Dental Prosthetics Market Size, Share & Industry Analysis, By Type (Crowns, Bridges, Abutments, Dentures, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

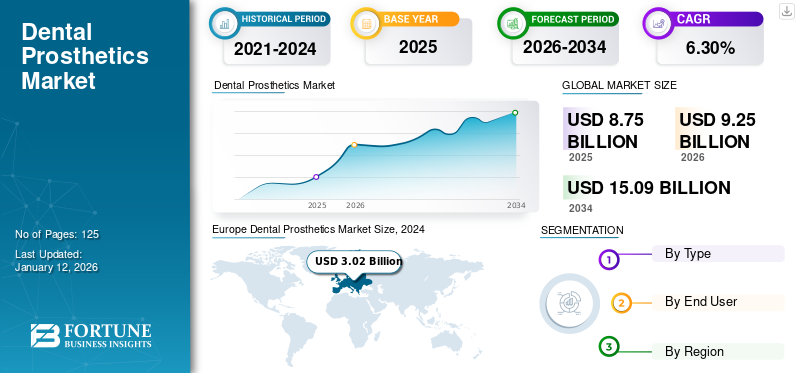

The global dental prosthetics market size was valued at USD 8.75 billion in 2025. The market is projected to grow from USD 9.25 billion in 2026 to USD 15.09 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. Europe dominated the dental prosthetics market with a market share of 36.13% in 2025.

Dental prosthetics refer to artificial replacements for missing teeth or oral structures. These prosthetics are designed to restore the functionality, aesthetics, and comfort for individuals who have lost their teeth due to injury, decay, or other reasons. Common types include dentures, bridges, and dental implants. Advances in materials and technology have greatly improved the durability, fit, and natural appearance of these products, enhancing the quality of life for countless patients globally.

The market is experiencing growth driven by various factors, such as the rise in the incidence of dental caries and periodontal diseases, increasing cases of tooth loss, expansion of the disposable income, the emergence of dental tourism, and the flourishing cosmetic industry. Dental prostheses, which are personalized intraoral appliances, play a crucial role in the restoration of lost parts of the teeth, addressing of dental deficiencies, and correcting issues with the jawbone or palate structures. These prostheses are instrumental in the restoration of mastication, enhancing aesthetics, and aiding speech.

The COVID-19 pandemic significantly affected the market, causing disruptions in manufacturing, supply chains, and patient access to prosthetics solutions. The lockdown measures and safety concerns led to postponed or canceled dental procedures, reducing the demand for prosthetics. However, in 2021 and 2022, the market witnessed a recovery as restrictions eased and dental practices adapted to the new safety protocols. The resumption of dental services increased the number of prosthetics procedures propelling the demand for the products in these years.

Global Dental Prosthetics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 8.75 billion

- 2026 Market Size: USD 9.25 billion

- 2034 Forecast Market Size: USD 15.09 billion

- CAGR: 6.30% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 36.13% share in 2025. This leadership is due to higher rates of diagnosis and treatment for dental ailments, increased dental spending, greater utilization of dental services, and a rising demand for premium dental products.

- By Type: The crowns segment held the largest market share in 2024. The growth is fueled by the widespread adoption of crowns for dental restoration and the integration of advanced technologies such as CAD/CAM for designing them, which reduces time and labor.

Key Country Highlights:

- Japan: As a key market in the fast-growing Asia Pacific region, demand is driven by a growing geriatric population requiring prosthetic solutions, rising disposable incomes, and an increase in product launches by major players.

- United States: The market is propelled by high per capita dental expenditure, an increasing edentulous population, growing public awareness about oral health, and strategic partnerships between dental companies to provide advanced prosthetic solutions.

- China: Growth is supported by the rising prevalence of dental caries, an expanding geriatric population, increasing disposable incomes, and a flourishing dental tourism industry, which drives the demand for cosmetic and restorative procedures.

- Europe: The market is driven by high diagnosis and treatment rates for dental conditions, significant dental spending per capita, and a comparatively higher density of dentists, which facilitates greater access to prosthetic treatments.

Dental Prosthetics Market Trends

High Adoption of Digital Dentistry to Boost Market Growth

The market is witnessing significant trends, including the rise of dental tourism, the development of advanced products, and the increasing utilization of mini dental implants. In the developed countries, the cost of medical treatments is soaring, prompting many individuals to seek dental care in emerging nations where it is more affordable. This trend is bolstered by globalization, which has facilitated the importation of technologically advanced dental products and equipment into the developing countries, thus fostering dental tourism.

Furthermore, advanced technologies such as 3D printing and CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) are becoming increasingly prevalent in the customization of dental prosthetics. These technologies allow for precise customization of teeth, utilizing materials that are both durable and aesthetically pleasing. Consequently, dental prosthetics are gaining popularity in cosmetic dentistry.

- For instance, in February 2019, the Continuous Liquid Interface Production (CLIP) company Carbon introduced a range of new 3D printing solutions for the dental market. The company launched the M2d 3D printer, new materials, and industry-specific updates for its operation software. This method of 3D printing is engineered to be around 100 times faster than the current 3D printing speeds.

Furthermore, there is a transition toward the utilization of mini dental implant-supported prosthetics owing to their minimally invasive characteristics and associated benefits, such as affordability, avoidance of bone grafting, shorter placement time, among others. Research and development efforts are notably increasing in this area, given the extensive adoption of mini implants in dental procedures compared to traditional implants.

Download Free sample to learn more about this report.

Dental Prosthetics Market Growth Factors

Growing Prevalence of Dental Diseases to Fuel the Dental Prostheses Demand

The growing prevalence of dental diseases, including tooth decay, gum diseases, and tooth loss, is expected to significantly fuel the demand for dental prostheses across the world. Factors such as poor oral hygiene, unhealthy dietary habits, and aging population contributes to the rising incidence of dental conditions globally. The tooth loss requires restorative dental prostheses, including dentures, bridges, and crowns.

- For instance, according to the data published by WHO in April 2023, Europe had the highest prevalence of major oral disease cases, which is 50.1% of the adult population across all regions globally.

Moreover, advancements in dental technologies and materials have improved the durability, aesthetics, and the functionality of these prosthetic devices, addressing the needs of the patients. Additionally, the increasing awareness about the importance of oral health and the availability of dental care services in the emerging economies are likely to drive the adoption of dental prostheses.

Furthermore, the rising disposable income levels, increasing patient pool for dental treatments, and the growing emphasis on cosmetic dentistry contributes to the expanding market for dental prostheses. Overall, the growing prevalence of dental diseases, coupled with technological advancements and changing consumer preferences, is anticipated to drive the demand for dental prostheses in the coming years, thereby boosting the growth of the market.

Increasing Demand for Cosmetic Dentistry to Propel Market Growth

The popularity of cosmetic dentistry is experiencing significant growth in both emerging and developed countries. The shifts in people's lifestyles and an increasing focus on dental aesthetics are driving the demand for cosmetic dental procedures. Additionally, the rise in the disposable income and willingness to undergo exclusive cosmetic treatments have created lucrative opportunities for dental restoration and aesthetic solutions.

Such prosthetic solutions, which includes veneers, inlays, and replacements of the teeth is expected to propel the market revenue. In recent years, dental prosthetics has gained recognition amongst all the age groups in terms of aesthetic procedures which is expected to drive the market during the forecast period.

- For instance, according to a study published by MBPI in September 2022, the majority, which comprises 90.7% of dental practitioners surveyed, believed that there is an increase in the demand for aesthetic dental procedures, and social media is a major contributor.

Overall, the growing demand for cosmetic dentistry is expected to propel market growth, as individuals increasingly seek aesthetic solutions to achieve their desired smiles and improve their overall quality of life.

RESTRAINING FACTORS

High Cost of Dental Prosthetics and Limited Reimbursements to Restrain Market Growth

The cost of dental prosthetics and procedures has been rising exponentially. Dental prosthetics are considered as a cosmetic product by most insurance companies across the world thereby, insurance companies provide minimal or no reimbursements for these products.

Dental prosthetic devices such as implants, bridges, and crowns often involve substantial expenses, including materials, and manufacturing. These expenses can hinder patients from seeking necessary dental treatments, especially those without adequate insurance coverage or financial resources.

These high costs of dental prosthetics and restricted reimbursement options might provide limitations to access to care for patients seeking prosthetic treatments. They might postpone the necessary dental procedures due to financial concerns. This potentially compromises their oral health and the quality of life, thereby hindering the adoption of prosthetics during the forecast period.

Dental Prosthetics Market Segmentation Analysis

By Type Analysis

Use of Crowns in Dental Restoration Dominated the Global Market

Based on type, the market is classified into dentures, bridges, crowns, abutments, and others.

The Crowns segment is expected to account for 38.47% of the market in 2026. The segmental growth is anticipated to be fueled by the integration of advanced technologies such as CAD/CAM for dental crown designs. Prosthetics crafted through the CAD/CAM technology entails reduced time and labor, and the widespread adoption of this technologically advanced approach in dental prosthetics production is expected to accelerate the growth of dental crowns.

The abutments segments held a significant share of the market due to their role in implant-supported restorations. These products provide stability, and functionality, which serve as connectors between dental implants and prosthetic components. The rising number of dental implant procedures, driven by factors such as aging populations and growing awareness of oral health, propelled the demand for abutments. Additionally, technological advancements in abutment design and materials enhanced their durability further propelling the segmental growth during the forecast period.

In 2024, dentures held a moderate market share due to their versatility, affordability, and widespread acceptance among patients. With advancements in materials and customization options, dentures offer a cost-effective solution for restoring oral functionality and aesthetics, catering to meet the needs of edentulous patients.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Dominated Due to Large Patient Volume in these Facilities

Based on the end-user, the market is segmented into solo practices, DSO/group practices, and others.

The Solo Practices segment is forecast to represent 64.91% of total market share in 2026. Furthermore, the rising number of dentists across the globe is projected to boost the establishments of well-equipped dental clinics in coming years.

- For instance, according to the American Dental Associations, in 2023, there were 202,304 professionally active dentists in the U.S., which represent 60.4 dentists per 100,000 U.S. population.

The DSO/group practices are expected to register the fastest growth during the forecast period. Introduction of digital dentistry has resulted in more preferences being given to the customized dental prosthesis and is expected to increase the demand in these settings during the forecast period. Furthermore, consolidation of dental practices and rising DSO activity in the developed countries are expected to boost the segment growth during the forecast period.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe Dental Prosthetics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Europe was USD 3.31 billion in 2026. The region's market exhibits the higher rates of diagnosis and treatment for dental ailments. Furthermore, increased dental spending, greater utilization of dental services, a rising demand for premium dental products, and a comparatively higher density of dentists per 1000 inhabitants, accounts for its significant share in the global market. The UK market is projected to reach USD 0.37 billion by 2026, and the Germany market is projected to reach USD 0.89 billion by 2026.

North America holds the second-largest market position, attributed to its increased per capita dental expenditure and the availability of advanced dental services. Additionally, market growth in this region is driven by an increasing edentulous population and rising public awareness. Furthermore, the strategic initiatives between dental laboratory companies to provide advanced prosthetic solutions in the region, is expected to drive the dental prosthetics market growth. The U.S. market is projected to reach USD 2.88 billion by 2026.

- In June 2023, Stabili-Teeth announced a strategic partnership with ROE Dental Laboratory. The partnership had formed to enable Stabili-Teeth licensees to benefit from ROE's prosthetic solution to complement Stabili-Teeth's innovative full mouth restoration process.

The Asia Pacific dental prosthetics market is projected to register the fastest CAGR during the forecast period. Factors contributing to this growth include a rise in dental caries prevalence, a growing geriatric population, increased product launches by major players, and rising disposable incomes. The Japan market is projected to reach USD 0.38 billion by 2026, the China market is projected to reach USD 0.60 billion by 2026, and the India market is projected to reach USD 0.18 billion by 2026.

Latin America and the Middle East & Africa are also anticipated to witness significant expansion during the forecast period. This growth can be attributed to increasing awareness of dental issues among the population and the burgeoning medical tourism industry in these regions. Moreover, the development of healthcare infrastructure and the rising prevalence of dental disorders are expected to further drive market growth in Latin America and the Middle East & Africa.

- For instance, according to the WHO, in 2019, the prevalence of edentulism was 14.4% in patients above 20 years. Such a large population suffering from the disease is expected to boost the demand for prosthetic solutions.

List of Key Companies in Dental Prosthetics Market

Diverse Portfolio and Strong Focus on Expansion of Distribution Channels to Be Leading Strategies by Key Market Players

The market is fragmented with the presence of various companies. 3M, DDS Lab Inc, Cheng Crowns, Dentsply Sirona, and Institut Straumann AG are few of the leading players in the market due to the strong product offerings and expanded distribution across the globe. Dentsply Sirona has a comprehensive product portfolio in dental care and is introducing new products to gain market share.

Other leading players include Glidewell, Directa AB, Altimed JSC, and other domestic companies in the market. These market players are focusing on technological innovations and geographical expansions through acquisitions, mergers, and collaborations with local vendors and dental practice organizations.

LIST OF KEY COMPANIES PROFILED:

- Cheng Crowns (U.S.)

- Altimed JSC (Belarus)

- Acero Crowns (U.S.)

- Directa AB (Sweden)

- Hu-Friedy Mfg (U.S.)

- DDS Lab Inc (India)

- Institut Straumann AG (Switzerland)

- Dentsply Sirona (U.S.)

- ZimVie Inc. (Zimmer Biomet) (U.S.)

- BioHorizons (U.S.)

- Cortex (Israel)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 – Boston Micro Fabrication (BMF), launched the UltraThineer, the thinnest cosmetic dental veneer. With the launch of this product the company entered in the market for dental prosthetics.

- November 2023 – Whites Beaconsfield launched non-peroxide natural teeth whitening products for dental veneers that removes stains and whitens them.

- April 2021 – Westlake Hills Dental Arts has updated a range of dental veneer treatments for patients in Texas. The treatment will include fixing broken or chipped teeth.

- September 2019 – Zimmer Biomet announced a multinational distribution agreement with Align Technology, Inc. for the award-winning iTero Element family of intraoral scanners. This agreement allowed Zimmer Biomet to expand its global footprint in the fast growing market for digital restorative dentistry solutions.

- May 2019 – Institut Straumann AG increased its stake in the French Group Anthogyr from 30% to full ownership. Anthogyr develops, manufactures and sells high quality, innovative implant and CAD/CAM solutions.

- January 2019 – Dentsply Sirona and Carbon Inc. announced a strategic collaboration to deliver innovative denture materials for digital 3D printing production solutions.

REPORT COVERAGE

The dental prosthetics market research report provides a detailed competitive landscape of the market and focuses on key aspects such as leading companies, market segments including product types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By End-user

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 9.25 billion in 2026 and is projected to reach USD 15.09 billion by 2034.

In 2025, Europe’s market size stood at USD 3.16 billion.

The market is expected to exhibit a CAGR of 6.30% during the forecast period.

The crowns segment is set to lead the market.

Growing prevalence of dental disorders, increasing use of CAD/CAM technologies, and increasing patient pool for dental treatments are the factors driving the market.

Altimed JSC, Directa AB, Cheng Crowns, Dentsply Sirona, and Institut Straumann AG, are the top players in the market.

Europe dominated the market in 2025 by holding the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us