Enhanced Oil Recovery Market Size, Share & Industry Analysis, By Technology (Thermal Injection, Gas Injection, and Chemical Injection), By Application (Onshore and Offshore), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

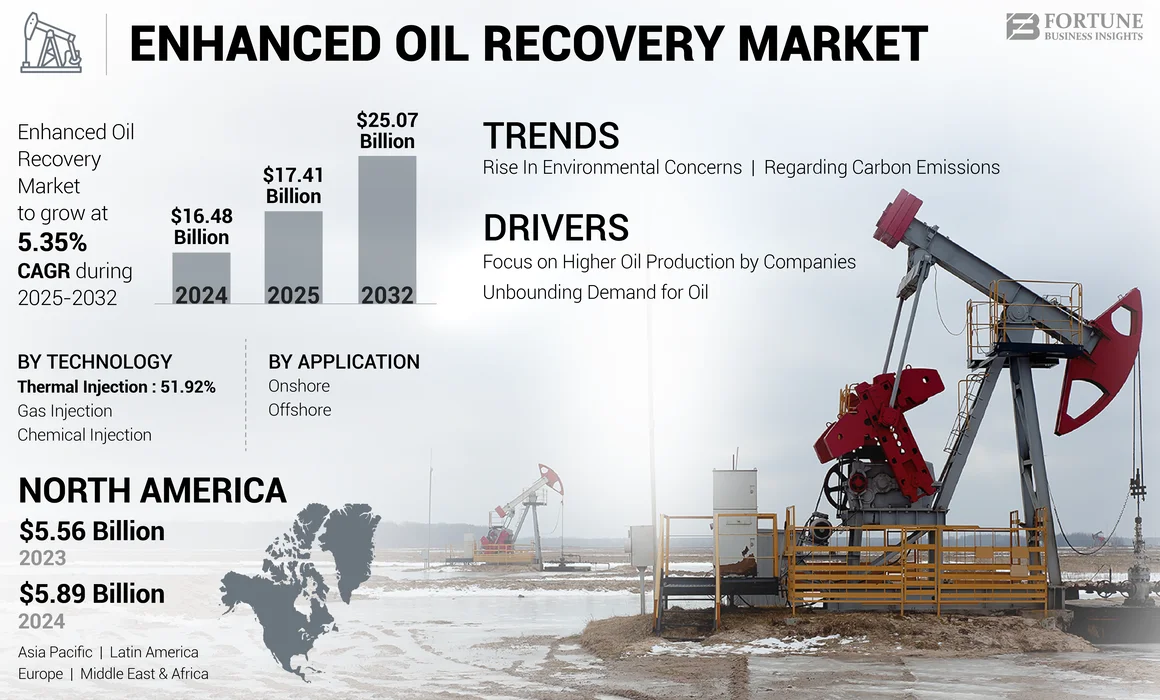

The global enhanced oil recovery market size was valued at USD 16.48 billion in 2024. The market is projected to witness growth from USD 17.41 billion in 2025 to USD 25.07 billion by 2032, exhibiting a CAGR of 5.35% during the forecast period. North America dominated the enhanced oil recovery market with a share of 35.74% in 2024.

North America dominated the global market with the largest market share owing to the increasing demand for oil and gas, technological advancements in the oil and gas industry, and government initiatives to support market growth. Also, the increasing adoption of EOR techniques in developing economies is contributing to the growth of industry.

Enhanced Oil Recovery (EOR) is a set of practices that upsurge the amount of crude oil that can be mined from a reservoir. It is used when conventional methods, such as gas injection and water, are no longer operative. The modern production technique presents several economic and technological benefits in extracting oil from the reservoir.

Chevron is one of the leading players in the market. The company delivers gas injection and thermal injection techniques. The strong portfolio of Chevron is backing the market growth with the addition of availability in multiple regions.

MARKET DYNAMICS

MARKET DRIVERS

Unbounding Demand for Oil to Provide Impetus to Market Growth

The exponential consumption of oil across different industry verticals, such as transportation, shipping, power, manufacturing, and others, increased the demand for petroleum products. Operators are embracing different advanced methods to meet the growing requisition of oil. Enhanced Oil Recovery projects offer the ultimate recovery of oil from the reservoir, which increases the overall production. Also, it optimizes production costs by avoiding drilling a new well, which is projected to drive the market.

Focus on Higher Oil Production by Companies to Boost Market Growth

Companies leading exploration operations and deployment of different methods to identify new oil and gas opportunities across the globe is expected to foster market growth in coming years. For instance, in July 2024, Saudi Aramco invested USD 25 billion in a natural gas substructure through numerous contracts to encounter increasing gas demand. Such initiatives can boost the enhanced oil recovery market growth.

MARKET RESTRAINTS

High Capital Investment and Economic Slowdown Puts the Growth on Back foot

Enhanced oil recovery around the world has predominantly relied on government incentives or some strategies owing to the high cost of EOR technology. The technique is quite inherently complex compared to conventional methods. Deployment of EOR requires highly skilled professionals, stepwise implementation, and integration of R&D, as well as commitment and risk-bearing capacity, which challenges the growth of the market. Currently, the world is undergoing a critical economic crisis due to the exponential spread of the COVID-19 pandemic. All the businesses across the globe hit a virtual standstill, which weakens the demand for oil and petroleum products. Fearing the ongoing economic crisis, most oil and gas companies are planning significant capital and operational expenditure cuts, putting the market on the back foot.

MARKET OPPORTUNITIES

Growing Demand for Energy in Emerging Economies to Create New Opportunities

In recent years, emerging countries such as India, China, the U.K., France, and others have been focusing on energy transitions. For instance, India has touched an important milestone in its renewable energy trip, with the country's total renewable energy capacity over 200 GW (gigawatt), and is focusing on new targets.

The demand for clean energy is growing globally owing to the aim of reducing carbon emissions. Considering the same, enhanced recovery plays a crucial role in this journey. Hence, it can create new opportunities for businesses.

MARKET CHALLENGES

Cost and Maintenance of Enhanced Oil Recovery to Become Challenging

Enhanced oil recovery is of complex design and can be expensive starting from the initial investment compared with the other equivalent techniques. EOR can be more expensive based on the site, owing to the challenges it faces during product deployment. EOR technologies, which often require substantial capital for specialized equipment, infrastructure, and advanced materials, can create new challenges. All these costs can be straining the financial resources of oil and gas companies, specifically in a volatile economic environment. In October 2024, THE MOOMBA carbon capture and storage project in Australia developed the world’s third-largest project to start interring emissions without Enhanced Oil Recovery.

ENHANCED OIL RECOVERY MARKET TRENDS

Rise in Environmental Concerns Regarding Carbon Emissions Leads to Market Restraints

Environmental concerns about carbon emissions have augmented due to the growing levels of carbon dioxide in the atmosphere. Hence, the rise in environmental concerns has increased interest in Carbon Capture and Storage (CCS) technology that can help the oil recovery market by reducing carbon emissions. Enhanced oil recovery technology can also boost the oil sector to help produce more oil. In April 2024, MYCELX Technologies Corporation was given a contract to treat shaped water during EOR production, which will signify its 2nd REGEN deployment with a Middle East producer. This contract follows the deployment of MYCELX exclusive REGEN Retro-fit package while controlling carbon emission.

Download Free sample to learn more about this report.

Impact of COVID-19

Limitations in Oil Production Affected Market Growth

The COVID-19 pandemic affected the global enhanced oil recovery market and its components. This is due to the negative impact on global supply and demand. In addition, there was a pause in demand for oil and gas operations in multiple regions, such as Europe, Middle East & Africa, North America, and others, which led to the low production of oil. The major factors were the inaccessibility of raw materials, unavailability of machinery, unavailability of workers, the closer of borders, and the import and export of goods stuck to the market growth.

SEGMENTATION ANALYSIS

By Technology

Economical Cost of Technology to Aid Thermal Injection Method

By technology, the market is classified into thermal injection, gas injection, and chemical injection.

Thermal Injection is the leading segment and held the largest enhanced oil recovery market share in 2024. It is one of the widely adopted technologies across the world for EOR. The method is suitable for heavy, viscous crude oil and involves the introduction of thermal energy into the reservoir to raise the temperature of the oil and reduce its viscosity. Natural gas is primarily used to generate thermal energy. However, in recent years, solar EOR has gained popularity over its environmental advantages. The segment is set to attain 54.58% of the market share in 2025.

Similarly, the gas injection method is extensively used to increase oil mobility in the reservoir. CO2 EOR is one of the fastest-growing techniques used in many countries to increase oil production. Carbon capture utilization and storage present economic opportunities for enhanced recovery of oil and government incentive approach, bolstering the growing gas injection method. Chemical EOR is mainly used to produce more oil by Injection of water-soluble surfactants and polymers. This segment is expected to grow with a substantial CAGR of 3.81% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By Application

Exponential Investment Bolter Growth of Onshore Segment

By application, the market is bifurcated into onshore and offshore.

The offshore segment is expected to emerge as the dominating segment due to the presence of aging oil reserves. However, onshore wells present several advantages over offshore, such as availability of resources, economical cost of production, established technology, reservoir understanding, and others. Hence, a substantial share of global oil is produced from the land-based well.

Most of the EOR deployed around the world encompasses onshore wells. The implementation of onshore EOR is more economical than offshore EOR. However, the growing investment in discovering untapped hydrocarbon reserves is likely to provide lucrative opportunities in the offshore segment.

The onshore segment captured 70.42% of the market share in 2024.

ENHANCED OIL RECOVERY MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Enhanced Oil Recovery Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Demand for Technological Advancement to Influence Market Growth

North America dominated the global market with a valuation of USD 5.57 billion in 2023 and USD 5.89 billion in 2024. The market is mainly concentrated in North America owing to the extensive adoption of the technique in the U.S. The Department of Energy (DoE) of the U.S. is working with several companies to implement the EOR project to increase production.

U.S.

Rapid Growth in EOR Projects to Boost Market

The U.S. is the dominating country in North America owing to the multiple active projects. The U.S. offers several incentives, such as U.S. section 45Q tax credit to provide a tax reduction of USD 35/tCO2 for 12 years for CO2 stored in EOR operations. In the midst of the pandemic outbreak, U.S. crude oil prices fell to 17 years low, putting the future of the hydrocarbon industry in the dark. The U.S. market is anticipated to gain USD 4.98 billion in 2025.

Europe

Europe is the fastest-growing region driven by Energy Demand

Europe is the third largest market anticipated to gain USD 3.47 billion in 2025. This region is one of the fastest-growing globally. This is owing to the growing demand for energy supplies for multiple applications. The U.K. market continues to expand, projected to reach a market value of USD 0.76 billion in 2025. This is also absorbed due to the deliberation of renewable sources in various sectors, such as power distribution. Moreover, Germany dominates the European market owing to the demand for energy transition, which leads to growth in industrial manufacturing and production. Germany is estimated to be valued at USD 0.45 billion in 2025, while Russia is predicted to stand at USD 0.76 billion in the same year.

Asia Pacific

Growing Demand for Oil and Gas Sector to Drive Market

Asia Pacific is the second leading region set to hold USD 4.24 billion in 2025, registering a CAGR of 6.10% during the forecast period (2025-2032). The region’s enhanced oil recovery stood behind North America in generating maximum revenue for the global EOR market. The exponential demand for oil is owing to the presence of electronics, automotive, and manufacturing industries in China, driving the market. China is poised to reach USD 2.07 billion in 2025. The Chinese national oil companies are pushing several projects to increase domestic production and reduce the foreign exchange on oil imports. Subsequently, India and Southeast Asian countries are implementing EOR projects that bolster the growth in the Asia Pacific. Southeast Asia market is estimated to be worth USD 0.38 billion in 2025, while India is likely to gain USD 0.65 billion in the same year.

Latin America

Industrial Expansion in Region to Influence Market Development

Latin America comprises some of the largest producers of hydrocarbon in the world. EOR is mostly implemented in Brazil and Venezuela to increase the production of oil. In addition, countries are focused on low carbon emissions, where EOR will directly help boost market growth owing to the expansion in the industrial sector.

Middle East & Africa

Emerging Countries in MEA to Boost Market Growth

The Middle East & Africa is the fourth largest market anticipated to gain USD 2.01 billion in 2025. The market in this region demonstrated slight growth due to the slow adoption of technology. The UAE, Saudi Arabia, and Qatar are already in a race to develop new technologies where EOR is playing an important role. Besides this, the coronavirus epidemic crumbled the crude oil prices and demand, causing severe economic threats to oil-baron nations. It can be stabilized in upcoming years. The GCC market is estimated to reach a value of USD 1.04 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Growing Technological Developments to Boost Businesses

Enhanced oil recovery is a highly coveted technology that aids in the recovery of a substantial amount of oil, which is not possible through the primary and secondary methods. American companies constitute a larger share of the market on account of the extensive adoption of EOR in North America. The technology not only helps to achieve the production targets but also saves capital costs in drilling new wells. For instance, in January 2024, Absolute Energy forestalls lower carbon footprint with ICM’s (Technology & Feed products) patented oil recovery technology.

List of Key Enhanced Oil Recovery Companies Profiled

- Chevron (U.S.)

- Oxy (U.S.)

- BP (U.K.)

- Husky Energy (Canada)

- ConocoPhillips (U.S.)

- China National Petroleum Corporation (China)

- China Petrochemical Corporation (China)

- Cairn Oil & Gas (India)

- Lukoil (Russia)

- Petrobras (Brazil)

- Ecopetrol (Colombia)

- Petroleum Development Oman (Oman)

KEY INDUSTRY DEVELOPMENTS

- October 2024 – Chevron- an energy corporation, is trying polymers—long-chained molecules—for Enhanced Oil Recovery at an oilfield site in Kuwait. This experiment could help solve more potential in what’s already a promising resource.

- December 2024 – Chevron- an energy corporation, set a record throughout 2024’s third quarter, producing about 900,000 barrels of oil equivalent per day in the Permian Basin with enhanced oil recovery and Artificial Intelligence (AI) technology.

- March 2020 – The U.S. Geological Survey developed a new assessment to evaluate how much oil and gas could be produced by injecting carbon dioxide into petroleum reservoirs. Carbon dioxide injection is a common form of enhanced oil recovery because it increases the flowability of the crude oil.

- April 2020 – The World Economic Forum reported that oil prices could remain depressed for at least a year due to the coronavirus pandemic, and the Russia/Saudi Arabia price war has sent oil prices plummeting. In addition, supply and demand might not become rebalanced until the virus is contained.

- July 2019 – the United States Department of Energy’s (DoE) subsidiary Fossil Energy (FE) announced USD 39.9 million in federal funding for enhanced oil recovery research and development projects. The authority selected five projects that will receive funding. Advancements in technology will help maximize America’s energy sources.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service process, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.35% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology, Application, and Region |

|

Segmentation |

By Technology

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 16.48 billion in 2024.

The market is likely to grow at a CAGR of 5.35% over the forecast period (2025-2032).

The onshore segment is expected to lead the market due to the rapid electrification.

The market size of North America stood at USD 5.89 billion in 2024.

Unbounding demand for oil to provide impetus to drive the market

Some of the top major players in the market are Chevron, Oxy, and BP.

The global market size is expected to reach USD 25.07 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us