Cooling Towers Market Size, Share & Industry Analysis, By Type (Wet, Dry, and Hybrid), By Application (Chemicals & Petrochemicals, Pharmaceutical, Power Generation, HVAC, Food & Beverages, and Others), and Regional Forecast, 2026-2034

GLOBAL COOLING TOWERS MARKET OVERVIEW

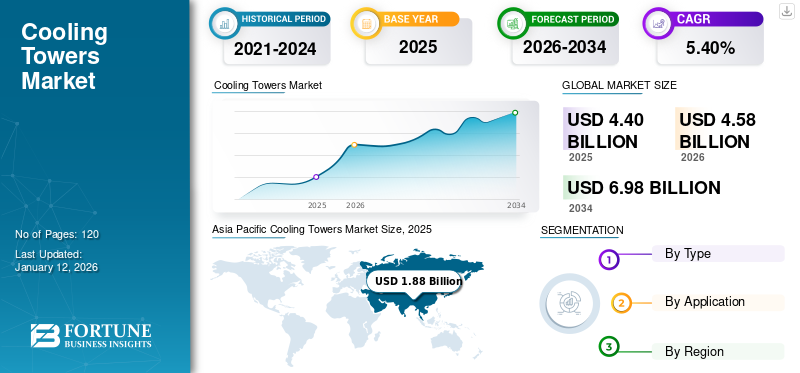

The global cooling towers market size was valued at USD 4.40 billion in 2025. The market is projected to grow from USD 4.58 billion in 2026 to USD 6.98 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. Asia Pacific dominated the cooling towers market with a share of 42.70% in 2025.

The cooling towers market is growing steadily around the world. These towers help remove excess heat in factories and buildings. More industries are using them because they save energy, support eco-friendly practices, and are needed for growing industries like power plants, chemical factories, and building cooling systems (HVAC).

Download Free sample to learn more about this report.

Market Size & Growth:

- 2025 Estimate Value: USD 4.40 billion

- 2026 Estimate Value: USD 4.58 billion

- 2034 Forecast Value: USD 6.98 billion

- CAGR (2026–2034): 5.40%

- Top Region: Asia Pacific – 42.70% share in 2025, led by industrial expansion in China and India

- Top Application: HVAC – driven by construction growth and rising investments in smart infrastructure

- High-Growth Region: North America – driven by strict environmental regulations and replacement of aging cooling infrastructure

Key Trends and Drivers:

- Eco-Friendly Cooling Innovations: Transition to HDPE towers, antimicrobial materials, and drift-reducing designs is driving demand for sustainable cooling systems.

- Energy Efficiency & Smart Technologies: Integration of Variable-Frequency Drive (VFD) motors and smart systems is enhancing energy performance.

- HVAC Demand Surge: Large-scale infrastructure projects and building automation systems are boosting HVAC usage, especially in emerging economies.

- Rise of Modular & Hybrid Cooling: Adoption of hybrid towers with low plume visibility and faster installation is growing across residential and airport zones.

- Industry Expansion: Power, pharma, and food & beverage sectors are increasingly deploying cooling towers for efficient process heat management.

Market Challenges:

- High Maintenance Costs: Operational expenses and need for regular maintenance limit adoption, especially among small facilities.

- Corrosion & Water Contamination: Chemical-laden water and air pollutants increase wear, requiring durable alternatives and water treatment.

- Competition from Alternatives: Geothermal and air-cooled systems are gaining traction due to lower environmental impact and reduced water use.

Market Opportunities:

- Industrialization in Emerging Economies: Growth in sectors such as data centers, desalination, and manufacturing in India, Egypt, and Eastern Europe presents robust demand.

- Water Conservation Technologies: Transitioning to dry and hybrid systems offers high potential for saving water and reducing thermal pollution.

- Customized HVAC Installations: Demand for application-specific tower designs in commercial buildings and critical infrastructure projects is increasing.

- Green Building Compliance: Regulatory pressure for sustainable building certifications creates a strong incentive for energy-efficient cooling solutions.

A cooling tower is a device that eradicates the release of waste heat to the environment by cooling a stream of coolant, essentially a stream of water, to a lower temperature. These towers can utilize the evaporation of water to expel process heat and cool the working fluid to approach the wet-bulb air temperature within the case of drying towers. This depends exclusively on air to cool the working liquid, approach the dry bulb, and later adjust the temperature with radiators. Growing demand across industries is expected to boost the cooling towers market share during the forecast period.

During the lockdown during the COVID-19 pandemic, buildings were left unused or unoccupied for an extended time in both HVAC systems and potable water systems, which created a considerable risk of growing legionella bacteria in these buildings. Therefore, it was important to ensure a safe re-opening of offices and buildings with thorough preventive maintenance of these buildings’ cooling infrastructure. Furthermore, the oil and gas sector also witnessed a considerable drop in demand as a result of the pandemic.

The oil and gas industry was already affected as a result of the dramatic drop in oil prices that began in mid-2014 and escalated. In 2020, the sector was hit by another setback as COVID-19 broke out. Major refiners were compelled to shut down their operations due to the pandemic and dwindling demand due to lockdowns.

The foremost applications of this market include cooling the circulating water utilized in petrochemical and other chemical plants, oil refineries, control stations, atomic control stations, and HVAC frameworks for cooling buildings. The classification is based on the sort of air induction into the tower, the majority of which are normal draft and initiated draft. Key players such as SPX Corporation, Krones AG, and others are focusing on investments in HVAC systems to boost market growth. Several strategic collaborations and partnerships with domestic players are being formed to boost the cooling towers market growth.

IMPACT OF SUSTAINABILITY

Optimal Energy Consumption and Durability to Drive the Market for Efficient Cooling Towers

Cooling towers with efficient and longer cooling effects are largely preferred across regions. Supportive government regulatory policies and effective usage of resources will further drive the growth of the cooling towers. End users are striving to develop cooling towers with reduced energy consumption and increased operational durability, further positively impacting the market.

MARKET DYNAMICS

Cooling Towers Market Trends

Evolving Environment-Friendly Products Accelerate the Market Growth

The cumulative change toward eco-friendly products due to the growing concerns regarding the environment is evolving as one of the prominent trends in the market. Furthermore, the changing government initiatives are resulting in the development of sustainable products. The manufacturers are focusing on the development of eco-friendly products. The product offers enhanced energy savings, i.e., 35%, and also has less piping and electric connection along with the lowest drift rate of circulating water flow.

Furthermore, the transition of towers from metal-clad into engineered plastic High-density polyethylene (HDPE) towers provides users with higher resilience, requiring low maintenance and fast installation time. Additionally, the new design of the towers consists of antimicrobial properties in the resins. This aids in reducing and eliminating the threat of outbreaks of diseases such as Legionnaires’ disease.

Additionally, these HDPE towers consume less water treatment, thereby improving water conservation, and thus making them an environment-friendly choice. Moreover, HDPE also saves energy owing to Variable-frequency Drive (VFD) motors increasing the demand for energy efficient cooling structure. Therefore, the factors above are contributing to the cooling towers market growth.

Market Drivers

New Technology HVAC Systems and Rise in Construction Activities to Propel the Market Growth

The global surge in infrastructure development is fueling the demand for HVAC systems, driven by extensive construction activities in both advanced and emerging economies. With increased construction of transportation infrastructure such as airports, bridges, and ports, the demand for heating, ventilation, cooling, and refrigeration equipment is poised to escalate.

Notably, major airport expansion projects such as the John F. Kennedy International Airport's addition of two international terminal complexes by 2025 underscore the scale of growth in the sector. These trends are driving a surge in demand as the construction industry seeks high-efficiency and tailored solutions to meet diverse requirements. Manufacturers are responding to this demand by offering customized solutions to address the evolving needs of customers, further propelling market growth.

Moreover, the emphasis on sustainability and energy efficiency in building design and construction is reshaping the cooling towers market, driving the adoption of innovative technologies and solutions. Integrating smart cooling systems, coupled with advancements in energy-saving technologies, is becoming increasingly prevalent as organizations strive to reduce environmental impact and operational costs. This shift toward eco-friendly cooling solutions is expected to drive further growth and innovation in the industry as businesses and consumers alike prioritize environmental responsibility and energy efficiency.

Market Restraints

High Maintenance Cost and Frequent Corrosion to Hinder the Market Development

Heightened corrosion concerns among customers continue to pose a significant challenge to the growth of the market. The presence of heavy chemicals in water supplies, such as sodium and air contaminants, exacerbates corrosion issues, jeopardizing equipment efficiency and safety. Furthermore, the drawbacks associated with traditional towers, including high water consumption, public health risks, and large physical footprints, have prompted the exploration of alternative cooling methods, such as geothermal cooling. Geothermal cooling offers enhanced energy efficiency and mitigates the drawbacks above, leading to increased interest in its adoption.

Moreover, transitioning from traditional cooling solutions to geothermal solutions presents substantial water conservation benefits. In the U.S. alone, such a shift could potentially save a minimum of 2 trillion gallons of water annually while also contributing to significant reductions in CO2 emissions over time. By embracing sustainable cooling technologies, industries can enhance operational efficiency and safety and contribute to environmental conservation efforts on a large scale. Thus, addressing corrosion concerns and promoting the adoption of eco-friendly cooling alternatives are essential steps toward fostering sustainable growth and innovation in the market.

Market Opportunities

Emerging Industries Across Developing Countries to Bring Huge Market Opportunities

Countries such as India, Egypt, and Eastern Europe are attracting investment for several industrial and renewable energy projects, including desalination plants, data centers, and power infrastructure. For instance, IDE Water Technologies announced the development of the Sorek 2 - Be’er Miriam Desalination Plant in Israel in March 2025. Industrial automation across sectors boosts the market for energy-efficient cooling solutions across regions.

SEGMENTATION ANALYSIS

By Type

Wet Towers to Hold Highest CAGR Owing to Rising Industrial Activities

By type, the market is bifurcated into wet, dry, and hybrid.

The wet cooling towers are forecasted to account for the highest revenue market share and CAGR during the forecast period, holding an 82.31% share in 2026. Wet towers, also known as open circuit towers, are an important component in industrial units. With the technological evolution, renewable technology has grown in acceptance. They employ the evaporation process to cool down the hot gear. Drift emissions are produced, and several drift eliminators are utilized to reduce them.

The dry segment tends to have steady growth. Dry towers do not require water to cool the equipment. The evaporation process meets the cooling requirements. However, the dry cooling tower offers many benefits, such as the removal of mist, icing, and fog. The water purification system provides a conclusive resolution to water problems by avoiding its use, thermal pollution, and evaporative losses. The dry cooling tower has a high demand in Heating, Ventilation, Air Conditioning, and Refrigeration (HVACR) systems and food & beverage applications.

Furthermore, hybrid towers are projected to experience a significant increase in popularity due to their ability to avoid visible plumes in cool, humid ambient conditions and when local constraints require this technology, such as at airports and residential areas. These towers have little or no plume visibility, are relatively cost-effective, and perform well compared to other types of towers.

To know how our report can help streamline your business, Speak to Analyst

By Application

HVAC Application to Notice Significant Growth Due to Rising Government Investments

By application, the market is divided into chemicals & petrochemicals, pharmaceuticals, power generation, HVAC, food & beverage, and others (pulp & paper, plastic). HVAC application to account for highest revenue market share and witness highest growth rate during the forecast period.

The HVAC segment is expected to experience significant growth in the coming years, accounting for a 61.35% market share in 2026. The growth is attributed to increased government investments in this industry that have increased HVACR deployments, which is fueling the market growth. These towers are commonly utilized to remove surplus heat from chillers as part of building HVACR systems. As a result, this market is likely to be driven by rising demand for HVACR equipment in buildings and industrial applications.

In addition, during the forecast period, the pharmaceuticals segment is predicted to increase significantly. The cooling infrastructures are frequently regarded as a vital component in the pharmaceutical industry operations since their effectiveness is dependent on how effectively and efficiently cooling water is used. Most of the critical operations in the pharmaceutical sector create heat, necessitating the need for a suitable cooling system.

Moreover, due to its need for energy conservation, energy efficiency, and the strengthening of pipelines, machinery, tanks, and boilers, power generation is one of the largest consumers of these towers. The industrial sector consumes the most power, followed by the residential, commercial, and service sectors.

Furthermore, the chemicals & petrochemicals segment is anticipated to have moderate growth. These industries use cooling towers & other equipment to cool the water integral to their operations.

COOLING TOWERS MARKET REGIONAL OUTLOOK

The market is segmented into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Cooling Towers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market is estimated to dominate the global market, driven by robust economic growth in countries such as China, India, Australia, and several ASEAN nations, with the regional market valued at USD 1.88 billion in 2025.

In the Asia Pacific region, raw materials and labor are highly affordable. Domestic demand is also expanding in the region, making it an appealing investment destination for cooling tower players. The market is driven by expanding population, urbanization, industrialization, and growing concerns about infrastructure development in China and India. The Japan market is projected to reach USD 0.33 billion by 2026, the China market is projected to reach USD 0.77 billion by 2026, and the India market is projected to reach USD 0.45 billion by 2026.

Furthermore, China to dominate the market for cooling towers. The massive expenditures in industrial expansion would drive cooling tower market growth in the country. Moreover, throughout the projected period, the increasing demand for energy-efficient systems in the food and beverage industry will enhance the market growth in the country and is expected to increase the cooling towers market share.

To know how our report can help streamline your business, Speak to Analyst

North America

The North American market is expected to experience significant growth during the forecast period. The region's strict government policies are expected to fuel market growth. Government policies that limit the water depletion for power generating plants and cooling machinery are favoring the market in the region. The strong presence of prominent companies, such as SPX CORPORATION, Babcock & Wilcox Enterprises, Inc. and EVAPCO, Inc., in North America are also aiding the growth of the market. Moreover, the U.S. host a diverse array of manufacturing industries, including pharmaceuticals, rubber and plastics, automotive, petrochemicals, oil and gas, food processing, sugar refining, and chemicals. These sectors utilize water cooling towers to dissipate excess heat from their operations. The U.S. market is projected to reach USD 1.37 billion by 2026.

In addition, the growing HVAC requirement across commercial and industrial buildings and the replacement of aging cooling infrastructure, which subsequently raises the demand for cooling towers, fueling the growth of the U.S. cooling towers market.

Europe

The European market is experiencing a moderate growth. A key driver for the development of the market is the rise in demand for energy-efficient cooling systems in commercial as well as industrial applications in the region. Moreover, these types of towers are excellent tools for cooling large commercial spaces and for cooling processes in several industries and industry verticals. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

Middle East & Africa

The Middle East & Africa is witnessing steady growth in the market. The market is expected to grow due to increased industrialization and a spike in the deployment of various types of cooling tower equipment to reduce wear and tear. Furthermore, high-density polyethylene towers are widely used in a variety of industries, including HVAC, manufacturing, renewable energy generating plants, cold storage, and others.

Latin America

Latin America is projected to grow slowly, owing to less presence of the players in the region. The need for a wet cooling tower is driven by rapid innovations in HVAC systems as well as continual technical breakthroughs to create cost-effective components, drift eliminators, and PVC fills in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players in the market are focused on Introducing Advanced Technology to Strengthen Competition

Key players are focusing on implementing modular designs to increase customer efficiency in the increasingly decentralized and digital energy markets. Manufacturers are emphasizing expanding the range of products. For instance, in February 2024 Aggreko introduced a mobile modular cooling tower to save space on industrial land and decrease customer’s energy costs. In addition, market participants engage in exhibitions and place advertisements in various magazines, websites, and newspapers to increase the demand for their products.

List of Key Cooling Towers Companies Profiled

- Krones AG (Germany)

- SPX CORPORATION (U.S.)

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- EWK (Spain)

- Kelvion Holding GmbH (Germany)

- HAMON & CIE (INTERNATIONAL) S.A. (Belgium)

- MITA Cooling Technologies Srl (Italy)

- JACIR – GOHL (Romania)

- ILMED IMPIANTI SRL (Italy)

- JAEGGI Hybridtechnologie AG (U.S.)

- EVAPCO, Inc. (U.S.)

- Artec Cooling Towers Pvt. Ltd. (India)

- Torraval Cooling (Germany)

- DELTA Cooling Towers Inc. (U.S.)

- Marley Cooling (U.S.)

- Baltimore Aircoil Company, Inc. (U.S.)

- Composite Custom Cooling Solutions (U.S.)

- Tower Tech (India)

- American Cooling Tower (U.S.)

- National Cooling Towers (India)

KEY INDUSTRY DEVELOPMENTS

- August 2023: Chiyoda Technip Joint Venture has announced the development of an induced draft cooling tower for the natural gas deposit in the Qatar region.

- June 2023: Johnson Controls International Plc. Partnered with Accenture to establish two new OpenBlue Innovation Centers in Bangalore and Hyderabad, India, aiming to expedite the development of building control systems and services.

- February 2023: Baltimore Aircoil Company (BAC) unveiled its TrilliumSeries Adiabatic Cooler, an energy-efficient cooling tower ideal for applications with limited water usage. This design prioritizes water and energy efficiency, reducing overall costs while also simplifying installation and maintenance.

- November 2022: Russia installed a new cooling tower at the Kursk II nuclear power plant, marking the country's tallest cooling tower at 179m. Expected to endure for a century, this tower surpasses Russia's previous tallest tower by 8 meters, exemplifying advancements in cooling technology.

- July 2021: Baltimore Aircoil Company purchased Eurocoil Spa in Italy, a European refrigeration and commercial manufacturer. This acquisition has boosted the company’s position in the global market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

|

Companies Profiled in the Report |

Krones AG (Germany), SPX CORPORATION (U.S.), Babcock & Wilcox Enterprises, Inc. (U.S.), EWK (Spain), Kelvion Holding GmbH (Germany), HAMON & CIE INTERNATIONAL S.A. (Belgium), MITA Cooling Technologies Srl (Italy), JACIR – GOHL (Romania), ILMED IMPIANTI SRL (Italy), Jaeggi Hybrid Technologies AG (U.S.), EVAPCO, Inc. (U.S.) |

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 4.4 billion in 2025.

By 2034, the market is expected to be valued at USD 6.98 billion.

The global market is estimated to depict a noteworthy CAGR of 5.40% during the forecast period.

Asia Pacific dominated the cooling towers market with a share of 42.70% in 2025.

By type, the wet segment is expected to be the leading segment in the market during the forecast period.

New technology HVAC systems and rise in construction activities to propel the market growth.

Krones AG, SPX CORPORATION, Babcock & Wilcox Enterprises, Inc., EWK, Kelvion Holding GmbH, HAMON & CIE (INTERNATIONAL) S.A., MITA Cooling Technologies Srl, JACIR – GOHL, ILMED IMPIANTI SRL, JAEGGI Hybridtechnologie AG, EVAPCO, Inc., and others.

HVAC systems is expected to drive the market for cooling towers.

China owing to several infrastructure developments is expected to dominate the market in the Asia Pacific region.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us