Dental Implants Market Size, Share & Industry Analysis, By Material (Titanium, Zirconium, and Others), By Design (Tapered Implants and Parallel Walled Implants), By Type (Endosteal Implants, Subperiosteal Implants, and Transosteal Implants), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

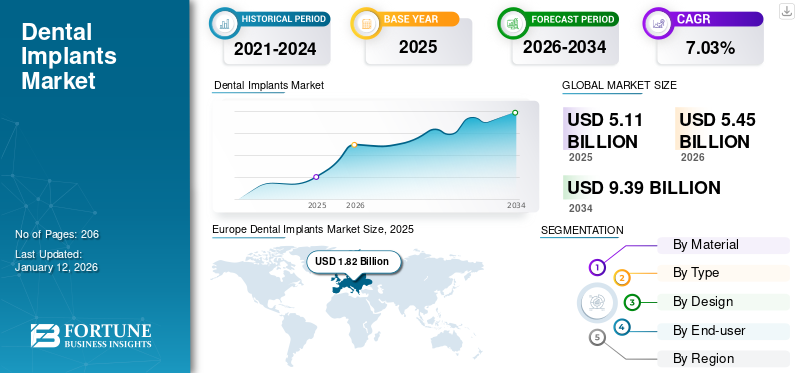

The global dental implants market size was valued at USD 5.11 billion in 2025. The market is projected to grow from USD 5.45 billion in 2026 to USD 9.39 billion by 2034, exhibiting a CAGR of 7.03% during the forecast period. Europe dominated the dental implants market with a market share of 35.65% in 2025.

Dental implants are devices that are used to support dental prosthetics/false teeth. They are surgically placed in the jaw, serving as a root of the missing teeth and restoring a person's ability to chew. Moreover, they provide support for artificial teeth, which include crowns, bridges, or dentures.

Due to tooth loss, an individual can experience complications, such as defective speech, rapid bone loss, or changes to chewing patterns, resulting in discomfort. Hence, tooth replacement utilizing a dental implant improves the person's quality of life and health. The increase in the prevalence of oral disorders globally is expected to boost the demand for dental implants, which is expected to propel market growth over the forecast period.

- For instance, in March 2023, according to the World Health Organization (WHO), it was estimated that oral diseases affected approximately 3.5 billion people globally. This higher prevalence poses a major health burden for many countries and leads to an increase in the adoption of implants in various dental procedures.

Moreover, the major factors attributable to the market growth include growing awareness about oral health, the increasing significance of aesthetic restoration of teeth.

In 2020, due to the COVID-19 pandemic, the demand for implants used in dental procedures was reduced due to a decline in elective surgical procedures, including dental implantation surgery. The decrease in the number of individuals visiting healthcare facilities, especially dentist offices, due to the fear of getting infected, strict government regulations, and the rapid spread of COVID-19 have postponed dental surgeries in several countries, impacting the market growth during the pandemic.

- For instance, in March 2021, according to the Dental Intelligence customer base, the dental practice revenue dropped by 6% year-over-year in 2020.

However, during 2021, due to the relaxation of regulations imposed by several governments, patient visits to dental clinics and hospitals increased. Thus, the demand for these devices increased in various geographies in 2021. In addition, due to lowered cases of the COVID-19 at the end of 2021, the resumption of dental services recovered the market entirely in 2022, the patient volume started returning to the pre-pandemic levels. This increasing demand significantly increased the revenues of major market players.

Global Dental Implants Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.11 billion

- 2026 Market Size: USD 5.45 billion

- 2034 Forecast Market Size: USD 9.39 billion

- CAGR: 7.03% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 35.65% share in 2025. This is due to the presence of a large number of dental implant manufacturers, favorable reimbursement policies, and a continuously growing geriatric population leading to a higher prevalence of dental disorders.

- By Material: The titanium implants segment held the largest market share. This dominance is attributed to titanium's high biocompatibility with bone, its non-allergic nature, cost-effectiveness compared to other materials, and higher success rates in dental procedures.

Key Country Highlights:

- Japan: Demand is driven by the growing adoption of advanced implant technologies and a large patient pool requiring treatment for oral disorders as part of the fast-growing Asia Pacific market.

- United States: Market growth is fueled by a high prevalence of edentulism, a growing number of dental professionals, the wide availability of advanced dental equipment, and a high acceptance rate of digital dentistry.

- China: The market is propelled by rising medical tourism due to the affordability of oral healthcare, which increases the demand for dental implant procedures from both domestic and international patients.

- Europe: The market is driven by its large and aging population, which increases the incidence of tooth loss, coupled with the presence of major manufacturers and favorable reimbursement systems that make implants more accessible.

Dental Implants Market Trends

Growing Demand for Antibacterial Coated Dental Implants to Foster Market Growth

Rising demand for antibacterial coated implants acts as one of the most significant global dental implants market trends. Factors, such as durability are an important concern associated with implants for dental procedures. The antibacterial coating improves its durability, which boosts the adoption of antibacterial coated implants. Furthermore, the antibacterial coating protects from harmful oral bacteria responsible for tooth decay and serious dental problems, which boosts their demand, improving patient outcomes.

- For instance, according to the research published in March 2022 in Materials Today, researchers have invented an antibacterial coating for implants combining Antimicrobial Peptides (AMPs) and silver nanoparticles (AgNPs) for the dual impact. This invention has made these products safer and more effective for dental procedures, driving their adoption.

In addition, various coating materials, such as silica, carbon, bioactive glasses hydroxyapatite, bisphosphonates, calcium phosphates, titanium, and fluoride, have been studied for their utilization in implantation devices used in dental surgery. Properties, such as porous structure, tunable particle size, and ease of adhering to any surface create an opportunity to increase the adoption of such products.

Download Free sample to learn more about this report.

Dental Implants Market Growth Factors

Increasing Prevalence of Dental Disorders to Boost Market Growth

One of the most significant drivers influencing the global dental implants market growth is the rising prevalence of dental disorders. The growing aging population is the most common factor behind the rising prevalence of dental disorders, particularly edentulism and dental caries. Hence, the rising number of aged individuals significantly contributes to the market growth.

- For instance, in March 2023, according to the World Health Organization (WHO), the estimated prevalence of edentulism was almost 7.0% among people aged 20 years or older and 23.0% for individuals aged 60 years or older.

In addition, increasing incidence of tooth loss, growing demand for aesthetic dentistry, rising healthcare expenditure, and the launch of new technologically advanced products in the global market are the major factors contributing to the market growth. The preferred treatment for missing teeth includes dental implant placement. As a result, the increasing incidence of tooth loss fuels the demand for these products, driving market growth.

Moreover, the increase in the number of oral disorders, such as tooth decay and periodontal diseases, is also expected to increase the adoption of these products, which may propel the growth of the market during the forecast period.

Increasing Technological Advancements in Dental Implants to Fuel Market Growth

The significant rise in demand for dental devices, owing to the increasing number of existing and new cases of tooth-related disorders, has encouraged prominent players to increase their focus on research and development initiatives. This increasing focus on research and development to introduce new technologically advanced implantation devices and equipment for dental implantation procedures will drive market growth during the forecast period.

- For instance, in February 2022, Desktop Health launched Einstein, a dental 3D printer series to deliver accurate dental implantations. This innovation enhances the manufacturing and placement of implants, increasing their availability and demand in the market.

The adoption of these products has considerably increased with the introduction of digital dentistry implants. Dentists can more accurately place an implant and predetermine the need for soft tissue augmentation with this computer-guided implantation. Moreover, this advanced technology allows a 4-dimensional (4D) virtual plan to be transferred to the real world via guided surgery. The benefits of digital dentistry devices, such as faster healing time, lesser bleeding, safety, and reduced pain, increase their utilization, ultimately increasing their adoption, which propels the market growth.

Such technological advancements, along with the strong focus of major players on increasing production, are anticipated to spur market growth in the coming years.

RESTRAINING FACTORS

Risks Associated with Implant Procedures and High Cost of Dental Implants Might Hinder Market Growth

Despite the several benefits, dental implantation procedures are associated with certain risks and safety issues, such as they may cause infection at the implant site, injury or damage to surrounding structures, and nerve damage resulting in pain, numbness or tingling. These side effects are expected to limit their adoption for treatment, hampering the market growth during the forecast period.

- For instance, according to the National Center for Biotechnology Information (NCBI), in April 2022, peri-implant mucositis and peri-implantitis post-implant insertions among patients ranged from 46% to 63% and 19% to 23%, respectively.

Moreover, implants for dental procedures are typically more expensive compared to other tooth replacement solutions due to their longevity and higher success rates. These higher costs are expected to act as a burden for a number of individuals seeking tooth replacement procedures, thereby limiting the growth of the market.

Dental Implants Market Segmentation Analysis

By Material Analysis

Titanium Implants Segment to Dominate the Market Due to High Biocompatibility

Based on material, the market is categorized into titanium, zirconium and others.

Among these market segments, the titanium segment is anticipated to hold the largest share of the market. This major share is attributed to the high biocompatibility of titanium with the bone structure, its suitability to a number of procedures, and its non-allergic nature. Additionally, the higher success rate of titanium implants and cost-effectiveness over other implants increase their utilization in the number of dental procedures, which is projected to boost segment growth during the forecast period.

- For instance, according to an article published by the American Academy of Implant Dentistry in July 2022, in the U.S., more than 2.5 million implants occur every year, which corresponds to an increase in the utilization of titanium and is contributing to the growth of the segment.

The zirconium segment is projected to account for a substantial market share during the forecast period. This growth can be positively impacted by the rising demand for dental aesthetic procedures with the introduction of new-generation zirconia material. The biocompatibility of the material has made it a preferential option to get an aesthetic prosthesis, thereby driving segmental growth.

The others segment which includes gold alloys and stainless steel, held a limited market share in 2024. The growing number of dental ailments and the increasing number of dental implant procedures across the globe is expected to increase the demand for these materials.

By Design Analysis

Tapered Implant Segment Showcased Considerable Growth Due to Greater Implant Stability

On the basis of design, the market is bifurcated into tapered implants and parallel walled implants.

In 2024, the tapered implants segment of the dental implants accounted for the largest share of the market. This significant growth is attributed to the benefits they offer over parallel implants, such as greater implant stability, excellent soft tissue attachment, and maximum bone maintenance. These benefits have greatly increased their acceptance, inspiring the companies to increase their manufacturing facilities, which significantly contributes to segment growth. Moreover, the increasing approvals for these products in several countries also contribute to the growth of the segment.

- For instance, in December 2021, China granted regulatory approval for Straumann Group’s BLX, an implant system. These increasing approvals may increase the adoption of tapered implants, contributing to the growth of the market.

The parallel walled implants segment is expected to grow substantially during the forecast period owing to the stability they provide. The chances of the success rate of dental implant surgery increase due to this stability, which can lead to the growth of the segment during the forecast period.

By Type Analysis

Endosteal Implants Segment Led the Market Due to Clinical and Economic Benefits

Based on type, the market is segmented into endosteal implants, subperiosteal implants, and transosteal implants.

The endosteal implants segment held the largest market share of 80.45% in 2026. Endosteal implants are the most common type of device used in dentistry due to their clinical and economic benefits. The growth of these devices can be highly attributed to the high success rates of endosteal implant procedures, the longevity they offer, and newer designs. These benefits associated with endosteal implants make them a treatment of choice in a number of dental procedures, which propels the segment growth.

- For instance, in April 2022, Straumann combined its TLX implant system with an implant and abutment connection design, which acts as an innovative endosteal design aiding in improving CAD/CAM workflows for clinicians.

The subperiosteal implants segment is anticipated to witness noteworthy growth during the forecast period. The subperiosteal implant procedure is a less time-consuming procedure, which makes it a preferable option for many patients. Moreover, the optimum success rate of subperiosteal implants increases its utilization, contributing to global dental implants market growth.

The transosteal implants segment is expected to grow at a robust rate during 2025-2032, owing to their specific advantages, such as the availability of sizes and shapes, due to which they can be used for individual teeth, multiple teeth and complete denture support.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Held the Largest Market Share Owing to Increasing Number of Dentists

Based on end-user, the market is segregated into solo practices, DSO/group practices and others.

The solo practices segment accounted for the largest global dental implants market share of 64.36% in 2026, owing to the increase in the number of dentists globally. This increasing number of dentists is estimated to surge the establishments of well-resourced dental clinics during the forecast period. Moreover, the segment growth is also influenced by the rising prevalence of dental ailments globally.

- According to the American Dental Association, the number of dentists working in dentistry in the U.S. increased from 163,409 in 2001 to 202,536 in 2022, which means 60.77 dentists per 100,000 U.S. population. This rising number of dentists will lead to an increase in establishments of well-equipped dental clinics, contributing to the growth of solo practices.

The DSO/group practices segment accounted for a significant market share and is primarily attributed to the rising preference of dentists toward DSO/group practices. In addition, the emergence of DSO/group practices in underserved areas for dental care is also expected to surge the market growth during the forecast period.

The others segment is expected to witness stable growth due to an increasing number of clinical research being conducted with an aim to evaluate the clinical outcomes of dental implants.

REGIONAL INSIGHTS

Geographically, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe Dental Implants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe

The revenue generated from the European market was USD 1.93 billion in 2026. Factors, such as the presence of a large number of dental implant manufacturers and favorable reimbursement policies primarily drove the market growth of this region. Moreover, the continuously growing geriatric population resulting in the increasing prevalence of dental disorders leads to the high adoption of tooth implants, which increases the demand for these devices in Europe. The UK market is valued at USD 0.1 billion by 2026, while the Germany market is valued at USD 0.41 billion by 2026.

- For instance, in February 2024, according to Eurostat, more than one-fifth (21.1 %) of Europe's population was aged 65 and over in 2022. Thus, the growing number of aged individuals in Europe is anticipated to increase the demand for these devices in dental procedures.

North America

North America held the second-largest share in 2024. The growth of this region is significantly attributed to the high prevalence of edentulism in the U.S. Furthermore, a growing number of dentists, an increase in the availability of advanced dental equipment, as well as high acceptance of digital dentistry are the major factors expected to spur the market growth in North America. The U.S. market is valued at USD 1.48 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at a higher rate due to the growing adoption of advanced implants in dentistry and the presence of a large patient pool in this region. Moreover, the rising medical tourism in countries such as China, India, and Singapore is expected to contribute to the market growth in the Asia Pacific. The Japan market is valued at USD 0.1 billion by 2026, the China market is valued at USD 0.24 billion by 2026, and the India market is valued at USD 0.07 billion by 2026.

- For instance, in June 2023, an article published by the International Journal of Travel Medicine and Global Health indicated an increase in dental tourism demand in developed nations, such as India, China, and Thailand, due to the affordability of oral health care in these countries.

Latin America and Middle East & Africa

The Latin America and Middle East & Africa markets are experiencing a boom due to rising medical tourism and increasing healthcare expenditure in Brazil and Mexico. Furthermore, the growing partnerships among hospitals and dental academic institutions to increase the awareness of dental care in these regions are expected to propel the market growth.

Key Industry Players

Institut Straumann AG Dominates the Market with a Broad Product Portfolio and an Extensive Range of Premium Products Offered

The market is highly fragmented, with a few prominent players holding a major share of it. The most prominent player, Institut Straumann AG, dominates the market due to its broad product portfolio in the industry's premium segment. Moreover, the company delivers an extensive range of implants at premium prices. Furthermore, the company has successfully penetrated across major regions, including North America, Europe, Asia Pacific, and Latin America, which aid in revenue generation. These factors have successfully ranked the company's position in the global market.

Other prominent players, such as Dentsply Sirona and Danaher, also mark a significant presence in the global market due to a strong focus on collaborations, partnerships, and new product launches.

LIST OF TOP DENTAL IMPLANTS COMPANIES:

- Institut Straumann AG (Switzerland)

- Dentsply Sirona (U.S.)

- Henry Schein, Inc. (U.S.)

- ZimVie Inc. (Zimmer Biomet) (U.S.)

- Osstem Implant (South Korea)

- BioHorizons (U.S.)

- CeraRoot SL (Spain)

- Envista Holdings Corporation (Danaher) (U.S.)

- Cortex (Israel)

- Dentium (South Korea)

- Zest Dental Solutions (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2025: ZimVie announced the launch of its new dental implant system, designed to offer enhanced stability and esthetics. The system aims to address the growing demand for minimally invasive procedures and improve patient outcomes.

- March 2025: BioHorizons announced the acquisition of a leading dental implant technology company, expanding its product portfolio and global reach. The acquisition is expected to enhance BioHorizons' position in the competitive dental implant market.

- January 2025: CeraRoot SL launched a new line of zirconia dental implants, offering improved biocompatibility and esthetics. The implants are designed to meet the growing demand for metal-free dental solutions.

- March 2025: Cortex introduced a new line of dental implants featuring advanced surface treatments aimed at enhancing osseointegration and reducing healing times. The implants are designed to cater to the needs of both general practitioners and specialists.

- November 2024: Dentium participated in KASHDENT 2024 in Srinagar, showcasing its innovative dental solutions. The event provided an opportunity for dental professionals to explore advancements in implant technology and connect with industry leaders.

- November 2024: Dentium hosted a seminar in Mumbai, featuring global experts discussing the future of implantology. The event included hands-on training sessions on topics such as short and narrow implants, digital minimalism, and sinus lift procedures.

- February 2025: Zest Dental Solutions announced the launch of its new line of implant abutments, designed to offer enhanced precision and compatibility with a wide range of implant systems. The abutments aim to improve clinical outcomes and simplify the restorative process.

REPORT COVERAGE

The research report includes a detailed market analysis. It focuses on key aspects such as prominent players, implant types, material type, design type, and end-user. Furthermore, the report offers insights into the impact of COVID-19, market trends, and the prevalence of dental disorders. Moreover, the report covers numerous aspects that have contributed to the growth of the dental implant market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.03% for 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Design

|

|

|

By Type

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 5.11 billion in 2025 and is projected to reach USD 9.39 billion by 2034.

The market will exhibit steady growth at a CAGR of 7.03% during the forecast period.

By material, the titanium segment will lead the market.

The increasing prevalence of dental disorders and growing awareness of dental implants are the key drivers of the market.

Institut Straumann AG, Dentsply Sirona, and Danaher are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us