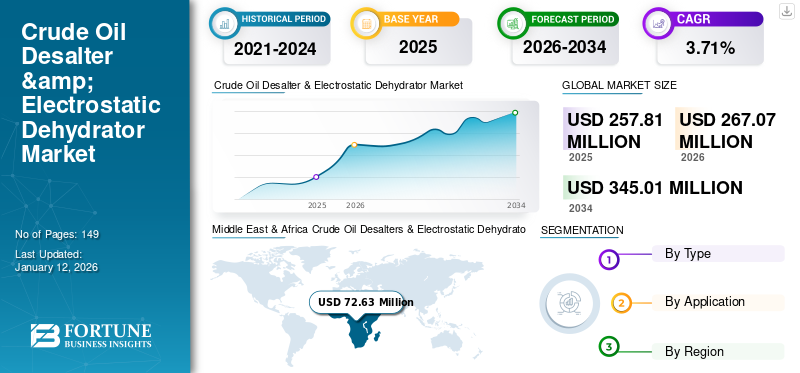

Crude Oil Desalters & Electrostatic Dehydrator Market Size, Share & Industry Analysis, By Type (Electrostatic Dehydrator and Desalting Process), By Application (Upstream and Downstream), and Regional Forecast, 2026-2034

Crude Oil Desalters & Electrostatic Dehydrator Market Size

The global crude oil desalters & electrostatic dehydrator market size was valued at USD 257.81 million in 2025 and is projected to grow from USD 267.07 million in 2026 to USD 345.01 million by 2034, recording a CAGR of 3.71% during the forecast period. Middle East & Africa dominated the global market with a share of 30.91% in 2025. The Crude oil desalters & electrostatic dehydrator market in the U.S. is projected to grow significantly, reaching an estimated value of USD 48.63 million by 2032.

Crude oil desalters & electrostatic dehydrators are specialized equipment that remove residual salt and impurities from crude oil to meet different requirements. Refining of crude oil encompasses several processes in refineries. Removal of water and contaminants generally comprises two steps: dehydrating and desalting. Both methods are essential to avoid corrosion and spoiling refinery equipment, such as heat exchangers and pumps. With an increasing number of oil refineries, there is a growing demand for this technology. For instance, the world's oil refining capacity has steadily increased, and in 2021, the total capacity was approximately 101 million barrels per day. However, the global production capacity of refineries was more than 79 million barrels of oil per day.

The COVID-19 pandemic had a negative impact on the global market growth. Oil and gas supply chains are critical assets for the global economy. The disruptions caused by a drastic reduction in sales during the pandemic caused a sudden plunge in oil and gas prices which had a significant economic impact on companies dealing with the production and distribution of oil and gas. It became difficult for these companies to manage and oversee their supply chain activities most effectively to reduce cost and enhance efficiency in every stream of oil and gas. Thus, lockdowns, the shutdown of various industries, and disruptions in the supply chain led to economic collapse in several countries, impacting the demand for crude oil desalters & electrostatic dehydrators negatively.

Crude Oil Desalters & Electrostatic Dehydrator Market Trends

Increase in Offshore Oil Production to Create Opportunities for Market to Grow

Global oil companies are investing billions of dollars in offshore drilling and have started a long decline and decades-long projects, including some in the remote iceberg waters. Increasing oil prices and depleting onshore oil sources are encouraging investments and boosting energy demand. Offshore sites have been designed to pump oil for decades, which is a counterintuitive move that could increase financial risk for the projects as the world is emphasizing on net-zero greenhouse gas emissions by 2050 to mitigate climate change concerns. Numerous offshore projects have been developed and are expected to commence over the forecast period, thereby creating ample opportunities for the crude oil desalters & electrostatic dehydrator market growth.

For instance, in 2023, India's top oil and gas producer, Oil and Natural Gas Corporation (ONGC) announced an investment of over USD 2 billion for drilling 103 wells in the Arabian Sea. The company’s new development plan is projected to add 100 million tons to the overall production. ONGC's main assets are off the west coast in Heera, Mumbai High, Neelam, Bassein, and Satellite.

Download Free sample to learn more about this report.

Crude Oil Desalters & Electrostatic Dehydrator Market Growth Factors

Increasing Demand for Oil and Gas to Compel Operators to Expand Refineries' Capacity

The global population is projected to increase to 9.7 billion by the end of 2050, and fuel consumption is also projected to increase, driving the demand for crude oil globally. Demand for crude oil is directly proportional to the growth of global energy demand and a multitude of other macroeconomic factors, ranging from disposable income to the rate of industrialization and urbanization.

Crude oil is processed in refineries to obtain end products, such as gasoline, kerosene, chemicals, and others. Desalting of crude oil is essential to improve its quality and reduce its cost. An increment of one portion per million (ppm) of water and brine minimizes the cost of rough oil by around USD 0.85-1.3 per barrel. The steady growth of unused petroleum refineries and generation units with in-house rough oil desalting and dried-out oilfields is anticipated to showcase robust growth amid the assessment period.

According to the International Energy Agency (IEA), the global oil demand in 2024 will rise faster than expected, and the outlook for near-term oil use remains robust despite the COP28 agreement to transition away from fossil fuels. As per reports, it is projected that the globals consumption will rise by 1.1 million barrels per day (bpd) in 2024, up by 130,000 bpd from its previous forecast during the last year.

According to the 2023 World Oil Outlook of OPEC, the global oil demand is expected to reach 116 million barrels per day (bpd) by 2045 from 110.2 million bpd in 2028, reflecting a jump of 10.6 million bpd compared to 2022 levels and roughly 6 million more bpd than it predicted in last year's report. The growth will likely be fueled by developing nations, such as India, China, other Asian countries, Africa, and the Middle East.

Upgradation and Refurbishment of Refineries led by Technological Advancement to Drive Market

The oil industry is exceedingly competitive, and players across the world are upgrading the effectiveness of crude oil desalters to diminish costs and achieve higher efficiency. The global oil demand is driving innovative improvement to empower more oil investigation from onshore to offshore. Subsequently, oil production evolved into a more complex process, moving from onshore to offshore in shallow waters and from shallow waters to deeper seas with harsher environments. The offshore industry has more challenges than the onshore one due to the environment in which it works, driving the cost of creating crude oil.

Offshore drilling produces crude oil, which contains several undesirable pollutants along with salts that corrode the drilling equipment. In such cases, desalters are utilized to expel salts and water displayed in unfiltered oil. The unrefined oil electrostatic dehydrators dispense water from the crude oil. Offshore crude oil generation accounts for over 30% of the global oil production, and it is expected to positively influence the global crude oil desalters & electrostatic dehydrator market growth.

According to the IEA, Asia has the greatest number of petroleum refineries under development. As of 2021, over 88 new facilities were in the planning or under-construction phase. By comparison, North America is set to see an addition of over ten petroleum refineries. The amount of oil fed through refineries in Asia has significantly increased in the past two to three decades as demand for petroleum products surged in developing countries, such as China and India. China is on track to surpass the U.S. with the greatest oil refinery throughput.

RESTRAINING FACTORS

Volatile Market Conditions and Adoption of Renewable Energy to Hamper Market Growth

Crude oil and petroleum product costs are unstable due to various factors, including geopolitical and weather-related conditions. These factors often disrupt the supply of oil and its products to the market, which creates uncertainty about the future supply and demand, eventually resulting in higher price volatility. The volatility of oil prices is also restricted by the low responsiveness of supply and demand to price changes in the short and long run. Oil-producing equipment that uses petroleum products as its main energy source is relatively fixed in the short term, whereas it takes years to develop new supply sources or change the production capacity. Under such conditions, a major price change can be necessary to re-balance the physical supply and demand following a disturbance to the system.

Most of the world's crude oil sources and refineries are in regions prone to historical political upheaval, where oil production was disrupted due to political events. Multiple major oil price spikes, falls, and supply disruptions have occurred due to political events, most notably the Arab Oil Embargo in 1973-74, the Iranian revolution, the Iran-Iraq war in the late 1970s and early 1980s, and the Persian Gulf War in 1990. More recently, disruptions to supply (or curbs on potential development of resources) from political events have been seen in Nigeria, Venezuela, Iraq, Iran, and Libya. Recently, intense volatility in fossil fuel markets was caused by Russia's invasion of Ukraine. Moreover, the increasing social and environmental pressures on countries and oil & gas companies are complicating the role of these fuels in a changing energy economy. According to IEA reports of 2023, the oil and gas production process accounts for more than 15-20% of the global energy-related GHG emissions. The same report shows that the annual clean energy investment in 2021 was around 15%, which rose much faster and increased to 24% in 2023.

Crude Oil Desalters & Electrostatic Dehydrator Market Segmentation Analysis

By Type Analysis

Electrostatic Dehydrator Dominates the Market as it Reduces the Overall Oil Production Costs

Based on type, the market is segmented into electrostatic dehydrator and desalting process.

Electrostatic dehydrator segment is projected to dominate the market with a share of 55.16% in 2026. Desalting and dehydrating are important processes in crude oil refining that help remove impurities and contaminants from crude oil. Electrostatic dehydrator technologies can play a key role in reducing oil production costs. Improved hydraulic efficiency, using alternative electrodes, and applying dual frequency modulation to the electrostatic power supply show significant production benefits. An effective flow distribution and collection system has achieved nearly 100% improvement in the hydraulic efficiency of electrostatic coalesces.

The purpose of desalting is to remove impurities in the crude oil, such as salts, water, and base sediments, which can cause problems later in the refining process. Water is present in oil, and salts, such as calcium, sodium, and magnesium chlorides are dissolved in an emulsion mixture.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Upstream Segment Dominates the Market Owing to its Critical Role in Oil Extraction Process

Based on application, the crude oil desalters & electrostatic dehydrator market is segmented upstream and downstream.

The upstream segment will account for 51.16% market share in 2026. Upstream oil & gas production maximizes petroleum recovery from subsurface reservoirs. It includes exploration, extraction, and other production processes. It involves locating the reservoirs, then employing advanced oil & gas technologies for drilling the wells, and conducting tubular inspections to extract the raw materials from these sources. Production activities include efficiently recovering oil and gas in a producing field using primary, secondary, and tertiary or enhanced oil recovery processes, also referred to as improved oil recovery.

The downstream segment is widely used as it focus on refining crude oil into various petroleum products like gasoline, diesel, and jet fuel. Crude oil desalters play a critical role in this process by removing salts and other impurities from crude, ensuring the quality of refined products. The industry's downstream processes mainly include oil refineries, petrochemical plants, and petroleum & natural gas distribution companies.

REGIONAL INSIGHTS

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Middle East & Africa Crude Oil Desalters & Electrostatic Dehydrator Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America is dominating the global market for crude oil desalters & electrostatic dehydrator, with the U.S. being a crucial player in shaping the regional market landscape. It consists of several companies, such as Chevron and ExxonMobil, the largest companies in the U.S. Some foreign companies, such as U.K.-based BP and Shell are also prominent players in the U.S., and several smaller companies specialize in the single process of exploration, mining, transportation, and processing. A government report showed that the U.S. crude refining capacity reversed a two-year decline, rising by more than 100,000 barrels to 18.1 million barrels per day (bpd). The U.S. market is estimated to reach USD 41.05 billion by 2026.

Asia Pacific is the second-leading region in this market, with China being the leading country. According to the IEA, China has the largest reserve capacity, and according to B.P. reports, in 2022, China was the dominant oil producer in the Assia Pacific region. The country’s production touched 3,994 kbp, accounting for 54% of the region's production in 2021.

The Japan market is estimated to reach USD 4.64 billion by 2026, the China market is estimated to reach USD 34.51 billion by 2026, and the India market is estimated to reach USD 8.98 billion by 2026.

Among European countries, Germany had the largest refinery capacity in 2024, exceeding two million barrels per day. Oil and natural gas production plays an important role in the Norwegian economy. In 2021, around USD 18 billion was invested in crude oil, natural gas extraction, and pipeline transportation. Investments in 2021 were about USD 160 million less than those in 2020. Norway's neighbor Great Britain invested about USD 4 billion in oil and natural gas exploration in 2021. European countries are expected to exhibit slight growth owing to the rising uptake of renewable energy sources in the U.K., Germany, and other countries to mitigate the increasing carbon emissions.

The UK market is estimated to reach USD 2.35 billion by 2026, while the Germany market is estimated to reach USD 2.34 billion by 2026.

The Middle East & Africa dominated the market with a valuation of USD 79.69 billion in 2025 and USD 83.43 billion in 2026. The region is home to five of the top ten oil-producing countries and responsible for producing about 27% of world’s oil. While state-owned enterprises produce much of the oil, many international companies are engaging in oil production and related activities in the Middle East.

Key Industry Players

Key Players are Expanding their Business Operations to Gain Higher Market Shares

The global crude oil desalters & electrostatic dehydrator market’s competitive landscape is highly fragmented, with large and some medium-scale players delivering a wide range of products at local and country levels across the value chain. Companies are also focusing on expanding their business operations to gain higher market shares.

List of Top Crude Oil Desalters & Electrostatic Dehydrator Companies:

- Frames (Netherlands)

- VME Companies (U.S.)

- Canadian Petroleum Processing Equipment Inc (Canada)

- Desalters LLC (U.S.)

- Forum Energy Technologies (U.S.)

- SLB (U.S.)

- SANTACC Energy Co. Ltd (China)

- OTSO Energy Solutions (U.S.)

- Petro-Techna International Ltd. (Canada)

- AMR Process Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023- Houston-based technology provider Forum Energy Technologies (FET) received a USD 25 million contract for delivering the design, engineering services, and source of four electrostatic desalter systems for an onshore project at the Safaniyah oil field in Saudi Arabia. As per the contract, the desalter systems will utilize FET’s Edge desalting technology, ForuMix's competent multiphase mixer technology, and in-house manufacturing capabilities at its Saudi facility.

- February 2022- Eni´s Miamte FPSO (Floating Production Storage and Offloading) started production in Mexico. This project required four production vessels and two electrostatic dehydrators/desalters. The project’s development in Area 1 in the Gulf of Mexico was approximately 10 kilometers offshore of the Tabasco coast. The FPSO will cause a surge in the country´s production, which will be an inexpensive benefit for Mexico.

- April 2020- VME was awarded a desalting and dehydration project for the Nassiriya Degassing Station in Thiqar, Iraq. The agreement came through Progetti Europa & Global for the client Thiqar Oil Company. ME’s scope of study on this project was the process design stage crude oil desalter, sizing of the first-stage and second-stage desalter and their associated attached degassers, and the process supply and design.

- May 2020- SANTACC Energy delivered a three-level desalting vessel to the Shenghong refining chemical integration project. With the new installation, the Shenghong refining project of 16 million tons/year atmospheric and vacuum distillation unit entered the comprehensive installation and construction phase.

- March 2019- Frames was awarded an agreement to supply two desalters (electrostatic coalescers) to the top Hungarian oil and gas company, MOL Group, for the Duna Refinery at Százhalombatta, Budapest. The company's desalters will allow MOL to procedure a broader range of crude oils more cost-effectively.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as major key players, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.71% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 257.81 million in 2025.

The market is likely to record a CAGR of 3.71% over the forecast period.

Based on type, electrostatic dehydrator leads the market due to the development of crude oil desalters & electrostatic dehydrators globally.

The market size of MEA was valued at USD 79.69 million in 2025.

Increasing refining capacity and upgrading and refurbishment of refineries led by technological advancements are the key factors driving the market growth.

Some of the top players in the market are Frames, VME Companies, and Canadian Petroleum Processing Equipment Inc.

The global market size is expected to reach a valuation of USD 345.01 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us