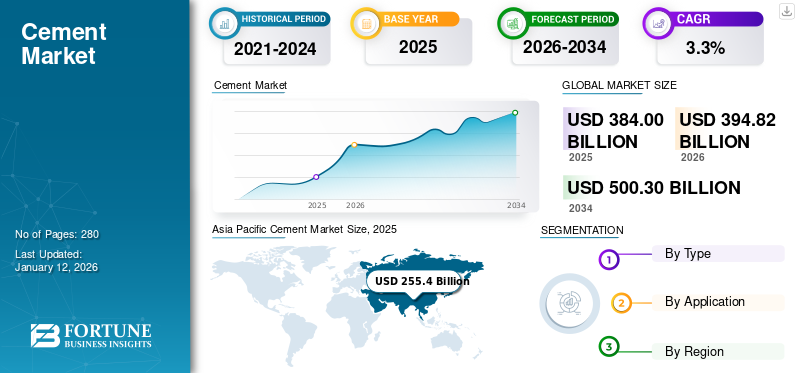

Cement Market Size, Share & Industry Analysis By Type (Portland, Blended, and Others), By Application (Residential and Non-Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cement market size was valued at USD 384 billion in 2025. The market is projected to grow from USD 394.82 billion in 2026 to USD 500.3 billion by 2034, exhibiting a CAGR of 3.3% during the forecast period. Asia Pacific dominated the cement market with a market share of 67% in 2025.

Cement is an important material used in construction industry which acts as a binder between the surfaces of panels, stones, and bricks. It is generally a fine powdery substance produced using sand, limestone, iron ore, clay, and bauxite.

The rising population has increased the need for residential buildings. This has surged the demand for cement manufacturing across the globe. The growing demand for non-residential buildings and public infrastructure, including healthcare centers and hospitals, has led to opportunities for product consumption. Hence, the soaring demand for the product from the growing construction sector is the current market trend. Holcim, Heidelberg Materials, Cemex, UltraTech Cement, and CRH are among the key players operating in the market.

GLOBAL CEMENT MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 384 billion

- 2026 Market Size: USD 394.82 billion

- 2034 Forecast Market Size: USD 500.3 billion

- CAGR: 3.3% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 67% share, rising from USD 255.4 billion in 2025 to USD 262.2 billion in 2026.

- By type: Blended cement dominated due to its improved workability, reduced water demand, and wide applications.

- By application: Non-residential segment held the largest share, driven by infrastructure projects, commercial complexes, and industrial buildings.

Key Country Highlights:

- China: Major producer and consumer, driven by population growth and urban infrastructure demand.

- India & Southeast Asia: Rapid urbanization and housing demand support market growth.

- U.S.: Focus on public infrastructure and adoption of modern construction techniques.

- Europe: Renovation of old structures and adoption of eco-friendly materials drives demand.

- Middle East & Africa: Growth fueled by infrastructural development, oil exploration, and mining activities.

- Latin America: Rising urbanization and government housing and transport projects support growth.

Cement Market Trends

Rising Adoption of Green Cement to Boost Growth Potential

The increasing adoption of green cement to construct sustainable and ecofriendly buildings will boost market growth. As part of an effort to reduce the threat posed by emissions, the process of manufacturing can be modified to reduce emissions significantly. This product uses a carbon-negative manufacturing technique that minimizes pollution during unit operations. It is a sustainable solution that addresses serious environmental concerns by reducing carbon footprint during production. In 2021, Hima Cement, a subsidiary of LafargeHolcim, launched a Fundi masonry product with a lower carbon footprint that finds application in plastering, bricklaying, and mortar works. Moreover, the United Nations Environment Program (UNEP) also urges the production and usage of environmentally sustainable, new, and cost-effective products. Hence, such factors will flourish the demand for green cement in the near future. Asia Pacific witnessed a growth from USD 278.52 billion in 2023 to USD 255.82 billion in 2024.

Market Dynamics

Market Drivers

Surging Demand from Construction Activities to Support Market Growth

The increasing population will effectively influence market growth on account of the surging need for residential spaces such as apartments and private bungalows. Furthermore, the growing demand for amenities in residential spaces is expected to accelerate the market expansion. Moreover, the rising need for non-residential establishments, such as malls, airports, industries, roads, and office buildings, is also expected to support the market growth.

Career opportunities and better quality of life have created a need for rapid urbanization. Government initiatives to support construction and infrastructural activities in developing countries will further increase the demand. Moreover, the rising demand for precast products, such as blocks, panels, roof tiles, and others, will increase global product consumption. Currently, China is the dominant producer and consumer across the world. Hence, the growth in construction activities will boost the market size in this country.

Government Investment in Massive Infrastructure Projects to Drive Market Growth

A key driver of the market is strong government support through large-scale infrastructure investments and funding initiatives that stimulate consistent demand. Across developed and emerging economies, governments view infrastructure as a catalyst for economic growth and job creation. For example, the U.S. Infrastructure Investment and Jobs Act continues to generate significant demand for the product in road upgrades, bridges, public transit, and water systems. The European Union is channeling major funding into sustainable construction, building renovation, and resilient infrastructure. In Asia, mega-programs such as India’s Smart Cities Mission and China’s Belt and Road Initiative are driving extensive urbanization and connectivity, requiring huge volumes of product for roads, housing, and industrial facilities. Similarly, public-private partnerships in Africa and Latin America are expanding ports, railways, dams, and transportation corridors. These initiatives guarantee long-term demand for the product and also encourage the adoption of lower-carbon products and modern production technologies as governments link spending to sustainability targets. Overall, this steady public investment pipeline stabilizes market cycles, stimulates innovation in eco-friendly alternative, and secures growth opportunities for producers aiming to meet rising infrastructure needs while complying with stricter environmental standards.

MARKET RESTRAINTS

Government Regulations on Carbon Emissions from Manufacturing Plants to Hinder Growth

Raw materials used for production include chalk, limestone, clay, shells, shale, and silica sand. Its production causes hazardous impact on the environment and human health. The inhalation of dust particles can cause difficulties in breathing and irritate the nose and throat. Furthermore, the manufacturing of this product causes a high amount of pollution. According to the United States Environmental Protection Agency, the cement industry is the third-largest industrial polluter releases over 500 kilotons of nitrogen oxide, carbon monoxide, and sulfur dioxide yearly. Due to such factors, various environmental regulations are imposed by governments over the production process, which are anticipated to restrain the cement market growth.

Download Free sample to learn more about this report.

Market Opportunities

Adoption of Modular Construction to Provide Market Growth Opportunities

Modular and precast construction offer a major growth avenue for the market by revolutionizing how structures are built. This method involves producing concrete elements such as walls, beams, and slabs in controlled factory settings, which are then transported and assembled on-site. It brings clear benefits such as higher quality control, reduced material waste, and faster project completion. By enabling parallel processes, off-site fabrication and on-site groundwork, project timelines can be shortened by up to half, which is especially valuable in urban areas facing housing shortages and tight deadlines. Precast solutions also align well with sustainability goals, as they allow for precise product usage, integration of recycled aggregates, and low-carbon binders, all while lowering site emissions and dust. As stricter green building standards emerge, this advantage grows. For producers, this trend creates opportunities to supply specialized high-performance precast mixes and partner with modular builders. By aligning with this shift, producers can tap into consistent, high-volume demand in both residential and commercial markets while strengthening their role in sustainable construction.

Market Challenges

High Energy Intensive Nature of Product Manufacturing to Create Challenges

Cement manufacturing is highly energy intensive, especially during the clinker production phase, which involves heating materials to extremely high temperatures. Most cement plants depend on fossil fuels such as coal and pet coke, making them vulnerable to energy price fluctuations and supply issues. While there is growing pressure to shift toward alternative fuels such as biomass or renewable sources, the transition requires significant investment and technical modifications. In addition to this, developing energy efficient plants is complex and depends on existing technology in the plant. As energy costs continue to rise and sustainability demands increase, securing reliable and affordable energy sources is likely to become a major operational challenge for the global industry.

Trade Protectionism and its Effects

Trade War to Increase Construction Costs in the U.S. Over the Short Term

The U.S. tariffs on cement imports are likely to have prominent global implications. While they benefit domestic producers by limiting cheaper imports and improving margins, they are expected to also raise product prices within the U.S., affecting construction costs. Exporting countries such as Turkey and China may divert their excess supply to other regions, intensifying competition and pressuring global prices. These tariffs disrupt trade flows and will be forcing adjustments in logistics and supply chains. Over time, such trade barriers may drive the localization of production and encourage product innovation to stay competitive in a more fragmented global market.

Segmentation Analysis

By Type

Blended Segment Exhibited the Dominant Share Owing to the Swiftly Expanding Demand from Various Applications

The market is segmented into portland, blended, and others on the basis of type.

Among these, the blended segment accounted for the largest cement market with a share of 7.61% in 2026 owing to its characteristics, such as reduced water demand, improved workability & pump ability, and reduced crack formation due to thermal stress. The blended segment comprises base portland in which other materials, such as pozzolana, slag, and limestone, are added to obtain the different blends. The increasing demand for blended types from applications, namely, buildings, road construction, and mining, is expected to help surge global market revenue.

Portland type cement is majorly used to produce concrete, which is further used in constructing beams, panels, and mega structures, such as dams and roads. It is also mixed with other materials, such as sand, in mortars and plasters. The segment led the market share by 18% in 2024.

The other types include colored, composite, low-alkali, quick setting, and air-entraining cement. The increasing demand for all these types from different applications will boost the market substantially.

By Application

To know how our report can help streamline your business, Speak to Analyst

Non-Residential Segment to Generate the Highest Revenue Due to Rising Investment in Infrastructure Projects

The market is segmented into non-residential and residential on the basis of application.

The non-residential segment is expected to dominated the segment accounting for 53.77% market share in 2026. In this segment, the product is used for applications such as constructing roads, dams, commercial complexes, industrial buildings, stadiums, and transportation hubs. Increasing rate of urbanization and infrastructural activities have led to an increased demand for the product. Additionally, the high need for hospitals and schools is expected to support market growth. This segment is anticipated to exhibit a CAGR of 3.39% during the forecast period.

The residential segment is growing due to the rising global population and increasing demand for residential spaces in the developing nations of the Asia Pacific and the Middle East & Africa regions. The growth of the residential segment is anticipated to increase the consumption of the product. The segment is expected to dominate the market share of 44% in 2025.

CEMENT REGIONAL OUTLOOK

On the basis of regional ground, the market has been studied across North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Cement Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for USD 262.2 billion in 2026 and is expected to remain dominant throughout the forecast period. The regional market value in 2025 was USD 255.4 billion. This is attributed to the increased demand for the product from developing nations, such as Southeast Asia, China, and India. Growth in urban infrastructure and construction activities is a key driver for the market in this region. China is the major country contributing to the market growth in the region as it is the dominant producer and consumer in the world. The country's dominance is attributed to factors including the rapid growth in population and infrastructure development activities in the region. Furthermore, the soaring demand for residential spaces in the country will support market growth in China. The market in China is expected to hit USD 189.13 billion in 2026, whereas India is likely to reach USD 31.12 billion and Japan is projected to hit USD 3.46 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

The market in Europe is anticipated to grow at a significant CAGR over the forecast period. Russia, Germany, France, and the U.K. are the key countries contributing to the market growth in the region. The region is anticipated to account for the second-highest market size of USD 62.43 billion in 2026, exhibiting the second-fastest growing CAGR of 2.28% during the forecast period. The renovation of old and potentially risky structures has increased the product demand in these countries. Further, the incorporation of sustainable and eco-friendly building materials will drive the market in the region. The market value in U.K. is expected to be USD 4.15 billion in 2026.

On the other hand, Germany is projecting to hit USD 5.95 billion in 2026 and France is likely to hold USD 3.87 billion in 2025.

North America

In North America, the increasing demand for public infrastructure is one of the major factors influencing the market growth. In this region, the U.S. holds the prominent share in 2025. The rising adoption of modern and advanced practices by the construction industry including precast concrete and 3D concrete printing is set to boost product consumption in the country. Moreover, the rising investment from government on the repair of potentially risky bridges and structures will further augment the market growth during the forecast period. The U.S. market is expected to hit USD 16.52 billion in 2026.

Latin America

The Latin America market will expand owing to rising urbanization. Government initiatives, such as housing schemes, the establishment of hospitals and school facilities, and the maintenance and development of transportation infrastructure, are other key factors that would drive the growth of this market. The region is to be anticipated as the fourth-largest market with USD 23.36 billion in 2026.

Middle East & Africa

The Middle East & Africa is projected to witness substantial growth. This expansion is associated with the increasing demand for the product from the escalating infrastructural activities in the region. Moreover, its use in oil exploration and mining activities is another factor driving the market in the Middle East & Africa. The Saudi Arabia market is expected to hit USD 28.28 billion in 2026.

Competitive Landscape

Key Industry Players

Major Players to Strengthen Position by Increasing Eco-Friendly Product Offerings

The global market is highly competitive, with major players such as Holcim, Heidelberg Materials, Cemex, UltraTech Cement, and CRH leading the industry. The competition is fueled by pricing pressure, operational efficiency, and growing product demand in emerging economies. Environmental regulations and rising concerns over carbon emissions are pushing companies to adopt greener technologies and sustainable practices. To remain competitive, leading companies are focusing on digital transformation, alternative fuels, and product innovation. This evolving landscape is driving investments in eco-friendly cement and modernized production methods to meet regulatory demands and capture higher market share.

LIST OF KEY CEMENT COMPANIES PROFILED

- CEMEX S.A.B. de C.V. (Mexico)

- HeidelbergCement (Germany)

- InterCement Participações S.A. (Brazil)

- Holcim Ltd. (Switzerland)

- CRH plc (Ireland)

- The Siam Cement Group (Thailand)

- Titan Cement Company S.A. (Greece)

- UltraTech Cement Limited (India)

- Votorantim Cimentos (Brazil)

- Buzzi Unicem S.p.A. (Italy)

- Mitsubishi Material Corporation (U.S.)

- Argos USA LLC (U.S.)

- China National Building Material Co., Ltd. (China)

- Taiheiyo Cement Corporation (Japan)

- Drake Cement LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Heidelberg Materials officially opened the Brevik CCS (carbon capture and storage) facility in Norway, making a global milestone in the cement industry’s decarbonisation journey. The plant will capture around 400,000 tons of CO2 annually, representing 50% of its emissions, and enable the production of evoZero- the world’s first carbon-captured cement.

- March 2025: Buzzi SpA, via its 90%-owned subsidiary TC Mena, acquired a 37.6% shareholding in Gulf Cement Company (GCC), a UAE-based cement manufacturer with an annual production capacity of 2.4 million tons. The acquisition expands Buzzi’s presence in the Middle East and aligns with its international growth strategy.

- October 2024: Ultratech Cement signed a collaboration agreement with the Institute of Carbon Management (ICM) at UCLA to pilot the Zero Carbon Lime (ZeroCAL) process. This technology would help to eliminate up to 98% of carbon dioxide emissions associated with the decomposition of limestone in cement manufacturing.

- April 2023: CEMEX Philippines (CHP) secured the milestone of a 50% drop in carbon dioxide emissions generated by Solid Cement Corporation and APO Cement Corporation, two of its cement subsidiaries. It reduced 18% of its carbon dioxide emission with the goal of less than 430 kg of CO2 for every ton of cement signifies a 67% reduction by 2030.

- December 2022: Siam Cement Group, a pioneer in manufacturing bricks, blocks, and autoclaved concrete panels, came up with the Joint venture with Bigbloc Construction and has announced to build a facility for 3 lakh cubic meters of lightweight concrete panels and AAC blocks in Kapadvanj, Kheda district near Ahmedabad, Gujarat. The plant would begin commercial production by 2023.

REPORT COVERAGE

The research report provides qualitative and quantitative insights and a detailed analysis of the market size and growth rate for all possible segments. It focuses on crucial aspects such as types, applications, and competitive landscape. Further, the report offers insights into market dynamics, and emerging trends and highlights industry developments. In addition to the factors mentioned above, it encompasses various factors that have contributed to the market's growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion); Volume (Million Ton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 394.82 billion in 2026 and is projected to reach USD 500.3 billion by 2034.

In 2025, the Asia Pacific market size was valued at USD 255.4 billion.

The market is anticipated to exhibit a CAGR of 3.3% during the forecast period of 2026-2034.

By application, the non-residential is the leading segment and is poised to dominate the market over the forecast period.

The expansion of the construction industry and the rising product demand in this sector are key factors driving the market.

Asia Pacific is expected to hold the highest share of the market.

Holcim, Heidelberg Materials, Cemex, UltraTech Cement, and CRH are the key players operating in the market.

The rapid expansion of residential spaces and healthcare facilities and the production of sustainable grades are the key factors expected to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us