DNA Synthesis Market Size, Share & Industry Analysis, By Product & Service (Products {Instruments, and Reagents & Consumables}, and Services), By Type (Oligonucleotide Synthesis and Gene Synthesis), By Application (Diagnostics {Infectious Diseases, Cancer, and Others}, Therapeutics {Gene Therapy, Preventive Medicine}, and Research & Development {Cloning and Gene Editing, Drug Discovery & Development}), By End-user (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs) & Contract Development And Manufacturing Organizations (CDMOs)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

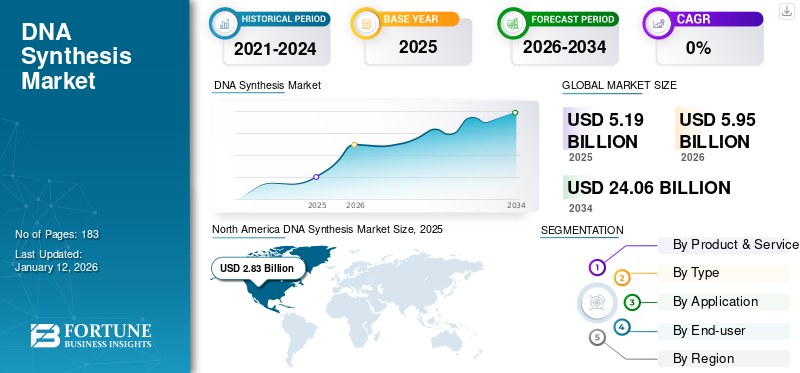

The global DNA synthesis market size was USD 5.19 billion in 2025. The market is expected to grow from USD 5.95 billion in 2026 to USD 24.06 billion by 2034, exhibiting a CAGR of 19.09% during the forecast period. North America dominated the DNA synthesis market with a market share of 54.61% in 2025.

DNA synthesis is a process of artificially manufacturing deoxyribose nucleic acid (DNA). The development of synthetic techniques to construct DNA has led to an improvement in the ability to understand and engineer biology. Different types of synthesized DNA, such as oligonucleotides, genes, and DNA fragments, are available and can be utilized as per the needs of the customer. Synthetic DNA is used for the development of new drugs and vaccines, gene therapies for genetic disorders, and the development of molecular diagnostic tools, including polymerase chain reaction (PCR) assays and nucleic-acid-based sensors, for the detection of pathogens and diseases. Furthermore, the increasing prevalence of chronic, genetic, and rare diseases, with the rising healthcare expenditure, has led to the increased awareness of personalized treatment, thus propelling the adoption of synthetic DNA. Therefore, the increasing demand for synthetic DNA in the areas of novel therapeutics, diagnostics, and research initiatives is boosting the global DNA synthesis market growth.

Moreover, the key companies are actively looking to lower the cost of synthesized DNA, allowing the researchers to focus more on the design landscape. In addition, the increasing initiatives by the key players to advance the infrastructure and facilities to expand the research and development activities for offering a wide range of services in the market is thus boosting the market growth.

- In April 2022, Ansa Biotechnologies, Inc. announced that they had raised USD 68.0 million in the series A funding with an aim to support the company's research and development activities for DNA synthesis processes and to launch customizable services.

During COVID-19, the global market was positively impacted. The sudden rise in the number of COVID-19 cases led to an increased demand for the development of molecular diagnostics tests and vaccines for the COVID-19 virus. The growth in the revenue of the key players was observed during the end of the pandemic. However, in 2022, the market stabilized and is anticipated to experience a robust CAGR throughout the forecasted period. The growing prevalence of chronic and infectious illnesses, along with heightened research and development efforts, has facilitated the global market in maintaining its growth trajectory during the forecast period.

Global DNA Synthesis Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.19 billion

- 2026 Market Size: USD 5.95 billion

- 2034 Forecast Market Size: USD 24.06 billion

- CAGR: 19.09% from 2026–2034

Market Share:

- North America dominated the DNA synthesis market with a 54.61% share in 2025, driven by the rising demand for precision medicine, robust research infrastructure, and active initiatives by key players to expand service offerings and launch advanced products.

- By type, Gene Synthesis is expected to retain its largest market share owing to its customizable applications for research and therapeutics, increasing demand from pharmaceutical & biotech companies, and continuous technological advancements aimed at delivering high-purity, cost-effective DNA sequences.

Key Country Highlights:

- United States: The growing prevalence of chronic and genetic diseases, alongside increasing adoption of personalized treatments, is driving demand for synthetic DNA in diagnostics and therapeutics.

- Europe: Rising R&D collaborations between key players and academic institutions, coupled with strategic facility expansions for DNA synthesis, are propelling market growth.

- China: Increasing investments in biotechnology infrastructure and partnerships with global companies to distribute advanced DNA synthesis systems are accelerating market development.

- Japan: Growing focus on synthetic biology research, combined with initiatives to develop innovative DNA synthesis platforms, is contributing to market expansion.

DNA Synthesis Market Trends

Advancements in DNA Synthesis Technologies to Identify the Path of Market Growth

In recent years, the DNA synthesis market has seen a significant trend, with leading companies focusing on the development of advanced products and technologies to synthesize DNA. The rising need for cost-efficient and sustainable synthetic products has led companies to emphasize synthesizing faster, cheaper, and more accurate DNA.

- For instance, one of the emerging synthesis methods includes the microfluidics approach. This method drastically reduces the turnaround time for gene synthesis via an automated microfluidic system due to the enhanced parallelization of reactions and the reduced need for manual multi-step protocols and such advancement in technologies is expected to propel the growth of the market in the future.

Moreover, the increasing fundraising activities by the key companies to develop advanced instruments to boost the sustainable method for synthetic DNA manufacturing is further expected to grow the market during the forecast period.

- For instance, in August 2023, Atantares raised a USD 13.9 million fund to develop molecular chips to improve enzyme efficiency and automate methods for high-throughput enzymatic DNA synthesis. Such initiatives are taken by key players, leading toward the growth of the market during the forecast period.

- North America witnessed a dna synthesis market growth from USD 2.25 Billion in 2023 to USD 2.51 Billion in 2024.

Download Free sample to learn more about this report.

DNA Synthesis Market Growth Factors

Increasing Demand for DNA Synthesis Products & Services Due to its Multiple Applications to Propel Market Growth

In the last few decades, the demand for synthetic DNA has increased tremendously, positively affecting the production of new enzymes, new proteins, and new drug discoveries. The rising adoption of synthetic biology in the introduction of novel drugs and treatments has propelled the demand for synthetic DNA. This has promoted the development of new technologies aimed at delivering DNA with enhanced purity, greater quantity, and reduced costs. Thus, these demands have led to a shift in commercial priorities toward the supply of synthetic DNA rather than the isolation of DNA from natural sources.

Furthermore, the rising prevalence of chronic diseases and increasing awareness among people for personalized treatment options has led to increasing usage and production of synthetic DNA products and services across the globe.

- For instance, in 2024, according to the data published by the American Cancer Society, Inc., it is estimated that 2,001,140 new cancer cases are projected to occur in the U.S. Such an increasing number of cases requires an early and precise diagnostics method, thus leading to the adoption of these services and products in the market.

Moreover rising approvals for gene-based therapies for rare disorders are increasing the adoption of synthetic DNA services and products, thus boosting the growth of the market.

- For instance, in December 2023, the U.S. FDA approved Casgevy and Lyfgenia as the first cell-based gene therapies to treat sickle cell disease in patients aged 12 and older. In that, Casgevy utilizes a new genome editing technology, marking a significant advancement in gene therapy. Such approvals and launches are driving the growth of the market.

Rise in Healthcare Spending to Enhance Patient Outcomes Boosts the Market Expansion

In recent years, with the increasing healthcare costs, both the healthcare providers and patients have been advocating for precision medicine and investing more in research and development of new treatments.

Furthermore, gene synthesis enables the options for tailored treatments for various diseases, including cancer and genetic disorders, making it a popular choice for clinical research and therapeutic interventions.

However, governments in several countries are also committed to promoting precision medicine and advancements in drug development to improve patient care standards.

- For instance, according to the U.K.'s Department for Business and Trade in January 2021, the U.K. government is increasing public spending by USD 27.36 billion by 2025 to focus more on R&D opportunities, including precision medicine. Also, the government's 2.4% of the GDP will be spent on research and development initiatives by 2027. Such government initiatives directed towards patient care to access these treatments at manageable costs propels the growth of the global market during the forecast period.

Moreover, the increasing fundraising activities by the key players to invest in cutting-edge technologies and state-of-the-art facilities are eventually driving the expansion of the market.

RESTRAINING FACTORS

Lack of Clear Regulatory Infrastructure & Shortage of Skilled Labors Hinders the Market Growth

In recent years, the demand for synthetic DNA has increased, although the market has faced challenges due to a lack of a robust regulatory framework. The regulatory uncertainties may slow down the launches of new products and services in the market.

- For instance, in September 2022, the European Medicines Agency released a concept paper addressing the need to establish a Guideline on the Development and Manufacture of Synthetic Oligonucleotides. It was proposed to establish a guideline addressing those specific aspects regarding the manufacturing process, characterization, specifications, and analytical control for synthetic oligonucleotides which are not covered in the Guideline on the Chemistry of Active Substances (EMA/454576/2016) and Chemistry of Active Substances for veterinary medicinal products (EMA/CVMP/QWP/707366/2017).

The presence of unclear regulatory scenarios may hamper the development and manufacturing of genes and oligonucleotides are expected to hamper the global market growth in the forecasting years.

DNA Synthesis Market Segmentation Analysis

By Product & Service Analysis

Cost Efficient and Customized Synthesis Leads to the Growth of Services Segment in the Market

In terms of product & service, the global market is divided into products and services. The product segment is further bifurcated into instruments and reagents & consumables.

The services segment dominated the global market in the product & service segment. The high share of 72.76% in 2026 the segment is due to the advanced services offered by the providers of synthesized DNA. Several companies offer comprehensive solutions with high-end equipment, reagents, and trained personnel coupled with high purity, accuracy, cost-effectiveness, and customized solutions in lesser turnaround times. Such factors have led to the increasing demand of academic research institutes and pharma biotech companies to opt for services to fulfill the research and industry demand for synthesized DNAs. Moreover, increasing collaborations between the companies to launch advanced synthesized DNA manufacturing facilities will lead to the growth of the segment in the market.

- For instance, in April 2024, Asahi Kasei Bioprocess (AKB) collaborated with Axolabs to launch a state-of-the-art manufacturing facility for oligonucleotide cGMP production in Berlin, Germany. This collaboration is focused on evolving the development of oligonucleotide-based treatments to enhance the well-being of patients on a global scale.

Additionally, the increasing strategic initiatives among the companies to enhance their service offerings to provide good quality products to the customer are expected to propel the segment's growth.

- For instance, in November 2023, LGC Limited business unit LGC Biosearch Technologies acquired PolyDesign, a manufacturer and supplier of solid support embedded frits for low and ultra-low-scale DNA/RNA oligonucleotide synthesis and purification, to enhance the company's oligonucleotide product capability.

Furthermore, the products segment held a significant portion of the market. The substantial share in the segment is augmented due to increasing product launches by key players in the market, boosting the growth of the segment in the market. Similarly, the reagents & consumables held a maximum share in the product segment due to increased applications of these products in diagnostics and therapeutics.

- In May 2023, Telesis Bio Inc. announced the commercial shipment of the BioXp Select DNA Cloning kit that enables automated assembly of DNA fragments via Gibson Assembly or Golden Gate assembly. Such launches boost the growth of the segment in the market.

By Type Analysis

Rising Launches of Gene Synthesis Services Lead to Segment Growth

Based on type, the market is bifurcated into oligonucleotide synthesis and gene synthesis.

The gene synthesis segment held the dominant market share of 74.31% in 2026 and is expected to expand at a substantial CAGR during the forecast period. Gene synthesis offers the customization of DNA sequences as per the specific needs of research institutions and industries. The advances in gene synthesis technologies have led to a cost reduction in the synthesizing of DNA sequences, coupled with the rising demand among researchers and companies to order customized genes. Moreover, robust efforts by key players in the market to launch new gene synthesis services to fulfill customer demand are expected to drive market growth during the forecast period.

- For instance, in November 2023, Twist Bioscience launched a new gene synthesis service, Twist Express Genes, to offer genes ranging from 0.3 to 5.0kb with an accelerated shipping turnaround of five to seven business days. Such developments lead to the expansion of the market segment.

Furthermore, the oligonucleotide synthesis segment holds a considerable share of the market and is expected to grow during the forecast period. The growth of the segment is due to the increased adoption of synthesized oligos in molecular diagnostics, therapeutics, and gene therapy. Also, the rise in the demand for oligonucleotide therapeutics has led to increasing collaboration activities among customized DNA manufacturers to expand the oligonucleotide manufacturing facilities to fulfill the growing demand for oligonucleotides in diagnostics and drug development.

- For instance, in May 2023, GenScript announced the expansion of its oligonucleotide and peptide production facility in Zhenjiang, China. The expansion of facilities is aimed at addressing the growing demand for oligonucleotide and peptide synthesis for molecular diagnostics and vaccine development. Such rising initiatives of the key players to expand its presence worldwide in the oligonucleotide synthesis segment propels the growth of the segment in the market.

By Application Analysis

Increased Usage of Oligonucleotides for Molecular Diagnostics Enabled the Diagnostics Segment Dominance in 2024

In terms of the application segment, the market is divided into diagnostics, therapeutics, and research & development. The diagnostics segment is further sub-segmented into infectious diseases, cancer, and others. The therapeutics segment is further sub-segmented into gene therapy, preventive medicine, and others. The research & development segment is further sub-segmented into cloning and gene editing, drug discovery & development, and others.

The diagnostics segment held the highest portion of the global DNA synthesis market share. The dominant share of the segment is augmented by the growing occurrence of chronic diseases and genetic disorders, alongside an increasing need for accurate and timely diagnosis to mitigate healthcare expenses.

- The Diagnostics segment is expected to hold a 50.26% share in 2026.

- For instance, in February 2024, according to the news published by the World Health Organization (WHO), approximately 20.0 million new cancer cases were reported in 2022.

Also, molecular diagnostics is becoming a key technology for the detection of the disease in a precise manner as oligonucleotides are used as probes and primers for PCR and used for molecular diagnostics, leading towards the growth of the segment in the market.

Furthermore, the therapeutics segment holds a substantial portion of the market and is expected to grow during the forecast period. The increasing adoption of oligonucleotides, genes, and DNA fragments for developing vaccines and gene therapy leads to the growth of the segment in the market.

- For instance, in April 2024, Pfizer Inc. announced the U.S. Food and Drug Administration (FDA) approval of BEQVEZ, adeno-associated virus (AAV)-based gene therapy used for the treatment of moderate to severe hemophilia B in adults.

Additionally, the research and development segment held a considerable share of the market, owing to increasing research initiatives for drug discovery & development, genetic engineering, gene cloning, editing for identifying genetic defects, and modeling the potential therapies for genetic disorders.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Increasing Approvals for Gene Therapies by Pharmaceutical & Biotechnology Companies Attributed to the Segment Growth

Based on the end-user, the global market is segmented into pharmaceutical & biotechnology companies, contract research organizations (CROs) & contract development and manufacturing organizations (CDMOs), and others.

The pharmaceutical & biotechnology companies segment held a dominant share of the global market share in 2024. The growth of the segment is due to the increasing adoption of synthesized DNA products by pharmaceutical and biotechnological companies to develop novel treatment options for various diseases, leading to the market's growth. Also, the increasing regulatory approvals and launches of gene-based therapies by the pharmaceutical and biotechnology companies are propelling the development of the segment in the market.

- For instance, in January 2024, the U.S. Food and Drug Administration approved Vertex Pharmaceuticals and CRISPR Therapeutics gene therapy to treat sickle cell disease, a rare blood disorder requiring regular blood transfusions.

The contract research organizations (CROs) & contract development and manufacturing organizations (CDMOs) segment held a significant global DNA synthesis market share. These institutions have high expertise, a regulated environment, and advanced infrastructure and require and provide comprehensive services for custom and large-scale production of synthetic DNA. Also, the increasing number of launches by the crucial companies that offer cost-effective and advanced services in the market also accounts for the segmental growth.

- For instance, in May 2023, GenScript launched the Gene Fragments synthesis service under the name GenTitan, the first and only commercial miniature semiconductor platform for high-throughput DNA synthesis. Such launches are expected to propel the segmental growth.

Furthermore, the others segment is anticipated to hold a notable portion of the market. The others segment includes academic & research institutes. The segment is expected to grow with a potential CAGR during the forecast period, owing to the rising research and development initiatives for advancement in the synthetic biology and genomic field.

REGIONAL INSIGHTS

Based on geography, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America DNA Synthesis Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.83 billion in 2025 and USD 3.22 billion in 2026.. The rising prevalence of chronic and genetic diseases, coupled with the increased awareness for personalized treatments among people, is boosting the research and development of these drugs. Such rising demand for early diagnosis and precision medicine propels the adoption of these products and services in the region. Additionally, the increasing number of services launched by prominent companies to offer faster and more reliable services to customers is expanding the growth of the area in the market. The U.S. market is estimated to reach USD 3.03 billion by 2026.

- For instance, in March 2024, Elegen launched an advancement in ENFINIA DNA, which offers delivery of very high-complexity DNA within ten business days to the researchers.

Additionally, the advanced research facilities and infrastructure in the region and active fundraising activities result in the expansion of the synthetic biology workflow, contributing to the dominance of the region in the market.

Europe held a considerable market share in 2024. The growth of the region is augmented by the increasing research and development activities in the area for the advancement of diagnosis and treatment. Also, the growing strategic initiatives of the major players with the institutes will lead to the growth of the region in the forecast period. The UK market is estimated to reach USD 0.22 billion by 2026, while the Germany market is estimated to reach USD 0.32 billion by 2026.

- In October 2023, Evonetix announced the installation of the DNA synthesis platform with a semiconductor chip and thermal controller at the Imperial College London (ICL) to enable the synthesis of DNA in any lab and conduct research for human disease and infection.

On the other hand, the Asia Pacific region is anticipated to grow significantly by 2032. The region is expected to grow with the highest CAGR during the forecast period. The growth of the region is attributed to the growing healthcare infrastructure and advancements in the DNA-based molecular biology solution. Rising investments for the launches of new DNA manufacturing facilities are expected to drive growth in the region. Additionally, increasing collaborations between the market players and the regional players to expand the synthetic DNA technologies in the area is propelling the development of the Asia Pacific DNA synthesis market. The Japan market is estimated to reach USD 0.24 billion by 2026, the China market is estimated to reach USD 0.43 billion by 2026, and the India market is estimated to reach USD 0.13 billion by 2026.

- For instance, in April 2022, DNA Script signed a distribution agreement with Research Instruments Pte. Ltd. for Singapore, Cold Spring Biotech Corp. for China, Taiwan, and Hong Kong, Premas Life Sciences Pvt. Ltd. for India, and Bio-Medical Science Co. Ltd. for South Korea, with an aim to boost the presence of SYNTAX systems in the region.

Latin America and the Middle East & Africa regions held a comparatively lower share of the market and are anticipated to expand at a moderately low CAGR by 2024-2032. The limited infrastructure and resources for biotechnology-based research and limited funding for research and development slows the growth of the region in the market. However, increasing government initiatives to change the biotechnology scenario in the area may propel the region's growth during the forecast period.

Key Industry Players

Wide Range of Service and Product Offerings by Key Companies to Expand their Market Position

The competitive landscape of the market reflects a semi-consolidated structure. Thermo Fisher Scientific Inc., Integrated DNA Technologies, Inc. (Danaher), and GenScript are some of the major players that held a significant position in the global market in 2024 due to their established brand presence and wide range of product and service offerings in the market.

- For instance, in May 2022, GenScript launched GenExact single-stranded DNA (ssDNA) and GenWand closed-end linear double-stranded DNA (dsDNA) services in the U.S. These new GMP-grade services support gene and cell therapy development.

Eurofins Scientific, Twist Bioscience, Azenta, Inc., and LGC Limited are also some of the other prominent players in terms of market share in the global market. Specific strategic initiatives, a wide range of service and product offerings, including customizable, cost-effective, early delivery options, and the launches of new services, are anticipated to boost their market presence in key countries during the forecast period.

List of Top DNA Synthesis Companies:

- Thermo Fisher Scientific Inc. (U.S.)

- Integrated DNA Technologies, Inc. (Danaher) (U.S.)

- Eurofins Scientific (Luxembourg)

- GenScript (U.S.)

- Azenta, Inc. (U.S.)

- LGC Limited (U.K.)

- Biomatik (Canada)

- Telesis Bio Inc. (U.S.)

- Twist Bioscience (U.S.)

- Bioneer Corporation (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Twist Bioscience introduced Twist Express Genes, a new gene synthesis service offering genes ranging from 0.3 to 5.0kb with an expedited shipping turnaround of five to seven business days.

- November 2023: Twist Bioscience introduced Twist Express Genes, a new gene synthesis service offering genes ranging from 0.3 to 5.0kb with an expedited shipping turnaround of five to seven business days.

- May 2023: Telesis Bio Inc. announced the commercial shipment of the BioXp Select DNA Cloning kit that enables automated assembly of DNA fragments via Gibson Assembly or Golden Gate assembly.

- February 2023: GenScript opened its state-of-the-art production facility in Singapore with the aim of meeting the demand of regional biotech clients and providing a premium gene synthesis service.

- August 2019: Eurofins Scientific acquired Blue Heron Biotech, a company advanced in gene synthesis, to expand its gene synthesis capabilities and portfolio in cloning and complex gene constructs.

REPORT COVERAGE

The global market report focuses on an industry overview and market dynamics, such as the drivers, restraints, opportunities, and trends. Besides this, the market research report provides information related to the technological advancements in the market. Furthermore, the global market analysis also focuses on key industry developments and new product launches in the market. In addition, the impact of COVID-19 and the industry overview during the pandemic are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 19.09% from 2026-2034 |

|

Segmentation |

By Product & Service

|

|

By Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 5.19 billion in 2025.

In 2025, the North America market stood at USD 2.83 billion.

The market is expected to exhibit a CAGR of 19.09% during the forecast period.

The services segment led the market in 2025.

North America region dominated the market in 2025.

The contributing factors, such as increasing demand for DNA synthesis products & services and a rise in healthcare spending, are expected to drive the market growth.

Advancements in DNA synthesis technologies are the key trend of the market.

Thermo Fisher Scientific Inc. and Integrated DNA Technologies, Inc. (Danaher) are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us