel market growth.

- For instance, according to a study published in NCBI in April 2023, the global prevalence of myocardial infarction in individuals above 60 years was found to be 3.8%. Thus, owing to the increasing rate of MI in the geriatric population, the market is expected to witness significant growth in the coming years.

By End User Analysis

High Rate of Hospital Admissions to Support the Significant Share of Hospitals & Clinics Segment

By end user, the market is categorized into diagnostic laboratories, hospitals & clinics, and homecare settings & others.

The hospitals & clinics segment accounted for the largest market with a share of 63.44% in 2026. This can be attributed to the growing awareness regarding cardiovascular diseases and the rising adoption of tests by healthcare providers. Furthermore, the SARS-CoV-2 pandemic also supplemented the growth owing to the increased rate of hospitalizations and the usage of these tests in checking the possibility of myocardial infarction in COVID-19 patients.

The diagnostic laboratories segment is estimated to grow considerably over the coming years. Factors influencing the segment growth include the increasing outsourcing activities of the test, particularly in developing countries due to the growing prevalence of cardiovascular disorders.

- For instance, according to an article published in the National Center for Biotechnology Information (NCBI) in January 2020, the prevalence of coronary artery disease (CAD) in India is 11.0% for nondiabetics and 21.4% for the diabetic population.

REGIONAL INSIGHTS

North America

North America Cardiac Troponin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share in 2025, generating a revenue of USD 1.44 billion. The region is expected to maintain its domination over the forecast period. Key factors contributing to the market growth include the rising prevalence of cardiovascular diseases in the U.S., increasing product approvals by regulatory bodies, and the availability of advanced products in the region. The U.S. market is projected to reach USD 1.4 billion by 2026.

- For instance, in December 2022, Health Canada approved the Quidel TriageTrue High-Sensitivity Troponin I (hsTnl) test for use on the Quidel Triage MeterPro platform. This test provides test results in around 20 minutes.

Additionally, presence of favorable policies for reimbursement and expenditure on healthcare for supporting the cardiovascular diseases in North America are set to drive the region’s market growth. As per the Centers for Disease Control and Prevention (CDC), in the U.S., heart disease costs around USD 219 billion every year. This cost includes the cost of healthcare services, medications, and premature death.

Europe

Europe held the second leading market share in the market owing to factors such as new products with CE marks and regulatory framework. The region marks a home to several primary market players such as F. Hoffmann-La Roche Ltd., Eurolyser Diagnostica GmbH, and others.

According to an article published in the National Center for Biotechnology Information (NCBI) in March 2019, high-sensitivity assays for troponin testing have been adopted by around 60% of centers in Europe. The UK market is projected to reach USD 0.18 billion by 2026, while the Germany market is projected to reach USD 0.25 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to be the fastest-growing region in the global market. The market is anticipated to register the fastest growth during the study period. This can be attributed to the increasing patient population for cardiovascular diseases in Asian countries and the launch of new products in the region. Additionally, growing focus on initiatives by the key operating companies for the expansion of their product portfolios and increasing awareness among the people are some other factors supplementing the regional market’s growth. The Japan market is projected to reach USD 0.19 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

- For instance, as per the news article published by The Times of India in April 2023, the hospitals in India have witnessed a spike in these tests in the past years. One of the major hospitals in India, Hiranandani Hospital, Mumbai, has witnessed an increase of 28.6% in the number of troponin tests performed compared to 2021.

Middle East & Africa, and Latin America

Furthermore, the markets in Middle East & Africa, and Latin America regions are estimated to grow at a moderate growth rate over the study period. Key factors contributing to this region’s market growth include the shifting focus of operating entities and government agencies on launching advanced testing facilities and introduction of new products.

List of Key Companies in Cardiac Troponin Market

F. Hoffmann-La Roche Ltd. to Lead Market Owing to its Robust Product Portfolio

The market space for cardiac troponin is moderately competitive, with the presence of a substantial number of global as well as domestic market players that are offering troponin testing assays. The COVID-19 pandemic also positively impacted the companies’ revenue growth during the years 2020 and 2021. This is due to the increased demand for this testing in individuals infected with the COVID-19 virus.

F. Hoffmann-La Roche Ltd. is one of the prominent players in the market. The company has a comprehensive portfolio of cardiac troponin. The company has undertaken various strategic initiatives, such as partnerships and collaborations to strengthen its market position. For instance, in April 2021, based on the Elecsys technology, Roche declared a new series of five new intended uses for two key cardiac biomarkers, namely NT-proBNP and cardiac troponin test. This was aimed to expand the company’s market presence by expanding product availability for cardiovascular diagnostics.

Furthermore, other prominent players, such as Abbott, bioMérieux SA, Beckman Coulter, Inc., PerkinElmer Inc., and others, are also adopting several growth strategies, such as mergers & acquisitions, new product launches, and others, which is helping the key market players to contribute to the growing competition and also expand their customer base by implementing various strategies.

LIST OF KEY COMPANIES PROFILED:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- bioMérieux SA (France)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- Eurolyser Diagnostica GmbH (Germany)

- QuidelOrtho (Quidel Corporation) (U.S.)

- PerkinElmer Inc. (U.S.)

- Beckman Coulter, Inc. (Danaher) (U.S.)

- RESPONSE BIOMEDICAL (Canada)

- LifeSign LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2023 - Bio-Rad Laboratories launched a four-level multi-analyte cardiac quality control for high-sensitivity troponin testing. This product is expected to enhance the sensitivity of the diagnostic assays for the detection of cardiac biomarkers.

- February 2023 - Pathology Queensland (PQ) announced that it has installed a new highly sensitive cardiac troponin (hs-cTnI) assay in all Queensland Hospital laboratories during 2022.

- October 2022 - HyTest Ltd launched five new antibodies specific for cTnI. These products can be used for quantitative cTnI immunoassay development.

- September 2020 - DIALAB GmbH introduced the DIAQUICK Troponin T Cassette, which, in turn, expanded its product offerings.

- December 2019 – Mayo Clinic switched to Roche Diagnostics’ Elecsys Troponin T Gen 5 Stat assay. This was the first high-sensitivity cardiac troponin test with the U.S. FDA approval.

REPORT COVERAGE

The global market report provides an in-depth analysis of the industry. It focuses on market segments, such as type, setting, indication, and end-user. Besides this, it offers the global cardiac troponin market forecast in relation to the current market dynamics, and latest market trends. Additionally, the report consists of several factors that have contributed to the market’s growth. The report also provides the competitive landscape of the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Setting

|

|

|

By Indication

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 3.5 billion in 2025 and is projected to reach USD 7.17 billion by 2034.

In 2025, the market value stood at USD 1.44 billion.

The market will exhibit a steady CAGR of 8.30% during the forecast period of 2026-2034.

Currently, the laboratory testing segment will be leading the market by setting.

The rising prevalence of cardiovascular diseases, increasing research & development activities by major market players, rising number of approvals, and launch of innovative POC products are the key drivers of the market.

Abbott, F. Hoffmann-La Roche Ltd., Siemens Healthcare Private Limited, Quest Diagnostics Incorporated, and PerkinElmer Inc. are the major players in the market.

North America dominated the cardiac troponin market with a market share of 41.15% in 2025.

The surge in the demand for effective treatment of cardiovascular diseases, increased adoption of technologically advanced diagnostic testing, and a considerable patient population base are some of the factors expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us