Detonator for Perforating Gun Market Size, Share & COVID-19 Impact Analysis, By Type (Electric, Electronic, and Non-electric), By Application (Onshore and Offshore), and Regional Forecasts, 206-2034

Detonator for Perforating Gun Market Size

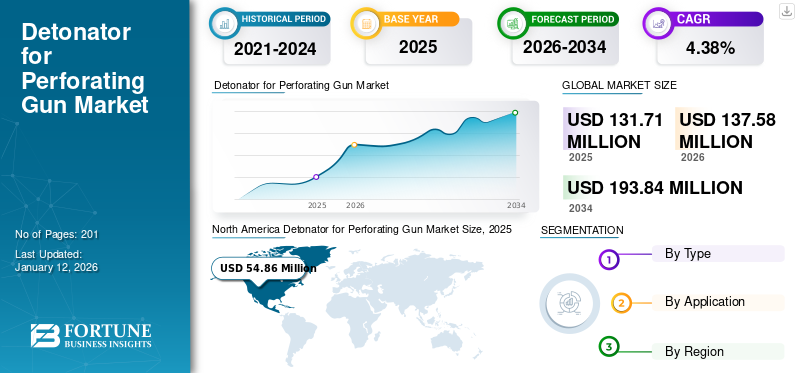

The global detonator for perforating gun market size was valued at USD 131.71 million in 2025 and is projected to grow from USD 137.58 million in 2026 to USD 193.84 million by 2034, exhibiting a CAGR of 4.38% during the forecast period. Asia Pacific dominated the global market with a share of 29.69% in 2025. The detonator for perforating gun market in the u.s. is projected to grow significantly, reaching an estimated value of USD 54.80 million by 2032.

A perforating gun is used in oil and gas drilling and hydraulic fracturing to create an opening in casings used while oil and gas wells are drilling. These guns generally hold several explosive charges, creating the type of openings. The main components of a perforating gun consist of a conveyance for the shaped charge, a detonator, and a detonating cord. The primary purpose of this perforating gun equipped with a detonator is to provide the effective flow between a wellbore and a reservoir, which the system offer through perforation activity and productive formation.

COVID-19 IMPACT

COVID-19 Outbreak Caused Disruption in Oil & Gas Activity Leading to Decline in Market Growth

COVID-19 impact has caused a reduction in economic activity globally. It has also significantly weakened the demand for oil and gas resources owing to disruptions of drilling activities, shutdowns of oil & gas exploration, production, and closures of various facilities.

Other effects of the pandemic include an adverse decline in revenue and net income, customer shutdowns of petroleum exploration and production activities, downward revisions to customer budgets, and increased costs to address health and safety requirements. These impacts affected the demand for oil & gas drilling products and significantly delayed specific projects and orders. For example, during the first quarter of 2020, DynaEnergetics reduced its workforce to address a sharp decline in well completions in the company's core oil and gas end market, principally due to the COVID-19 pandemic.

However, the industry has displayed an immediate revival in the deployment as various nations are in the advanced stages of vaccine development and are focused on implementing carbon-neutral technologies in public and private transportation activities.

Detonator for Perforating Gun Market Trends

Download Free sample to learn more about this report.

Government Investments in Oil & Gas Production, Along With Product Enhancement Market Opportunities

Increasing investment by government entities to discover new oil and gas reserves is propelling new growth avenues for the oil & gas exploration equipment market. Further, projects are being launched across several regions to meet the increasing oil demand, parallelly increasing demand for detonators for perforating guns for exploration activities.

For instance, Egypt announced a USD 1.4 billion investment in oil and natural gas exploration at multiple new locations in the Mediterranean and Red Sea. The State Department of Petroleum and Natural Resources declared the news and plans to drill 23 new wells in both seas, creating vast opportunities for the drilling equipment market, including detonators for perforating guns.

Additionally, oil and gas exploration has been growing continuously due to economic development and technological advances in the perforating gun, pushing the demand for drilling activities. Further, various companies operating in the oil and gas industry are strengthening to increase their oil & gas production by filling patents every year for advancing detonators and perforating technology, resulting in an improved market landscape of detonators for perforating gun market forecast. For instance, DynaEnergetics has almost six patents for its perforating gun and detonator assembly.

Detonator for Perforating Gun Market Growth Factors

Increasing Exploration and Production of Unconventional Oil & Gas Reserves to Propel Market Growth

The significant growth of the global crude oil market due to its usage in power generation, manufacturing goods, transportation, and other end-use industries holds potential investment opportunities in the upstream oil & gas sector. For example, as per the Energy Information Administration (EIA), 98.8 million barrels per day (b/d) of petroleum and liquid fuels were consumed in July 2022 across the world, an increase of 0.9 million b/d from July 2021. In addition, global consumption of oil and liquid fuels for all of 2022 will average 99.4 million barrels per day, an increase of 2.1 million barrels per day from 2021.

Additionally, exploring various oil & gas on account of globalization, urbanization, and massive economic development is set to dampen the demand-supply ratio. For example, in September 2021, the Bureau of Ocean Energy Management (BOEM) released a new report on assessed oil and gas reserves in the Gulf of Mexico region of the Outer Continental Shelf (OCS). The report's results include an average volume of undiscovered technically recoverable resources (UTRR) of 29.59 billion barrels of oil and 54.84 trillion cubic feet of gas.

Rising Oil & Gas Expenditures by Key Market Players to Drive the Market Growth

The demand for the detonators used in perforating guns for oil & gas exploration largely depends on the level of expenditure by the oil & gas industry in the exploration, development, and production of oil and natural gas. This expenditure generally depends on the industry's view of future oil and natural gas prices. Key players operating in the market are steadily investing in the exploration & production of oil & gas, resulting in a probable increase in the demand for detonator for perforating guns.

For instance, Abu Dhabi National Oil Co. has increased its five-year investment plan for 2022-2026 to USD 127 billion, enabling the company to stretch its upstream and downstream portfolio production capacities. The company is working towards increasing oil production capacity to 5 MMbopd (from the current 4 MMbopd) by 2030 and has plans to double its LNG production capacity from 6 MMtpa to 12 MMtpa. Furthermore, ADNOC recently awarded USD 6 billion in service contracts to boost its drilling capacity, including USD 3.27 billion for wellheads over ten years and USD 2.34 billion for downhole completion equipment over five years.

RESTRAINING FACTORS

Volatility in Oil & Gas Expenditures and Growing Trend of Renewable Energy To Restrain Market Growth

The increased prices of oil and gas have increased the spending of oil and gas companies on completion activity, which has resulted in the companies controlling their operating costs and putting downward pressure on the prices of drilling equipment, hindering the market growth for detonators used in perforating guns. For example, in October 2021, DynaEnergetics, a business of DMC Global Inc. and a leading producer of detonators for the perforating gun, announced a 5% global price re-implementation increase on all products effective from November 2021. The company has taken this step due to increased oil and gas prices and well-completion activity, resulting in high labor and material costs.

Also, the recent trend and development of renewable energies such as wind, solar, and geothermal have gained momentum as an alternative to oil and gas as fuel. For instance, Egypt aims to generate almost 40% of its electricity from renewable power sources by 2025. Subsequently, Saudi Arabia, a leading oil reserve in the Middle East, perceives the renewable energy mix as a strategic priority and invests in further development. The growing trends in energy mix through renewable energy and volatility in oil & gas spending will likely restrain detonator for perforating gun market growth in the coming period.

SEGMENTATION

By Type Analysis

Electronic Detonator Dominates the Market Due to the Varied Features Offered

Based on the type, the global detonator for the perforating gun market analysis has been done for electric, electronic, and non-electric detonators.

The Electronic segment will account for 59.59% market share in 2026. Due to their high precision, reduced ground vibration, and safe extraneous environments, electronic-type detonators are widely used for perforating guns in the oil & gas industry. Additionally, the electronic detonator limits the use of the detonator per shot, resulting in simplified operations, time, and cost savings on each perforating project. Based on this factor, the electronic detonator dominates the demand for detonators in the global perforating gun market.

Furthermore, the high strength of electric detonators makes them suitable for initiating most priming charges. Electric detonators can be instantaneous or delayed, so they can explode instantaneously or lag a few times before detonation.

Subsequently, non-electric detonators, with their simple, flexible, and reliable application techniques, have long proven their value and are gaining substantial market share amongst other detonator types in perforating gun systems. Additionally, the non-electric type of detonator, which generally includes the exploding-bridge wire (E.B.W.) detonator, has also revolutionized initiation systems' safety, efficiency, and reliability. For example, Orica Limited's Exel non-electric detonators offer the security, innovation, and excellence of the best non-electric blasting technologies across the globe.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Onshore Application to Hold the Largest Share Owing to the High Oil & Gas Production

Based on application, The Onshore segment will account for 78.87% market share in 2026. the global market is segmented into onshore and offshore applications. The onshore application is expected to dominate the detonator used in the perforating gun industry owing to the availability of conventional & unconventional deposits. Additionally, increasing oil & gas production from existing fields adds momentum to the segment market.

The offshore application segment is also anticipated to grow considerably due to recent exploration activities and discoveries, mainly in deep water.

REGIONAL ANALYSIS

North America Detonator for Perforating Gun Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The global detonator market for perforating guns has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America dominated the market with a valuation of USD 54.86 million in 2025 and USD 57.92 million in 2026. North America holds the maximum part in the detonator for perforating gun market share of detonators for perforating gun factors such as increased oil and natural gas production. For context, the U.S. Energy Information Administration (E.I.A.) forecast that U.S. crude oil production will increase to 12.0 million b/d in 2022, up 760,000 b/d from 2021. Furthermore, the E.I.A. also estimates that crude oil production from existing wells will experience decline in production, and the production from new wells will offset these legacy production declines. The U.S. market is valued at USD 38.39 million by 2026.

Followed by North America, Asia Pacific led the detonator for perforating gun market for perforating guns. Supported by consumption, most oil demand is met by the oil produced from the Persian Gulf in Western Asia. Furthermore, substantial economic growth and increasing electricity demand will likely increase oil & gas exploration demand. The Japan market is valued at USD 0.77 million by 2026, the China market is valued at USD 32.39 million by 2026, and the India market is valued at USD 0.37 million by 2026.

In Europe, The UK market is valued at USD 1.15 million by 2026, while the Germany market is valued at USD 0.37 million by 2026.

Furthermore, Latin America & Middle East region are likely to hold significant markets with growing investments in oil & gas exploration.

KEY INDUSTRY PLAYERS

Key Participants in the Market Are Focusing on Product Enhancement to Maintain Competitiveness

The global market for detonators used in perforating guns is highly competitive. Key players operating in the market compete with a broad spectrum of companies that produce perforating services and products. Many of these companies are the oil and natural gas industry's largest oilfield service providers, with a global presence, longer operating histories, more significant financial, technical, and other resources, and greater name recognition.

In addition, the market also comprises various small-scale key players with high competitiveness at the regional or domestic level, leading them to respond more quickly to new or emerging technologies and changes in customer requirements.

The competition in the market is primarily based on price, service delivery, health, safety, and environmental standards and practices, service quality, global talent retention, understanding the geological characteristics, and many others.

Various key players operating in the market are focusing on providing innovative products at competitive prices to remain competitive. For instance, SLB offers hollow carrier gun perforating systems along with wireline conveyed casing.

List of Top Detonator for Perforating Gun Companies:

- DynaEnergetics (U.S.)

- Hunting Plc (U.K.)

- SLB (U.S.)

- Halliburton (U.S.)

- Dyno Nobel (U.S.)

- Owen Oil Tools (U.S.)

- Devon Global (U.S.)

- Promperforator (Russia)

- Wellmatics (U.S.)

- GEODynamics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2022 - SLB announced the acquisition of Gyrodata Incorporation, a global company specializing in gyroscopic wellbore positioning and survey technology. The acquisition will enable the integration of Gyrodata's innovative sensors and proprietary technologies within SLB's drilling and logging suites, resulting in the industry’s most accurate and highly optimized well placement services.

- September 2022 - DynaEnergetics has introduced IS2 Xpress as a significant upgrade to its core initiating technology. The company’s IS2 Xpress is developed with the IS2 TF Intrinsically Safe Initiating System, a wirefree, integrated switch detonator. This allows for unmatched safety, reliability for the oil, gas well perforating operations, and significant time savings for the well perforation system.

- June 2022 - GEODynamics partnered with Hydrawell to provide advanced perforating & completion technologies and enable the operator to execute more efficient and cost-effective well plugs and abandonment operations compared to other methods. To support this method, GEODynamics has provided several solutions that optimize and uses it, including the Eclipse & Isoloc perforating systems.

- January 2022 - Dyno Nobel has introduced Ranger, a new electronic initiation system majorly for quarries, civil, and pipeline applications. The introduction of Ranger features innovative factors such as simple design, ease of blasting, and many others, which act as a complete system for blast optimization.

- February 2021 - Promperforator has successfully tested its products on the territory of workshop No. 465. They were successfully tested with confirmation of the declared technical characteristics for service companies JSC PGO Tyumenpromgeofizika, JSC Pomorneftegeofizika, and the oil-producing company Salym Petroleum Development.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as leading companies, competitive landscape, product/service types, porters five forces analysis, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.38% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 131.71 million in 2025.

The global market is projected to grow at a CAGR of 4.38% over the forecast period.

The market size of North America stood at USD 54.86 million in 2025.

Based on the type, the electronic detonator segment holds the dominating share in the global market.

The global market size is expected to reach USD 193.84 million by 2034.

The key market drivers are increasing unconventional oil & gas exploration and rising oil & gas production expenditure.

The top players in the market are DynaEnergetics, SLB, Halliburton, Devon Global, and Hunting Plc.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us