Digital Signature Market Size, Share & Industry Analysis, By Deployment Mode (Software/Apps and As a Service), By Enterprise Type (Businesses/Enterprises and Government Entities), By End Use (Legal Services, BFSI, Healthcare, Real Estate, Education, Manufacturing, Cross-Border Trade, and Others), and Regional Forecast, 2026-2034

Digital Signature Market Size

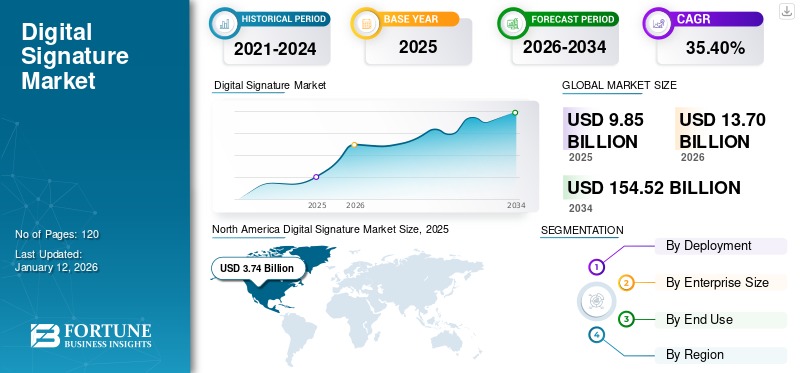

The global digital signature market size was valued at USD 9.85 billion in 2025. The market is projected to grow from USD 13.70 billion in 2026 to USD 154.52 billion by 2034, exhibiting a CAGR of 35.40% during the forecast period. North America dominated the market with a share of 38.00% in 2025.

Digital signatures use cryptographic technology to create a digital certificate that confirms the authenticity and integrity of electronic documents. It is a secure method to sign documents electronically by verifying the signer’s identity and ensuring that the document has not been altered.

Companies are increasingly focusing on adopting artificial intelligence (AI) and Blockchain technology into their electronic signature platforms to provide enhanced automation, identity verification, fraud prevention, and user experience. This trend is gaining a rapid pace and is likely to boost market growth.

The market is dominated by established key players, such as Adobe Inc., DocuSign, Inc., OneSpan, Inc., GlobalSign, Inc., and SIGNiX, Inc. These players focus on engaging in partnerships with enterprises, government entities, and financial institutions to provide a secure and enhanced signing experience of electronic documents around the world.

REGULATORY LANDSCAPE

|

Region/ Country |

Regulatory Framework |

Key Features |

Legal Recognition |

Scope of Application |

Certifying Authorities |

|

European Union (EU) |

eIDAS Regulation (EU) No 910/2014 |

Defines three types of electronic signatures: Simple, Advanced, and Qualified. |

Qualified Electronic Signatures (QES) have the same legal effect as handwritten signatures. |

Applies to all EU member states, ensuring cross-border recognition. |

Qualified Trust Service Providers (QTSPs) accredited under eIDAS. |

|

United States (U.S) |

ESIGN Act (2000) and UETA (1999) |

ESIGN provides federal recognition; UETA applies at the state level. |

Electronic signatures are legally binding if all parties consent. |

ESIGN applies nationwide; UETA has been adopted by 47 states. |

Certifying Authorities are recognized under federal and state laws. |

|

India |

Information Technology Act, 2000 (IT Act) |

Recognizes digital signatures based on asymmetric cryptosystems. |

Digital signatures have the same legal validity as traditional signatures. |

Applies across India, including e-filing and GST filings. |

Certifying Authorities are licensed by the Controller of Certifying Authorities (CCA). |

IMPACT OF GENERATIVE AI

Growth of AI Automation Drives Faster and More Efficient Digital Signature Workflows

Digital signature platforms use cryptographic techniques such as hashing and Public Key Infrastructure (PKI) to ensure the integrity and authenticity of electronic documents. It is important to use these technologies to safeguard electronic documents in the era of AI-generated content, where fake documents can be produced and may pose risks of fraud and misinformation. AI technology can easily verify users’ identities with the help of biometric data to detect irregularities and fraudulent activities. This leads to faster turnaround times and reduced operational costs.

Moreover, market players are increasingly focusing on integrating generative AI technology into their e-signature platforms to enhance user experience and attract a massive customer base worldwide.

For instance,

- In April 2023, Shangshangqian launched the industry's first exclusive AI product, "Hubble“. Hubble helps customers by summarizing contract content during the initialization phase, streamlining document understanding and review.

MARKET DYNAMICS

Market Drivers

Increasing Awareness and Acceptance of Digital Signatures among Businesses Drives Market Growth

Businesses and consumers across the globe are becoming more familiar with digital signing platforms due to their legal validity and the enhanced security they provide for sensitive documents. Many enterprises are using digital signature solutions instead of traditional paper-based signatures for various types of agreements, including financial transactions, contracts, and lease-related work. The rise in awareness and legal recognition of e-signatures across multiple industries is boosting their adoption globally. In highly regulated industries, such as BFSI, manufacturing, real estate, and government sectors, e-signatures are considered an ideal method, as they ensure the integrity and authenticity of documents. For instance,

- According to industry experts, in the U.S. and European financial firms, when customers are given the option, over 90% of the customers choose to e-sign documents rather than a traditional paper-based signature.

These factors are driving the adoption of e-signatures among businesses, thereby boosting market growth.

Market Restraints

High Implementation Cost and Regulatory Compliance May Hinder Market Growth

The implementation of a digital signature platform requires a high cost, especially for small organizations, whereas, for large enterprises, it requires a substantial initial investment. These costs may include the purchase of hardware (biometric systems and signature pads) and software licenses. Furthermore, organizations may need to recruit new personnel or provide training to existing employees to operate these systems efficiently. This high initial implementation cost may act as a barrier for SMEs to invest in such an expensive system.

Moreover, different countries across the globe have varying rules and requirements governing the use of e-signatures. For instance, in certain jurisdictions, there may be few restrictions on the use of e-signature, or they may require an additional certificate to authenticate the document and be considered legal. The discrepancies may create uncertainty and delay the adoption of e-signatures.

Market Opportunities

Increasing Demand for Digital Transformation & E-Governance Initiatives Create Lucrative Opportunities for Market Growth

Governments across the globe are actively promoting the digitization process to reduce paperwork, improve efficiency, and provide better public services. The growing emphasis on adopting e-governance is a key factor contributing to the increasing popularity of electronic signatures among government entities. For instance,

- In India, the nationwide push for using e-signature for online transactions and document authorization has simplified the path for the adoption of e-signature in the public and private sectors.

- In Europe, multiple countries are planning to develop a unified strategy to create a seamless digital environment across member countries. This initiative is fueling the adoption of e-signature across the region.

These government-led digital transformation projects create a lucrative opportunity for adoption of e-signature solutions in government organizations.

Digital Signature Market Trends

Utilization of Blockchain Technology in Digital Signatures to be Prominent Market Trend

The growing popularity of the paperless system creates a huge demand for electronic authorization in various sectors. Blockchain technology is also gaining popularity in fields such as cybersecurity, politics, and data analytics. Furthermore, it is also used in electronic signature software to protect a document’s integrity after the signing process. For instance,

- According to an October 2021 report by eMudhra on blockchain, all transactions are digitally signed to ensure data integrity and prevent tampering.

By integrating blockchain, the e-signature platform can enhance security and transparency, ensuring that once a document is signed, it cannot be altered. These capabilities are crucial in boosting the adoption of digital signatures and are expected to contribute significantly to digital signature market growth during the forecast period.

Download Free sample to learn more about this report.

SEGMENTATION Analysis

By Deployment Mode

Rising Demand for Convenience and Accessibility Boosted Software/Apps Segment Growth

Based on deployment mode, the market is divided into software/apps (cloud-based and mobile-enabled) and as a service.

Software/Apps accounted for the largest market share of 81.20% in 2026, as digital signature solutions allow users to sign documents anytime and from anywhere with internet connectivity. This feature excludes the need for physical availability and the time-consuming tasks of printing, signing, and scanning documents, thereby enhancing convenience and efficiency.

As a service is anticipated to grow at the highest CAGR during the forecast period, as businesses are not required to make significant investments in infrastructure, hardware, or software licenses. This model, often offered on a pay-per-use or subscription basis, helps businesses control costs. This feature is beneficial for SMEs with limited budgets for IT infrastructure.

By Enterprise Type

Growing Demand for Advanced Encryption Techniques Encouraged the Businesses/Enterprises Segment Growth

Based on enterprise type, the market is bifurcated into businesses/enterprises (large enterprises and SMEs) and government entities.

Businesses/Enterprises captured the largest market share of 76.80% in 2026, as electronic signatures use advanced encryption techniques, such as Public Key Infrastructure (PKI), to ensure the authenticity and integrity of signed documents. They provide a secure method of verifying the identity of signatories and ensure that the documents remain unaltered. Thus, they are mainly adopted in businesses such as finance, healthcare, real estate, and manufacturing to safeguard their sensitive information.

Government entities are expected to grow at the highest CAGR during the forecast period, as government officials are increasingly using e-signature platforms to secure emails and other electronic communications. These platforms help ensure the authenticity and confidentiality of official government documents.

By End Use

To know how our report can help streamline your business, Speak to Analyst

Surge in Demand for Faster Transaction Processing Dominated the BFSI Segment Growth

Based on end use, the market is categorized into legal services, BFSI, healthcare, real estate, education, manufacturing, cross-border trade, and others (media & entertainment).

The legal services segment dominated the market accounting for 23.20% market share in 2026. Banking financial services and insurance (BFSI) accounted for the largest market share in 2024. Traditional paper-based signing processes in banking organizations often require physical presence, printing, document management, and mailing, which may cause delays in document handling. To speed up the transaction and approval workflows, multiple banking organizations are increasingly adopting e-signature platforms to enable real-time signing of documents online. Additionally, it reduces the time-to-approval for loans, insurance claims, account opening, and other services to make banking services faster.

Healthcare is anticipated to grow at the highest CAGR during the forecast period. With the growing adoption of digital technology, healthcare workers and doctors are heavily reliant on precise medical records for every patient to provide correct treatment. Owing to this, multiple healthcare organizations across the globe are integrating e-signing devices directly into their Hospital Information Systems (HIS) and Electronic Health Record (EHR) platforms to scan documents and update records seamlessly within existing software, thereby driving the segment’s growth.

DIGITAL SIGNATURE MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

North America Digital Signature Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest digital signature market share in 2025. The region is known as an early adopter of digital document technologies. According to the U.S. Electronic Signatures in Global and National Commerce (ESIGN) Act of 2000, electronic signatures are legally recognized in every U.S. state and territory where the federal law applies. In the region, industries such as banking, healthcare, and legal services have adopted digital signatures to enhance security and prevent fraud.

- For instance, approximately 70%-80% of U.S. organizations have adopted e-signature tools into their operations as part of their broader digital transformation technologies.

In the U.S., organizations are increasingly prioritizing efficiency, security, and compliance, key drivers behind the significant adoption of e-signature tools. Furthermore, with an increase in the number of cybercrime incidents, demand for e-signatures increases across the country, as it offers a higher level of security than traditional handwritten signatures. The U.S. market is projected to reach USD 3.58 billion by 2026. For instance,

- According to industry experts, in 2024, 78% of law firms across the U.S. have adopted e-signature software as part of their remote working tech stack.

South America

The adoption of electronic signatures is growing significantly in South America, owing to the growing adoption of e-signatures in government services, enabling citizens to access services online and submit documents securely. For instance,

- In November 2001, Argentina enacted Ley Nº 25.506, an electronic signature law that supports both commercial and governmental transactions.

Furthermore, law firms and courts in the region are increasingly adopting e-signature tools for contracts, filings, and other legal documentation. It speeds up the documentation work by reducing paper-based processes.

Europe

In Europe, digital signing is growing at a prominent pace, owing to the rising implementation of e-business systems across industries. In July 2016, the European Union formed a new regulation, such as eIDAS (electronic Identification, Authentication, and Trust Services), to establish a framework for e-signature tools across the region. Moreover, countries in the region may collaborate to match regulations and standards for electronic signatures to simplify cross-border transactions and foster regional integration. The UK market is projected to reach USD 0.71 billion by 2026, while the Germany market is projected to reach USD 0.7 billion by 2026. For instance,

- In March 2023, RegTech, a London-based startup, launched dSign, a digital signing solution. By combining the power of DLT with its flagship product, dSend, the company has made an electronic signature accessible for businesses of all sizes. Its affordable, fixed-fee model supports adoption across various sectors.

Middle East and Africa

The Middle East and Africa (MEA) is expected to showcase noteworthy growth during the forecast period. Increasing adoption of e-signature across various industries fuels market growth across the region. The Dubai International Financial Centre (DIFC) has adopted the Electronic Transactions Law, under which digital signatures are legally accepted in the country’s financial organizations. Additionally, the UAE government promotes the use of e-signatures for public sector services, which plays a crucial role in fueling market growth across the region.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region is witnessing a rapid digital transformation across various sectors, supported by strong government initiatives aimed at improving digitalization across industries. In China, the electronic signature law (ESL), first enacted in 2004 and amended in 2015, was later updated in 2019. In India, the Information Technology Act (2000) provides a legal framework for the use of digital signatures. These laws legally recognize e-signatures and provide a regulatory backbone. Thus, the growing adoption of e-signature tools across government, legal, and financial sectors factors is expected to fuel market growth across the region. The Japan market is projected to reach USD 0.56 billion by 2026, the China market is projected to reach USD 0.59 billion by 2026, and the India market is projected to reach USD 0.41 billion by 2026.

- For instance, in July 2023, Zoho Corporation Pvt. Ltd. engaged in a partnership with PwC India to boost digital transformation across businesses. Through this collaboration, Zoho aims to integrate its products with PwC’s consulting services to enhance business efficiency.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Customer Base

Key players are focusing on expanding their global geographical presence by presenting industry-specific services. Major players are strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Key Digital Signature Companies Studied:

- Adobe, Inc. (U.S.)

- OneSpan, Inc. (U.S.)

- DocuSign, Inc. (U.S.)

- Thales Group (France)

- ASSA ABLOY (Sweden)

- GlobalSign, Inc. (Belgium)

- Entrust Corporation (U.S.)

- Ascertia Limited (U.K.)

- SIGNiX, Inc. (U.S.)

- IDEMIA (France)

- IdenTrust (U.S.)

- QuickSign (France)

- SigniFlow (U.K.)

- SignWell (U.S.)

- AlphaTrust (U.S.)

- Actalis (Italy)

- Zoho Corporation Pvt. Ltd. (India)

- Notarius (U.S.)

- Symtrax (U.S.)

- DigiSigner (Germany)

….and more

KEY INDUSTRY DEVELOPMENTS

- March 2025: DocuSign, Inc. engaged in a strategic partnership with Algebrik AI. Through this collaboration, DocuSign would integrate its e-signature and agreement automation capabilities into Algebrik AI’s platform to enable seamless loan origination workflows and enhance customer experience.

- July 2024: Protean eGov Technologies Ltd launched eSignPro, an electronic signature tool. It is enabled with an enterprise-grade full-stack smart documentation and automation suite that helps organizations with the ease of doing business.

- May 2024: Cygnet.One partnered with GlobalSign to launch Cygnature, an e-signature tool enabled by blockchain technology. Through this product launch, the company aims to provide a secure and paperless transaction in the Middle East and India.

- February 2023: Zoho updated its Zoho Sign service for ISVs and OEMs. This service enabled software vendors and equipment manufacturers to incorporate Zoho's electronic signature feature into their products. It offers robust APIs, mobile SDKs for seamless app integration, SSO authentication, and the ability to fully customize the branding for a stronger brand identity.

- January 2023: DocuSign partnered with TechnoBind to present eSignature technology to the Indian market, in line with the Digital India campaign. This collaboration utilized DocuSign's range of applications and integrations to streamline the entire agreement process, including eSignature, contract lifecycle management, and document creation.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Adobe Inc., DocuSign, Inc., OneSpan, Inc., GlobalSign, Inc., and SIGNiX, Inc., are focusing on enriching their partner ecosystem. This approach helps them to reinforce their product expertise and enhance customer experience. In addition, the market players are also strengthening their distributors and resellers to expand their global presence. Furthermore, the market players are continuously working towards securing support from several compliances that align with the regulations and provide customers with a secure and streamlined process. These factors are expected to create a lucrative opportunity for market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 35.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Mode

By Enterprise Type

By End Use

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is expected to reach USD 154.52 billion by 2034.

In 2025, the market was valued at USD 9.85 billion.

The market is projected to grow at a CAGR of 35.40% during the forecast period.

By deployment mode, the software/apps segment led the market.

Increasing awareness and acceptance of digital signatures among businesses is a key factor driving market growth.

Adobe, Inc., OneSpan, Inc., DocuSign, Inc., Thales Group, ASSA ABLOY, GlobalSign, Inc., Entrust Corporation, Ascertia Limited, SIGNiX, Inc., and IDEMIA are the top players in the market.

North America dominated the market with a share of 38.00% in 2025.

By end use, the healthcare segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us