Energy Recovery Ventilator Market Size, Share & Industry Analysis, By Type (Wall-mount, Ceiling-mount, and Cabinet), By Application (Residential, Commercial, and Others), and Regional Forecast, 2026-2034

Energy Recovery Ventilator Market Size

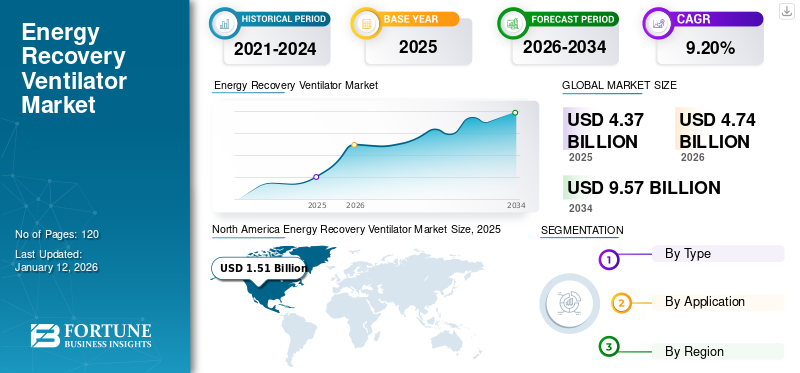

The global energy recovery ventilator market size was valued at USD 4.37 billion in 2025 and is projected to grow from USD 4.74 billion in 2026 to USD 9.57 billion by 2034, exhibiting a CAGR of 9.20% during the forecast period. North America dominated the energy recovery ventilator market with a market share of 34.50% in 2025.

An Energy Recovery Ventilator (ERV) is a central ventilation system that provides fresh air by removing indoor polluted air and balancing the humidity within the room space. It is commonly known as ERV ventilation systems and ERV air exchangers. ERV captures the pollutants, pollen, and other hazardous contaminants to ensure that the pleasant air enters the available room space.

Global Energy Recovery Ventilator Market Overview

Market Size:

- 2025 Value: USD 4.37 billion

- 2026 Value: USD 4.74 billion

- 2035 Forecast Value: USD 9.57 billion

- CAGR (2025–2032): 9.20%

Market Share:

- Regional Leader: North America 34.49% in 2024

- Fastest‑Growing Region: Asia Pacific is expected to exhibit the fastest growth, driven by rising standards of living and infrastructure expansion

- End‑User Leader (by Application): The commercial segment dominates—reflecting widespread adoption in offices, institutions, and public facilities

Industry Trends:

- Ceiling-Mount Units Predominate: Ceiling-mounted ERVs are leading the type segment due to their easy installation in existing structures and space-saving design

- IAQ-Focused Deployment: Indoor air quality considerations are driving the deployment of ERVs in both new projects and retrofits

- Green and Sustainable Building Solutions: Energy-efficient ventilation systems are increasingly incorporated into environmentally certified constructions

Driving Factors:

- Emphasis on Indoor Air Quality (IAQ): Growing awareness of IAQ benefits—enhanced occupant health, comfort, productivity—is fueling ERV adoption

- Energy Efficiency Mandates: Regulatory and eco-conscious building standards encouraging ERV integration to reduce HVAC energy loads

- Expansion in Commercial Real Estate: Rising construction and retrofit activities in commercial buildings are driving demand for scalable and efficient ERV systems

The Environmental Protection Agency (EPA) stated that Indoor Air Quality (IAQ) is two to five times worse than outdoor air. The poor indoor air quality in a compact building is due to a lack of ventilation. Inhalation of bad air can cause various health issues, such as Sick Building Syndrome (SBS). To avoid such adverse consequences, It is gaining popularity as it removes foul air and moisture and improves the indoor environment. Owing to the growing need for ventilation, the global energy recovery ventilation system market is expected to spur in the upcoming years.

COVID-19 IMPACT

Moderate COVID-19 Impact Resulted in Increased ERV System Installation

The world is facing the adverse impacts of the COVID 19 pandemic, which has also ultimately affected their production across the manufacturing sites due to the sudden lockdown. Referring to multiple secondary sources, in the U.S., approximately 45% of the HVAC companies lost their seasonal sales, owing to the shrunken installation of ERVs and lack of workers. Several industries were hampered amid coronavirus and witnessed major downfall till the second half of 2020. HVAC is one of the least affected industries, owing to the need for ventilation across various sectors. Thus, the market was moderately affected during the pandemic and is projected to recover soon during the forecast period.

Energy Recovery Ventilator Market Trends

Increasing Construction of Green Buildings to Accelerate Market Growth

The growing trend toward the construction of green buildings is aiding the market of energy recovery ventilators. This is attributable to the rising awareness of occupants for health due to rising hazardous emissions. According to the U.S. Green Building Council (USGBC), green and healthier buildings streamlined with supportive ventilation can grow Return on Investment (ROI) by 19% and building asset value by 10%.

Owing to this, the market for energy ventilators is anticipated to grow significantly in future. Additionally, key suppliers are aligning their products in line with green building certifications. For instance, RenewAire Company offers products that meet the stringent energy-efficiency requirements for green building certifications. Therefore, the growing construction activities across the globe for green buildings are expected to bode well for the global energy recovery ventilator market growth during the forecast period.

Download Free sample to learn more about this report.

Energy Recovery Ventilator Market Growth Factors

Rising Awareness of Indoor Air Quality (IAQ) to Fuel Product Demand

The quality of air is an important concern and is getting acknowledged in the present time. The deficient Indoor Air Quality (IAQ) creates an adverse impact on the health, cognitive function, productivity, and wellbeing of indoor occupants. Therefore, the demand for energy recovery ventilators ERVs is anticipated to drive the market. Since it can continuously replace stale indoor air with fresh outdoor air. Additionally, it can remove pollutants, including excess moisture, household chemicals, optimize energy efficiency, minimize carbon footprint, and others.

Moreover, until recent times, bringing in enough outdoor air to enhance indoor air quality was a major challenge as the conditioning process demands high cost. To overcome such challenges, manufacturers introduced ERVs, which potentially downsized ventilation energy costs and improved outdoor air quality intake. Furthermore, government intervention to construct energy consumption buildings and policies related to carbon emissions for residential and commercial purposes is one of the driving factors for the global market.

RESTRAINING FACTORS

Complex Installation Process and High Maintenance Cost of Product to Hamper Market Growth

The demand for this equipment is increasing with the growing awareness of air quality. However, complex installation procedures are limiting the market surge. It becomes challenging to integrate ERV at old constructed projects wherein the space to install ventilators is ideally not designed. Additionally, improper location of such systems can minimize the outdoor air intakes and blockage of airflow resulting in the intake of contaminated air. Moreover, depending on the designing and installation of this equipment, the system requires an additional substantial length of air ducting. Thus, the cost for maintenance of the products further increases as these ducts need to be sealed and insulated from external dirt and dust.

Energy Recovery Ventilator Market Segmentation Analysis

By Type Analysis

Existing Ducting over Walls to Propel Ceiling-Mount Segment Growth

By type, the market is segmented into wall-mount, ceiling-mount, and cabinet.

The ceiling-mount segment is estimated to hold a vital part of the market share, exhibiting the highest growth rate. Ceiling-mounted ERVs have exponential demand in the market as the existing wiring and ducting over the walls ultimately minimizes the installation cost and the invasiveness.

The wall-mount segment has the second-highest CAGR, owing to its feasibility of installing in the buildings without the mechanical ventilation systems. Buildings that possess smaller duct spaces and are built without mechanical ventilation systems prefer installing smaller and unitized wall-mounted ERV’s that vent directly outside through the exterior wall.

The cabinet segment is projected to have moderate growth rate during the forecast period due to its high installation and maintenance costs. This type of equipment is mostly integrated into the industrial sector with a life span of more than a decade.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Integration of ERVs to Boost Commercial Segment

Based on application, the market is segmented into residential, commercial, and others (industrial sector).

The commercial segment is expected to lead end-use adoption, contributing 49.16% of the market share in 2026. The commercial sector dominates the global market, hotels & restaurants, airports, educational institutions, private workplaces, and others opt for ERVs to provide a healthy workplace that helps in escalating work efficiency. According to the United Nations Environment Program Finance Initiative (UNEP FI), in 2015, 195 countries worldwide agreed to work together to curb global warming. Considering such statistics, the integration of ERVs is expected to grow in the commercial sector.

The residential segment is anticipated to experience significant growth during the forecast period. It is attributed to the rising per capita spending throughout the world. The housing development sector is on a hike in developed countries and developing countries such as China, India, Nigeria, and others that boost the global market growth. According to the Congressional Research Service (CRS) study, as of 2018, the overall spending on housing services was about USD 2.6 trillion in the U.S., contributing nearly 11.6% of the GDP.

The others (industrial) segment is expected to witness progressive growth, owing to its longer shelf life and usage. The rising foreign direct investments in the manufacturing sector of developing countries propel the demand for cabinet ERVs for industrial purposes.

REGIONAL INSIGHTS

Geographically, the market is segmented across five major regions, North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. They are further categorized into countries.

North America Energy Recovery Ventilator Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for USD 1.51 billion in 2025 owing to the regions high emphasis on energy efficiency and indoor air quality in the buildings. Harsh climatic conditions, such as hailstorms, hurricanes, and heavy snowfall, in North America worsen the indoor air quality, thus directly affecting people's health. North America’s residential fixed investment accounted for USD 785 billion with 3.3% of GDP. The rising investment in the residential sector is expected to increase the need for their installation to offer a safe and healthy indoor environment across the sector.

U.S. to Hold Highest Market Share Attributed to Country’s Strong Infrastructure

The mature construction industry in U.S. along with strong HVAC infrastructure, provides a conducive environment for their integration. Further the country’s climate diversity with both cold and hot regions further boosts the demand for systems that recover heat and maintain indoor comfort effectively. The presence of established manufacturers along with technological advancements and innovation has largely contributed to growth of the market in U.S.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is anticipated to witness the highest CAGR over the forecast period. It is attributed to the rising living standards in countries such as China, India, Malaysia, South Korea, Thailand, and others. These countries are aiming at modernizing residential and commercial building stocks. According to the International Finance Corporation (IFC), East and Pacific Asia account for the largest market share in the real estate sector. Additionally, it is expected to get investment opportunities of USD 16 trillion in the commercial and residential building sector. Such market opportunities will uplift the demand across the region.

India is considered the leading country in installing ERVs and overall HVAC systems across buildings and other facilities. The governmental bodies are offering Foreign Direct Investment (FDI) schemes that benefit the manufacturers. Owing to this, manufacturers such as Johnson Controls and others are focusing on manufacturing the cabinet, wall-mounted, and ceiling-mounted for residential, industrial, and commercial facilities. India being a humid prone country, these ERVs regularize the indoor air quality and humidity to provide a safe and healthy indoor environment. The Japan market reaching USD 0.29 billion by 2026, the China market reaching USD 0.35 billion by 2026, and the India market reaching USD 0.27 billion by 2026.

Europe

Europe is expected to witness progressive energy recovery ventilation system market growth in the near future due to new housing construction in Western countries. The UK market reaching USD 0.20 billion by 2026 and the Germany market reaching USD 0.46 billion by 2026.

Middle East and Africa and Latin America

The Middle East and Africa and Latin America are expected to grow moderately compared to the other regions. This is mainly due to the stagnant growth rate of the construction sector across the Middle East and Africa and minimized port business activities across Latin America.

KEY INDUSTRY PLAYERS

Key Players Focus on Expanding their Business across the Globe

Key energy recovery ventilator players emphasize expanding their manufacturing plants, research & development centers to meet consumer demand on time. Additionally, these players are pouring heavy investments into upgrading the existing technologies to align with different emission standards. Moreover, to sustain in the market, market participants strengthen the profit structure by implementing the profitability improvement strategy. This includes mergers & acquisitions and sales of these units and components to small and medium-sized companies. For instance, in March 2018, Daikin added two new compact units to reinforce its position in the commercial ventilation market.

Zehnder Group AG is Focusing on Acquisition Activities to Expand Product Reach

Zehnder Group AG is acquiring regional & local companies to expand its business across the residential and commercial sector applications. For instance, in March 2019, Zehnder Group AG acquired Recair, a ventilation product offering company, for approximately USD 8.3 million to offer ventilation solutions in Europe. The acquisition strengthens the market penetration of energy-efficient heat exchangers utilized in residential ventilation units.

LIST OF KEY COMPANIES PROFILED:

- Carrier (United Technologies) (U.S.)

- Johnson Controls (Ireland)

- Daikin Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- LG Electronics (South Korea)

- Nortek Air Solutions, LLC (U.S.)

- Lennox International Inc. (U.S.)

- Greenheck Fan Corporation (U.S.)

- Fujitsu Limited (Japan)

- Zehnder Group AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- August 2022 – At ARBS 2022, Mitsubishi Electric Corporation unveiled an expanded lineup of products aimed at enhancing residential air conditioning. The company introduced new offerings that utilize both split system and ducted technologies reflecting their extensive expertise in air treatment and energy recovery ventilators.

- March 2022 - Greenheck Fan Corporation announced launch of a new energy recovery ventilator for multi-family residential buildings. The company came up with four different models that gave a variety of options and accessories for the customer.

- October 2020 - Holtop developed and launched a new energy recovery ventilator equipped with DX coils that offers cool and warm fresh air to customers. It operates with both VRF/VRV for optimal indoor comfort.

- August 2020 - Mitsubishi Electric Trane HVAC US launched Lossnay energy recovery ventilator units that make use of a free-cooling function that assist in increasing efficiency and reducing cost

- April 2020 - Mitsubishi Electric Corporation’s European subsidiary named ‘Mitsubishi Electric Europe B.V.’ acquired AQS PRODUKTER AB to strengthen commercial cooling and heating products in Sweden and total solution capabilities Mitsubishi Electric Europe B.V.

REPORT COVERAGE

The research report provides detailed insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2019 to 2030 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 9.57 billion by 2034.

In 2025, the market was valued at USD 4.37 billion.

The market is projected to grow at a CAGR of 9.20% during the forecast period.

The ceiling-mount segment is expected to lead the market.

The increasing importance of Indoor Air Quality (IAQ) is driving the global market.

Daikin Industries, Ltd., Carrier, and Mitsubishi Electric Corporation are the leading companies in the market.

North America is expected to hold the highest market share.

Fast-tracked green building construction is a key trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us