Cloud Encryption Market Size, Share & Industry Analysis, By Component (Solution and Services), By Service Model (PaaS, IaaS, and SaaS), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Industry (BFSI, Healthcare, Retail & Ecommerce, IT & Telecommunication, Government, Aerospace & Defense, and Others), and Regional Forecast, 2026 - 2034

KEY MARKET INSIGHTS

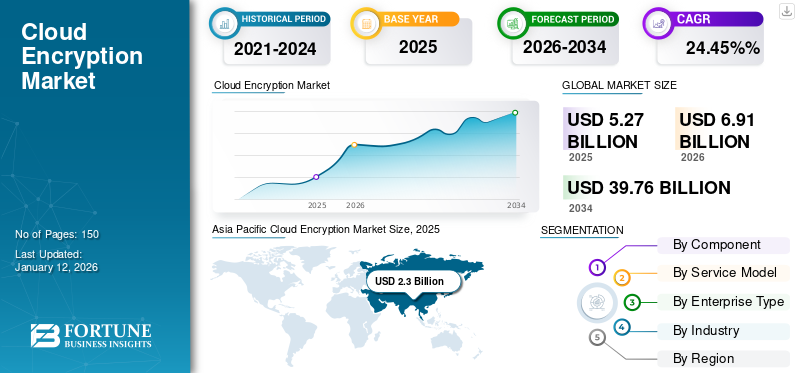

The global cloud encryption market size was valued at USD 5.27 billion in 2025. The market is projected to be worth USD 6.91 billion in 2026 and reach USD 39.76 billion by 2034, exhibiting a CAGR of 24.45% during the forecast period. Asia Pacific dominated the global market with a share of 43.61% in 2025.

Cloud encryption is a data security method in which plaintext data is encrypted into unreadable ciphertext to aid in keeping that data secure within or between cloud environments. This is one of the most effective ways to ensure data privacy and protect cloud data in transit or at rest from cyber-attacks. Furthermore, the cloud storage provider encrypts the data and transmits the encryption key to the user. These keys are used to securely decrypt data when necessary, turning hidden data into readable data during data transfer.

In addition, several enterprises are focusing on data encryption in the cloud to minimize security concerns and confidentiality risks. Cloud cryptography employs encryption techniques, including symmetric and asymmetric encryption, to defend sensitive data stored in the cloud from unauthorized users and prevent data breaches. Thus, by applying strong encryption and safeguarding decryption keys, businesses can store data in the cloud, protecting it from hackers and malicious users.

The shift to remote work by businesses during the COVID-19 pandemic accelerated the adoption of cloud services due to the increasing importance of data security. However, the adoption of these services led to various security challenges, which created the need for robust cloud encryption strategies and proper implementation and continuous security monitoring to ensure data protection in the cloud.

Cloud Encryption Market Trends

Rising Cloud Adoption and Virtualization among Various Organizations to Fuel Market Growth

Many organizations are increasingly migrating their operations to the cloud due to its scalability, flexibility, and cost-efficiency. Cloud services provide businesses with the ability to scale their IT infrastructure up or down as needed, reducing the need for costly on-premises hardware. Therefore, virtualization technologies play a crucial role in this process by enabling the efficient allocation of cloud resources and the creation of virtual instances of servers, storage, and networking components.

According to the Encryption Consulting Report, 2023, 68% of organizations were leveraging cloud platforms for storing and processing their sensitive data, 58% had already implemented one or more encryption technologies to protect the sensitive data stored in the cloud. Whereas, 44% of the organizations were planning to implement cloud encryption over the next two years.

This allows for greater resource utilization and flexibility in managing workloads. This factor is expected to boost the growth of the market over the study period.

Download Free sample to learn more about this report.

Cloud Encryption Market Growth Factors

Rising Concerns over Data Security to Drive Market Growth

Increasing concerns about privacy and data security have heightened the demand for cloud encryption solutions. The use of these solutions offers a secure way to defend complex data from unauthorized access, ensuring that data remains secure and confidential even against unauthorized customers or cybercriminals. It also helps businesses comply with regulatory requirements, including the Payment Card Industry Data Security Standard (PCI DSS) and General Data Protection Regulation (GDPR). The cost-effectiveness of this encryption solution is also boosting demand for these solutions. Through this encryption, organizations can protect their data without investing in expensive infrastructure and hardware. This makes cloud encryption an attractive decision for enterprises of all sizes, especially those with limited budgets, thus boosting the revenue of the market.

RESTRAINING FACTORS

Lack of Awareness about Cloud Encryption and Performance Concerns among Enterprises May Hinder Market Growth

Managing encryption keys in the cloud can be complex. If the keys are lost or compromised, data can become inaccessible. Securely managing and storing encryption keys is crucial. Encrypting and decrypting data adds computational overhead. This can impact the performance of applications that rely heavily on cloud services.

As a result, many enterprises may not fully understand the importance of encryption in the cloud. This lack of awareness can lead to misconceptions about the level of security provided by cloud service providers. Consequently, organizations may not prioritize encryption or may rely solely on default encryption settings, which may not be sufficient for their specific needs.

Hence, by addressing these issues and improving awareness, the market can overcome these hindrances and increase adoption among enterprises concerned about security and performance.

Cloud Encryption Market Segmentation Analysis

By Component Analysis

Solution Segment Dominates the Market by Safeguarding Data in the Cloud

By component, the market is fragmented into solution and services. The solution segment dominates the market with the highest share of 57.55% in 2026. The primary function of these solutions is to secure data. They protect sensitive information from unauthorized access and data breaches, ensuring the confidentiality and integrity of data stored in the cloud. Several solutions such as Thales CipherTrust, Symantec, and McAfee MVISION Cloud are indispensable tools for safeguarding data, meeting regulatory requirements, and building trust in cloud environments. Therefore, by addressing the evolving security challenges posed by the widespread adoption of cloud solutions and increasing the value of data, many organizations rely on robust encryption solutions to boost the global cloud encryption market growth.

In addition, the services segment is predicted to grow with the highest CAGR during the forecast period. Major cloud service providers such as AWS, Azure, and Google Cloud have incorporated encryption services into their platforms. This integration makes it easier for organizations to implement encryption as a part of their cloud infrastructure. Thus, the adoption of encryption services is driven by the imperative to protect sensitive data in an increasingly digital and interconnected world.

Hence, these factors fuel the adoption of encryption solutions and services, propelling market growth over the forecast period.

By Service Model Analysis

Platform-as-a-Service Segment Leads the Way by Streamlining Security and Development

On the basis of service model, the market is subdivided into Platform-as-a-Service, Infrastructure-as-a-Service, and Software-as-a-Service. The Platform-as-a-Service segment holds the largest market share of 40.44% in 2026. This is due to the integration of encryption into applications, enhanced security, and the reduced complexity and costs associated with building and maintaining encryption solutions based on this service model. Thus, these platforms with strong encryption capabilities benefit organizations in protecting their data effectively while accelerating their development efforts.

The Software-as-a-Service segment is anticipated to grow at the fastest CAGR over the analysis period. This is due to the increasing need to protect cloud applications from cyber-attacks. This platform allows enterprises to use cloud-based web applications with a Pay-As-You-Go pricing model. Hence, the increasing requirement to protect cloud applications from cyber-attacks, as well as the increased use of cloud-based services, are driving market expansion.

By Enterprise Type Analysis

Large Enterprises Segment Spearhead Market by Ensuring Data Security at Scale

By enterprise type, the market is subdivided into large enterprises and small & medium enterprises. The large enterprises segment dominated the market with the highest global cloud encryption market share of 55.66% in 2026. These enterprises handle vast amounts of sensitive data, including customer information, financial records, and intellectual property. Cloud encryption helps mitigate security risks by ensuring that data remains confidential and protected, even in the cloud. These encryption services help enterprises meet compliance standards by providing robust security measures.

In addition, the Small & Medium Enterprises (SMEs) segment is predicted to grow with the highest CAGR during the forecast period. As SMEs often have limited budgets for managing business operations and other activities, they are turning to cloud-based solutions to meet their growing business requirements. Cyber threats are more frequent in SMEs, and encryption solutions help enhance the security levels of the company’s data by encrypting information and securing it from the reach of hackers. These factors play a vital role in boosting market growth.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

IT & Telecommunications Segment Lead Market Share, Prioritizing Data Security

On the basis of industry, the market is segmented into BFSI, healthcare, retail & ecommerce, IT & telecommunication, government, aerospace & defense, and others. The IT & telecommunications segment held the largest market share of 21.80% in 2026. Data security is one of the primary concerns of the telecom and IT industry, which is driving the market. IT companies use cloud encryption to protect their customers' data, such as call records, text messages, and browsing history. These companies also use encryption to protect their own infrastructure, such as network equipment and data centers. Moreover, they are using cloud technologies to reduce the time and cost of the processes. With cloud capabilities, the industry is focused on growing its business processes, and the increasing number of cyber threats and data breaches creates a growth opportunity for cloud encryption software.

The BFSI segment is expected to grow at the highest CAGR during the forecast period. This industry has high data security requirements as it deals with delicate and private data of account holders. Banks are keen to enhance their cybersecurity infrastructure to identify cyber risks through better investments in cloud encryption. These encryption solutions help the BFSI industry by ensuring the confidentiality and security of customer records and information, protecting against threats or dangers to data integrity, and preventing unauthorized access to data. In addition, increasing digital payments will increase the risk of cyber-attacks, which is expected to drive segment growth over the analysis period.

REGIONAL INSIGHTS

In terms of geography, the global market is divided into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further segmented into countries.

Asia Pacific Cloud Encryption Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 2.3 billion in 2025 and USD 3.22 billion in 2026. The healthcare and telecom sectors in Japan and China, as well as India's massive service economy and other evolving Asian nations, are driving the market expansion in the region. Hence, the growing adoption of technology in the region acts as a catalyst for market expansion. The Japan market is projected to reach USD 0.84 billion by 2026, the China market is projected to reach USD 1.07 billion by 2026, and the India market is projected to reach USD 0.39 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America holds the significant market share. The regional market is expected to witness rapid growth over the study period as data privacy and security are one of the major concerns for businesses in the region. Additionally, the region has experienced several high-profile data breaches in recent years, which have resulted in outrage among companies providing cloud services as the privacy of user data was compromised. This has forced various companies to tighten their cloud security and implement better encryption solutions. The U.S. market is projected to reach USD 0.69 billion by 2026.

Furthermore, similar breaches have compelled many companies to invest heavily in better encryption software. This data loss problem is expected to drive the market for these encryption solutions. As a result, North America holds the largest market share due to the region's growing development.

According to the Encryption Consulting Survey, the global average adoption of encryption was about 52%. The U.S. showed the highest adoption of encryption (77%) compared to Germany (76.5%), while Japan showed a higher encryption adoption rate (66%) across the Asian region. This shows the difference in the level of encryption adoption across regions and its impact on the decision-making process.

Europe

Europe is expected to showcase steady growth over the forecast period. It is another rising market for data encryption platforms. Growing implementations of data encryption solutions in government, as well as private and public establishments to protect private data, support market growth. Furthermore, Europe has some of the strictest data protection regulations in the world, such as the General Data Protection Regulation (GDPR). These regulations require enterprises to execute appropriate security measures to protect personal data, and cloud encryptions are a key component of any data protection strategy. Hence, these factors are set to boost the regional market growth. The UK market is projected to reach USD 0.21 billion by 2026, and the Germany market is projected to reach USD 0.21 billion by 2026.

South America and Middle East and Africa

South America is poised to depict significant growth over the study period. This is due to the lower level of economic development and a lack of awareness regarding the benefits of cloud computing. The region shows less stringent data protection regulations than other regions. This makes organizations less likely to implement security measures such as cloud encryption. In addition, the Middle East and Africa (MEA) market is expected to witness substantial growth over the analysis period due to increased investment and government funding for digitization.

Key Industry Players

Market Players to Adopt Merger & Acquisition Strategies to Expand Their Operations

Prominent players operating in the global market are focusing on increasing their global presence and market share through product developments, partnerships, mergers, and acquisition strategies. These companies are concentrating on creating effective marketing strategies and developing new solutions to maintain and grow their market share. The growing demand for cloud solutions is expected to create lucrative opportunities for the market players.

List of Top Cloud Encryption Companies

- IBM (U.S.)

- Sophos Group plc (U.S.)

- Thales Group (France)

- Skyhigh Security (U.S.)

- Microsoft (U.S.)

- Netspoke Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Atos (France)

- Hitachi Solutions, Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- December 2023: Cisco Systems Inc. introduced an artificial intelligence assistant to enhance cybersecurity measures by providing policy recommendations, advanced data analysis, and automated task management. The Cisco AI Assistant for Security helps customers make informed decisions, enhance the tool’s capabilities, and automate difficult tasks.

- November 2023: Skyhigh Security expanded its global Point of Presence (POP) in collaboration with Oracle Cloud Infrastructure to deliver cloud security services to scale and support organizations across the world.

- September 2023: IBM announced the expansion of the IBM Cloud Security and Compliance Center, a group of security solutions designed to aid organizations in mitigating risk and protecting data across their multi-cloud environments, hybrid, and workloads.

- July 2023: Microsoft Corporation expanded its cloud logging accessibility and flexibility for accessing the wider cloud security logs of customers present across the globe. This product expansion will protect customers' databases and increase the secure-by-default baseline of cloud platforms with deeper insights.

- June 2023: Thales Group launched the CipherTrust Data Security Platform on a cloud-based subscription model. The launch of this platform would give customers the choice and flexibility to leverage the platform's data and classification discovery, key management, encryption, and secrets management capabilities in their software offerings.

- June 2023: Netskope Inc. announced the launch of a comprehensive data protection solution to benefit businesses by securely managing customers' use of ChatGPT and other synthetic artificial intelligence (AI) applications, such as Google Bard and Jasper. It would help organizations encourage the responsible use of these increasingly popular applications by using appropriate data protection controls to help businesses stay safe and productive.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Moreover, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.45% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Service Model

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market value is projected to reach USD 39.76 billion by 2034.

In 2025, the market was valued at USD 5.27 billion.

The market is projected to record a CAGR of 24.45% during the forecast period.

By industry, the IT & telecommunication segment is expected to lead the market.

Rising concerns over data security across the globe is the key factor driving market growth.

IBM, Sophos Group Plc., Thales Group, Skyhigh Security, Microsoft, Netspoke Inc., Cisco Systems Inc., Hewlett Packard Enterprise, Atos and Hitachi Solutions, Ltd. are the top players in the market.

Asia Pacific dominated the global market with a share of 43.61% in 2025.

By component, the services segment is expected to grow with a remarkable CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us