Customer Data Platform Market Size, Share & Industry Analysis, By Component (Platform and Services), By Deployment (Cloud and On-premises), By Type (Access, Analytics, and Campaign) By Industry (Banking, Financial Services and Insurance (BFSI), Retail and E-commerce, Information Technology (IT) and Telecom, Media and Entertainment, Travel and Hospitality, Healthcare, and Others), and Regional Forecast, 2026-2034

Customer Data Platform (CDP) Market Latest Insights

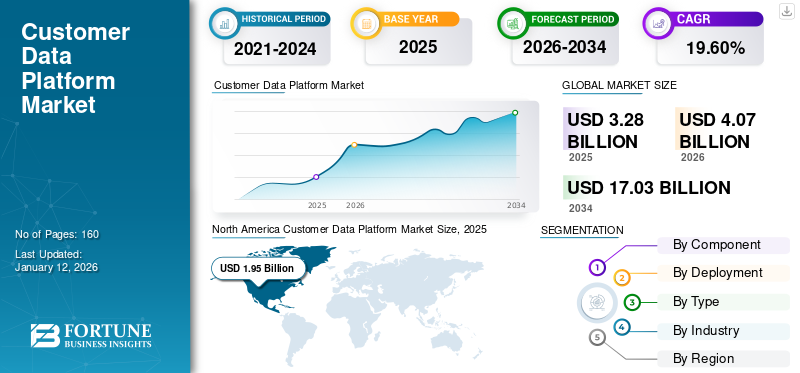

The global customer data platform (CDP) market size was valued at USD 3.28 billion in 2025 and is projected to grow from USD 4.07 billion in 2026 to USD 17.03 billion by 2034, exhibiting a CAGR of 19.60% during the forecast period. North America dominated the global market with a share of 59.60% in 2025. Rising need for tailored, real-time customer interaction, faster adoption in the retail, BFSI, and healthcare sectors, and the incorporation of AI/ML technologies for improved customer insight are the main drivers of the CDP market growth.

While advertisers and marketers prioritize real-time, customized client services throughout the CDP industry, platform adoption is being further strengthened by the growing awareness of consumer satisfaction and the need for enhanced shopping experiences.

- In May 2021, Salesforce announced upgrades for its Customer Data Platform solution to help companies prioritize first-party data and make their conversation with customers more personalized.

In the scope of the study, we have considered solutions such as Oracle’s Unity solution, SAP Emarsys Customer Engagement, Salesforce Customer 360 Audiences, Adobe Experience Platform, and Microsoft Dynamics 365 Customer Insights.

As a result of changing architectural preferences, the CDP market is seeing a change in 2025 toward "composable CDPs" integrated with cloud data warehouses and activation layers. The market for customer data platforms is anticipated to shift from data unification to real-time orchestration of predictive customer journeys by 2032, making CDPs an important tool for digital transformation.

Furthermore, the market for customer data platforms is developing into a key component of business data ecosystems, acting as a link between analytics infrastructure, CRM, and marketing automation. CDPs are increasingly seen as corporate intelligence layers that integrate structured and unstructured data across business silos, rather than just marketing tools, as companies pursue data-driven change.

The CDP industry's competitive dynamics are changing due to the increasing requirement to unify consumer data in the context of omnichannel attribution, digital identity resolution, and privacy-first customization. Over the course of the projection period, enterprise expenditures in data integration, customer experience orchestration, and consent management frameworks are anticipated to influence product innovation and market consolidation.

Global Customer Data Platform Overview

Market Size & Share:

- 2025 Market Value: USD 3.28 billion

- 2026 Estimated Value: USD 4.07 billion

- 2034 Forecast: USD 17.03 billion

- CAGR (2026–2034): 19.60%

- Top Region: North America – early adoption in BFSI and retail

- Top Industry: Retail & E-commerce – high personalization demand

- High-Growth Segment: Cloud-based platforms – for real-time, scalable access

Key Trends and Drivers:

- AI/ML integration: AI-driven analytics enable next-best-action recommendations

- Personalized marketing: Brands prioritize real-time, tailored customer engagement

- Omnichannel visibility: Unified customer profiles across apps, websites, and devices

- BFSI digital shift: Banks and insurers adopt CDP to improve targeting and loyalty

- Healthcare data boom: CDP enables faster, accurate patient engagement

Market Challenges:

- Data privacy regulations: GDPR and global compliance issues limit data sharing

- Customer trust: Growing concern around personal data usage affects adoption

- Integration complexity: Legacy systems and fragmented data hinder deployment

Market Opportunities:

- Cloud scalability: Cloud-based CDPs offer flexibility, security, and cost-efficiency

- E-commerce growth: Rising online activity boosts real-time personalization needs

- Asia-Pacific expansion: Internet penetration and digital retail drive demand

- Analytics-driven insights: Businesses increasingly invest in behavior-driven strategies

To improve privacy-safe cooperation between brands, agencies, and publishers, the industry leaders are concentrating on creating interoperability with data clean rooms and identity management solutions. In the post-cookie marketing age, when first-party and zero-party data techniques are crucial, this tendency is especially pertinent. The next stage of CDP innovation is anticipated to be driven by the growing need for cross-channel measurement and customer lifetime value modeling, which will be aided by integrations with business intelligence (BI) and enterprise resource planning (ERP) systems. Consequently, the size of the worldwide CDP market is expected to grow beyond marketing use cases to include sales enablement, customer support, and product development..

COVID-19 IMPACT

COVID-19 Pandemic to Propel the Demand for Customer Data Platform Solutions

With the global spread of COVID-19, many organizations encountered difficulties providing their employees with appropriate access to high-quality data. To maintain business inflow, organizations have been investing in infrastructure that allows access to the company's data collection. Depending on their services and products, different industries developed remote working strategies. The consumer-facing organization relies heavily on customer data to acquire a new customer base and retain existing ones to maintain business stability.

In addition, the novel coronavirus played an important role in boosting the demand for data solutions. During the pandemic, many sectors ranging from the government to retail shifted toward digitalization to continue their business operations smoothly and efficiently.

The software provides users in various locations with access to data to maintain the business process. As a result, having a single, trustworthy source allows advertisers and marketers to appropriately target customers based on their preferences, location, and needs. The CDP’s real-time data will ensure ROI via campaigns organized from remote locations by product developers and managers. In such crises, incorrect data can lead to the company's decline. As a result, ensuring accurate data about customers and their demands has become critical. In such a scenario, the platform can provide real-time and personalized solutions. Thus, the demand for customer data platforms is expected to rise in the pandemic situation.

In previously offline sectors like manufacturing, education, and public services, the pandemic sped up the digital transformation process, which led to the introduction of CDPs to handle increasingly digitalized customer journeys. Businesses realized how important CDPs are for sustaining continuity across dispersed consumer interaction channels in the long run. Organizations have continued to emphasize resilience via omnichannel service continuity, real-time data synchronization, and predictive analytics since the epidemic. As a result, the CDP market became a crucial facilitator of digital resilience plans in international businesses.

LATEST TRENDS

Download Free sample to learn more about this report.

Adoption of Artificial Intelligence and Machine Learning to Drive Market Expansion

With the increasing availability of artificial intelligence (AI) and machine learning (ML) technologies, the next-generation customer data platform is becoming popular. It uses AI, ML, and natural language processing to reduce the workload of marketing teams.

AI-enabled tools allow providers to offer personalized solutions and services to customers, which help in improving customer experience and maintaining customer relationships. For instance, the platform analyzes customer patterns and behavior across all channels. AI and ML generate data sets, evaluate, and compare the relationships between these data, such as product or service preferences, and purchase history, and then offer recommendations for the customer's next need and purchase plans. The marketer gains a better and deeper understanding of their customer base and purchasing patterns due to AI and ML.

CDPs are using deep learning and predictive AI models to provide intent-based interaction, real-time churn prediction, and hyper-personalized customer experiences. Another developing difference is generative AI, which automates campaign material and does dynamic segmentation based on contextual triggers. To make analytics more approachable for non-technical marketing teams, vendors are increasingly integrating explainable AI (XAI) and natural language querying (NLQ) capabilities. AI-powered CDPs are becoming important assets in data-driven customer experience ecosystems thanks to these developments, which are extending their impact beyond marketing into enterprise-wide analytics.

With AI at the core of CDP, analysis and appropriate results would provide the next best action to improve the customer experience. For instance, in conjunction with AI and historical data on customer purchasing traits, customer data platforms will recommend the next best product based on their preferences. Advanced data analysis and intelligence are expected to increase platform adoption. This would also provide better predictions based on the customer's purchasing history and patterns, allowing for a more appropriate recommendation.

DRIVING FACTORS

CDP's Real-Time and Personalized Data Analysis to Drive Market Growth

Customers are now present on every channel or platform for everyday activities such as reading books, checking emails, online shopping for food and apparel, social media apps, and online payments. As a result, the number of data sets has increased along with the number of customers that enter, quit, or switch between apps frequently. Thus, keeping track of real-time engagement is critical. This database is being used by businesses to make valuable offers and recommendations to clients based on their app and website usage.

The marketer collects and analyzes data with the help of a CDP before executing the marketing strategy. Previously, data was stored in a decentralized system, making it difficult and time-consuming to collect data in a single frame and analyze it. The solution stores the data on a single platform from which all analysis is carried out. When users enter any information about a customer, it provides personalized real-time data. This means that the analysis is provided in real-time. The moment the data is fed, it provides certain related analyses about customers and their choices. This aids in increasing customer engagement and developing a suitable customer experience strategy.

Furthermore, the customer does not have to return to the website with the same preferences the next time they visit. The historical data about the customer will not be applicable at that time. Instead, the platform will collect the customer's most recent choices and requirements to guide the business while providing solutions and services. For instance, based on preferences, brand, and price, the marketer can recommend related topics to the customers' most recent searches or the product offer the customer is looking for.

The transparency of the platform allows the marketing team to take quick actions, allowing to gain more customer loyalty. The platform improves relationships with vendors and partners through transparent, targeted interactions. This is expected to sustain the customer data platform market growth in the coming years.

Rising Importance of Customer Satisfaction and CRM in the BFSI Sector to Aid Market Growth

In the BFSI sector, CDP is prominently used to collect and analyze customer data quickly. The industry has witnessed an increase in online client interaction in recent years. The increasing availability and affordability of the Internet have encouraged customers to use numerous online channels to interact with banks, insurance firms, and other financial institutions. Thus, this has encouraged financial institutions to implement a customer engagement strategy. To engage customers online, a company must first understand its personal information and purchasing traits. As a result, the BFSI sector is heavily investing in customer engagement strategies and approaches for maintaining partnerships and sponsorships.

With the increased pressure of online engagement, the BFSI industry focuses on providing personalized customer engagement across all channels. Banks could recognize prospective customers through historical data searches and queries before logging in to websites using CDP.

For instance, a user visits an insurance company's website, accesses the medical insurance page, spends some time on it, and then leaves. The solution monitors the users’ whole journey and analyses where they spend the most time and their search history. When a customer enters the website, offers linked to his previous experience, such as medical insurance, are displayed. The platform provides BFSI marketers foundation as well as a platform for delivering customer-centric experiences.

The market is driven by the growing opportunity for customer experience in the BFSI industry.

RESTRAINING FACTORS

Customer Data Privacy Concerns to Obstruct Product Adoption

Recently, major customer data providers encountered legal issues regarding sharing customer insights within organizations. Today's internet users are more concerned about the privacy of their personal information. With this growing concern, Europe's General Data Protection Regulation (GDPR) was enacted to protect customers’ private data. According to the law, organizations do not have legal rights to their customers' data. In addition, the customer has the right to know where and how their personal information is being used and for what purpose. This has restricted data sharing and is expected to hinder the growth of the market.

SEGMENTATION

By Component Analysis

Platform Segment to Dominate Impelled by Rising Need for Customer Satisfaction

By component, the market is categorized into platforms and services. The platforms segment is expected to obtain the majority of the market with a share of 68.82% in 2026 during the forecast period. The need for software is growing in response to the rising need for customer satisfaction. Different sectors are actively investing in marketing and advertising to provide individualized solutions to customers.

Furthermore, the services segment is expected to gain notable traction over the forecast period. The vendors are providing services to industries to install the platform. Big competitors, including Oracle Inc. and Microsoft Corp., have also joined the industry by acquiring small and local vendors. These CDP vendors invest in the platform's maintenance and AI and Machine Learning (ML) integration services. For instance, in February 2021, Nagarro, a digital engineering and technology solutions provider, collaborated with BlueConic, a CDP provider. The partnership was intended to help enterprises deploy BlueConic with the long-term impact of the platform.

Businesses' move toward data unification and real-time activation capabilities that enable smooth integration across marketing and analytics ecosystems are strengthening the platform segment's supremacy.

With the development of composable architectures that provide modular functionality, modern CDP systems allow businesses to integrate with pre-existing martech stacks like CRM, data warehouses, and personalization engines. Large companies looking to improve interoperability and lessen vendor lock-in are drawn to this architectural flexibility.

In the meanwhile, the need for platform modification, managed services, and data strategy consulting is driving the growth of the service industry, especially among mid-sized businesses without internal knowledge. Service providers are anticipated to play a more strategic role in ROI measurement, regulatory compliance, and implementation success as the consumer data platform industry develops.

By Deployment Analysis

On-Premises Segment to Gain Prominence Driven by Increasing Adoption of Customer Data Platforms

By deployment, the market is categorized into cloud and on-premises. The on-premises segment is expected to have a large revenue with a share of 54.96% in 2026. Several advertisers and markets manage the on-premises system. Some businesses prefer on-premises software as it gives complete control over their data.

With the development of cloud-based technology, CDP users are increasingly using cloud-based services. These platforms provide more storage space and allow for more cost-effective expansion. Furthermore, cloud-based technology provides data security as well as the capabilities needed to protect sensitive client information. On a cloud-based solution, data can be accessed in real-time. For instance, in February 2023, Treasure Data, a CDP provider, partnered with Amazon Web Services, Inc. to help companies deliver omnichannel connected customer experience and accelerate digital transformation. Thus, cloud-based platforms are becoming more popular.

The landscape of the CDP industry is changing due to the increasing use of hybrid deployment approaches. Hybrid CDPs, which combine the management of on-premises systems with the scalability of cloud environments, are becoming more and more popular among organizations with stringent data residency requirements, such as those in the healthcare and BFSI sectors. Businesses may benefit from real-time analytics and elastic storage capabilities while maintaining compliance thanks to this dual strategy.

Deployment decisions are also being influenced by the growth of edge computing, as businesses look to process client data closer to the source for quicker personalization and lower latency. Due to lower total cost of ownership and simpler API integration with other martech platforms, cloud deployment is anticipated to surpass on-premises growth overall, establishing cloud-based CDPs as a pillar of digital transformation strategies in the global customer data platform market.

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Access Type to Gain Traction Owing to Rising Investment by Various Organizations

By type, the market is categorized into access, analytics, and campaign. The access type provides customer data across the organization and at customer touchpoints such as email, phone calls, and others. The access type is expected to have the highest revenue with a share of 55.10% in 2026.

Furthermore, the analytics segment is expected to grow at an exponential rate over the forecasted period. Analytics provide granular insights into customer behavior, which aid in analyzing customer segmentation and the tracking of customers across channels. This type has also seen an increase in investment by organizations. Analytics solutions go beyond campaign-centric solutions by providing strategies that matter more such as understanding a company's values and building a foundation of insights using first and third-party data. As a result, businesses will be able to engage with specific customers based on their needs.

Furthermore, the analytics sector is becoming a high-value growth driver in the CDP industry due to the quick development of AI-driven predictive and prescriptive analytics. In order to support omnichannel marketing automation and personalization engines, access-type CDPs are increasingly being integrated with real-time APIs to enable dynamic customer profile updates.

In the meantime, next-best-action features that make use of machine learning algorithms and automated orchestration are being added to campaign-oriented CDPs. The strategic change from static audience segmentation to ongoing journey optimization is reflected in this evolution. The analytics and campaign types are anticipated to see a higher CAGR than the access type as businesses prioritize data-driven decision-making, making them important drivers of future CDP market size expansion.

By Industry Analysis

Wide Adoption in Retail & E-Commerce and Healthcare Industry to Boost Market Growth

By industry, the market is categorized into banking, financial services and insurance (BFSI), retail and e-commerce, information technology (IT) and telecom, media and entertainment, travel and hospitality, healthcare, and others (government, education).

In today's digital world, retail and e-commerce businesses quickly adopt marketing automation tools for business growth. Real-time marketing systems built on central platforms, such as CDP, can take marketing strategies to the next level. The increasing competition in the retail and e-commerce markets is increasing the use of these platforms to reach suitable customers. One method of targeting customers offline is to use their online data history. For instance, a customer visits a retail website and adds items to their cart before abandoning the cart and logging out. When the same customer visits the same brand's offline store, they receive offers based on previous cart transactions owing to real-time platforms.

In addition, customers receive an enhanced offline customer experience as a result of their previous purchasing history. Thus, retailers can improve customer experience and conversations with the help of the solution. In this highly competitive market, CDP benefits the retailer who uses it and creates unified brand views.

Similarly, in the healthcare industry, personalized information leads to satisfied customers. It provides immediate assistance to the patient at the appropriate time. Recently, the explosion of data in the healthcare industry created new opportunities for data monitoring. Without a central analytics platform, it is near impossible to maintain the process of recording, analyzing, and updating data on patient medical visits and activity, hospital records, and insurance specifics. Even a minor lack of data can result in incorrect diagnosis and treatment recommendations. Therefore, the platforms are designed with a centralized data storage capacity, allowing healthcare providers to respond quickly to emergencies.

Citing an instance, Providence St. Joseph Health, a healthcare provider, implemented CDP to provide patients with a real-time call center experience. This enabled the health provider on the line to provide and assist with the caller's proper personal information. The platform shortened the time it took to collect data. This has resulted in increased productivity and lower risk to a patient's health.

In addition, the media, telecom, and BFSI industries are quickly increasing adoption in the larger CDP market in order to combat rising competition and customer attrition. CDPs are used by banks and insurers for omnichannel customer onboarding, fraud detection, and tailored product recommendations. Through unified subscriber profiles, CDPs are facilitating cross-sell campaigns and predictive churn analytics in the telecom industry. By using CDPs to synchronize viewer data across platforms and customize content recommendations, media and entertainment companies greatly improve audience retention.

CDP frameworks are also being implemented by governments and educational institutions to enhance digital service delivery and citizen engagement. Cross-sector convergence is anticipated to further expand the size of the global customer data platform market as digital transformation initiatives pick up speed across industries, establishing CDPs as the fundamental infrastructure for data-driven engagement strategies.

REGIONAL ANALYSIS

North America Customer Data Platform Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global market is classified across five regions - North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America

According to our findings, North America dominates the global market, accounting for the largest market share. North America dominated the global market in 2025, with a market size of USD 1.95 billion. Most of the major players have their headquarters in the U.S. The solution providers have made the most acquisitions and developments in the country. Retail, BFSI, and healthcare are among the industries in the U.S. that are implementing the platform to increase customer satisfaction and enrich their experience through personalization. The U.S. market is projected to reach USD 2.14 billion by 2026.

Europe

Europe is the second-largest revenue contributor to the market. More than half of the country's homegrown vendors are from the U.K. and France. With the implementation of GDPR, vendors in Europe are offering GDPR-compliant solutions. The UK market is projected to reach USD 0.18 billion by 2026, while the Germany market is projected to reach USD 0.24 billion by 2026.

Asia Pacific

The Asia Pacific is expected to grow at a high rate during the forecast period. India and China have the largest and second-largest number of internet users globally, respectively, with young users in India accessing the internet at least once a week. The need for such platforms is growing for brands to understand such a dynamic population. Retail and e-commerce, banking and finance, and healthcare are advancing rapidly in these countries, with significant investments being made to better understand customer data. Japan is expected to grow steadily over the forecast period. Other factors favoring industry growth comprise growing digitalization, Big Data, and data analytics to invest in the market. Furthermore, rising government policies regarding customer data privacy have increased the platform's adoption by advertisers and marketers. The Japan market is projected to reach USD 0.15 billion by 2026, the China market is projected to reach USD 0.18 billion by 2026, and the India market is projected to reach USD 0.13 billion by 2026.

Latin America and the Middle East and Africa

To know how our report can help streamline your business, Speak to Analyst

During the forecast period, the markets in Latin America and the Middle East and Africa are expected to grow moderately. Due to its real-time analysis, marketers and advertisers are now investing in these platforms. However, African countries are not utilizing the platform to its full potential. Also, due to Brazil and Mexico's growing internet presence, the platforms have enormous opportunities.

North America

Local data protection regulations, such as the California Consumer Privacy Act (CCPA) in North America, the Personal Information Protection Law (PIPL) in China, and new data residency legislation throughout the Middle East, are having an increasing impact on regional CDP adoption. Vendors are investing in sovereign cloud alliances and regional data hosting as a result of these regulatory tendencies. Lightweight, API-first CDPs that can quickly grow their customer base are in high demand in Asia Pacific due to the rise of digital-native startups and cross-border e-commerce platforms. In the meantime, the developed martech ecosystem in North America keeps emphasizing AI-enhanced analytics and composable architectures, solidifying its dominance in the worldwide market for consumer data platforms.

KEY INDUSTRY PLAYERS

Key Players Focus on Acquisition of Other Players to Expand Reach in the Market

Key providers are developing a wide range of offerings. The introduction of a cutting-edge customer data platform assists players in maintaining their business expertise. Furthermore, upgrading and expanding an existing product portfolio will strengthen a vendor's market position. Furthermore, the companies are investing in integrating customer 360 platforms with CDP. For instance, Salesforce Inc. focuses more on investments by completing acquisitions & mergers with regional and local players to expand its product portfolio. For instance, in December 2022, Bharti Airtel acquired a stake in Lemnisk to build the largest CDP through its Start Up Accelerator Programme.

The CDP market is characterized by a combination of specialist individual suppliers and multinational technology giants. While new suppliers like Segment (Twilio), Treasure Data, BlueConic, and Tealium are gaining traction with modular, cloud-native designs, major incumbents like Salesforce, Adobe, Oracle, and SAP continue to control enterprise sectors through integrated ecosystems.

Competitive strategies revolve around strategic alliances, mergers, and acquisitions, with vendors concentrating on developing AI-driven capabilities and vertical-specific data models. Additionally, there is an increase in private equity activity, which indicates that investors are highly confident in CDP solutions' long-term scalability and potential for recurring revenue. Additionally, interoperability frameworks and open-source CDPs are lowering entry barriers for small and mid-market businesses and opening up new competitive frontiers.

March 2023- Adobe launched new innovations in Adobe Real-Time CDP to help brands with business insights. The platform delivers more than 600 billion predictive insights per year based on real-time customer data. It enabled improved B2B account-based marketing and better personalization via online shopping behaviors.

June 2021- Dentsu and Merkle's customer experience management (CXM) service line revealed that Merkury, its identity resolution and data platform, has been fully integrated into the Salesforce CDP. Salesforce users would be able to capture, unify, and activate customer data across all channels without relying on third-party cookies to first-party data.

List of the Key Companies Profiled:

- Salesforce.com, Inc. (U.S.)

- Exponea s.r.o. (Slovakia)

- Segment.io, Inc. (U.S.)

- Optimove Inc. (U.S.)

- Oracle Inc. (U.S.)

- Leadspace, Inc. (U.S.)

- Ignitionone.com (U.S.)

- Kabbage Inc. (Radius Intelligence) (Georgia)

- Tealium Inc. (U.S.)

- CaliberMind (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2022 – Acquia added enhancements to its CDP to support enterprise marketing teams. The new features expanded the ways marketers work with the data managed by Acquia CDP. It also strengthened the product portfolio in customer data strategies.

- September 2022 – Permission.io partnered with Treasure Data to launch CDP for the Web3 Ecosystem. The collaboration enabled advertisers to use Permission Ads to leverage Treasure Data's CDP to segment customer profiles.

- May 2022 – Amplitute Inc. launched Amplitude CDP, a platform with integrated product analytics. The software tracks and analyzes customer interactions with digital products. It also recommends on which features to add, as well as tests, tracks, and analyzes new feature implementations.

- January 2021 – Bloomreach, a provider of commerce experiences, acquired Exponea, the Customer Data and Experience Platform (CDXP). The acquisition aims to increase the speed with which businesses personalize, create, and optimize strong commerce experiences and increase revenue growth for both B2C and B2B brands.

- April 2021 – Adobe released the next generation of its real-time CDP, the sole enterprise application designed from the bottom up for first-party data-driven customer engagement and acquisition. The solution would help marketers activate known and unknown user information, allowing them to manage the entire customer profile and journey in a single system without third-party cookies.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report highlights leading regions across the globe to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge of the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021– 2024 |

|

Growth Rate |

CAGR of 19.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Component, Deployment, Type, Industry, and Region |

|

By Component |

|

|

By Deployment |

|

|

By Type |

|

|

By Industry |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 3.28 billion in 2025.

Fortune Business Insights says that the market is expected to reach USD 17.03 billion in 2034.

Growth of 19.60% CAGR will be observed in the market during the forecast period (2026-2034)

The retail & e-commerce and healthcare segments are expected to lead during the forecast period within the industry segment.

CDPs real-time and personalized data analysis is expected to drive the market.

Salesforce.com, Inc., Segment.io, Inc., Exponea s.r.o., Oracle Inc., Leadspace, Inc., and Kabbage Inc. are the top companies in the global market.

The analytics segment is expected to grow exponentially at the highest CAGR during the forecast period.

The revenue of the market in North America in 2025 was USD 1.95 billion.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us