Dental Imaging Market Size, Share & Industry Analysis, By Type (Extraoral Imaging {Panoramic Systems, Panoramic & Cephalometric Systems, and Dental Cone Beam Computed Tomography (CBCT)} and Intraoral Imaging {X-ray Systems, Intraoral Sensors, Intraoral Photostimulable Phosphor Systems, Intraoral Cameras, and Intraoral Scanners}), By Application (Endodontics, Implantology, Orthodontics, Oral & Maxillofacial Surgery, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

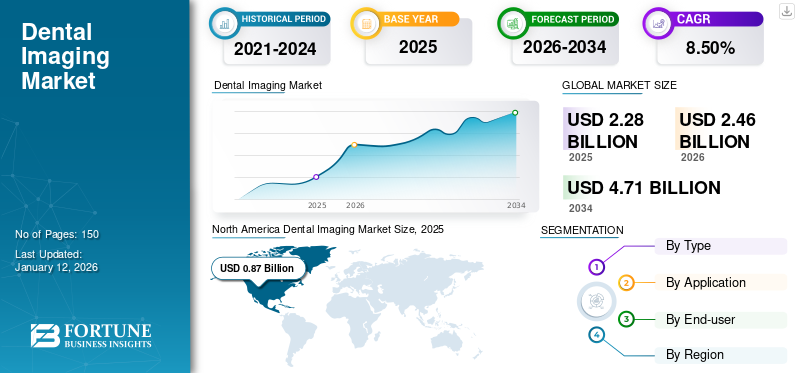

The global dental imaging market size was valued at USD 2.28 billion in 2025. The market is projected to grow from USD 2.46 billion in 2026 to USD 4.71 billion by 2034, exhibiting a CAGR of 8.50% during the forecast period. North America dominated the dental imaging market with a market share of 38.00% in 2025.

Dental imaging, primarily involving dental radiography, is a crucial diagnostic tool used by dentists to visualize the internal structures of the teeth, bones, and surrounding tissues. This imaging technique includes various methods such as intraoral and extraoral radiographs, with intraoral types such as bitewings and periapical images being the most common. Dental X-rays help detect issues such as cavities, bone loss, and other oral health problems that are not visible during a standard examination. The process employs electromagnetic radiation to create images, which can be either traditional film-based or digital, with the latter significantly reducing radiation exposure.

Advanced techniques, such as Cone Beam Computed Tomography (CBCT), provide three-dimensional images, enhancing the ability to assess complex dental conditions and plan treatments effectively. The growth of the market can be attributed to technological advancements, such as high-definition imaging and 3D capabilities, digital sensors, and panoramic systems, which enhance the diagnostic accuracy, image quality, and treatment planning. In addition, the surging awareness of oral health and preventive care practices and the need for a comprehensive imaging platform to plan the treatment are expected to fuel the market growth during the forecast period. The escalating health awareness can be attributed to the increasing prevalence of dental disorders.

The global market witnessed negative growth during the COVID-19 pandemic. This decline was due to the reduced number of patient visits to dental care facilities and which enabled these facilities to postpone their non-essential purchases such as imaging equipment. This reduced the sales of products such as extraoral and intraoral cameras, 3D CBCT systems, and sensors. Furthermore, in 2021, there was a resumption of postponed dental procedures due to increased patient visits, which led the market to fall back to its pre-pandemic growth levels.

Dental Imaging Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.28 billion

- 2026 Market Size: USD 2.46 billion

- 2034 Forecast Market Size: USD 4.71 billion

- CAGR: 8.50% from 2026–2034

Market Share:

- Region: North America dominated the dental imaging market with a 38.00% share in 2025, driven by the presence of advanced dental care infrastructure, high healthcare spending, and adoption of digital dental technologies across the U.S. and Canada.

- By Type: Intraoral imaging held the largest market share in 2026 and is projected to grow at the fastest CAGR through 2032, supported by innovations in intraoral sensors, cameras, and scanners offering higher resolution, ease of use, and digital integration.

Key Country Highlights:

- Japan:Market growth is supported by the country's emphasis on precision diagnostics and aging population demand for complex dental procedures. Strict imaging regulations and advancements in CBCT systems tailored for small clinics further promote adoption.

- United States: The U.S. market benefits from the Infrastructure Investment and Jobs Act and favorable reimbursement policies that accelerate the adoption of advanced diagnostic tools like CBCT, intraoral scanners, and panoramic systems. A high number of dental practitioners and DSOs drives volume demand.

- China: Demand is driven by government-backed dental health awareness programs, urbanization, and the rising middle class seeking improved oral healthcare. The expansion of dental clinics and integration of AI-based diagnostic tools also boost adoption.

- Europe: European nations are witnessing growing demand for digital dental solutions due to increasing cases of pediatric and geriatric oral diseases. Government mandates for low-radiation, high-precision diagnostic systems and widespread use of CBCT in orthodontics and implantology fuel the market.

Dental Imaging Market Trends

Integration AI, ML, and Photon Counting Devices in Imaging Equipment for Improved Diagnostics

Artificial intelligence (AI) and machine learning (ML) technologies are transforming the dental imaging equipment landscape by improving the image interpretation and diagnosis accuracy. These algorithms are capable of processing large datasets, which enables dentists to diagnose issues such as dental caries and oral tumors more precisely than traditional methods. By leveraging patient-specific data and historical imaging, AI can help clinicians predict disease progression, refine treatment plans, and improve patient outcomes, catering to the growing demand for personalized dental care.

Moreover, the integration of photon counting device (PCD) technology in equipment such as intraoral sensors enhances their capabilities by offering higher resolution and sensitivity in X-ray imaging. In addition, the photon counting device (PCD) can detect individual photons, providing superior image quality with reduced radiation exposure for patients compared to traditional sensors that use analog technology.

- For instance, as of July 2024, XpectVision Technology Co., Ltd.’s XpectVision intraoral sensor employs edge photon-counting technology that provides direct imaging in dentistry, minimizing light scattering for stable image acquisition.

Download Free sample to learn more about this report.

Dental Imaging Market Growth Factors

Technological Advancements in Dental Imaging Equipment to Boost the Market Growth

In recent years, there have been significant advancements in imaging equipment, such as extraoral and intraoral cameras, intraoral scanners and sensors, and CBCT systems across the globe. These technological advancements are leading to the development of new ways to diagnose and treat patients.

Advancements in software and image processing techniques are enhancing the usage of extraoral imaging techniques, enabling dental professionals to manipulate and analyze images more effectively, improving treatment outcomes and patient care.

- For instance, as of July 2024, Dental Imaging Technologies Corporation’s ORTHOPANTOMOGRAPH OP 3D LX unit offers flexible FOV options from 5x5 cm to 15x20 cm. The solutions help diverse dental specialties catering from endodontics to complex surgeries.

In addition, wireless intraoral scanners usually employ sophisticated imaging sensors and optics, which lead to enhanced resolution and clearer images. Such advancements in the device and improved image quality allow dental practitioners to attain highly detailed digital impressions, enhancing the accuracy of treatment planning and the design of dental restorations.

Moreover, advancements in CBCT systems are leading to enhanced imaging quality, reducing radiation exposure, which is expected to drive its adoption among dental care facilities. Such technological advancements in dental imaging, which provide several benefits to dental professionals, are expected to spur dental imaging market growth in the coming years.

Expansion of Healthcare Infrastructure to Propel Product Adoption

Over the past few years, there has been a significant expansion of healthcare infrastructure in emerging countries, which is boosting the demand for advanced diagnostic imaging technologies, such as intraoral scanners, intraoral cameras, CBCT, and panoramic radiography.

Such expansion of healthcare infrastructure is significantly improving access to dental imaging equipment, resulting in increased patient visits and diagnostic procedures. Technologies, such as cone beam computed tomography (CBCT), provide detailed three-dimensional images of dental structures and adjacent tissues, which are vital for accurate diagnosis and effective treatment planning of various dental issues.

- For instance, in November 2023, Global Dental Services secured a strategic equity investment of USD 50.0 million from the Qatar Investment Authority (QIA), the sovereign wealth fund of Qatar. This funding would help expand their network of clinics and develop a range of therapeutic oral care products.

Moreover, the growth of healthcare infrastructure involves setting up specialized dental clinics, oral surgery centers, and multispecialty hospitals equipped with cutting-edge medical imaging facilities. These clinical settings are expanding their services by investing in advanced technologies such as panoramic radiography, intraoral sensors, and CBCT to provide better patient care and stay competitive in the market. In such a way, the investments in healthcare infrastructure development are driving the widespread adoption of such equipment, which is anticipated to fuel market growth.

RESTRAINING FACTORS

High Cost of the Product and Superior Degree of Expertise Required for Correct Utilization May Hinder Market Growth

The high costs associated with imaging equipment and the extensive training required for effective use may pose significant challenges for the dental imaging market. The substantial investment needed to acquire advanced imaging systems, such as cone beam computed tomography (CBCT) and intraoral scanners, can be a barrier for many dental practices, particularly smaller ones. Such factors may limit their adoption, hindering the market growth.

- For instance, as per an article published by Renew Digital, LLC, in August 2022, the price of a new small to mid-sized dental cone beam computed tomography (CBCT) machine ranges between USD 50,000.0 and USD 100,000.0. The high prices of these systems may decrease their adoption in dental practices, especially in emerging countries.

Additionally, the specialized skills and ongoing training necessary for dental professionals to interpret and utilize the data obtained from these imaging modalities effectively can limit their widespread adoption. These factors contribute to the high costs of implementing and maintaining such technologies, ultimately limiting access to these valuable diagnostic tools for some dental practices and hindering the growth of the market.

Dental Imaging Market Segmentation Analysis

By Type Analysis

Intraoral Imaging Dominated the Market due to the Growing Technological Advancement

By type, the market can be bifurcated into intraoral imaging and extraoral imaging. Furthermore, extraoral imaging is sub-segmented into panoramic systems, panoramic & cephalometric systems, and dental cone beam computed tomography (CBCT). On the other hand, intraoral imaging is sub-categorized into X-ray systems, intraoral sensors, intraoral photostimulable phosphor systems, intraoral cameras, and intraoral scanners.

The intraoral imaging segment dominated the market with a share of 56.08% in 2026 and is projected to expand at the fastest CAGR during the forecast period. The segment growth can be attributed to the increasing introduction of innovative devices, including intraoral cameras by key players, to offer better examination prospects, with enhanced features such as ergonomic designs for ease of use, improved resolution, and compatibility with digital dental systems. This is leading to the higher adoption of intraoral devices, propelling the segment growth during the forecast period.

The extraoral imaging accounted for the substantial share of the global market in 2024. This can be attributed to the advancements in extraoral technologies such as panoramic systems and digital sensors that have improved diagnostic accuracy and image quality. In addition, an increased transition from 3D extraoral imaging to 2D extraoral imaging offers volumetric data acquisition, allowing for the detailed 3D visualization of bone morphology, dental structures, and soft tissues. These advancements are leading to a preferential shift of dental practitioners toward extraoral imaging technology, which is anticipated to boost the segment growth.

- For instance, as per a survey published by the National Center for Biotechnology Information (NCBI) in April 2024, the dental cone beam computed tomography (CBCT) in hospitals was predominantly used for evaluating dental implants, which represented 1,148 out of 1,456 radiation scans, or 78.85% of the total.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

High Incidence of Tooth Decay Fueled the Dominance of Implantology Segment in 2024

Based on application, the market is subdivided into endodontics, implantology, orthodontics, oral & maxillofacial surgery, and others.

The implantology segment accounted for the maximum with a share of 31.21% in 2026. This growth is due to a significant rise in tooth decay (dental caries) cases, which is driving the demand for implantation procedures. Such procedures involve the use of imaging equipment, providing a detailed view of the jawbone, and facilitating the precise treatment planning and placement of dental implants. The high equipment adoption in implantation procedures is projected to boost segment growth in the coming years.

The orthodontics segment is projected to expand at the fastest CAGR during the forecast period. The segment growth is attributed to the mounting adoption of digital orthodontic workflows. Dental imaging equipment plays a vital role in orthodontic treatment planning by capturing precise images of a patient’s teeth and facilitating the customization and design of orthodontic appliances such as aligners, braces, and retainers. This significance of imaging equipment in orthodontics is anticipated to boost the revenue growth of prominent players, further contributing to the segmental expansion.

- For instance, in 2021, Align Technology, Inc. witnessed a two-fold increase in its revenue for CAD/CAM services and imaging systems, generating USD 705.5 million.

The oral & maxillofacial segment held a substantial market share. The segment growth is driven by advancements in technology that improve diagnostic abilities for intricate dental issues. Moreover, the growing emphasis on preventive care and the early identification of oral and maxillofacial disorders is expected to fuel segmental expansion.

By End-user Analysis

Solo Practices Segment Held the Major Share Due to Affordability of Procedures and Robust Number of Dentists

By end-user, the market can be trifurcated into DSO/group practices, solo practices, and others.

In 2024, the solo practices segment accounted for a dominant global dental imaging market with a share of 28.03% in 2026. These practices often emphasize the significance of efficiency, cost-effectiveness, and adaptability in their diagnostic imaging tools. Equipment such as dental cone beam computed tomography (CBCT) systems meet these demands by providing compact and intuitive imaging options specifically tailored for individual practitioners. Moreover, the rising number of dentists globally and the increasing need for all-inclusive treatment options are expected to bolster the segment growth over the coming years.

- For instance, as per Eurostat, in 2021, there were 84.1 dentists per 100,000 inhabitants in Italy and 85.7 per 100,000 in Germany.

The DSO/group practices segment is projected to grow at a substantial CAGR during the forecast period. The practices often handle the large patient base through operated dental clinics and the availability of advanced dental imaging equipment. In addition, the strong financial resources and infrastructure of DSOs enable large investments in such equipment, which is boosting their widespread global adoption. Such a scenario is expected to boost the segmental growth during the forecast period.

The others segment, including dental hospitals and academic & research institutes, are expected to grow at a moderate CAGR over the forecast period. The growth of the segment is driven by the focus on more facilities adopting advanced imaging technologies, such as intraoral scanners, intraoral cameras, panoramic X-rays, and CBCT, to enhance patient outcomes and integrate dental imaging with wide-ranging dental services.

REGIONAL INSIGHTS

Based on geography, the market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America emerged as the dominant region in the market with a revenue ofUSD 0.87 billion in 2025. The regional growth is due to the existence of a large number of dental imaging centers and dental clinics, which are boosting the product adoption in the region. In addition, robust research and development activities, positive policies for reimbursement, and the presence of key market players are also anticipated to fuel the demand for the utilization of this equipment, propelling the market growth. The U.S. market is projected to reach USD 0.87 billion by 2026.

Europe

The Europe market held the second dominant revenue share in 2024. This growth can be attributed to the increasing cases of oral diseases, especially among pediatrics, which is anticipated to increase the number of visits to dental practices for disease diagnosis, thereby driving the adoption of imaging equipment. This is expected to fuel the regional market growth in the coming years. The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

- For instance, an article published by the American Hospital of Paris in April 2021 reported that 50.0% of children under 15 have gingivitis in France. Such a scenario is expected to boost patient visits to hospitals, driving the utilization of dental imaging equipment in the region.

Asia Pacific

The Asia Pacific market is anticipated to rise at the highest CAGR over the projection period. The growth rate is attributed to the evolving imaging equipment landscape in the regional dental sector. This is fueled by a high demand for advanced diagnostic tools, increasing healthcare expenditures, a surge in dental tourism, and greater awareness of oral health. Moreover, innovations in imaging technology and a rising geriatric population requiring dental care are also contributing to the regional market growth. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.15 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa regions accounted for a limited market share. However, these regions are expected to show strong growth potential in the future. The regional growth can be attributed to the supportive government initiatives to improve access to dental care and growing urbanization in these regions. Furthermore, the underserved areas of these regions represent significant opportunities for key players to expand their product offerings, which is expected to boost market growth.

KEY INDUSTRY PLAYERS

Acteon, PLANMECA OY, and Dentsply Sirona Held Significant Market Share in 2024 due to Strong Global Presence and Broader Portfolio

Market players such as Align Technology, Inc., PLANMECA OY, and Acteon accounted for significant market share in 2024. The major market share of these companies is attributable to factors such as their advanced imaging portfolios, a large customer base globally, and a strong international presence. Moreover, the launch of cutting-edge products by these players to improve dental care is anticipated to strengthen their market positions worldwide.

Other prominent players, such as Dentsply Sirona, Medit, and OMNIVISION, are engaged in numerous strategic initiatives such as acquisitions, partnerships, and geographical expansions to enhance their market share in the forthcoming years. In addition, they are involved in the incorporation of advanced features into their existing products and expansion of their distribution networks through local distributors in different regions.

List of Top Dental Imaging Companies:

- Acteon (U.K.)

- Dentsply Sirona (U.S.)

- OMNIVISION (U.S.)

- Align Technology, Inc. (U.S.)

- Medit (South Korea)

- PLANMECA OY (Finland)

- Trident (Italy)

- Owandy Radiology (France)

- XpectVision Technology Co., Ltd (China)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Planmeca OY entered into a strategic partnership with Benevis, which have 120 dental offices across 13 states and Washington, D.C., in the U.S.

- January 2024: Align Technology, Inc. launched their iTero Lumina intraoral scanner. Some of the features of the product include a 3X wider field of capture in a wand, which is 45% lighter and 50% smaller. This device offered superior visualization, greater accuracy, and faster scanning speed.

- March 2023: COLOGNE launched PANDA Smart, the smallest and latest PANDA intra-oral scanner, at IDS 2023.

- November 2022: Ori Dental introduced the Ori intraoral scanner, a new alternative to conventionally-used dental PVS impressions. This equipment offers a faster, precise, and easier solution, enhancing patient experience.

- March 2022: Align Technology, Inc. introduced a new integration feature for its ClinCheck digital treatment planning software that utilized cone beam computed tomography (CBCT). This user-friendly tool merges information from roots, bone, and crowns and enables dentists to visualize a patient’s roots as part of the digital treatment planning process.

REPORT COVERAGE

The report provides a detailed analysis of the global market forecast and competitive landscape. It covers crucial aspects such as new product launches and market dynamics. Additionally, it covers key industry developments such as important global market statistics, key developments such as mergers, partnerships, and acquisitions and technological advancements in the market. Moreover, it focuses on key aspects, including analysis of different segments in various regions, company profiles of prominent players, and the impact of COVID-19 on the market. The report also provides a detailed analysis of qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 2.28 billion in 2025 and is projected to reach USD 4.71 billion by 2034.

In 2025, the North America market stood at USD 0.87 billion.

The market is expected to exhibit a CAGR of 8.50% during the forecast period.

By type, the intraoral imaging segment is the leading segment as it captured a dominant market share in 2026.

The technological advancements in imaging equipment and expansion of healthcare infrastructure are the key factors driving the market growth.

Align Technology, Inc., PLANMECA OY, and Acteon are the top players in the market.

North America dominated the dental imaging market with a market share of 38.00% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us