Digital Oilfield Market Size, Share & Industry Analysis, By Process (Production Optimization, Reservoir Optimization, Drilling Optimization, and Others), By Solution (Services, Software, and Hardware), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

Digital Oilfield Market Size and Future Outlook

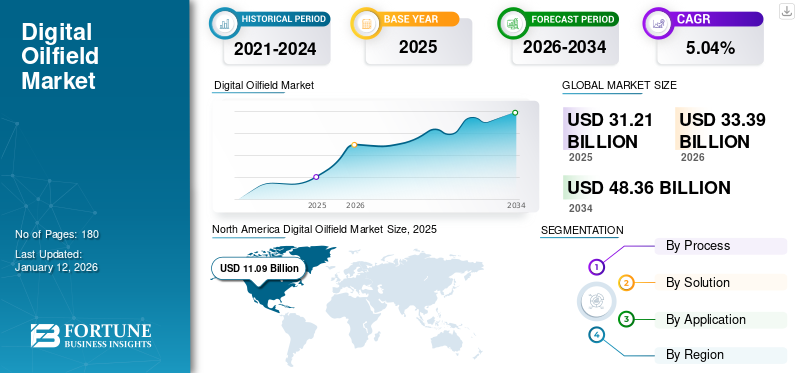

The global digital oilfield market size was valued at USD 31.21 billion in 2025. The market size is projected to grow from USD 33.39 billion in 2026 and is expected to reach USD 48.36 billion by 2034, exhibiting a CAGR of 5.04% during the forecast period. North America dominated the digital oilfield market with a market share of 33.20% in 2025.

Digital oilfield is a technology that includes a wide range of equipment & functions deployed in different upstream, downstream, and midstream stages to enhance the operational efficiency of oil & gas processes. The technology adopted by oilfield companies achieves a blend of benefits such as improved recovery, optimized resources, reduced rig downtime, and various other benefits to ensure flexible and reliable operations. The system is a set of hardware, software, and services to deliver smart solutions for analyzing, integrating, and processing data. Development of distant onshore & offshore wells drilling at numerous depth levels, along with rising efforts to increase monetary returns by the assets, has catered to the adoption of digital oilfield technology in different regions.

Rapidly growing demand for oil, gas, and other petroleum products from developing economies, along with increasing efforts to mitigate production costs, will positively influence the global digital oilfield market. Exploring discoveries of high-potential conventional and unconventional reserves in various formations is projected to augment industry growth further.

SLB is a major player in advancing the digital oilfield by integrating cutting-edge technologies into the oil and gas industry's exploration, production, and management processes. Through its DELFI Cognitive E&P Environment, a cloud-based platform leveraging AI, data analytics, and machine learning, SLB provides real-time insights into oil and gas exploration and production operations.

MARKET DYNAMICS

MARKET DRIVERS

Rising Need to Augment Production from Aged Wells is Estimated to Boost Global Market

Growing initiatives to integrate efficient production techniques to escalate output production and the existence of old and mature wells in different regions are set to propel the industry revenue in the coming years. Digital oilfield techniques are an integral part of effective planning, production, and exploration of oil & gas wells. They thereby can substantially increase production more efficiently by using statistical and analytical tools & software. For instance, in January 2024, SLB and Nabors partnered to expand automated drilling solutions, integrating their technologies to enhance well construction performance and efficiency. Customers can now access a wider range of drilling automation tools and use existing rig systems with SLB's PRECISE or Nabors' SmartROS.

Development of New Technology and Improving Existing Set of Tools to Propel Market Size

Increasing focus on improving the existing equipment and developing more efficient and advanced hardware, software, and services tools is anticipated to play a key role in global digital oilfield market growth. Technologically advanced players are approaching progress with innovative solutions to optimize capital investments, as well as improved asset tracing, fast data interpretations, and reduced operational risk. This will further accelerate the technology demand, driving the need for advancement in the oilfield. For instance, at the Global Oil and Gas Summit in September 2024, Huawei and industry customers showcased their latest innovations in large-model construction, intelligent oilfield reconstruction, and natural gas industry upgrades. These advancements aim to enhance industry quality, boost reserves and production, ensure safety, and promote high-quality development. In collaboration with CNPC, Huawei integrated neural network technology with geophysical technology, using seismic exploration data to create an AI model with 5 billion parameters. Thus, the development of similar kinds of advanced techniques in the coming years is expected to raise the demand for digital oilfields.

MARKET RESTRAINTS

Delay in Decision-Making Process to Limit Market Growth

The collection of real-time data and productive analysis is time-consuming, which is one of the primary restraints for the digital oilfield market. It is tough to collate large amounts of informative data and deliver it as information for wellheads in the market. A suitable, experienced, proficient, and skilled workforce is essential for collecting and analyzing data. The key players in the oil & gas industry should focus on exploring discoveries by tapping the potential with precise and accurate data. Hence, analytical tools adopted for exploring and defining the potential of wellheads are time-consuming methods and techniques. Thus, delay in decision-making processes owing to analytical tools restraints the market growth in the projected timeframe.

MARKET OPPORTUNITIES

Advancement in Data Analytics to Play a Key Role in Market’s Growth

Advancements in data analytics are crucial to the success of digital oilfields, driving efficiency and improving decision-making. By collecting data from seismic data, well logs, and production history, analytics enable accurate reservoir management and optimized drilling strategies. Real-time monitoring and decision-making are enhanced by the analysis of data from IoT sensors, allowing the operators to respond quickly to issues and minimize downtime. For instance, in May 2023, Shell Plc announced the use of AI technology from SparkCognition to enhance its deep-sea exploration and offshore oil production. The AI algorithms will analyze large seismic data sets to help Shell, the top oil producer in the U.S. Gulf of Mexico, find new oil reservoirs. Moreover, Predictive maintenance is another key benefit, with machine learning models identifying potential equipment failures before they occur, reducing costly repairs. Data analytics also optimizes production by identifying inefficiencies and adjusting operations for maximum output and reduced waste. Ultimately, data analytics in digital oilfields empower more informed decisions, enhance operational efficiency, and support environmental goals, all of which contribute to higher profitability and sustainability in the oil and gas industry.

MARKET CHALLENGES

High Initial Cost to Constrain Market Expansion

The high initial costs of digital oilfields stem from investments in infrastructure, including sensors, IoT devices, and data storage systems, as well as advanced software for analytics and AI. Companies also need to allocate resources for training personnel, system integration, and cybersecurity measures. Additionally, ongoing maintenance and software updates add to the long-term expenses. Despite these significant upfront costs, the long-term benefits, such as improved efficiency and predictive maintenance, can ultimately help companies achieve higher profitability. However, the expense can be a barrier for smaller operators.

DIGITAL OILFIELD MARKET TRENDS

Increasing Focus Toward Operational Management Fuel Market Growth

Growing focus on operational management and a decline in operating and capital expenses have influenced the adoption of intelligent digitalized devices, services, and solutions. The significant development in wireless mobility, technologies, data analysis, and data collection platforms has enabled a substantial improvement in decision-making and performance. The production optimization process goes through intelligent decisions, effective measurement, analysis, and modeling. Significant developments in technology and an increasing focus on operational management have made the recovery of a large number of oil fields possible and have resulted in one of the key digital oilfield market trends.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The outbreak of the COVID-19 pandemic impacted the oil and gas industry significantly across the globe. Various oil and gas companies worldwide had to shut down their manufacturing facilities and services as countries had to adopt a lockdown strategy to deal with the pandemic.

Many industries across the globe, such as automotive, aviation, power, manufacturing, and transportation, experienced a negative impact on their business. Manufacturing activities were considered essential activities for many construction, industrialization, and power industries globally and were mostly exempted from the lockdown measures. The spread of COVID-19 posed a significant threat to the global market owing to the lockdown in transportation, industrial, and commercial operations. The companies across regions also suspended major oil & gas projects. Furthermore, the COVID-19 pandemic also dramatically impacted crude oil prices, well drilling, production activities, and the supply chain of oil and gas.

SEGMENTATION ANALYSIS

By Process

Ability to Maximize Well Productivity to Lead Share of Production Optimization

Based on process, the market is segmented into production optimization, reservoir optimization, drilling optimization, and others.

The production optimization process is estimated to hold the largest portion over the forecast timeframe. It includes various methods such as modeling, measuring, analyzing, and prioritizing functions to enhance the well or reservoir's overall productivity. The segment is foreseen to hold 37.06 % of the markets hare in 2026.

The production optimization process includes various actions such as maintaining well integrity, efficient designing of surface facilities, removal of near-wellbore damage, sand control management, and other activities to yield maximum outcomes.

The reservoir optimization technique is projected to witness substantial growth with a CAGR of 5.30% during the forecast period (2025-2032), owing to its increasing adoption to assess normal as well as complex reservoirs with higher accuracy. Precise reservoir data efficiently helps to analyze the actual wellbore behavior and mitigate damage rates.

The drilling optimization process is adopted across the globe owing to its ability to reduce operating costs, increase drilling speed, decrease rig downtime, and improve Health, Safety, And Environment (HSE) conditions.

To know how our report can help streamline your business, Speak to Analyst

By Solution

Increasing Focus from Gas Operating Firms Augments Services Solution to Have a Positive Market Outlook

Based on solution, the market is segmented into services, software, and hardware.

The services segment is estimated to witness significant growth in the industry owing to the availability of established and large consulting firms with expertise in technical know-how to deliver assistance on digital oilfield management services. Increasing advancements in technology to develop new artificial intelligence and other data storage solutions are set to influence the software solution segment positively. This segment is set to grow with a share of 39.49% in 2026.

The hardware segment is estimated to grow considerably over the forecast period due to significant research & development activities to build advanced hardware equipment and solutions such as Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), and others.

The software segment is likely to grow with a considerable CAGR of 5.28% during the forecast period (2025-2032).

By Application

Increasing New Discoveries Augments Onshore Application which Projects a Dominating Share Over Forecast Period

Based on application, the market is broadly categorized into onshore and offshore.

The onshore segment is anticipated to hold the dominant global digital oilfield market share due to the accessibility of large-capacity reservoirs on land in conventional and unconventional reserves. Additionally, discoveries of oil, gas, shale reserves, and production from mature wells will positively escalate the segment market dynamics. The segment held 76.34% of the market share in 2026.

Offshore application is projected to witness significant growth due to complex drilling, production, and completion, along with the increasing need to handle multiple types of equipment, which are very risky and challenging when operated manually.

DIGITAL OILFIELD MARKET REGIONAL OUTLOOK

Geographically, the global market has been studied across five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America

North America Digital Oilfield Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Presence of Huge Oil & Gas Companies and High Oil & Gas Production to Lead Market Growth

North America dominated the market with a valuation of USD 10.36 billion in 2025 and USD 11.09 billion in 2026. North America digital oilfield market is projected to maintain the highest share and grow substantially over the forecast period. Technological giants such as Halliburton, Baker Hughes, Schlumberger, and others are consistently working to build technological developments, which helps favor the North America market outlook. The U.S. and Canada are the leading countries operating in North America for advancements in digital oilfield technology across the region. Hence, advancements in technology are driving the market.

U.S.

High Offshore Oil & Gas Production in the Country to Augment Market Growth

The U.S. leads in offshore oil production, particularly in the Gulf of Mexico, where digital technology is being used for seismic data analysis, predictive maintenance, and real-time monitoring of operations. According to the U.S. Energy Information Administration, in 2022, the Federal Offshore Gulf of Mexico contributed roughly 14.6% of the total U.S. crude oil production and around 2.3% of the nation's dry natural gas production. These technologies allow for better reservoir management, optimized drilling strategies, and improved resource utilization. Despite high initial investments, the industry is embracing digital transformation to improve profitability and sustainability. The integration of digital tools is expected to continue to reshape the U.S. oil and gas sector, addressing challenges such as resource optimization, environmental impact, and energy transition goals. The U.S. market is foreseen to hold SD 9.12 billion in 2026.

Asia Pacific

Rising Exploration of Additional Oil & Gas Wells to Foster Market Growth

Asia Pacific is the third largest market projected to reach USD 2.09 billion in 2026. Asia Pacific is projected to register the fastest growth in the coming years owing to increasing production & exploration activities to cater to the growing energy demand. Developing economies such as India, China, and South Korea are continuously facing an increase in the overall energy need to suffice the industrial, commercial, and automobile demand. In August 2024, India's ONGC announced five discoveries in FY'25, including three since May 2024—one onshore and two offshore. Two of these are prospective (one onshore and one offshore), while one is a new pool discovery (onshore). Countries from the Southeast Asian region, which includes Thailand, Indonesia, Malaysia, and Myanmar, have witnessed an abrupt increase in production & exploration activities, coupled with discoveries of oil & gas reserves. India is poised to stand at USD 0.44 billion in 2026, while Thailand is estimated to reach a market value of USD 0.59 billion in the same year.

China

Huge Investment in Advanced Technologies to Beef up the Market

The digital oilfield industry in China is experiencing significant growth as the country invests heavily in advanced technologies, such as IoT, AI, and others, to modernize its oil and gas sector. Chinese companies are increasingly integrating digital solutions such as AI, big data analytics, IoT, and automation to enhance exploration, production, and reservoir management. China is predicted to be worth USD 3.47 billion in 2026. These technologies enable better decision-making, real-time monitoring, and predictive maintenance, improving efficiency and reducing costs. China’s state-owned oil companies, including Sinopec, PetroChina, and CNOOC, are leading the push toward digital oilfields, implementing systems that optimize operations, boost safety, and support sustainability goals.

Europe

Growing Potential in North Sea Region to Push Market Growth

Europe is the second leading region estimated to be valued at USD 8.79 billion, exhibiting a CAGR of 4.53% during the forecast period (2026-2034). Europe's digital oilfield market is estimated to grow substantially over the forecast period. Increasing onshore and offshore activities in North Sea regions and different countries and growing demand for digitalization in the oil & gas industry will augment the industry outlook. The U.K. and Norway hold a huge potential for the production and development of hydrocarbons. Furthermore, Russia is experiencing a large investment from E&P operations in different assets, coupled with bulk new oil & gas discoveries, which will shape the outline of regional technology demand. The U.K. market continues to grow, projected to be valued at USD 1.06 billion in 2026. Other major countries operating in the region are Germany and France, which hold significant potential and help to increase the market size in the projected timeframe. Norway is set to reach USD 1.60 billion in 2025, while Russia is foreseen to gain USD 3.71 billion in the same year.

Latin America

Presence of Untapped Resources in Region to Positively Impact Market

The digital oilfield industry in Latin America is expected to grow steadily as countries in the region seek to modernize their oil and gas sectors through the adoption of digital technologies. Major oil producers such as Brazil, Mexico, and Argentina are integrating IoT, AI, big data analytics, and automation into their exploration and production operations. These technologies help optimize reservoir management, improve efficiency, and reduce operational costs. For example, Brazil's Petrobras has implemented digital tools for real-time monitoring and predictive maintenance, enhancing safety and productivity. In Mexico, state-owned Pemex is focusing on digital transformation to improve its oil production capabilities.

Middle East & Africa

Presence of Huge Hydrocarbon Reserves to Positively Impact Market

The Middle East & Africa region is anticipated to hold USD 4.91 billion in 2026 and holds substantial market potential for untapped capacity for hydrocarbon development, along with non-complex formations to effectively drill the wells, which is expected to drive the digital oilfields market growth in the coming years. Countries in the Middle East & Africa, which include UAE, Saudi Arabia, Kuwait, Bahrain, and others, are members of the Organization of the Petroleum Exporting Countries (OPEC). Therefore, they are focusing on attaining the production targets set by the organization. Other prominent countries engaged in the market across the region are Oman, Algeria, Qatar, and Nigeria. Oman is likely to gain USD 1.11 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players are Focusing on Developing Advanced Digital Oilfield Technologies

Various regional and international players are consistently working on developing advanced digital oilfield technologies and featured products for application in the oil & gas industry. Major companies are focused on undergoing different mergers & acquisitions, product development, and JV's to strengthen their position in a competitive environment. Key players, such as SLB, excel in data management and analytics, utilizing advanced tools to process vast sensor data while offering predictive maintenance capabilities to reduce downtime and improve asset utilization. The company integrates automation and AI into operations, optimizing well placement, enhancing reservoir understanding, and increasing safety through automated drilling and robotics. By employing IoT devices, SLB ensures real-time monitoring of equipment and operations, facilitating proactive maintenance and actionable insights into performance.

List of Key Digital Oilfield Companies Profiled:

- Slb (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- Siemens (Germany)

- Osprey Informatics (Canada)

- IBM (U.S.)

- Digi International (U.S.)

- Microsoft (U.S.)

- Baker Hughes (U.S.)

- Kongsberg Digital (Norway)

- Rockwell Automation (U.S.)

- Accenture (Ireland)

- Honeywell Process Solutions (U.S.)

- ABB (Switzerland)

- Emerson (U.S.)

- National Oilwell Varco (U.S.)

KEY INDUSTRY DEVELOPMENTS:

November 2024: ADNOC awarded Jereh Oil & Gas Engineering Corporation a USD 920 million EPC contract to install remote sensing and well-operating equipment at its Bab, Bu Hasa, and Southeast fields. This extends ADNOC's AI-powered well-digitalization program. Over 80% of the contract's value will support the UAE's economy through ADNOC's In-Country Value (ICV) program, boosting economic growth and diversification.

July 2023: Petrobras partnered with SLB on a five-year contract to accelerate its digital transformation using SLB's cloud-based Delfi platform. This initiative aims to optimize oil and gas production, move subsurface workflows to the cloud for faster decision-making, and support Petrobras' decarbonization and net-zero goals. The contract represents one of Petrobras' largest investments in cloud technologies.

May 2021: Schlumberger and NOV announced a partnership to speed up the adoption of automated drilling solutions. By combining Schlumberger's drilling automation technology with NOV's rig automation platform, the collaboration aims to enhance well construction performance. This integration automates manual workflows, improving safety, decision-making, consistency, and efficiency in drilling operations.

March 2020: Weatherford International plc introduced Centro, a holistic method for effectively managing complex, well-site operations digitally. It combines data management, visualization, and real-time engineering technologies to deliver a single solution for multiple well operations.

June 2019: Baker Hughes and C3.ai had planned to initiate a joint venture to provide digital transformation technologies. The JV agreement is set to amalgamate C3.ai’s artificial intelligence solutions & software with the skilled expertise of Baker Hughes and its long-standing oil & gas portfolio.

REPORT COVERAGE

The global digital oilfield market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.04% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Process

|

|

By Solution

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 31.21 billion in 2025.

The market is likely to grow at a CAGR of 5.04% during the forecast period of 2026-2034.

Based on application, the onshore segment is expected to lead the market during the forecast period.

The market size of North America stood at USD 9.61 billion in 2025.

The rising need to augment production from aged wells is one of the key factors driving market growth.

Some of the top players in the market are Schlumberger, Weatherford, Halliburton, Baker Hughes, Honeywell, and others.

The global market be worth USD 48.36 in 2034

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us