Data Catalog Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and SMEs), By Industry (BFSI, Healthcare, Manufacturing, Retail, IT, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

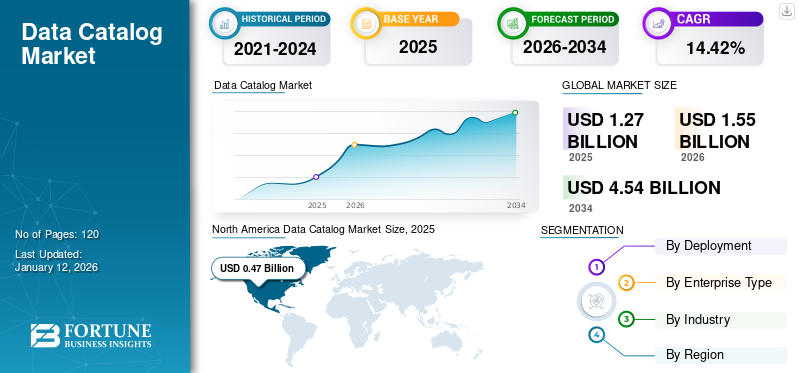

The global data catalog market size was valued at USD 1.27 billion in 2025. The market is projected to grow from USD 1.55 billion in 2026 to USD 4.54 billion by 2034, exhibiting a CAGR of 14.42% during the forecast period. North America dominated the global market with a share of 36.5% in 2025.

Data catalog is a centralized repository that organizes and indexes metadata about data assets within an organization. It provides a structured way to discover, understand, and manage data sources and related information. Many organizations recognize the value of having a centralized and well-organized metadata repository to manage their data assets effectively. The increasing adoption of cloud-based solutions and big data technologies also contributed to the popularity of data catalogs, as they helped organizations handle the complexities of managing diverse and large datasets. The adoption of data catalog software was particularly prevalent in industries that heavily rely on data-driven decision-making such as BFSI, technology, retail, healthcare, manufacturing, and others. Companies offering data catalog software include Alation, Inc., Collibra, Informatica Inc., Atlan Pte. Ltd., TIBCO Software, Boomi Corporation, and Tableau Software, LLC.

The COVID-19 pandemic fueled the adoption of digital technologies across industries. Data catalog adoption has been an integral part of these transformations, as it improves data management, governance, and accessibility, supporting agile decision-making. As organizations transitioned to remote work during the pandemic, data cataloging processes faced many challenges regarding collaboration, access to data sources, and maintaining data quality.

Furthermore, the pandemic’s economic impact led some organizations to face budget constraints, affecting their technology investment decisions. Data catalog projects might have been delayed or deprioritized in favor of more immediate operational needs. However, in the middle of 2020, the pandemic generated a massive amount of data related to COVID-19 cases, healthcare, economic impact, and more. This data explosion posed challenges in managing and understanding complex data relationships, making this solution more crucial than ever.

Data Catalog Market Trends

Growing Adoption of AI and Automation Technologies to Amplify Market Growth

Data catalogs increasingly incorporated Machine Learning (ML) and Artificial Intelligence (AI) to automate metadata tagging, data classification, and data lineage tracking tasks. This trend aimed to reduce manual efforts and improve data accuracy. For instance, in many organizations, a large amount of data is collected from multiple sources, and various systems are used to analyze the data. Adopting AI and machine learning technology in this application is vital in providing detailed insights into how data flows through various systems and transformations. This helps organizations to ensure data accuracy, trace data issues, and comply with regulatory requirements effectively. For instance,

- In October 2023, Alation, a data catalog specialist, launched new generative AI capabilities with Allie AI and benchmarking tools, such as Analytics Cloud, to enhance analytics operations and data management. These tools aim to boost productivity and enable organizations to measure the maturity of their data catalog initiatives.

Data management vendors are engaged in enhancing AI/ML capabilities and adopting them into their offerings to help users explore, refine, analyze, and discover data sets quickly. Thus, the growing adoption of AI/ML is transforming the landscape of this tool.

Download Free sample to learn more about this report.

Data Catalog Market Growth Factors

Exponential Growth of Data Volume and Data Analytics to Fuel Market Growth

With the advent of digital transformation, businesses are collecting and generating enormous amounts of data from numerous sources, including social media, customer interactions, and IoT devices. This surge in data volume has created a pressing need for organizations to organize, manage, and analyze their data assets effectively. Data catalog plays a crucial role in addressing this challenge by providing a centralized repository for metadata, enabling users to discover, understand and access data across the organizations easily.

- According to Exploding Topics and their latest estimations, the total data generated on a single day amounted to 328.77 million terabytes globally.

Moreover, the growing reliance on data analytics for decision-making has fueled the demand for data catalogs. Businesses increasingly leverage advanced analytics techniques like machine learning and AI to extract valuable insights from their data. These analytical tools require access to high-quality, well-organized data, which data catalogs can facilitate by providing a comprehensive view of available data assets and their characteristics. Data catalogs enable organizations to leverage their data for analytics purposes efficiently

RESTRAINING FACTORS

High Initial Deployment Cost and Privacy Concerns to Hinder Market Growth

Data catalog requires large investments in setting up and configuring this solution, including selecting the right tool and integrating it with existing systems. Further, installing this solution requires specialized expertise and knowledge involving complex algorithms and modeling techniques. In addition, metadata stored in the solution might include sensitive information. Therefore, organizations must implement appropriate access controls and security measures to protect this metadata. These factors could hamper the adoption and effective use of the solution, thereby limiting the market growth.

Data Catalog Market Segmentation Analysis

By Deployment Analysis

Increasing Popularity of Cloud-based Solutions to Propel Market Growth

Based on deployment, the market is bifurcated into cloud and on-premises.

The cloud segment held the largest market share in 2023 and is expected to continue its dominance by growing at the highest CAGR during the forecast period. It offers scalability that accommodates growing data volumes and evolving business needs. Adoption of cloud-based data catalog solutions, the cloud can scale up or down based on demand, allowing organizations to manage diverse and expanding datasets effectively. In 2026, the cloud segment is projected to lead the market with a 79.82% share.

The on-premises segment is expected to grow at a moderate CAGR during the forecast period. Organizations using on-premise infrastructure can achieve data security and regulatory compliance at a lower cost. Cloud-based software providers must invest heavily in security measures and compliance certifications.

By Enterprise Type Analysis

Rising Demand for Data Discovery and Access in Large Enterprises Propel Market Growth

Based on enterprise type, the market is divided into large enterprises and SMEs.

The large enterprises segment held the maximum market share in 2023 as it deals with vast data spread across various departments and systems. Data catalogs provide a centralized platform for discovering and accessing data, making it easier for employees to find the necessary information. Further, different teams and departments work with diverse datasets in large enterprises. This solution fosters collaboration by enabling teams to share and collaborate on data assets, reducing data silos and promoting a culture of data sharing. Owing to these features, it will likely continue its dominance during the forecast period. The large enterprises segment is poised to account for 62.7% of the market share in 2026.

The SMEs segment is expected to grow at a significant CAGR during the forecast period, as SMEs need data-driven insights to make informed decisions. This solution enhances data discoverability, enabling SMEs to quickly find relevant information and make better decisions based on data analysis. Moreover, it provides an organized and simplified way to manage data assets, making it easier for SMEs to locate, access, and utilize their data effectively.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Need for Data Governance and Privacy Propel Data Catalog Adoption in BFSI Segment

Based on industry, the market is classified as BFSI, healthcare, manufacturing, retail, IT, and others (education, media & entertainment, and others).

The BFSI segment held the maximum share of the market in 2024, owing to its ability to enhance data governance, improve data discovery, and facilitate compliance with regulations. By centralizing metadata and data lineage information, this solution helps organizations better understand their data assets, which is crucial for making informed decisions and ensuring data accuracy. Additionally, in the highly regulated BFSI industry, this tool assists in maintaining data privacy and security while supporting the development of analytics and reporting capabilities. The BFSI segment is anticipated to hold a dominant market share of 22.75% in 2026.

The retail segment is anticipated to grow at the highest CAGR in the coming years, enabling organizations to manage and utilize their vast amount of data effectively. Retailers use this tool to organize and categorize product information, customer data, and sales records. This streamlined approach enhances data accessibility for various teams, such as marketing, sales, and inventory management, allowing them to make data-driven decisions quickly. In this way, increasing usage of this tool in the retail sector is expected to fuel market growth.

REGIONAL INSIGHTS

By region, the market is analyzed across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Data Catalog Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America is expected to hold the largest data catalog market share, followed by Asia Pacific. North American businesses have been increasingly embracing data-driven decision-making. This solution provides the necessary infrastructure for accessing, understanding, and utilizing data assets. The U.S. is estimated to showcase significant growth, as the U.S. financial services sector has a significant need for data management due to regulatory requirements, complex data structures, and the need for accurate reporting. The U.S. market is estimated to reach USD 0.39 billion by 2026.

Asia Pacific

Asia Pacific is estimated to grow at the highest CAGR during the projected period. The APAC region encompasses various industries, from manufacturing to technology and finance to retail. This tool caters to the diverse needs of these industries by providing efficient data management solutions. Moreover, the booming e-commerce sector in China, India, and Southeast Asian nations generates massive amounts of data. The data catalog tool is used in the region to manage huge amounts of data for informed decision-making. The Japan market is forecast to reach USD 0.08 billion by 2026. The China market is poised to reach USD 0.09 billion by 2026. The India market is set to reach USD 0.06 billion by 2026.

Europe

Europe is estimated to grow at a moderate CAGR during the estimated period. The General Data Protection Regulation (GDPR) significantly impacts European data management practices. This tool helps organizations comply with GDPR requirements by managing and documenting data usage and access. Apart from GDPR, various European countries have data protection and privacy regulations. This tool aids them in navigating these regulatory landscapes. The UK market is expected to reach USD 0.08 billion by 2026. The Germany market is anticipated to reach USD 0.07 billion by 2026.

Rest of The World

The Middle East & Africa and South America are projected to grow more during the forecast period. Many countries in the MEA region have been investing in digital transformation to modernize their economies and services. This solution can support these initiatives by providing efficient data management and analytics capabilities. Moreover, South America has invested in developing workforce data literacy and analytics skills. Data catalogs can facilitate this effort by providing user-friendly interfaces for exploring data. These factors play an important role in the significant growth of the market in South America.

List of Key Companies in Data Catalog Market

Growing Key Players' Engagement in Expanding their Offerings to Aid Market Growth

Rising investments by key players in advanced technologies, including AI, machine learning, and cloud, to improve their platform capabilities. The major market players are also adopting various strategies, such as collaborations, partnerships, mergers, and acquisitions, to expand their market position.

List of Key Companies Profiled:

- Alation, Inc. (U.S.)

- Collibra (U.S.)

- Informatica Inc. (U.S.)

- Atlan Pte. Ltd. (Singapore)

- BigID (U.S.)

- QlikTech International AB (U.S.)

- TIBCO Software (U.S.)

- Boomi Corporation (U.S.)

- Okera (U.S.)

- Tableau Software, LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – Collibra launched Collibra AI Governance, built on their Data Intelligence Platform, enabling organizations to deliver trusted AI effectively through the use of Collibra Data Catalog. It aided teams in collaborating for compliance, improved model performance, reduced risk, and led to faster production timelines.

- September 2023 – AWS Lake Formation launched a Hybrid Access Module for the AWS Glue Data Catalog, allowing users to selectively enable Lake Formation for tables and databases without interrupting existing users or workloads. This feature provided flexibility and an integral path for enabling Lake Formation, reducing the need for coordination among owners and consumers.

- July 2023 – Teradata acquired Stemma Technologies to enhance its analytics capabilities, particularly in data discovery and delivery. Stemma’s automated data catalog bolstered Teradata’s offerings, aiming to improve user experience and accelerate ML and AI analytics growth.

- June 2023 – Acryl Data secured USD 21 million in Series A funding led by 8VC to enhance its open-source data catalog platform. This investment enhanced their cloud offerings and expanded their vision towards a data control plane.

- May 2023 – data.world launched its new Data Catalog Platform, integrating generative AI bots to enhance data discovery. With over 2 million users, the platform aimed to make data discovery and knowledge unlocking accessible to users of all expertise levels.

- February 2023 – data.world, a data governance platform, launched the first AI Lab for the data catalog industry. This Artificial Intelligence (AI) Lab would be important in bringing partners and customers together to enhance data team productivity using AI technology.

- November 2022 – Amazon Web Services (AWS) launched DataZone, a new machine learning-based data management service to help enterprises catalog, share, govern, and discover their data quickly.

REPORT COVERAGE

An Infographic Representation of Data Catalog Market

To get information on various segments, share your queries with us

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.42% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 4.54 billion by 2034.

In 2025, the market stood at USD 1.27 billion.

The market is projected to grow at a CAGR of 14.42% during the forecast period.

By industry, BFSI is expected to lead the market.

The exponential growth of data volume and data analytics to fuel market growth.

The top players are Alation, Inc., Collibra, Informatica Inc., Atlan Pte. Ltd., TIBCO Software, Boomi Corporation, and Tableau Software, LLC.

North America is expected to hold the highest market with a share of 36.5% in 2025.

By industry, the retail segment is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic