DC Contactor Market Size, Share & Industry Analysis, By Type (Definite-Purpose DC Contactors and General Purpose DC Contactors) By End-User (Electric Vehicle, Renewable Energy and Storage, Aerospace and Defense, Industrial Machineries, and Others), Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

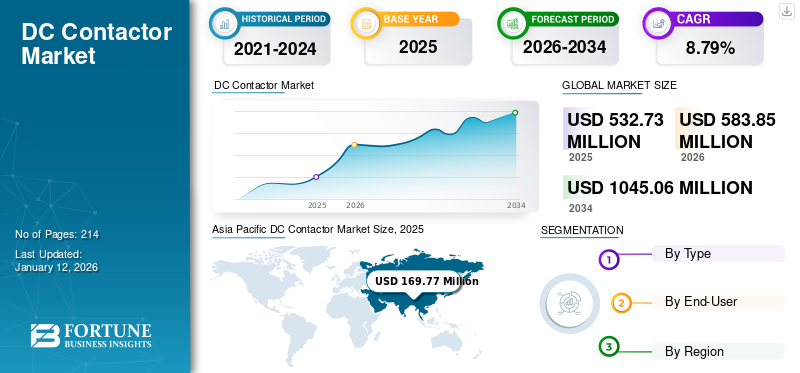

The global DC contactor market size was valued at USD 532.73 million in 2025 and is projected to grow from USD 583.85 million in 2026 to USD 1,045.06 million by 2034, exhibiting a CAGR of 8.79% during the forecast period. Asia Pacific dominated the global market with a share of 31.87% in 2025. The DC Contactor Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 165.41 million by 2032.

A DC contactor is an electrically controlled device that controls current in DC circuits by closing and opening internal contacts and simultaneously turning power on and off. They control much lower voltages when compared to AC circuits, and they also offer the advantage of minimal arcing during opening and closing the circuit. The contacts are the current-carrying part of the contactor, which includes power contacts, auxiliary contacts, and contact springs. The electromagnet provides the driving force to close the contacts. They provide an inexpensive and reliable power-switching method in low-voltage DC circuits. Some end-use industries that use DC contactors include electric vehicles, renewable energy (solar and wind), and other industrial machinery.

The sudden outbreak of the infectious disease recognized as the coronavirus disease (COVID-19) caused chaos and panic across the globe, causing the termination of all normal daily activities, such as going to work, gathering, meetings, and commuting between countries, stepping foot outside the house.

The COVID-19 outbreak hampered the growth of the market. Strict government-imposed regulations had limited market growth during the pandemic. Several industrial projects were halted or permanently shut down, hampering these shooters' growth.

DC Contactor Market Trends

Growing Usage of Contactors in Electric and Renewables to Create Tremendous Opportunities

The demand for EVs and HEVs is increasing due to rising fuel prices and government incentives. Governments of different countries are promoting electric mobility to reduce dependence on crude oil and reduce vehicle pollution. Numerous automobile manufacturers have started the production of electric vehicles or hybrid electric vehicles, thereby supporting the market's growth. Such contactors are used in EVs or HEVs to disconnect the high-voltage battery from the high-voltage grid.

The growing awareness of the importance of maintaining a clean environment has fueled the growth of renewable energy projects. Solar energy is considered to be the fastest-growing renewable energy application. Additionally, the continuously increasing demand for growing green electricity shares also supports the growth of solar energy. The main application for contactors in PV systems is disconnecting the inverter from the PV strings when the required power is low. Moreover, these contactors are used to change the configuration of the PV strings to increase system efficiency by changing other strings to an optimal converter.

Download Free sample to learn more about this report.

DC Contactor Market Growth Factors

Rising HVAC System Installations to Propel Market Growth

Consumers' growing desire for comfort has increased the installation of HVAC systems. Several companies are developing products that provide multiple benefits to meet consumer demands. To reduce repair costs, the HVAC system also alerts consumers to system failures, maintenance cycles, and unusual behavior. Sudden climate change is also fueling the growth of HVAC systems in commercial and residential areas. Therefore, the growing HVAC system supports the development of DC contactors, as these are majorly used in HVAC systems to regulate the voltage applied to the loads.

The major factors driving global market trends are high voltage transmission lines for renewable energy sources and minimizing the risk of failure by increasing the availability of inverters in substations that allow connection to a generator during a power outage. Growing demand for renewable energies such as solar, wind, and hydroelectric power and the increasing adoption of DC power systems in industrial applications are some other factors that have contributed to the industry's development.

Rising Energy Demand Integrated Renewable Sources is About to Augment Market Growth

Increasing industrialization and urbanization across the globe, particularly in countries like China and India, have boosted electricity demand. The consumption of energy per capita has augmented with the rising population in several regions. This is owing to the adaptation of several renewable resources integrated with the DC contractor. Renewable energy sources, such as wind and solar power, have driven the demand for DC contactors in wind turbine and photovoltaic inverter systems. DC contactors play a vital role in these applications for switching and disconnecting DC power sources.

According to major players, global electricity demand is growing by approx. 1.8% per year, growing to nearly 50% growth rate due to the growing population, adaption of renewable sources and expenditure capacities. Led by the growing economies of developing countries, average global household electricity consumption will increase by about 75% between 2021 and 2050. Energy efficiency plays a major role in restraining energy demand growth in the residential and commercial sectors. Modern appliances, advanced materials, and focused policies integrated with renewable sources will help shape the future.

RESTRAINING FACTORS

High Cost of DC Contactors and Availability of Alternatives to Limit Product Adoption

The high cost of these contactors is causing consumers to turn to alternatives such as relays and solenoids, hampering the DC contactor market growth. Also, the shooters needed a more central area of the location. In contrast, magnets and relays take up less space and are available in the market at a lower price than contractors. Further, if the maintenance of a component is not performed in a certain time frame, it can cause system failure or frequent failures, which can cause damage to the system.

Additionally, the DC contactor needs to be replaced within a certain span, as the aging of relays causes problems due to dust and can result in system failure. However, leading manufacturers are developing solutions to mitigate such threats. For example, Panasonic introduced EV-A Series Automotive Relay, suitable for usage in electric vehicles, DC Charging Stations, and other high-voltage DC applications such as Hybrid Construction Equipment.

DC Contactor Market Segmentation Analysis

By Type Analysis

Definite-purpose DC Contactor Dominates the Market Due to its Wide Acceptance in the HVAC Sector

Depending on the type, the market is segmented into general-purpose and definite-purpose DC contactors.

General purpose contactors dominated the global market trends in 2024 due to their wide acceptance in the HVAC industry. The general-purpose DC contactors are used in motor end-users, power switching, process automation, and protection against voltage fluctuations.

Definite-purpose contractors also show significant growth in the market with a share of 50.98% in 2026, due to their convenient use and easily interchangeable characteristics. General-purpose contactors are generally used to control the direct power flow in a circuit.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Electric Vehicle Segment Holds the Dominant Market Share due to Rising Adoption of Product

By end users, the market is segmented into electric vehicles, renewable energy & storage, aerospace & defense, industrial machinery, etc.

The electric vehicle segment dominated the global market with a share of 49.91% in 2026, due to its rising demand for low carbon emissions.

Electric vehicles don’t emit carbon directly; hence, they are less harmful to the environment than vehicles powered by combustion engines and are also less expensive and cheaper to run. Based on these aspects, the demand for these contactors is increasing with the rising demand for EVs.

REGIONAL INSIGHTS

Asia Pacific DC Contactor Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is spread across five key regions, including Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific is expected to dominate the global DC contactor market throughout the forecast period, having already led the market in 2025 with a size of USD 169.77 million. The region’s leadership is supported by a strong manufacturing base, rapid electrification of transport, and expanding renewable energy installations. China remains the dominant country, benefiting from its position as a global hub for electric vehicle production and EV component manufacturing, where DC contactors are essential for connecting and disconnecting power in EVs and HEVs. Japan and India follow, supported by technological advancement in automotive electronics and rising investments in clean mobility and power infrastructure. By 2026, the Japan market is projected to reach USD 34.96 billion, China USD 68.85 billion, and India USD 18.89 billion, reflecting sustained demand from automotive, energy storage, and industrial electrification applications across the region.

North America

North America is forecast to grow at a steady pace, driven by increasing adoption of electric vehicles, expansion of renewable energy projects, and modernization of power distribution systems. Regulatory support for clean energy transition and vehicle electrification continues to encourage the deployment of DC-based electrical systems, directly supporting demand for DC contactors. The U.S. leads the regional market due to high EV penetration, strong investment in charging infrastructure, and growth in solar and wind energy installations. The U.S. market is projected to reach USD 112.02 billion by 2026, underpinned by consistent demand from automotive, energy, and industrial end-use sectors.

Europe

Europe represents a significant and technologically advanced market, shaped by stringent environmental regulations and long-term carbon neutrality targets set by several countries for 2050. These policies are accelerating renewable energy deployment and the transition toward electric and hybrid vehicles, both of which rely heavily on DC contactors for efficient power control. The presence of a strong automotive manufacturing ecosystem further supports market demand as OEMs increasingly shift their portfolios toward EVs and HEVs. Within the region, the UK market is projected to reach USD 19.86 billion by 2026, while Germany is expected to reach USD 66.74 billion, supported by robust industrial activity, renewable energy integration, and regulatory emphasis on low-emission technologies.

Latin America

Latin America is experiencing moderate growth in the DC contactor market, supported by gradual expansion of renewable energy capacity and increasing electrification across industrial and commercial sectors. Governments in the region are progressively introducing energy efficiency and sustainability measures, which are encouraging the adoption of DC-based electrical systems. Although market penetration remains lower compared to developed regions, rising investment in power infrastructure and electric mobility is expected to support steady demand growth over the forecast period.

Middle East & Africa

The Middle East & Africa region is anticipated to witness notable growth potential due to large-scale infrastructure development, industrial expansion, and rising electricity consumption. Ongoing investments in renewable energy projects and smart grid infrastructure are increasing the need for reliable power control components, including DC contactors. In addition, expanding commercial and industrial activities across developing economies in the region are supporting adoption, as DC contactors play a critical role in controlling, isolating, and protecting electrical systems in high-load environments.

List of Key Companies in DC Contactor Market

Big Corporations Focus on Developing High-Performance Products to Secure Position

The global market is considerably fragmented, with various players operating at the national, regional, and global levels. The major players are focusing on the research and development of high-performance motor systems with amplifying operational features to secure their foothold across the industry.

Schaltbau Group is expected to generate significant market share due to its increasing focus on delivering DC contactors for various applications. The company has also gained strong brand value primarily by providing an extensive range of efficient and advanced DC contactors with optional customized delivery across the globe.

Besides, Ametek Switch has also exhibited significant potential and is striving to expand its horizons by successfully delivering its motors & other products for a wide range of applications.

Additionally, other key participants operating in the industry include ABB, TE Connectivity, Sensata Technologies Inc., and many other small, medium, and major players. These organizations continuously focus on expanding their product offerings and reaching across the market.

List of Key Companies Profiled:

- Omron Corp. (Japan)

- Siemens AG (Germany)

- Rockwell Automation (U.S.)

- ABB (Switzerland)

- TE Connectivity (Switzerland)

- Mitsubishi Electric (Japan)

- Sensata Technologies Inc. (U.S.)

- Ametec Switch (U.S.)

- Hotson International Ltd. (China)

- Trombetta Inc. (U.S.)

- Schaltbau Company (Germany)

- Cotronics BV (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 – Littelfuse, Inc., announced its product portfolio expansion of direct current (DC) contactors majorly for industrial applications. The company aims to provide more flexibility for developing high-powered EVs.

- February 2023 – Mitsubishi Electric Corporation announced that on February 16, it entered into a stock transfer agreement to acquire 100% of Scibreak AB, a Sweden-based company that develops direct current circuit breakers (DCCBs). Both companies aim to strengthen the competitiveness of their combined company by working closely together on developing DCCB technologies for direct high-voltage current (HVDC) systems to support the growing global deployment of renewable energy.

- December 2022 – ABB announced that it had signed an agreement to purchase Siemens' low-voltage NEMA motor business. This acquisition brings a respected product portfolio with manufacturing operations in Mexico.

- April 2022 – OMRON Corporation announced that it had launched K7TM on a global level, a condition monitor that can visualize the deterioration tendencies of heaters generally used in automobile and semiconductor manufacturing without expert knowledge and contribute to the realization of predictive maintenance.

- January 2022 – Sensata Technologies announced that they would launch the new GXC and MXC series of Smart Tactor contractors, which will come with CAN-bus communication and provide valuable data for improved system performance, battery systems, energy storage, and supply industrial applications.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the market report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.79% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 532.73 million in 2025

The global market is projected to grow at a CAGR of 8.79% over the forecast period.

The market size in Asia Pacific stood at USD 169.77 million in 2025.

Based on the end-user, the electric vehicle end-user holds the dominant share in the global market.

The global market size is expected to reach USD 1,045.06 million by 2034.

Rising HVAC System installations to boost market development.

The top players in the market are Schaltbau and Ametek Switch are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us