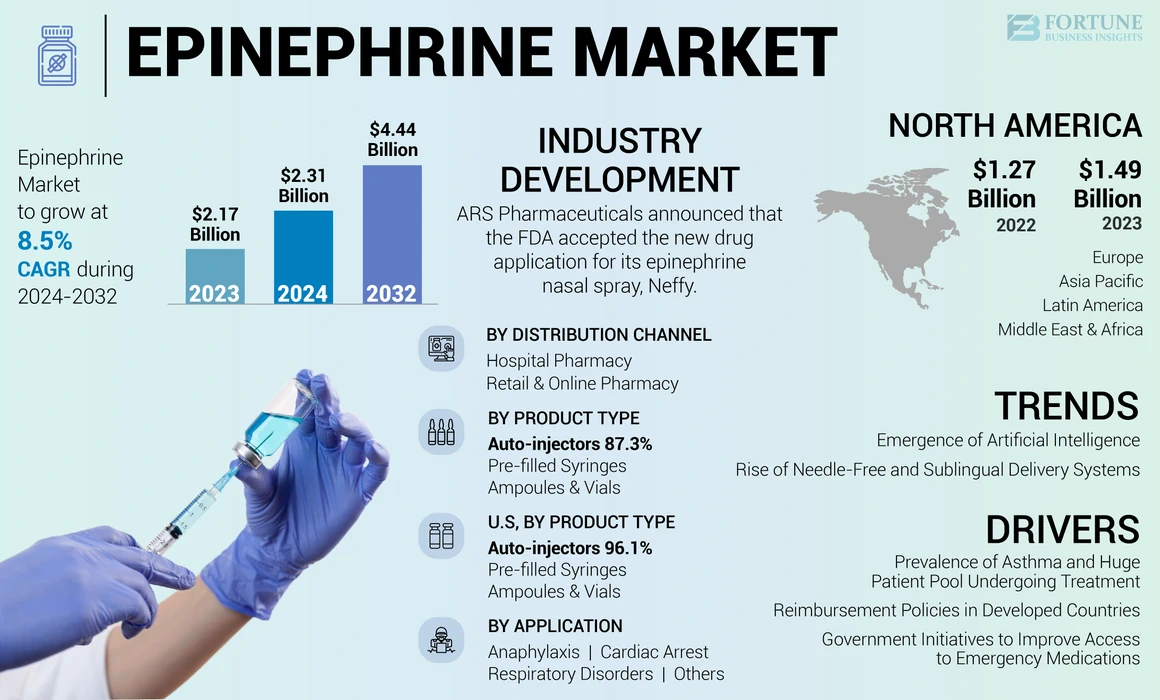

Epinephrine Market Size, Share & Industry Analysis, By Product Type (Auto-injectors, Pre-filled Syringes, and Ampoules & Vials), By Application (Anaphylaxis, Cardiac Arrest, Respiratory Disorders, and Others), By Distribution Channel (Hospital Pharmacy and Retail & Online Pharmacy), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

The global epinephrine market size was valued at USD 2.31 billion in 2024. The market is projected to grow from USD 2.48 billion in 2024 to USD 4.44 billion by 2032, exhibiting a CAGR of 8.48% during the forecast period. North america dominated the epinephrine market with a market share of 68.66% in 2023.

Epinephrine is used to treat severe allergic reactions, such as anaphylaxis and asthma attacks. It can be administered through various ways, including intramuscular, subcutaneous, intravenous, and inhalation. The burden of these diseases has been increasing at a significant rate globally. This will fuel the demand for epinephrine.

- For instance, as per data published by the National Center for Biotechnology Information (NCBI) in 2022, asthma affects around 4-6% of adults and 10% of children in Germany.

Furthermore, favorable reimbursement policies and increasing focus of market players on new and advanced product launches will also fuel the market growth.

In 2020, due to the sudden outbreak of the COVID-19 virus, the market experienced a decline in its value due to the limited number of patient visits to hospitals and clinics to control the spread of the virus. Also there were disruptions in the supply chain and manufacturing processes. This reduced the demand for epinephrine products during the pandemic. Moreover, the market players also experienced a decline in the sales of their product offerings. However, the market normalized in 2024 and is expected to attain stable growth during the forecast period.

Epinephrine Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 2.31 billion

- 2025 Market Size: USD 2.48 billion

- 2032 Forecast Market Size: USD 4.44 billion

- CAGR: 8.48% (2024–2032)

Market Share:

- North America dominated the epinephrine market in 2023 with a 68.66% share, attributed to strong reimbursement policies, advanced healthcare infrastructure, high awareness about anaphylaxis treatment, and widespread availability of auto-injectors like EpiPen and ALLERJECT.

- By Product Type, auto-injectors held the largest share in 2023 due to their ease of use, rapid drug delivery, and growing demand in emergency treatment scenarios. Needle-free and AI-enabled options are gaining popularity.

Key Country Highlights:

- United States: Growth supported by Medicare coverage under Part C & D for auto-injectors, high asthma burden (24.96 million affected in 2021 per CDC), rising awareness campaigns like the 2024 Food Allergy Awareness Week, and frequent product launches such as Neffy by ARS Pharmaceuticals.

- Germany: Increasing asthma burden, with 4–6% of adults and 10% of children affected (NCBI, 2022). This is driving demand for injectable and needle-free epinephrine formulations.

- China: Entry of autoinjectors like Jext through partnerships (e.g., ALK-Abelló and Grandpharma, 2021) is expanding access to epinephrine, supporting market growth in underpenetrated segments.

- Europe (Region-wide): High prevalence of allergies and anaphylaxis (e.g., 20.9% of adults aged 20–44 suffer from allergic rhinitis). Government and healthcare providers are focusing on expanding access to emergency medications and supporting new drug formats (e.g., sublingual films and nasal sprays).

Epinephrine Market Trends

Emergence of Artificial Intelligence to Enhance Administration of Epinephrine

The rising prevalence of medical conditions, such as anaphylaxis, cardiovascular diseases, respiratory diseases (asthma), and others, and the increasing need for effective treatments have fueled the demand for epinephrine.

- For instance, as per data published by the National Center for Biotechnology Information (NCBI) in 2022, around 20.9% of the population aged 20-44 years suffered from allergic rhinitis in Europe.

- Moreover, according to the National Center for Biotechnology Information (NCBI), in August 2023, more than 50 million Americans suffer from allergies every year.

To control the rising burden of these diseases and allergies, the demand for AI-enabled autoinjectors and needle-free autoinjectors has increased. The increasing applications of these injectors, apart from anaphylaxis, in various medical conditions, such as cardiac arrests, respiratory disorders, and other conditions, are creating more opportunities for key players to launch the product for various conditions.

Additionally, several key players are adopting growth strategies, such as acquisitions and collaborations to enhance their offerings that will cater to the unmet needs of the patients.

- In November 2021, Marathon Asset Management acquired Kaleo, Inc. to enhance the development and commercialization of its offerings.

Rise of Needle-Free and Sublingual Delivery Systems

The occurrence of severe allergic reactions, heart stoppages, and lung conditions is on the rise globally. As these conditions become more common, the need for epinephrine is also on the upswing in both developed and developing nations. To cater to the growing demand for this drug, market players are focusing on the introduction of innovative products that offer novel routes of administration. They are also focusing on developing technologically advanced epinephrine injectors for lucrative but underpenetrated markets.

- For instance, in August 2024, ARS Pharmaceuticals Operations, Inc. announced that it had received the U.S. Food and Drug Administration (FDA) approval for neffy (epinephrine nasal spray) 2 mg for the treatment of Type I allergic reactions, including anaphylaxis in adults and children. Neffy is an epinephrine nasal spray and a needle-free alternative to the traditional epinephrine autoinjectors like EpiPen.

Several studies have also shown positive results for the drug. A study indicated that about 91% of participants would consider using a nasal spray over an autoinjector, while 82% preferred a needle-free option. Such clinical trials and regulatory approvals for new and advanced delivery options for epinephrine are expected to become a prominent trend in the market.

- North America witnessed a growth from USD 1.27 Billion in 2022 to USD 1.49 Billion in 2024.

Download Free sample to learn more about this report.

Epinephrine Market Growth Factors

Growing Prevalence of Asthma and Huge Patient Pool Undergoing Treatment to Support Demand for Auto-injectors

With the rising prevalence of anaphylaxis and asthma globally, the demand for effective treatments is increasing in developing and developed countries. For instance, as per the U.S. Centers for Disease Control and Prevention (CDC), in 2021, around 24.96 million people in the U.S. suffered from asthma.

To cater to this growing demand, major market players are focusing on the introduction of innovative products that offer novel routes of administration. They are also focusing on developing technologically advanced injectors for the market.

- For instance, in July 2022, ARS Pharmaceuticals and Silverback Therapeutics partnered for the regulatory approval and commercialization of Neffy, an epinephrine nasal spray.

Additionally, the market players are focusing on increasing the accessibility of their product offerings through acquisitions and partnerships. In November 2021, Kaleo, Inc. and Marathon Asset Management entered an agreement through which Marathon acquired Kaleo, Inc. With this acquisition, the company aimed to expand its offerings focused on anaphylaxis treatment.

Adequate Reimbursement Policies in Developed Countries to Drive Adoption of Autoinjectors

As the demand for these injections is increasing rapidly in developed countries, such as the U.S. and European nations, companies are focusing on the launch of new products. Moreover, reimbursement policies are improving for these auto-injectors as their cost is quite high and they are inaccessible to many patients. For instance, to make these auto-injectors more accessible for patients suffering from anaphylaxis, Medicare offers coverage for the auto-injector through its Part C and Part D drug plans. Part C or the Medicare Advantage (MA) Plan, was established in 2003, whereas the Part D plan came into effect in 2006.

Despite the higher cost of these auto-injectors in developed countries, the penetration is still comparatively higher in these countries. This is due to adequate reimbursement policies available for these injectors.

Government Initiatives to Improve Access to Emergency Medications

Another critical driver that is responsible for fueling the epinephrine market growth is the rising awareness among patients regarding different disease treatments through various campaigns and programs initiated by key government bodies across the globe.

- In May 2024, the Office of the State Superintendent of Education (OSSE) and the Division of Health & Wellness of U.S. recognized the Food Allergy Awareness Week from May 12-18 to promote education and awareness about food allergies and anaphylaxis. The campaign also introduced the Undesignated Epinephrine Auto-injector Plan (UEA Plan) to the school community, ensuring everyone is informed about the procedures for handling anaphylactic emergencies. Additionally, students with known allergies are encouraged to obtain an Action Plan for Anaphylaxis and submit it to their school.

RESTRAINING FACTORS

High Cost of Auto-injectors and Limited Reimbursement in Developing Countries May Limit Market Growth

With increasing demand for effective treatment options for severe reactions to allergies, such as anaphylaxis, the need for these injections is increasing rapidly. However, the high cost of auto-injectors is projected to limit the global epinephrine market growth during the forecast period.

- For instance, a set of two EpiPen auto-injectors costs around USD 650 to USD 700. Similarly, 2 kits of Auvi-Q injectable of 0.1 mg cost around USD 664.4.

In addition, in developing countries, most people are not aware of the treatment options available for anaphylaxis, which can limit the adoption of the drug in these countries.

Moreover, lack of reimbursement policies in these nations and higher out-of-pocket expenditure associated with auto-injectors are responsible for the lower adoption of these products in the market.

Product Recalls are Affecting the Market Growth

The new launches of epinephrine injectors are increasing due to the rising demand from patients. However, the recalls of these products are also rising due to potential manufacturing defects and inaccurate dosage delivery. These factors are anticipated to limit the growth of the market.

- In April 2023, Bausch Health Canada Inc. recalled its Emerade epinephrine autoinjectors, 0.3 mg (DIN 02458446) and 0.5 mg (DIN 02458454), due to possible device failure. Such scenarios surrounding epinephrine may negatively influence the investment strategies and brand image of key companies, which can limit the market’s growth.

Opportunities

Technological Advancements to Lead to Innovative Epinephrine Formulations

A pioneering advancement in the management of anaphylaxis is the development of formulations, such as nasal sprays and sublingual films for drug delivery. Various players are engaged in clinical trials to launch such products in the market.

- For instance, in February 2024, Aquestive Therapeutics, Inc. announced a poster presentation highlighting the positive pharmacokinetic (PK) and pharmacodynamic (PD) data from two completed clinical studies for Anaphylm. This presentation will be presented at the American Academy of Allergy, Asthma, and Immunology (AAAAI) 2024 annual meeting. In that presentation, Anaphylm PK and PD data were comparable to epinephrine delivered through an autoinjector or a manual intramuscular injection (IM).

Expansion in Emerging Markets

Globally, the prevalence of anaphylaxis, cardiac arrest, and respiratory diseases is increasing rapidly. With the growing prevalence, the demand for epinephrine is rising in developed and emerging countries.

Market Challenges

Competition from Generic Manufacturers in Regions With Cost-Effective Healthcare Systems

The presence of key players in markets with generic versions of autoinjectors is a major threat to branded drug manufacturers.

- In August 2019, Teva Pharmaceutical Industries Ltd. announced the availability of EpiPen Jr Autoinjector, 0.15 mg, in the U.S. The product was available in most retail pharmacies. This development helped the company expand its geographical footprint in the U.S. market.

Research and Development in Epinephrine Market

Key Clinical Trials and Studies

The market has numerous pipeline products with innovative formulations and routes of administration. Such a strong focus of the key players on research and development initiatives is expected to propel the market growth in the future. For instance, in December 2023, Aquestive Therapeutics, Inc. announced that the first patient had been given a dose of the Anaphylm (epinephrine) Sublingual Film in its initial Phase 3 pivotal Pharmacokinetic (PK) clinical study. Anaphylm is the company’s orally administered epinephrine candidate under development for the treatment of severe, life-threatening allergic reactions, including anaphylaxis.

EPINEPHRINE MARKET SEGMENTATION ANALYSIS

By Product Type

Various Advantages Associated with Use of Auto-injectors Fueled Their Market Dominance

By product type, the market is segmented into auto-injectors, pre-filled syringes, and ampoules & vials.

The autoinjectors segment dominated the market in 2023 owing to their benefits over other products, such as easy usability, convenient handling, and others. Autoinjectors can be used for emergency treatment of acute anaphylaxis as it helps in fast absorption of the drug. Such factors are responsible for the segment’s growth. The segment held 87% of the market share in 2025.

The pre-filled syringes segment is expected to grow significantly during the forecast period. This is due to its quick response to emergency allergic reactions and increasing demand from hospitals and clinics for the treatment of various illnesses.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increasing Prevalence of Anaphylaxis Fueled Its Demand

On the basis of application, the market is divided into anaphylaxis, cardiac arrest, respiratory disorders, and others.

The anaphylaxis segment dominated the market in 2023, accounting for a major global epinephrine market share. The dominance of the segment is attributed to the growing cases of anaphylaxis globally. For instance, as per data published by the Centers for Disease Control and Prevention (CDC) in 2021, 25.7% of adults in the U.S. suffered from seasonal allergy and 6.2% of adults suffered from food allergy. The segment is expected to capture 68% of the market share in 2025.

The respiratory disorders segment is projected to record a significant CAGR during the forecast period. This is due to numerous factors, such as rising awareness about the treatment options available for respiratory disorders and increasing diagnosis and treatment rate of respiratory disorders.

The cardiac arrest segment is likely to record a significant CAGR of 8.05% during the forecast period (2024-2032).

By Distribution Channel

Increasing Number of Retail & Online Pharmacies Globally Helped Retail & Online Pharmacy Segment Dominate Market

On the basis of distribution channel, the market is divided into retail & online pharmacy and hospital pharmacy.

The retail & online pharmacy segment dominated the market in 2023. The factors responsible for the growth of this segment include the increasing number of retail & online pharmacy stores globally, easy availability of autoinjectors, and easy accessibility of the products on companies’ online platforms. This segment is foreseen to document a considerable CAGR of 8.61% during the forecast period (2024-2032).

The hospital pharmacy segment is expected to record a substantial CAGR over the forecast period. The increasing emergency hospital visits by patients due to severe allergic reactions, cardiac arrest, and respiratory conditions is responsible for the segment’s growth. The segment is anticipated to gain 22% of the market share in 2025.

GLOBAL EPINEPHRINE MARKET REGIONAL OUTLOOK

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Epinephrine Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 1.49 billion in 2023 and gained USD 1.58 billion in 2024. The region dominated the global market due to various factors, such as adequate reimbursement policies in the U.S. for auto-injectors and increasing launch of technologically advanced products. For instance, in May 2020, Kaleo, Inc. announced the availability of ALLERJECT autoinjector in Canada. With this announcement, Canadian patients were able to access different treatment options for anaphylaxis. The U.S. market is likely to be worth USD 1.63 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the third largest market expectd to be worth USD 0.31 billion in 2025. In Europe, the market’s growth is due to the increasing prevalence of anaphylaxis, cardiovascular diseases, and other factors. The U.K. market continues to expand, anticipated to reach a market value of USD 0.05 billion in 2025. Moreover, the increasing demand for technologically advanced products is also responsible for the regional market’s growth. For instance, according to an article published in the European Journal of Allergy and Clinical Immunology, in March 2020, the prevalence of food allergies in children from birth to 17 years was around 61.6%. Germany is foreseen to hold USD 0.06 billion in 2025, whil France is estimated to be worth USD 0.05 billion in 2025.

Asia Pacific

Asia Pacific is the second leading region set to gain USD 0.38 billion in 2025, documenting a CAGR of 10.93% during the forecast period (2024-2032). Asia Pacific is projected to grow at a significant rate over the forecast period. This is owing to changing regulatory policies for the adoption of autoinjectors. The Chinese market is expected to be valued at USD 0.11 billion in 2025. Additionally, companies are expanding their presence in the region to meet the increasing demand. For instance, in July 2021, ALK-Abelló A/S partnered with Grandpharma to launch its adrenaline autoinjector “Jext” in China. Jext is expected to be the first autoinjector in China. India is predicted to hold USD 0.09 billion in 2025, while Japan is likely to reach USD 0.10 billion in the same year.

Latin America

Latin America is the fourth largest market anticipated to hold USD 0.02 billion in 2025. The market in Latin America is growing due to increasing diagnosis and treatment rate of anaphylaxis, which has created a demand for these injections in the region. The launch of new products is also supporting the market’s growth in the region.

Middle East & Africa

The Middle East & Africa market will capture a considerable market share during the forecast period. This is due to the strategic initiatives taken by governments of various countries to control the increasing prevalence of anaphylaxis. The GCC market is foreseen to stand at USD 0.01 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players Leads Market With Strong Portfolio of Autoinjectors

The market is consolidated, with a few players holding a major share of the market. Industry leaders, such as Teva Pharmaceutical Industries Ltd., Viatris Inc., and Amneal Pharmaceuticals LLC are significant players in the market due to the strong sales of their brands, such as EpiPen and EpiPen Jr., among others.

The other market players, such as USWM, LLC., kaleo, Inc., and ALK-Abelló A/S have a strong global presence. These companies have been focusing on partnerships and collaborations to fuel the sales of their products.

- For instance, in August 2022, Kaleo, Inc. and Valeo Pharma entered a ten-year commercialization agreement for the sales of ALLERJECT in Canada.

Investment Analysis

The market is witnessing increased investments by various players. Opportunities for investors in emerging regions and technologies will prompt new product launches in the market. For instance, in 2021, ARS Pharmaceuticals raised USD 55 million in Series D funding for the launch of Neffy. In November 2024, ARS Pharmaceuticals announced a USD 145 million deal with ALK-Abello Pharmaceuticals to sell Neffy outside the U.S., Australia, New Zealand, Japan, and China.

List of Key Companies in the Epinephrine Market:

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- Bausch Health Companies Inc. (Canada)

- Amneal Pharmaceuticals LLC. (U.S.)

- DMK Pharmaceuticals (U.S.)

- ALK-Abelló A/S (Denmark)

- BIOPROJET (France)

- ARS Pharmaceuticals Operations, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Nasus Pharma Ltd., a clinical-stage biopharma company, announced the completion of its additional Phase II clinical trial, which confirmed the efficacy and safety of its FMXIN002 Intranasal Epinephrine product.

- March 2023 - Daiichi Sankyo, Inc., through its subsidiary American Regent, Inc., launched a sulfite-free Epinephrine Injection, USP, intended for emergency treatment of Type I allergic reaction.

- October 2022 – ARS Pharmaceuticals announced that the FDA accepted the new drug application for its epinephrine nasal spray, Neffy.

- November 2020 - Upjohn, Pfizer Inc.’s division, and Mylan N.V. formed a global pharmaceutical company called Viatris Inc. The company was formed for product development in therapeutic areas, such as cardiovascular diseases, central nervous system & anesthesia, and infectious diseases around the world.

- May 2020 - USWM, LLC. and Adamis Pharmaceuticals Corporation entered an agreement to grant commercial rights to USWM for the distribution and commercialization of the SYMJEPI injection.

REPORT COVERAGE

The report provides a detailed market analysis. It focuses on key aspects, such as leading companies, product types, applications, and distribution channels. Besides this, it offers insights into the market forecast, trends, the impact of COVID-19, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 8.5% from 2024-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.17 billion in 2023 and is projected to reach USD 4.44 billion by 2032.

In 2023, the North America market value stood at USD 1.49 billion.

The market will exhibit steady growth at a CAGR of 8.5% during the forecast period.

By product type, the auto-injectors segment led the market.

Growing prevalence of anaphylaxis among general population, increasing reimbursement for these injections, and recent launches of advanced injections are the key market drivers.

Teva Pharmaceutical Industries Ltd., Viatris Inc., and Amneal Pharmaceuticals LLC are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us