Electric Vehicle HVAC Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Car and Commercial Vehicle), By Technology (Automatic and Manual), By Component (Compressor, Condenser, Evaporator, Receiver Dryer, Expansion Valve, and Others), By Propulsion Type (BEV and HV), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

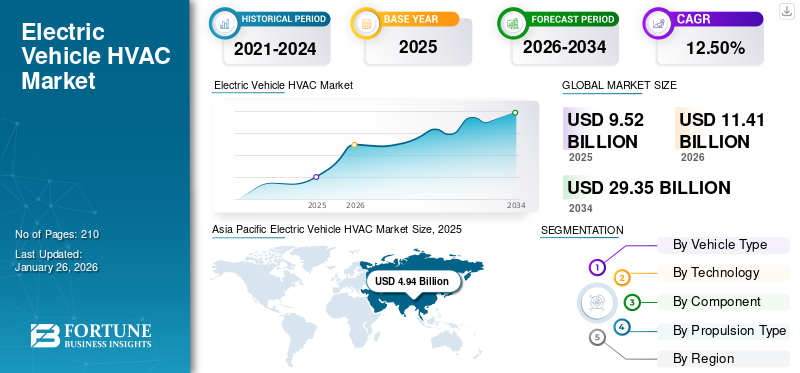

The global electric vehicle HVAC market size was valued at USD 9.52 billion in 2025. The market is projected to grow from USD 11.41 billion in 2026 to USD 29.35 billion by 2034, exhibiting a CAGR of 12.50% during the forecast period. Asia Pacific dominated the global market with a share of 51.89% in 2025. The electric vehicle HVAC market in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.16 Billion By 2032.

An electric vehicle HVAC (Heating, Ventilation, and Air Conditioning) system is a specialized climate control system designed specifically for Electric Vehicles (EVs). It is responsible for regulating the interior temperature and air quality of the EV cabin, ensuring passenger comfort, and maintaining optimal conditions for vehicle components, including batteries and electronics. The air conditioning system cools the cabin during hot weather conditions. Similar to heating, cooling in electric vehicles can be achieved through electrically driven compressors, heat pumps, or other efficient cooling technologies.

Global Electric Vehicle HVAC Market Overview

Market Size:

- 2025 Value: USD 9.52 billion

- 2026 Value: USD 11.41 billion

- 2034 Forecast Value: USD 29.35 billion, with a CAGR of 12.50% from 2026–2034

Market Share:

In 2025, Asia Pacific held the largest market share of 51.89%, driven by strong EV adoption in countries like China, Japan, and South Korea. The U.S. market is expected to grow significantly, reaching USD 3.16 billion by 2032, due to advancements in EV infrastructure and government incentives.

Industry Trends:

- Growing integration of energy-efficient HVAC systems tailored for EV platforms to enhance battery performance.

- Rising adoption of heat pump technologies to reduce power consumption and improve vehicle range, especially in cold climates.

- Manufacturers are focusing on modular and compact HVAC architectures that occupy less space and offer better thermal comfort.

- Increasing use of eco-friendly refrigerants and demand for smart climate control systems across EV segments.

Driving Factors:

- Surging global demand for electric vehicles is directly accelerating the need for specialized HVAC systems.

- Stringent government emission norms and electrification policies are pushing OEMs to adopt advanced HVAC technologies.

- Technological advancements in battery thermal management and interior climate control enhance passenger comfort and vehicle efficiency.

- Rising consumer preference for luxury and comfort features in EVs is supporting market growth.

The heating component warms the cabin during cold weather conditions. In electric vehicles, heating may be provided through electric resistance heaters, heat pumps, or other innovative technologies that utilize waste heat from the vehicle's powertrain or battery system. The ventilation system ensures the circulation of fresh air within the cabin, preventing the accumulation of stale air, odors, and pollutants. It may include air intake vents, cabin air filters, and fans to facilitate airflow.

The COVID-19 pandemic sent shockwaves through most industries. However, the electric vehicle industry remained resilient during this period. The pandemic induced lockdowns in early 2020, and the resumption of production at a reduced capacity led to an unprecedented drop in global car sales. In the first few months of 2020, the electric vehicle HVAC market faced difficulties owing to strict lockdown measures and transportation restrictions. In addition, the supply chain associated with electric vehicles was affected due to trade barriers. The production facilities of electric vehicles and their related components, including HVAC systems, across the world were slowed down due to labor unavailability and raw material procurement issues. All these above mentioned factors collectively considerably slowed down the market’s growth during 2020.

Electric Vehicle HVAC Market Trends

Efficiency Improvements through Heat Pump Integration to Augment Market Growth

Manufacturers have been focusing on improving the efficiency of electric vehicle HVAC systems to extend the vehicle's range. This includes advancements in heat pump technology, better insulation, and intelligent thermal management systems. Heat pumps have been gaining traction in EVs as they are more energy-efficient compared to traditional resistive heating systems. The heat pump can draw heat from the surrounding air or from various vehicle components such as the battery or motor to warm the cabin.

For instance, in April 2023, Kia tested the efficiency of the HVAC system in their EV9 model with an innovative heat pump. Unlike typical EVs, EV9 uses a heat pump instead of a basic electric heater, thus increasing efficiency. The pump operates as a reverse refrigerator, warming the interior when it's cold outside. Additionally, waste heat from e-motors and the power electronics system heats the cabin, reducing energy usage and extending the driving range.

Download Free sample to learn more about this report.

Electric Vehicle HVAC Market Growth Factors

EV Market Expansion and HVAC Innovation to Stimulate Market Growth

The increasing adoption of electric vehicles globally is directly proportional to the demand for electric vehicle HVAC systems. As consumers and governments seek to reduce reliance on fossil fuels and mitigate the impacts on the environment, the demand for electric vehicles increases year on year. HVAC systems are essential components of electric vehicles, ensuring occupant comfort and convenience.

Technological innovation and integration for electric vehicles drive the demand for EV in the HVAC market. Electric vehicles are technologically advanced, with regenerative braking, Advanced Driver Assistance Systems (ADAS), and connectivity. HVAC systems in modern EVs are also evolving to incorporate advanced technologies for improved performance, efficiency, and user experience. These innovations enhance the appeal of electric vehicles to consumers, driving demand for EVs equipped with high-quality HVAC systems.

RESTRAINING FACTORS

Range Constraints and Anxiety May Hinder Market Growth

Battery capacity and range concerns pose significant challenges to the electric vehicle HVAC market growth due to their direct impact on vehicle performance, consumer acceptance, and overall market adoption. HVAC systems consume energy from the vehicle's battery to operate, impacting the overall range. Since EVs rely entirely on battery power, any additional energy consumption, such as that by HVAC systems, reduces the vehicle's driving range per charge. Consumers may prioritize maximizing range over comfort, leading to compromises in HVAC usage or adoption.

Moreover, range anxiety, which is the fear of running out of battery charge before reaching the destination or charging station, is a significant concern for EV drivers. The limited range of EVs combined with energy-intensive systems such as HVAC exacerbates this anxiety. Drivers avoid using the HVAC system or opt for less energy-intensive settings to conserve battery power, affecting comfort and usability. For instance, according to the American Automobile Association (AAA), at a temperature of 20°F, utilizing the HVAC system to warm the vehicle's interior reduces the average driving range of an EV by approximately 41%. Similarly, with temperatures reaching 95°F and the use of air conditioning inside the vehicle, the driving range decreases by around 17%.

Electric Vehicle HVAC Market Segmentation Analysis

By Vehicle Type Analysis

Passenger Car Segment to Dominate Owing to the Rising launches Electric Passenger Cars

By vehicle type, the market is segmented into passenger car and commercial vehicle.

The passenger car segment held the highest market share of 88.69% in 2026 and is expected to grow at the highest rate owing to increasing adoption of passenger cars and rising electric passenger car launches by manufacturers. The adoption of passenger cars is directly proportional to the demand for the electric vehicle HVAC market. For instance, in March 2024, BYD announced the launch of the Seal electric sedan in India. The car can travel 200 km with 15 minutes of charging and can accelerate from zero to 100 km/h in just 3.8 seconds. It has automatic rain-sensing wipers and electrically adjustable AC vents. Such technological advancement is likely to drive the demand for the BYD Seal electric sedan, contributing to overall market growth in the segment.

The commercial vehicle segment held the second-largest market share. Its growth is attributed to the expansion of e-commerce sectors, urbanization, and last-mile delivery services. Thus, the rising adoption of electric commercial vehicles for logistics and delivery sectors fuels the demand for the HVAC market.

By Technology Analysis

Automatic Segment Held Largest Share Owing to Technological Advancement in HVAC System

Based on technology, the market is segmented into automatic and manual.

The automatic segment held the largest market share contributing 80.98% globally in 2026 owing to technological advancement in sensor technology, artificial intelligence, and climate control algorithms to enable more sophisticated automatic HVAC systems. These advancements improve performance, efficiency, and user experience, further driving demand for the electric vehicle HVAC market.

The manual segment held the second-largest share of the market. Factors such as low cost and easy recycling are attributed to the dominance of this segment in the market. Manual HVAC systems are typically simpler and less expensive to manufacture than other systems. This cost-effectiveness increases the demand for manual systems, especially for EV manufacturers to provide affordable models to a border consumer base.

By Component Analysis

Compressor Segment to Lead Owing to Effective HVAC Operation

Based on component, the market is segmented into compressor, condenser, evaporator, receiver dryer, expansion valve and others.

The compressor is expected to dominate its position in terms of market share accounting for 39.35% market share in 2026 throughout the forecast period owing to effective HVAC operation. The compressor is a vital component of the HVAC system. It is responsible for compressing and circulating the refrigerant, essential for cooling or heating the vehicle's interior. As such, the demand for compressors remains consistently high for effective HVAC operation.

The condenser segment is expected to grow considerably during the forecast period due to the increasing demand for more efficient cooling systems for electric vehicles. The condenser's efficiency in dissipating heat directly impacts the overall performance of the HVAC system.

To know how our report can help streamline your business, Speak to Analyst

By Propulsion Type Analysis

BEV segment Dominates owing to Increasing Adoption of Battery Electric Vehicle

Based on propulsion type, the market is divided into BEV and HV.

The BEV segment held the largest market share 71.95% in 2026 as many consumers are increasingly choosing BEVs due to their silent operation, lower operating costs, and reduced environmental impact. According to the International Energy Agency (IEA), around 9.85 million BEVs were sold in 2023. The BEV segment witnessed a rise of 35.67%, compared to 2022, which was 7.3 million BEVs. This shift in consumer preference is a significant driver of BEV market dominance.

The HV segment holds the second-largest market share in 2023. The growth of this segment is driven by the ongoing improvements in hybrid technology, including more advanced HVAC, battery systems and regenerative braking systems, enhancing the performance and efficiency of HEVs.

REGIONAL INSIGHTS

Asia Pacific Region Dominated the Market in 2023, Owing to Presence Major EV OEMs in China

Geographically, the market is studied across North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Electric Vehicle HVAC Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Regionally, Asia Pacific dominated the global market, with China accounting for the major electric vehicle HVAC market share. APAC countries, especially China, are major manufacturing hubs for both electric vehicles and their components. These countries have established a robust supply chain and manufacturing infrastructure, making it cost-effective to produce HVAC components and other EV components. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 5.64 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

Europe is expected to show significant growth in the market, driven by its dedication to green transportation and carbon footprint reduction. This commitment is evident in robust backing for electric vehicles (EVs) to foster cleaner and sustainable mobility. Notably, the European Union's move in October 2022 toward prohibiting non-electric vehicle sales by 2035 underscores this momentum. The UK market is projected to reach USD 0.55 billion by 2026, while the Germany market is projected to reach USD 1.07 billion by 2026.

North America is also expected to show significant growth in the forecast period. The growth of the segment is attributed to the increasing technological advancement of electric vehicle HVAC systems and increasing contracts from governments to achieve zero-emission contribute to the region’s market growth. The U.S. market is projected to reach USD 1.56 billion by 2026.

KEY INDUSTRY PLAYERS

Key Players are Focusing on R&D Efforts to Develop New Products

Major players in this market include Denso Corporation, Valeo, and Hanon System. The electric vehicle HVAC manufacturers focus on expanding their product portfolio, enhancing sales network, and fostering strategic partnerships.

Denso corporation is one of the leading manufacturers in the electric vehicle HVAC market. The company is focusing on research and development activities to develop new products with improved capabilities and contracts.

List of Top Electric Vehicle HVAC Companies:

- DENSO CORPORATION (Japan)

- Valeo SA (France)

- SANDEN CORPORATION (Japan)

- MAHLE GmbH (Germany)

- TOYOTA INDUSTRIES CORPORATION (Japan)

- Mitsubishi Heavy Industries, Ltd (Japan)

- Hanon Systems (Korea)

- Highly Marelli (Tokyo)

- Brose Fahrzeugteile SE & Co. (Germany)

- ESTRA Automotive Systems (Korea)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Hanon Systems announced its new engineering center in Palmela, Portugal. The center is located within the company’s compressor manufacturing campus in Palmela, which has been operational since 1998 in the Setúbal District, about 25 kilometers (16 miles) south of Lisbon, Portugal’s capital city. The Palmela plant is the company’s European flagship for electric scroll compressors, which are essential components of heat pump systems.

- September 2023: Brose Fahrzeugteile SE & Co. introduced a high-voltage compressor for fast-charging of EVs. The core element of Brose's thermal management is the electric climate compressor. The high-voltage version is particularly economical, and its efficient power electronics enable ultra-fast charging of vehicle batteries.

- November 2022: Highly Marelli Holdings Co. and APM Automotive Holdings Berhad (APM) signed an agreement to establish a joint venture, PT. The joint venture aimed to provide HVAC units to customers in Indonesia . The signing ceremony was held online on August 25, with leaders from both parties attending from China, Japan, Malaysia, and Indonesia.

- July 2022: Toyota Industries Corporation announced that the company would increase the capacity of the machining line of its Higashiura Plant and its Chinese subsidiary TACK*1, the assembly line of its Kariya Plant. These expansions were part of a strategy to construct a 10-million-unit global production capacity, responding to the growing demand for electric compressors for car air conditioners amidst the global electrification of automobiles.

- March 2022: MAHLE GmbH announced that MAHLE Aftermarket, expanded its portfolio to include indirect air conditioning condensers, which are becoming standard components in the air conditioning systems of modern vehicles. By continuously extending its thermal management product range, MAHLE Aftermarket is making it easier for workshops to generate new business.

REPORT COVERAGE

The research report covers a detailed focus on key aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report delivers an in-depth analysis of several factors that have contributed to its growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.50% from 2026 to 2034. |

|

Unit |

Value (USD Billion), Volume (Units) |

|

Segmentation |

By Vehicle Type

|

|

By Technology

|

|

|

By Component

|

|

|

By Propulsion Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 11.41 billion in 2026 and is projected to reach USD 29.35 billion by 2034.

The market is expected to register a CAGR of 12.50% during the forecast period.

Rising demand for electric vehicles is likely to drive the demand for electric vehicle HVAC system.

Asia Pacific is the leading region of the global market.

Major players in this market include Denso Corporation, Valeo, and Hanon Systems.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us