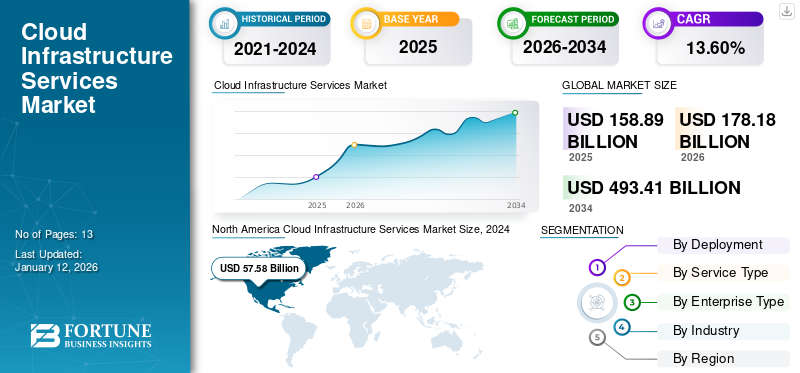

Cloud Infrastructure Services Market Size, Share & Industry Analysis, By Deployment (Public Cloud, Private Cloud, and Hybrid Cloud), By Service Type (Compute as a Service, Storage as a Service, Network as a Service, and Others), By Enterprise Type (Large Enterprises and SMEs), By Industry (BFSI, IT & Telecom, Retail, Healthcare, Government, and Others), and Regional Forecast, 2026 – 2034

Cloud Infrastructure Services Market Size

The global cloud infrastructure services market size was valued at USD 158.89 billion in 2025 and is projected to grow from USD 178.18 billion in 2026 to USD 493.41 billion by 2034, exhibiting a CAGR of 13.60% during the forecast period. North America dominated the global cloud infrastructure services market with a share of 39.90% in 2025.

Cloud computing is a revolutionary technology trend in various industries, which has become a core component of a modern system and application integration strategy. According to industry experts, around 85% of businesses are estimated to adopt a cloud-first strategy by 2025. Rather than investing in costly hardware, enterprises are turning to cloud players, including Microsoft Azure, Amazon Web Services, and Google Cloud, for flexible cloud infrastructure as a service for networking, modernized computing, and storage resources. According to a survey by Radixweb, around 39% of companies are using the cloud as their cost-cutting objective.

Digital transformation gained popularity during the COVID-19 pandemic, and small and medium and large enterprises moved their workloads to the cloud and adopted productivity and collaboration services. According to industry experts, during the COVID-19 pandemic, end-user spending on public cloud infrastructure globally surged by 18.4% in 2021, with a total of USD 304.9 billion. Moreover, the pandemic and remote working scenarios highlighted the significance of cloud technology for business continuity. According to the Flexera survey, 27% of industry leaders said that there is a significant increase in cloud spending due to the COVID-19 pandemic. Due to these factors, the demand for cloud infrastructure services gained traction during the pandemic.

IMPACT of GENERATIVE AI

Rising Operational Models to Adapt to the Abilities of Generative AI

According to a survey by PwC, around 70% of business leaders believe AI is fundamental and necessary for developing future business opportunities. Therefore, generative AI has paved its way as a catalyst for change within cloud infrastructure. Generative AI is an important factor for enterprises that helps enhance security within the cloud environments. It helps enterprises detect predictive threats by evaluating huge datasets. It can anticipate potential cyber threats before they materialize, allowing for proactive defense mechanisms to be deployed. These proactive measures strengthen cloud systems against various cyber threats, including intrusions, malware, and sophisticated attacks. Generative AI focuses on threat identification and extends to optimizing operational efficiency within the cloud infrastructure.

The impact of Gen AI has expanded beyond cybersecurity into the broader domain of cloud operations. As cloud computing demand is surging, the operational models and development methods are growing to adapt to the abilities of Gen AI. This transformation includes a shift to more dynamic, AI-driven methodologies from traditional IT operating models. As per industry experts, by 2024, around 50% of new system deployments will be cloud-based, and generative AI will play a significant role in the transition.

Cloud Infrastructure Services Market Trends

Rising Trend of Hybrid and Multi-Cloud is Driving the Cloud Infrastructure Services Market Growth

Due to the increasing cost of cloud resources, players in the market are developing strategies that minimize wasteful use of the cloud and, in turn, save money. As per research, around 90% of large organizations have already utilized multicloud architectures, and their data is dispersed among various cloud providers. The usage of hybrid and multi-clouds is an ongoing trend in cloud computing that will continue in 2024 and beyond. Multi or hybrid cloud solutions facilitate effective workload management, assuring that each service or application resides in the most suitable cloud environment. This approach improves flexibility, reduces risks, and provides a strategic outline for IT infrastructure management.

According to a research report on Multi-Cloud Maturity, around 95% of organizations said that multi-cloud architectures are critical for business success, and 52% of organizations believe that organizations that do not embrace a multi-cloud approach will risk failure. A multicloud architecture is the present and future for most enterprises. Multi-cloud strategies allow organizations to operate on an independent cloud in order to safeguard customer privacy and more effectively manage compliance with data-sovereignty laws.

Thus, the trend of hybrid and multi-cloud is poised to drive cloud infrastructure services market growth during the forecast period.

Download Free sample to learn more about this report.

Cloud Infrastructure Services Market Growth Factors

Increasing Demand for Edge Computing is Propelling Market Growth

Edge computing is gaining popularity, as per the Fortune Business Insights Research, the edge computing market is estimated to reach USD 216.76 billion by 2032 from 21.14 billion in 2024 with a CAGR of 33.6%. The expanding landscape of edge computing is creating significant opportunities for the global cloud infrastructure service market. According to the Strategies for Success at the Edge survey, around 30% of enterprises are willing to spend their IT budgets on edge computing. As edge computing gains prominence, there is a growing need for decentralized infrastructure that brings computational power closer to data sources. Cloud infrastructure services can capitalize on this trend by developing solutions tailored to edge environments.

Edge computing utilizes data that is locally generated for supporting real-time responsiveness, which creates new user experiences and, at the same time monitors sensitive data and reduces costs of data transmission to the cloud. Cloud infrastructure services and edge computing are used in various industries, and the following are some use cases:

- Healthcare: In healthcare, edge computing can be used to process real-time data from wearable devices, enabling doctors to monitor patients remotely and make quick decisions based on the data. Cloud services can be used to store data securely and provide authorized personnel with access.

- Manufacturing: In manufacturing, edge computing can be used to analyze real-time data from sensors on machines, enabling predictive maintenance and reducing downtime. Cloud services can be used to store the data and provide insights into the performance of the machines.

- Autonomous vehicles: In autonomous vehicles, edge computing can be used to process real-time data from sensors on the vehicle, enabling quick decision-making and reducing the risk of accidents. Cloud services can be used to store the data and provide insights into the performance of the vehicles.

Therefore, the increasing demand for edge computing is propelling the cloud infrastructure services market share.

RESTRAINING FACTORS

Limited Customization May Hinder the Cloud Infrastructure Services Market Expansion

The limitation of customization for certain workloads turns into an important restraint for the market. The one-size-fits-all nature of cloud offerings does not meet the specific requirements of industries that demand highly specialized computing needs. Enterprises involved in niche sectors, including complex simulations or scientific research, often require customized configurations that do not adapt within standardized cloud infrastructures. This restricts the adoption of cloud services in sectors where personalized solutions are essential for optimal performance and efficiency.

Cloud Infrastructure Services Market Segmentation Analysis

By Deployment Analysis

Public Cloud Dominates with its Increasing Adoption by Enterprises Owing to its Scalability

By deployment, the market is segmented into public cloud, private cloud, and hybrid cloud.

The public cloud segment is expected to lead the market, contributing 67.42% globally in 2026, as enterprises are shifting to the public cloud for its ability to allow easy scalability and provide greater security and reliability for both internal team members and end-users. As per Accenture, moving workloads to the public cloud leads to 30%-40% of Total Cost of Ownership savings. In addition, with the public cloud, enterprises can create nimble virtual machines that can grow and shrink, save from server-intensive computing, and balance workloads. According to Flexera, around 30% of enterprises in various industries spend between USD 2.4 million and USD 12 million on public cloud.

By Service Type Analysis

Compute as a Service Leads with its Easy Creation of Containers

By service type, the market is divided into compute as a service, storage as a service, network as a service, and others.

The compute as a service segment dominated the market in 2023. With compute as a service, enterprises can quickly and easily create and deploy containers as needed, which allows them to scale their applications on demand. In addition, it helps them allocate computing resources, including memory, CPU, and storage, to the containers based on the application needs and provides APIs so that enterprises can manage and automate the tasks related to containers.

The network as a service segment is poised to account for 32.34% of the market share in 2026. Network as a service helps in identifying network issues by performing ongoing monitoring and preventive maintenance and generates alerts when a particular site is exhibiting abnormally high latency issues. This service type is a more efficient alternative to virtual private networks, multiprotocol label switching, and other legacy network configurations.

By Enterprise Type Analysis

Large Enterprises Segment Led Owing to Acceleration of Cloud Services Adoption Amid the Pandemic

By enterprise type, the market is bifurcated into large enterprises and SMEs.

The large enterprises segment will account for 61.46% market share in 2026. During the pandemic, large enterprises accelerated cloud services adoption to facilitate remote working and enhance productivity. In addition, cloud services play a significant role in protecting data against the cyber threat. With the surge in cyber-attacks, the cloud is becoming increasingly sophisticated and offers large enterprises an extra layer of protection. As per a cybersecurity firm report, around 90% of successful data breaches are due to human error. However, large enterprises are adopting cloud services.

The SMEs segment is estimated to showcase the highest CAGR during the forecast period. Cloud services provide SMEs with enhanced data security, flexible storage, and decreased downtime. As per a survey by TechRepublic, 44% of SMEs currently utilize cloud infrastructure or hosted cloud application services. According to Flexera, in 2024, around 70% of enterprises plan to increase their cloud spending by leveraging cloud technologies for operational enhancement.

By Industry Analysis

Growing Demand for Cloud Services in Telecom Companies to Boost IT & Telecom Segment Growth

By industry, the market is segmented into BFSI, retail, healthcare, IT & telecom, government, and others.

The IT & telecom segment dominated the market in 2023. In recent years, the telecom industry has undergone significant transformation due to the widespread adoption of cloud computing. Telecommunication companies are increasingly turning toward cloud computing as an alternative to traditional network architectures for enhancing agility and reducing operational costs. In the telecom sector, cloud computing provides a software-defined infrastructure that facilitates telcos to store and process data in remote data centers, rapidly expand their services, and respond quickly to changing demand. According to telecom statistics, nearly 35% to 50% of telecom companies use the cloud for deeper collaboration across digital ecosystems.

The BFSI segment is expected to account for 26.55% of the market in 2026, as the BFSI sectors depend heavily on technology to conduct day-to-day operations. These operations include managing customer data, processing transactions, and analyzing financial data. To guarantee continuous operations, BFSI organizations are adopting robust and reliable cloud infrastructure. As per the Rapyder Survey, around 83% of BFSI organizations already use cloud infrastructure, and 70% of leading banks expect their cloud spending to increase till 2026 to meet their customer requirements.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market for cloud infrastructure services is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further classified into leading countries.

North America Cloud Infrastructure Services Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 63.34 billion in 2025 and 69.93 billion in 2026, owing to digitization among enterprises in the region. According to the U.S. Federal Cloud Computing Strategy, the U.S. government instituted the Cloud First policy to accelerate the pace of cloud adoption. Around 94% of the U.S. and 88% of Canadian enterprises have at least one type of cloud deployment, with the majority being a multi-cloud or hybrid cloud. Enterprises in the U.S. and Canada utilize cloud computing for running and developing applications in a modern and dynamic environment. Around 74% of the U.S. infrastructure decision-makers stated that their firms are using containers on on-premise and public cloud environments and 14% of developers in Canada reported regular use of containers on public cloud. In addition, the COVID-19 pandemic accelerated cloud usage among enterprises in the region.

The U.S. market is expected to reach USD 51.99 billion by 2026.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Cloud spending in the region is estimated to reach around USD 200 billion in 2024 and enterprises in the region are integrating emerging technologies into their businesses. According to RedHat, around 87% of Japanese executives said that their firms have fully adopted cloud computing technology, and in Singapore, 68% of respondents stated that their firms have fully adopted cloud solutions. In addition, cloud investments in India accelerated during the pandemic, and the cloud market is estimated to reach around USD 13 billion by 2025. Thus, increasing cloud investments in countries in the region is a significant factor contributing to market growth.

The Japan market is expected to reach USD 6.67 billion by 2026, the China market is expected to reach USD 11.86 billion by 2026, and the India market is expected to reach USD 5.77 billion by 2026.

Europe is witnessing substantial growth as the active investments by government and private corporations to accelerate cloud adoption across the countries drives market growth. As per Eurostat, around 73% of enterprises use advanced cloud services related to application security and the use of computational platforms for application development.

The UK market is expected to reach USD 9.5 billion by 2026, while the Germany market is expected to reach USD 7.34 billion by 2026.

South America and the Middle East & Africa are experiencing significant growth as the governments in Brazil, Argentina, GCC, and South Africa are investing in digital strategies. In addition, enterprises in the countries are adopting cloud services to enhance agility, scalability, and cost-effectiveness.

Key Industry Players

Major Players Adopt Advanced Technologies to Strengthen Their Market Positions

Key players, such as Google, Amazon, and IBM, among others operating in this market, are upgrading their existing solutions to keep up with the changing user requirements. With the advanced technologies, including AI & ML, companies are upgrading their product portfolio. With this, companies aim to transform their services and serve their customers better. Furthermore, these market players proactively pursue partnerships, collaborations, mergers, and acquisitions to boost their product offerings.

List of Top Cloud Infrastructure Services Market:

- Google (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Alibaba Cloud (U.S.)

- Amazon Web Services (U.S.)

- VMware (U.S.)

- NEC Corporation (U.S.)

- Fujitsu Limited (U.S.)

- DXC Technology (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Fujitsu Limited extended its partnership with AWS to accelerate the modernization of legacy applications on the AWS cloud.

- September 2023: Oracle and Microsoft extended the partnership for delivering Oracle Database Services for simplifying cloud migration and multicloud deployment and management.

- May 2023: IBM Corporation launched IBM Hybrid Cloud Mesh to help enterprises manage their hybrid multicloud infrastructure and automate the process and observability of application connectivity between the public and private clouds.

- May 2023: VMware introduced VMware Cross-Cloud managed services to improve partner profitability and increase recurring services revenue.

- April 2023: DXC Technology launched an integrated data center solution, DXC Secure Network Fabric, that is optimized for hybrid cloud.

REPORT COVERAGE

The cloud infrastructure services research report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Service Type

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 493.41 billion by 2034.

In 2025, the market was valued at USD 158.89 billion.

The market is projected to grow at a CAGR of 13.60% during the forecast period.

By service type, the compute as a service segment led in 2025.

The increasing demand for edge computing is propelling the market growth.

Oracle, IBM, Amazon, and Google are the top players in the market.

North America held the largest market share in 2024.

By industry, the BFSI segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us