Data Center UPS Market Size, Share & Industry Analysis, By UPS Type (Standby, Line Interactive, and Double Conversion), By Data Center Size (Small, Medium, and Large), By Industry (BFSI, IT & Telecom, Healthcare, Government, Manufacturing, Energy & Power, and Others), and Regional Forecast, 2026 – 2034

Data Center UPS Market Size

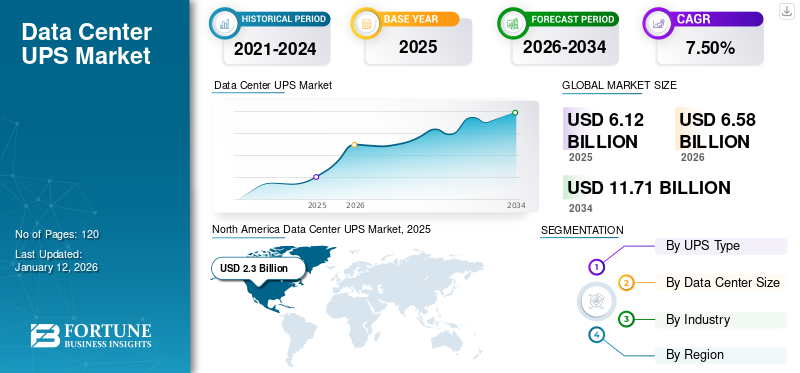

The global data center UPS market size was valued at USD 6.12 billion in 2025. The market is projected to grow from USD 6.58 billion in 2026 to USD 11.71 billion by 2034, exhibiting a CAGR of 7.50% during the forecast period. North America dominated the global market with a share of 37.20% in 2025.

A data center UPS (Uninterruptible Power Supply) is an important component of a data center’s infrastructure. It is primarily used to provide uninterrupted power supply to networking equipment, servers, and other important systems in an organization. UPS systems also regulate voltage fluctuations, ensuring that the power supplied to the equipment in the infrastructure remains within acceptable limits, thereby helping prevent damage due to undervoltage or overvoltage. Further, it helps organizations to remotely monitor the status of the UPS, as the system administrator receives alerts about conducting battery testing and firmware updates. These factors will play an important role in driving the market growth during the forecast period.

With the accelerated digital transformation due to the COVID-19 pandemic across the globe, there has been increased demand for data center services, including online collaboration tools, cloud computing, streaming devices, and e-commerce. This rise in demand has led to an increased need for reliable power backup systems, such as UPS to ensure the uninterrupted operation of data centers. The shift to remote work has put additional strain on data center infrastructure, as organizations were forced to scale up their IT resources to support remote access and virtual collaboration. This increased workload has fueled the demand for UPS systems in multiple organizations globally.

In the scope of work, we have included solutions offered by companies, such as Schneider Electric, Eaton Corp., ABB Ltd., Mitsubishi Electric Corporation, Vertiv Group Corp., Delta Electronics, Inc., Legrand, and others.

Impact of Generative AI

Growing Demand for Energy Optimization and Predictive Maintenance in Data Center to Boost Market Growth

Generative AI algorithms play an important role in optimizing energy consumption in data centers. It adjusts power usage based on environmental conditions and workload, which helps data center operators minimize energy waste and improve the efficiency of UPS systems. Also, generative AI can enable predictive maintenance of UPS systems by analyzing data from monitoring equipment and sensors. By detecting potential issues before they lead to system failures, predictive maintenance can help reduce downtime and prolong the lifespan of UPS equipment. In addition, generative AI is capable of offering customization and optimization of UPS systems based on specific data center requirements. Overall, generative AI has the potential to revolutionize the market by enabling more reliable, efficient, and secure power backup solutions.

Data Center UPS Market Trends

Increasing Focus On Adoption of Energy Efficient Power Backup System to Fuel Market Growth

With the growing focus on environmental responsibility and sustainability, data center operators are increasingly prioritizing energy-efficient UPS systems. This includes deploying UPS systems with higher efficiency ratings (such as those certified by ENERGY STAR) and implementing advanced energy management strategies to optimize power usage and reduce carbon emissions. In addition, Lithium-ion (Li-ion) batteries are significantly replacing lead-acid batteries in UPS systems. This new technology, Li-ion batteries, offers multiple advantages, including faster recharge times, longer lifespan, higher energy density, and smaller footprint. As data centers are increasingly focusing on reducing maintenance costs, enhancing energy efficiency, and saving space, the adoption of Li-ion UPS systems is anticipated to grow. For instance,

- September 2023: Vertiv launched its Liebert APM2, a scalable and energy-efficient solution, to its UPS systems portfolio. It is compact and compatible with VRLA and lithium-ion batteries.

These factors play an important role in increasing the adoption of energy-efficient data center UPS systems in businesses, which will fuel the market growth during the forecast period.

Download Free sample to learn more about this report.

Data Center UPS Market Growth Factors

Rising Awareness of Maintaining IT Infrastructure for Businesses Continuity to DriveMarket Growth

Organizations across various industries are increasingly recognizing the importance of maintaining continuous uptime for their IT infrastructure. Downtime can damage a company’s reputation, resulting in significant financial losses and loss of customer trust. Data center UPS systems play a vital role in ensuring business continuity by providing backup power during outages and minimizing the risk of data loss and service disruptions.

Moreover, the skyrocketing growth of digital data, driven by various factors, such as IoT, big data, AI, and cloud computing has led to a significant increase in the number and size of data centers worldwide. This rapid growth is fueling the demand for reliable backup power solutions, such as data center UPS systems to ensure uninterrupted operations and protect against downtime.

RESTRAINING FACTORS

High Implementation Cost and Physical Space Constraints May Hinder Market Growth

Data center UPS systems require significant initial implementation costs, including the purchase of UPS hardware, installation, and ongoing maintenance. For a few businesses, such as startups or small businesses, these initial investment requirements may pose a barrier to entry or expansion. In addition, data center facilities often have limited physical space, especially in urban areas, where real estate is expensive. Traditional UPS systems, which can be large and require dedicated space for installation, may pose challenges in terms of space utilization and optimization. These factors are expected to hinder the data center UPS market growth.

Data Center UPS Market Segmentation Analysis

By UPS Type Analysis

Growing Need of Zero Transfer Time Fuels Demand for Dual Conversion UPS Systems

Based on UPS type, the market is divided into standby, line interactive, and double conversion.

The double conversion UPS segment captured a large market with a share of 41.06% in 2026, as it offers seamless and real-time transfer of battery power in the event of power failure. Since the UPS is always supplying power to connected equipment from its inverter, there is no interruption or transfer time required to switch from utility power to battery power. This zero transfer time ensures uninterrupted operation of critical IT systems and prevents downtime. Thus, they are majorly adopted by large businesses worldwide.

The standby UPS segment is expected to grow at the highest CAGR during the forecast period. This unit is compact, lightweight, and cost-effective compared to double conversion or line interactive UPS systems, making it well-suited for installations where space is limited. Their small footprint and low profile allow them to be easily integrated into rack-mounted enclosures or confined spaces within data centers. As a result of these factors, standby UPS systems are majorly adopted in startups and small enterprises.

To know how our report can help streamline your business, Speak to Analyst

By Data Center Size Analysis

Increasing Focus on Adoption of Highly Efficient UPS Systems to Drive Demand for Large Data Centers

Based on data center size, the market is bifurcated into small, medium, and large.

The large data center segment captured the maximum data center UPS market share accounting for 44.10% in 2026. Large data centers majorly use centralized UPS systems with high capacity to provide power protection for IT infrastructure. These data centers leverage advanced cooling systems, energy-efficient equipment, and power distribution designs to achieve higher levels of energy efficiency. By combining computing resources and optimizing infrastructure utilization, large data centers can reduce energy waste and operating costs.

The small data center segment is expected to grow at the highest CAGR during the forecast period. This data center is highly flexible, allowing businesses to quickly deploy and adapt IT infrastructure to meet changing business needs. It can be easily scaled up or down in response to fluctuations in demand, new projects, or evolving technological requirements. Also, owing to their smaller size and infrastructure, they are easier to manage and maintain. Thus, they are expected to fuel the market growth in the coming years.

By Industry Analysis

Rising Demand for Protection Against Data Loss in IT & Telecom to Propel Product Demand

Based on industry, the market is categorized into BFSI, IT & telecom, healthcare, government, manufacturing, energy & power, and others (media & entertainment, etc.).

The IT & telecom segment captured the highest market share contributing 24.33% globally in 2026, Data loss can have severe concequences for IT & telecom companies, including the loss of intellectual property, valuable information, and customer data. UPS systems play a vital role in preventing data loss by providing sufficient time for systems to shut down properly or switch to backup power sources in the event of a power failure.

The BFSI segment is expected to grow at the highest CAGR in the coming years. BFSI institutions operate critical systems, such as core banking applications, including online banking platforms, ATMs, and trading systems that require continuous availability. UPS systems provide backup power during utility fluctuations or outages, ensuring uninterrupted operation of these systems and minimizing downtime.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America Data Center UPS Market, 2025

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.3 billion in 2025 and USD 2.44 billion in 2026, as the region is home to a large and growing number of data centers, driven by increasing demand for digital transformation, cloud services, big data analytics, Internet of Things (IoT), and Artificial Intelligence (AI). UPS systems are essential components of data center infrastructure, supporting the growth and expansion of data center facilities across the region. Further, data center UPS systems help organizations in North America maintain operational reliance, protect critical infrastructure & data, and meet the evolving needs of the digital business environment. These factors will play an important role in boosting the market growth in the region. The U.S. market is projected to reach USD 1.68 billion by 2026.

Asia Pacific data center UPS market is expected to grow at the highest CAGR during the forecast period. The region is experiencing rapid digital transformation across various industries, including manufacturing, healthcare, government, finance, and retail. As organizations digitize their operations and rely more on IT infrastructure, the demand for reliable power protection solutions, such as UPS systems is growing to ensure the uninterrupted operation of critical systems. Many developing countries in the region have unreliable or unstable power infrastructure due to frequent voltage fluctuations, power outages, and grid instability. In order to overcome this problem, many countries in the region are significantly adopting UPS systems. For instance,

The Japan market is projected to reach USD 0.32 billion by 2026, the China market is projected to reach USD 0.36 billion by 2026, and the India market is projected to reach USD 0.26 billion by 2026.

- In July 2023, ABB India’s Electrification business launched a novel UPS solution known as MegaFlex DPA (Decentralized Parallel Architecture) UPS for data centers in the Indian Market. This solution offers notable sustainable power technology with reduced energy losses.

Europe is anticipated to grow at a prominent CAGR in the coming years. Businesses across various industries in Europe prioritize business continuity planning to mitigate risks, protect assets, and maintain operations during disruptions and emergencies. UPS systems play a vital role in business continuity planning by providing backup power to data centers, enabling organizations to continue operating critical systems during power outages or disasters. UPS systems help organizations in Europe maintain operational reliance, protect critical infrastructure and data, and meet the evolving needs of the digital business environment. For instance,

The UK market is projected to reach USD 0.33 billion by 2026, while the Germany market is projected to reach USD 0.31 billion by 2026.

- In December 2022, Delta Electronics unveiled a new Customer Experience Center for its Data Center and UPS solutions in Germany. This facility supports testing capacity and multiple-MW power.

The Middle East & Africa is expected to showcase noteworthy growth during the forecast period. The region is witnessing increasing investments in data center infrastructure to support the growing demand for e-commerce, cloud services, mobile apps, social media, and IoT applications. Owing to this, data center operators in the region are investing in UPS systems to safeguard their infrastructure.

Moreover, with growing concern about data privacy and security, organizations in South America are investing in UPS systems to protect sensitive information and customer data from loss. Also, UPS systems prevent downtime or data loss during power outages, ensuring data confidentiality.

Key Industry Players

Key Market Players are Focusing on Partnership and Acquisition Strategies to Expand Their Analytics Services

Key players are focusing on expanding their geographical presence across the globe by presenting industry-specific services. Major players are focusing on mergers and acquisitions with regional players strategically to maintain dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Top Data Center UPS Companies:

- Schneider Electric (France)

- Eaton Corp. (Ireland)

- ABB Ltd. (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Vertiv Group Corp. (U.S.)

- Clary Corp. (U.S.)

- Huawei Technologies (China)

- Delta Electronics, Inc. (Taiwan)

- Legrand (France)

- Toshiba International Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Eaton launched a new UPS product, named Eaton 93T UPS to deliver stable power for critical applications, such as small data centers and server rooms. This solution is beneficial to industries, including IT sectors, finance, government, and healthcare.

- April 2023: Schneider Electric launched Easy UPS 3-Phase Modular. This UPS is designed to safeguard critical loads while providing Live Swap functionality.

- June 2022: Vertiv unveiled its Liebert ITA2 – 30 kVA and Liebert EXM2, at its Xpress Power Drive exhibition. The company provided this solution to end users across India for critical infrastructure applications.

- September 2021: ABB launched a Medium Voltage (MV) UPS solution that delivers 98% efficiency with a reliable power supply of up to 24kV for data centers.

- May 2021: Delta Electronics launched its Highest Power Density UPS to match the Data Center requirements, such as providing continuous power supply up to 600kW.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market’s growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By UPS Type

By Data Center Size

By Industry

By Region

|

Frequently Asked Questions

The market is projected to record USD 11.71 billion by 2034.

In 2025, the market was valued at USD 6.12 billion.

The market is projected to record a CAGR of 7.50% during the forecast period.

By UPS type, double conversion is leading the market.

Rising awareness of maintaining a robust IT infrastructure for business continuity will drive the market growth.

Schneider Electric, Eaton Corp., ABB Ltd., Mitsubishi Electric Corporation, Vertiv Group Corp., Delta Electronics, Inc., and Legrand are the top players in the market.

North America is expected to hold the highest market share.

By industry, the BFSI segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us