Endodontics Market Size, Share & Industry Analysis, By Product Type (Equipment {Apex Locator, Motor, Dental Handpiece, Dental Laser, and Others} and Consumables {Dental Burs & Drills, Endodontic Files, Dental Dams, Gutta-Percha Points, Dental Sealers, and Others}), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

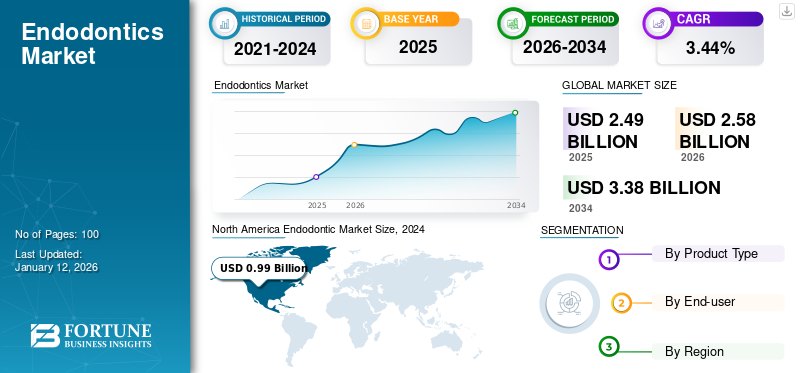

The global endodontics market size was valued at USD 2.49 billion in 2025. The market is projected to grow from USD 2.58 billion in 2026 to USD 3.38 billion by 2034, exhibiting a CAGR of 3.44% during the forecast period. North America dominated the endodontics market with a market share of 41.12% in 2025.

Endodontics is a specialized branch of dentistry focused on the diagnosis, prevention, and treatment of diseases of the dental pulp and tissues surrounding the roots of teeth. The primary treatment within this field is root canal therapy, which involves the removal of infected or damaged pulp to save a tooth and alleviate pain. These consumables include the irrigation solutions paper points, endodontic files, reamers, lubricants, regenerative cement, gutta-percha, endodontic sealers, endodontic burs & drills, and other obturation accessories.

The endodontics market is driven by several key factors, including the growing prevalence of dental issues such as tooth decay, infections, and gum diseases. Rising awareness of oral health and the increasing demand for root canal treatments are also contributing to market growth. Advances in dental technology, such as improved imaging systems and treatment tools, have enhanced the effectiveness of endodontic procedures. Additionally, an aging population, which is more prone to dental problems, along with increased access to dental care, further boosts the demand for endodontic services across the globe.

The market faced challenges in 2020 due to a decline in restorative procedures caused by the COVID-19 pandemic. However, in 2021, patient visits to dental clinics and hospitals observed a significant rise as restrictions eased by the government. By 2022, the market had recovered to pre-pandemic levels and is projected to experience consistent growth over the coming years.

Endodontics Market Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 2.49 billion

- 2026 Market Size: USD 2.58 billion

- 2034 Forecast Market Size: USD 3.38 billion

- CAGR: 3.44% from 2026–2034

Market Share:

- North America dominated the endodontics market with a 41.12% share in 2025, driven by a well-established dental care infrastructure, high awareness of oral hygiene, and increasing prevalence of dental caries and root canal procedures.

- By product type, consumables held the largest market share in 2024. The segment’s dominance is attributed to their recurring use in routine dental procedures such as root canal treatments. Products like endodontic files, sealers, gutta-percha, and burs are critical for effective treatment, and advancements in materials and single-use technologies are driving growth.

Key Country Highlights:

- Japan: Demand is supported by a rapidly aging population, a high prevalence of root canal treatments, and adoption of advanced dental technologies. Companies like MANI, INC play a vital role in supplying precision endodontic tools.

- United States: The market benefits from favorable reimbursement policies, a large base of practicing endodontists, and expansion of DSO (Dental Support Organization) networks. Programs like the Domestic Access to Care Program enhance access to underserved populations.

- China: Rapid urbanization, rising disposable incomes, and government-supported healthcare reforms are increasing access to dental services. Growth is further supported by the expansion of private dental chains and medical tourism.

- Europe: Countries such as Germany, France, and the U.K. are driving demand through adoption of cutting-edge imaging technologies, public investment in dental care, and growing emphasis on preventive treatments. The market is also benefitting from increasing use of bioceramic sealers and reciprocating file systems.

Endodontics Market Trends

Advancements in Biocompatible Materials is a Prominent Trend

Advancements in biocompatible materials represent a significant trend in the endodontics market, as they help improve the quality and success rates of treatments. These materials, designed to interact positively with human tissues, are used in various applications, such as root canal fillings, sealers, and regenerative procedures. Innovations in materials such as bioactive glass, Mineral Trioxide Aggregate (MTA), and calcium silicate-based cements have enhanced the ability to promote healing and regeneration in damaged or infected teeth. These materials improve the sealing of root canals, preventing reinfection, and also encourage the regeneration of dental tissues, leading to better long-term outcomes.

Biocompatible materials also minimize adverse reactions in patients, enhancing the safety of endodontic procedures. As a result, endodontics companies are focusing on the introduction of advanced materials to enhance the root canal treatment.

- For instance, in December 2022, Septodont Holding introduced BioRoot Flow, a bioceramic root canal sealer designed for use with both warm and cold obturation techniques.

Download Free sample to learn more about this report.

Endodontics Market Growth Factors

Expansion of Dental Care Services to Boost Market Growth

The expansion of dental care services is a major factor driving the endodontics market growth. As the number of dental clinics and practices increases, especially in developing countries, access to specialized endodontic treatment improves significantly. This broader reach helps address the growing demand for procedures such as root canal therapy and contributes to the market expansion.

- For instance, in April 2021, the Foundation for Endodontics, the philanthropic arm of the American Association of Endodontists, and U.S. Endo Partners introduced the Domestic Access to Care Program. The new program would aid endodontic specialists in providing free access to important endodontic care to underserved patients within the U.S.

Additionally, the rise of multi-specialty dental centers and the inclusion of endodontic services in general dental practices provide more comprehensive care options, attracting a larger patient base. The integration of advanced technologies and the expansion of dental care networks, including tele-dentistry and mobile clinics, further enhance accessibility. As a result, the increased patient engagement and a higher volume of endodontic procedures, fueling overall growth in the sector.

Technological Advancements to Drive Global Market Growth

Modern dental tools, such as advanced rotary instruments and precision handpieces, enhance the accuracy and efficiency of root canal treatments. Innovations in imaging systems, including 3D Cone-Beam Computed Tomography (CBCT) and digital radiography, provide detailed, high-resolution images that aid in precise diagnosis and treatment planning.

Furthermore, advancements in treatment techniques, such as the use of bioceramic materials and laser-assisted procedures, have improved patient outcomes by making treatments less invasive and more effective. These technological enhancements lead to better procedural outcomes, shorter recovery times, and increased patient comfort, driving higher demand for endodontic consumables and equipment over the forecast period.

Moreover, continuous focus of market players to launch various advanced consumables and equipment to provide efficient and better treatment of endodontics to the patients suffering from dental caries. The introduction of these devices is expected to surge the market growth in the long-run.

- For instance, February 2024, J. MORITA USA announced the latest generation apex locator product line with a high-frequency module for canal treatment.

RESTRAINING FACTORS

Presence of Alternative Treatment May Limit Market Growth

Dental implants offer a durable and aesthetically pleasing solution for replacing missing or severely damaged teeth, often preferred for their long-term success and minimal maintenance. As implant technology advances, patients and dentists may opt for implants over root canal therapy, especially when a tooth's prognosis is uncertain.

Additionally, conservative treatments that focus on preserving natural tooth structure through preventive and minimally invasive techniques are gaining popularity. These approaches can reduce the need for extensive endodontic procedures by addressing dental issues early and avoiding the progression to more complex treatments. The growing preference for these alternatives, driven by their effectiveness and lower risk profiles, influences patient choices and can reduce the demand for traditional endodontic therapies, thereby affecting the global market growth.

Endodontics Market Segmentation Analysis

By Product Type Analysis

Consumables Dominate Owing to their Vital Role in Routine Dental Procedures

Based on product type, the market is classified into consumables and equipment. The consumables segment is further classified into dental burs & drills, endodontic files, dental dams, gutta-percha points, dental sealers, and others.

The consumables segment dominated the market accounting for 67.48% market share in 2026. The growth is attributed to the essential role of these products in routine dental procedures. Consumables, such as files, sealers, obturators, and irrigants, are regularly used in root canal treatments and other endodontic therapies. Their recurring demand, driven by the high volume of dental procedures globally, contributes significantly to the market growth. Additionally, advancements in materials and technology for endodontic consumables have further boosted their adoption. For instance, Kerr Dental, a subsidiary of Envista, launched a new SimpliCut rotary product, a pre-sterilized single-patient use diamond burs line.

The equipment segment held a substantial endodontics market share in 2024 owing to the increasing use of rotary endodontics instruments, endodontic motors, and apex locators, which enhance precision and efficiency in treatments. Continuous technological advances in endodontic equipment drive its adoption, contributing to its significant market shares. The growing demand for modern dental care and improved treatment expected to boost its market growth

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Competitive Pricing of Solo Practices has Contributed to the Segment’s Leading Position

Based on end-user, the market is divided into solo practices, DSO/group practices, and others.

The solo practices segment will account for 64.83% market share in 2026. The growth of solo practices in the market is driven by increasing patient visits, a larger number of practicing dentists, and a rise in root canal treatments. These factors, along with the preference for personalized care in smaller practices, boost the demand for specialized endodontic services. Additionally, advancements in dental technology and greater awareness of dental health contribute to the expansion of this segment.

The DSO/group practices segment is expected to grow at the highest CAGR due to a shift toward DSO affiliation in developed countries. These practices often have higher patient volumes and access to advanced technologies, which streamline endodontic procedures. Additionally, the collaborative approach in group settings improves efficiency, leading to better patient outcomes and greater market penetration, solidifying the dominance of this segment.

REGIONAL INSIGHTS

On the basis of region, the market for endodontics is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Endodontic Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a value of USD 1.06 billion in 2026. The advanced healthcare infrastructure, a high prevalence of dental disorders, and strong demand for root canal treatments. The presence of leading dental product manufacturers and increasing awareness of oral health further boost market growth. Additionally, favorable reimbursement policies and the growing number of skilled endodontists contribute to the regional dominance in the market. The U.S. market is projected to reach USD 0.97 billion by 2026. The UK market is projected to reach USD 0.10 billion by 2026, and the Germany market is projected to reach USD 0.20 billion by 2026.

Europe has a substantial market share and is projected to experience significant growth over the coming years. The market expansion in the region is driven by the growing demand for advanced root canal treatments. Furthermore, Germany, France, and the U.K. drive market growth through their adoption of cutting-edge dental technologies and increasing investment in dental care.

In Asia Pacific, the market for endodontics is expected to grow at the highest CAGR during the forecast period. The growth is attributed to the government initiatives aimed at improving dental care and increasing public health awareness. The region is also witnessing growth due to medical tourism, as India and Thailand, offer cost-effective dental treatments. Furthermore, the expanding geriatric population with higher susceptibility to dental issues, along with a rise in disposable incomes, boosts the demand for specialized dental procedures such as root canal treatments. The Japan market is projected to reach USD 0.12 billion by 2026, the China market is projected to reach USD 0.17 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

Latin America and the Middle East & Africa are witnessing growth, driven by the rising prevalence of dental diseases and an increasing population, which boost the demand for dental treatments, including endodontic procedures. Governments in the region are focusing on improving healthcare services and private sector involvement is expanding access to modern dental care.

- According to a March 2023 report by the World Health Organization (WHO), around 44.0% of individuals in the African region are affected by oral health issues. This rising prevalence is anticipated to drive the demand for endodontic procedures, leading to anticipated growth in the market for endodontic equipment & consumables over the coming years.

KEY INDUSTRY PLAYERS

Leading Players Hold a Competitive Edge With Their Wide Range of Endodontic Products

Considering the competitive landscape, the global endodontic consumables sector is consolidated. Dentsply Sirona holds a prominent revenue share due to its wide range of products. Additionally, the new product launches and strategic acquisitions supports its growth in the global market. Additionally, the strategic initiatives such as collaborations are anticipated to help companies expand their market share.

Other major players in the global market for endodontics such as Envista, Brasseler USA, Ultradent Products, and Septodont Holding have a significant presence in the market. Brasseler USA holds a significant share in the market due growing focus on innovation, superior product performance, and strong relationships with dental professionals worldwide contribute to its leading market position.

LIST OF TOP ENDODONTICS COMPANIES:

- Envista (U.S.)

- Dentsply Sirona (U.S.)

- Septodont Holding (U.S.)

- COLTENE Group (Switzerland)

- Brasseler USA (U.S.)

- MANI,INC (Japan)

- DiaDent (South Korea)

- Ivoclar Vivadent (Switzerland)

- Ultradent Products Inc. (U.S.)

- FKG Dentaire Sàrl (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- June 2024 – Aseptico Inc. launched a new model of its GO Ultra-Portable Dental System, the AEU-350S, which features a fully integrated piezoelectric ultrasonic scaler.

- February 2022 – Ultradent Products, Inc. expanded its endodontic product line with the launch of MTApex, a bioceramic root canal sealer.

- July 2021 – Septodont Holding expanded its dental portfolio, including endodontic consumables, through the acquisition of four dental brands from Sanofi.

- June 2021 – COLTENE Group introduced the MicroMega One RECI, a new file designed for reciprocating root canal preparation.

- February 2021 – Ultradent Products Inc. partnered with American Orthodontics to distribute its Opal Orthodontics branded products, intending to boost the overall company revenue.

REPORT COVERAGE

The report provides an in-depth analysis of the industry, focusing on various segments such as products and end-users. The report offers a market outlook forecast, taking into account current market dynamics, the impact of COVID-19 on the market, and emerging trends. Additionally, the report outlines the market share across different regions and highlights key growth drivers. It also covers major industry players, gives an overview of the competitive landscape, and provides key insights into the annual number of root canal treatments, recent product advancements, and the prevalence of major dental diseases.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.44% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.58 billion in 2026 and is projected to reach USD 3.38 billion by 2034.

In 2025, the market value stood at USD 1.02 billion.

The market will exhibit a CAGR of 3.44% during the forecast period of 2026-2034.

Currently, the consumables segment is leading the market by product type.

The expansion of dental care services and rising technological advancements are key factors driving market growth.

Dentsply Sirona, Envista, Brasseler USA, and Septodont are some of the top players in the market.

North America dominated the market in 2025 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us