Circuit Breaker Market Size, Share & Industry Analysis, By Type (Solid State Circuit Breakers, Mechanical Circuit Breakers, and Others), By Voltage (Low Voltage, Medium Voltage, and High Voltage), By Installation (Indoor and Outdoor), By Rated Voltage (Upto 500V, 500V – 1kV, 1kV – 15kV, 15kV – 50kV, 50kV – 70kV, 70kV – 150kV, 150kV – 300kV, 300kV – 600kV, 600kV – 800kV, and above 800kV), By End-User (Residential, Commercial, Industrial, and Utility), and Regional Forecast Report, 2026-2034

Circuit Breaker Market Overview

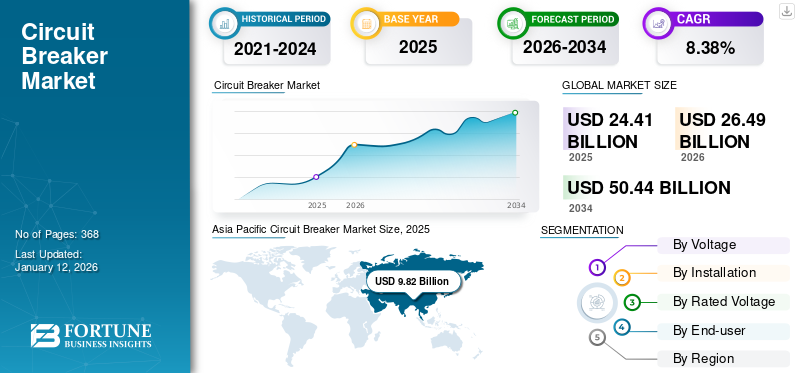

The global circuit breaker market size was valued at USD 24.41 billion in 2025 and is projected to grow from USD 26.49 billion in 2026 to USD 50.44 billion by 2034, exhibiting a CAGR of 8.38% during the forecast period. Asia Pacific dominated the circuit breaker market with a share of 40.23% in 2025.

Market Trends and Strategic Insights

- Asia Pacific circuit breaker market held the largest share of 40.23% of the global market in 2025.

- By type, Mechanical circuit breakers held the highest market share of 55.99% in 2024.

- Based on voltage, Medium-voltage segment held the highest market share of 45.53% in 2025.

- Based on end-user, Utility segment held the highest market share of 43.66% in 2024.

Market Size and Growth Forecast

- 2025 Market Size: USD 24.41 Billion

- 2034 Projected Market Size: USD 50.44 billion

- 2026 North America Market Size: USD 26.49 Billion

- CAGR (2026–2034): 8.38%

- Asia Pacific: Largest market in 2025

- Utility: Largest end-user segment in 2025

A circuit breaker is an electrical safety device which safeguards an electrical circuit from harm caused by excessive current during overloads or short circuits. It functions as a switch that automatically halts the flow of electricity when a fault is identified, thereby preventing potential fires and damage to equipment. Increasing emphasis on energy transition and grid modernization initiatives, along with industrialization in emerging economies, is driving demand for circuit breakers.

ABB is a global market leader. It specializes in electrification products, robotics, and motion. The company offers a wide range of circuit breakers that serve an array of industries, including commercial buildings, manufacturing, and renewable energy installations.

MARKET DYNAMICS

MARKET DRIVERS

Global Energy Transition and Grid Modernization Initiatives Drive Demand in the Market

With numerous government programs for renewable energy and the emerging need to upgrade the aging grid system, advanced electrical circuit breakers are in great demand. In addition to enhanced grid stability, smart, and often DC-compatible circuit breakers are necessary as renewable energy sources are intermittent and require DC circuit breakers. Modern network connections require complex, structured protection to control decentralized generation, microgrids, and energy storage technology. Conventional networks were designed to handle the unidirectional power flow from massive central power facilities.

In order to improve the efficiency and resilience of power distribution and transmission networks, many countries and utility companies are also investing in upgrading and modernization. Installing next-generation breakers that do predictive maintenance, communicate with grid management, and expedite outage recovery is more crucial. These modernizations have increased the demand for advanced circuit breaker technologies required to control the expanding demand for power while ensuring a consistent supply from a diverse energy mix. For instance, in November 2024, the Indian government announced its goal to improve its electricity transmission infrastructure, with an investment of USD 107.89 billion for capacity augmentation by 2032. Interregional transmission capacity is expected to rise from 119 GW to 143 GW by 2026–2027 and 168 GW by 2031–2032.

Accelerated Urbanization and Industrialization in Emerging Economies Boost Market Demand

The increasing rate of urbanization and industrialization in emerging economies, especially in Asia, Africa, and parts of Latin America, is driving the demand for these breakers in electrical systems across different industries. The demand for additional residential, commercial, and public infrastructure, from housing complexes, shopping centers, and office buildings to schools, hospitals, and transit hubs, is enormous as millions of people move from rural to urban areas.

Simultaneously, manufacturing, industries, and logistics drive industrialization in these regions, which is at the stage of high development investment, thus demanding large investments in new factories, data centers, power substations, and industrial infrastructure. To prevent overloads and short circuits in heavy machinery, motors, and intricate industrial processes, industrial settings require extremely durable, dependable, and specialized circuit breakers, such as vacuum circuit breakers (VCBs) and air circuit breakers (ACBs). As of November 2023, India's multi-modal connectivity platform, PM Gati Shakti, launched in 2021, continues accelerating numerous infrastructure projects, including industrial corridors, urban development, and logistics hubs, requiring extensive electrical installations.

MARKET RESTRAINTS

Global Supply Chain Vulnerabilities and Volatile Raw Material Costs are Expected to Hamper the Market Demand

The global supply networks and the fluctuating prices of essential raw materials constitute a distinct constraint for the market. For components like semiconductors used in smart breakers, copper, aluminum, and other such elements, the production of circuit breakers mostly depends on foreign sourcing. Production schedules and delivery capacities for manufacturers globally have been directly impacted by higher shipping costs, a shortage of essential parts brought on by trade disputes, and labor shortages. Large-scale projects that need these components may be delayed due to this uncertainty, making planning challenging.

Furthermore, the cost of producing these products is directly impacted by the price volatility of essential raw materials like copper, aluminum, and steel, which is indirectly impacted by changes in global demand, energy prices, and trade deals. Manufacturers and key players are forced to pass on higher costs to customers or face decreased profit margins due to rising raw material costs, which may delay investment decisions or make projects less economically viable. For example, a rise in copper costs affects the breaker's conductive parts and the wiring it guards.

MARKET OPPORTUNITIES

Expansion of Electric Vehicle (EV) Charging Infrastructure and Data Centers Anticipated to Create Growth Opportunities

The market for electrical circuit breakers has a unique and high-growth opportunity due to the rapid rise in electric vehicle (EV) use and the concurrent, large-scale expansion of large scale data centers. First, extremely specialized and durable DC circuit breakers are necessary for EV charging infrastructure, particularly fast-charging stations. In contrast to conventional AC protection, DC breakers must manage the particular difficulties of continuous current and arc suppression in the absence of a natural zero-crossing, necessitating sophisticated designs for dependability and safety. The need for these specialized, high-power DC circuit breakers is growing as governments and commercial organizations worldwide spend billions developing extensive charging networks from public stations to fleet depots and home smart chargers.

Moreover, the increasing number of data centers due to the unrelenting growth of cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) is expected to create further growth opportunities. From utilities inbound inputs to individual server racks, these facilities require massive, redundant, and extremely dependable power distribution systems. Continuous operation data centers need high-capacity, often intelligent circuit breakers to protect against overloads and failures. For instance, in January 2023, Amazon Web Services announced plans to invest approximately USD 35 billion by 2040 in new data centers in Virginia, a major cloud computing hub, highlighting the immense and ongoing need for robust power infrastructure.

MARKET CHALLENGES

With Increasing Advancements, Cybersecurity Threats are Expected to Challenge the Market Expansion

Global supply chain vulnerabilities and fluctuating raw material prices are major restraining factors. However, the quick transition to smart, linked grids and the associated cybersecurity threats are expected to act as a major challenge for the market expansion over the forecast period. Circuit breakers are evolving from basic mechanical devices into vital nodes in a digital system as they incorporate cutting-edge sensors, communication modules, and artificial intelligence (AI) for predictive maintenance and grid management. The challenge is not only in creating this advanced technology but also in protecting these smart gadgets from cyberattacks that could compromise data integrity, grid stability, or even be used as a weapon for sabotage, necessitating the development of completely new security designs and protocol levels.

CIRCUIT BREAKER MARKET TRENDS

Increasing Shift toward Smart and Digital Circuit Breakers is one of the Latest Trends

There is an increasing shift towards smart and digital circuit breakers, further promoting the technological advancements in circuit breakers for enhanced performance. Some emerging technologies include the growing need for energy management, smart grid initiatives, and increasing adoption of the Industrial IoT, remote monitoring, and predictive maintenance in industrial and commercial sectors. In addition, the miniature circuit breakers (MCBs) are widely used in low-voltage residential, commercial, and industrial systems to protect electrical circuits from overloads and short circuits. They are popular because they are compact, reliable, easy to reset, and safer than traditional fuses.

Smart circuit breakers with the above features can improve system efficiency and dependability, optimize power distribution, and transmit data efficiently. In April 2020, China's National Development and Reform Commission (NDRC) announced the New Infrastructure initiative in their plans to speed up the 5G, AI, and industrial internet deployment, which includes collaboration, investments, research, and development of smarter, interconnected electrical components. This push for digital transformation across industries in China is creating growth opportunities for manufactures to develop better products to meet the increasing demand.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS ON THE MARKET

Recently announced Trump tariffs are expected to raise the price of electrical circuit breakers imported into the U.S., especially those from target nations like China. U.S. importers and consumers would absorb this direct cost increase, or companies would be forced to quickly diversify their supply chains by moving purchases to non-tariffed areas or possibly considering domestic U.S. manufacturing. However, the later is a more complicated and long-term change. These actions are expected to change long-standing trade patterns and change the competitive environment in the U.S. market, possibly increasing the price competitiveness of foreign circuit breakers made in the U.S. or free from tariffs.

Major producers of electrical circuit breakers, many of whom have a variety of production facilities, will systematically reassess their global production and distribution networks. This situation will probably hasten the current "China Plus One" trend, promoting investments in new manufacturing facilities outside conventional high-volume centers or possibly resulting in certain reshoring initiatives. The global market may see more competition from non-tariffed nations seeking to gain market share, even though U.S. consumers would pay more. This could result in a more fragmented supply chain and general price volatility as the industry adjusts to new trade restrictions.

SEGMENTATION ANALYSIS

By Type

Solid State Circuit Breakers Dominate the Market Due to Its Suitability in Various Electronic Equipment

Based on type, the market is segmented into solid state circuit breakers, mechanical circuit breakers, and others.

Solid state circuit breakers is growing at a fastest rate with a CAGR of 10.00%, as they are suitable for sensitive electronic equipment, data centers, and renewable energy applications because they meet the requirements for arc-less switching, precise current management, and ultra-fast operation. In September 2022, ABB launched its new solid-state circuit breaker, a SACE Infinitus, which is designed to make it easier to connect, safeguard, and manage DC network systems for ships of all shapes and sizes. The SACE Infinitus is the world's first semiconductor-based circuit breaker with IEC 60947-2 certification. For low-voltage maritime applications, the device will be offered with DNV certification.

Mechanical circuit breakers hold the dominating market share with 55.99%. They are widely adopted due to their proven reliability, cost-effectiveness, and robustness across various applications. Growth of this segment is mostly driven by ongoing construction activities in residential, commercial, and industrial sectors, as well as the need to replace aging electrical infrastructure, especially in developing economies.

By Voltage

Medium Voltage Dominates the Market Due to Its Wide Range of Applications

Based on voltage, the market is segmented into low voltage, medium voltage, and high voltage.

Medium voltage holds a majority share of the market with 45.53% in 2026 as they are crucial for industrial plants, utility distribution networks, and renewable energy integration. In January 2022, ABB introduced a new medium-voltage circuit breaker that improves equipment life and steel mill performance. For applications up to 38kV, the recently announced VD4-AF1 is the first medium-voltage (MV) circuit breaker with servomotors.

High voltage is the second leading segment, growing at a CAGR of 6.46%, essential for large power generation, transmission networks, and intercontinental grid connections. Market expansion is driven by massive grid infrastructure projects, cross-border energy trade, long-distance renewable energy transmission, and the replacement of aging high-voltage components to ensure grid stability and reliability.

Low-voltage accounted for the fastest growth rate of 9.92% during the forecast period and are widely used in residential, commercial buildings, and light industrial applications. New construction, increasing electricity consumption and the rising adoption of smart home/building technologies are driving demand for these electrical devices.

By Installation

Outdoor Installations Dominates the Market Due to High Demand for Large Outdoor Plants

Based on installation, the market is segmented into indoor and outdoor.

Outdoor installation holds a major share of the market accounting for 56.47% in 2026. In outdoor installations, circuit breakers are deployed in large substations, transmission lines, and renewable energy farms, requiring robust equipment resistant to extreme weather conditions. Large-scale utility projects and the rollout of new renewable energy projects' infrastructure are driving the growth of this segment.

Indoor installations are expected to be the fastest-growing with a CAGR of 8.80% over the forecast period due to industrial growth and development of compact and secure electrical infrastructure within confined spaces. These are widely used for controlled environments such as substations, industrial facilities, and large commercial buildings where space optimization, protection from elements, and enhanced safety are critical.

By Rated Voltage

15kV – 50kV Range Dominates the Market Due to its Wide-Scale Application in Distribution Networks

Based on rated voltage, the market is categorized into upto 500V, 500V – 1kV, 1kV – 15kV, 15kV – 50kV, 50kV – 70kV, 70kV – 150kV, 150kV – 300kV, 300kV – 600kV, 600kV – 800kV, and above 800kV.

15kV – 50kV rated voltage range holds majority share of the market accounting for 17.21% in 2026. These are widely used for distribution networks, larger industrial facilities, and renewable energy collection systems. Some of the major driving factors include expanding distribution grids, integrating distributed renewable energy sources, and upgrading urban power infrastructure.

Upto 500V and 500V–1kV category is widely used to serve most residential, commercial, and light industrial applications, ensuring building safety and fault protection. The upto 500V segment is set to grow at a CAGR of 7.93% and 500V-1kV with a growth rate of 9.77%. New residential and commercial construction, expanding adoption of electric vehicles requiring dedicated charging circuits, and integration of smart home/building technologies are all increasing the demand for reliable low-voltage protection.

50kV – 70kV, 70kV – 150kV, 150kV – 300kV, 300kV – 600kV, 600kV – 800kV, and above 800kV are fundamental for high-capacity power transmission and grid interconnections over vast distances. The 600kV-800kV is expected to grow at a highest growth rate of 11.04% during the forecast period. High-voltage circuit breakers are used to protect transmission and distribution networks by interrupting fault currents and safely isolating equipment during abnormal conditions.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Utility Dominates the Market Due to Numerous Ongoing Upgradation Projects

Based on end-user, the market is categorized into residential, commercial, industrial, and utility.

Utility is the dominant end-user in the market with a share of 43.66% due to increasing demand for upgradation, aging grid infrastructure replacement, grid modernization, integration of large-scale renewable energy sources, and increasing electricity demand from population and industrial growth, requiring highly reliable and often eco-friendly solutions.

In February 2023, ABB won a major order from National Grid in the UK to upgrade critical substations with advanced circuit breakers and gas-insulated switchgear, enhancing the resilience and capacity of the national transmission system.

The industrial segment is the second leading end-user, growing at a CAGR of 23.10% in 2026, covering manufacturing plants, process industries, mining, and heavy industries. Growth of this segment is driven by factory automation, new plant construction, and upgrades to existing facilities for improved safety, efficiency, and meeting increasing power demands.

In March 2023, Siemens supplied its industrial circuit protection solutions, including robust circuit breakers, for a new EV battery manufacturing plant in Germany, supporting the high power demands and safety requirements of automated production lines.

CIRCUIT BREAKER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market and is expected to be the fastest-growing region due to large-scale infrastructure and grid modernization.

Asia Pacific

Asia Pacific Circuit Breaker Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Large-scale Infrastructure Developments in the Region Boost the Market in the Region

The Asia Pacific held the dominant share in 2025, valued at USD 9.82 billion with a CAGR of 39.99%. The market in the region is shaped by mega-scale infrastructure and synthetic grid duality. With significant regional investments in Ultra-High Voltage (UHV) transmission lines, the region is leading the way. With switchgear and circuit breakers expressly developed in collaboration with OEMs such as XD Electric and GE China, China's State Grid operates over 30 UHV lines, some of which surpass 1,100 kV. In June 2025, the State Grid Corporation of China declared that the ±800 kV ultra-high voltage (UHV) direct current transmission project connecting Chongqing in Southwest China and Hami in Xinjiang was now operational. This is China's third significant project to transport electricity from Xinjiang, a region rich in energy, to other regions. The Japan market is projected to reach USD 1.24 billion by 2026 and the India market is projected to reach USD 1.68 billion by 2026.

China

High Investment in Ultra-High Voltage (UHV) and Smart Grid Drive Demand in China

China is one of the leading countries in the market in the region. It is at the forefront of investing heavily in Ultra-High Voltage (UHV) transmission networks, smart grids, and renewable energy parks, all requiring advanced solutions. For instance, in January 2025, China's State Grid announced it to invest over USD 88.7 billion in the country's power grid in 2025, up from USD 83.53 billion in 2024. Its main objectives are to improve the power grid, fortify the distribution system, and support the growth of renewable energy. Additionally, it is constructing enormous long-distance UHV transmission lines to provide the nation's population centers with electricity from mega-bases in western China.

North America

Grid Modernization and Increased Resilience against Severe Weather Events Drive Demand in the Region

During the forecast period, the North America region is projected to record a growth rate of 8.09%, which is the second highest amongst all the regions, and touch the valuation of USD 5.67 billion in 2026. North America's market is driven by a unique combination of regionally specific causes, with major factors among them being the urgent need for grid modernization and increased resilience against increasingly severe weather occurrences. In August 2023, Eaton made over USD 500 million in manufacturing investments in North America to promote energy transition, electrification, and industry-wide digitization. Eaton is expanding the production of its metering and circuit breakers for residential and commercial buildings. To increase the supply of its solutions for clients, improve supply chain efficiency, and strengthen manufacturing resilience, these investments include diversifying production across many American locations and increasing capacity. Backed by these factors, countries including the U.S. are expected to record the valuation of USD 4.72 billion in 2026 and Canada to record USD 0.88 billion in 2025.

U.S.

High Industrial Electrification and Automation Drive the Market Demand in the U.S.

U.S. dominates the North America market due to high demand for high-tech circuits driven by industrial electrification and automation. Data centers, logistical hubs, and factory floors are adopting more automated machinery and equipment, which increases the need for uninterruptible power and safety measures. In March 2025, ABB announced that it would increase the production capacity of its low-voltage electrification products in the U.S. by investing USD 120 million. Moreover, over the last three years, the corporation has invested over USD 500 million in its U.S. operations. It built a new USD 100 million industrial electric drive manufacturing facility and innovation lab in New Berlin, Wisconsin, in October 2024.

Europe

Highly Interconnected Electrical Networks in the Region to Drive Demand in the Region

The market in Europe is estimated to reach USD 5.01 billion in 2026 and secure the position of the third-largest region in the market. In the region, the Germany is estimated to reach USD 1.34 billion each in 2026. Europe operates one of the most interconnected electrical networks, the ENTSO-E grid linking over 35 countries, which has created high demand for circuit breakers that must comply with multiple national standards while operating across borders. Moreover, manufacturers are focusing on customizing circuit breakers for cross-border substations, which is also challenging for most manufacturers. For instance, in August 2025, ABB launched its SACE Emax 3, the next version of its flagship air circuit breaker in Italy. The cutting-edge Emax 3 addresses growing concerns about grid stability, cybersecurity, and the soaring power demands of artificial intelligence (AI) in data centers. It is aimed at large facilities with high power demands, such as data centers, advanced manufacturing sites, and critical infrastructure like hospitals. The UK market is projected to reach USD 0.73 billion by 2026.

Latin America

Improving Infrastructure and Ongoing Grid Upgrades Boosts the Demand in the Region

The market in Latin America is influenced by several factors, including the rising countries' substantial infrastructure construction such as development of electricity grids, ongoing grid upgrade requirements, and the quick integration of renewable energy. Public-private partnerships (PPPs) for transmission expansion and large-scale renewable energy auctions have resulted in new regional projects. For instance, in June 2023, Brazil's National Electric Energy Agency (ANEEL) conducted a major transmission auction, awarding 15 lots totaling USD 3.2 billion (R$15.7 billion) in investments for new transmission lines and substations across several states, directly driving substantial demand for high-voltage circuit breakers. The Latin America market in 2026 is set to record a valuation of USD 2.38 billion.

Middle East and Africa

Rapid Industrialization and Renewable Energy Integration Projects Demand Circuit Breakers in the Region

Middle East & Africa is anticipated to grow at a considerable rate owing to rapid industrialization, integration of renewable energy sources, infrastructure developments, and growing focus on electrical safety. The Middle Eastern countries such as the UAE, Saudi Arabia, and others are diversifying their economies beyond oil & gas, which has led to significant infrastructural developments, including the development of ports and transportation networks. In addition, rising investments in power generation, transmission, and distribution networks are increasing the demand for robust electrical protection systems, including circuit breakers. In the Middle East & Africa, GCC is set to attain the value of USD 1.22 billion in 2025. These factors are anticipated to drive the market growth in this region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Innovation and Advanced Product Portfolio Drive the Competition among Major Players

In the global market, some of the major players such as ABB, Schneider Electric, Eaton, Siemens AG, General Electric, and others hold a considerable share.

Key players are known for their innovative and advanced circuit breakers with a wide range of product portfolios meeting varied demands in the market. ABB is a pioneering company in electrification products, robotics, and motion. The company offers wide range of electrical equioment and protective devices that serve a wide array of industries, including commercial buildings, manufacturing, and renewable energy installations. With the growth of Industry 4.0, ABB switches and circuit breakers will play a crucial role in smart manufacturing, industrial automation, and other advanced applications. Some other players include Eaton, Legrand, Mitsubishi Electric Corporation, among others.

List of the Top Circuit Breaker Companies Profiled

- ABB Ltd (Switzerland)

- GE Vernova (U.S.)

- Schneider Electric (France)

- Eaton (Ireland)

- Siemens (Germany)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- CG Power and Industrial Solutions Limited (India)

- Kirloskar Electric (India)

- Camsco Electric (Taiwan)

- BCH Electric Limited (India)

- Salzer Electronics Limited (India)

- Atom Power, Inc. (U.S.)

- Larsen & Toubro Ltd (L&T) (India)

KEY INDUSTRY DEVELOPMENTS

- April 2025- ABB announced the launch of a comprehensive switchgear solution for wind turbines. In order to facilitate the installation of larger wind turbines with greater yields, it combines a 3200A AF Contactor and a 7200A Emax 2 air circuit breaker. The system provides the greatest power rating in the industry for a full switchgear solution, resulting in exceptional switching efficiency and dependability.

- August 2024- Mitsubishi Electric Corporation signed an agreement with Siemens Energy Global GmbH & Co. KG to jointly create requirements specifications for DC circuit breakers and DC switching stations. The agreement seeks to implement multi-terminal high voltage DC (HVDC) systems to facilitate the effective operation of extensive renewable energy resources. Both businesses will produce relevant components separately and sell and service their own HVDC and DC switching systems.

- July 2024- Mitsubishi Electric Corporation received an order from Kansai Transmission and Distribution, Inc. for 84kV dry air insulated switchgear, a new green, greenhouse gas-free product that will be used in gas-insulated switchgear (GIS) that will be installed in substations.

- April 2024- Schneider Electric launched two new entry-level products, the Manual Transfer Switch (MTS) and the GoPact Moulded Case Circuit Breaker (MCCB). Five frame sizes ranging from 125 to 800 amps are available, and most of the accessories required for simple operation, easy maintenance, and strict security are included. In addition, the MTS can function at 55 ˚C without derating and has a long mechanical life of 10,000–20,000 cycles.

- May 2023- Schneider Electric announced the launch of EvoPacT, a new medium voltage circuit breaker for the Canadian market. This updated solution was created to meet the demands of cloud and service providers, infrastructure, huge industrial and commercial buildings, and electro-intensive operations.

Investment Analysis and Opportunities

- Increasing R&D for developing new product categories and increasing manufacturing capacity to meet changing market demands, investment in the circuit breaker sector is propelling notable growth. This includes significant funding for the creation of intelligent (IoT-enabled) circuit breakers with improved arc/ground fault prevention, predictive maintenance, and customized solutions for direct current (DC) applications.

- For instance, major manufacturers like ABB and Schneider Electric have consistently highlighted their increased R&D spend on digital electrification solutions. In May 2025, Schneider Electric Infrastructure Ltd. (SEIL) announced plans to increase its circuit breaker manufacturing capacity across India. SEIL plans to establish a new circuit breaker facility in Kolkata with an investment of millions of dollars. With an anticipated completion date of FY 2027, this new facility will have the capacity to produce 40,000 units of advanced breakers annually.

REPORT COVERAGE

The global Circuit Breaker market report delivers a detailed insight into the market and focuses on key aspects such as the leading companies in the. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.38% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Voltage

|

|

By Installation

|

|

|

By Rated Voltage

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 26.49 billion in 2026.

The market is likely to grow at a CAGR of 8.38% over the forecast period (2026-2034)

The utility segment is expected to lead the market owing to the use of miniature circuit breakers.

The market size of Asia Pacific stood at USD 9.82 billion in 2025.

Rising focus on electrification to propel the adoption of circuit breaker products.

Some of the top major players in the market are ABB, General Electric, and Schneider Electric.

The global market size is expected to reach USD 50.44 Billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us